This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 69,685 times.

A business credit report allows a person or company to evaluate the credit worthiness of a competitor, customers, and potential suppliers. By running a report on itself, a company can see how its financial stability is presented to the larger business community. Before entering into a business relationship with a new company, it is a good idea to run a credit report so you get a better sense of how much risk is involved in the business relationship.

Steps

Acquiring Business Information

-

1Conduct an internet search. In order to acquire a business credit report, you need some basic information about the business including the business name and location. One of the easiest ways to gather information about a company, including where the business is registered, is by reviewing their business website. You can locate the business by searching for the business or owner’s name or and the state where the business is located, if you know the location.

- If you don’t know the name of the business but do know the location of the business, you can search for all businesses in a particular area or categories of business, such as banks, in a particular area.

-

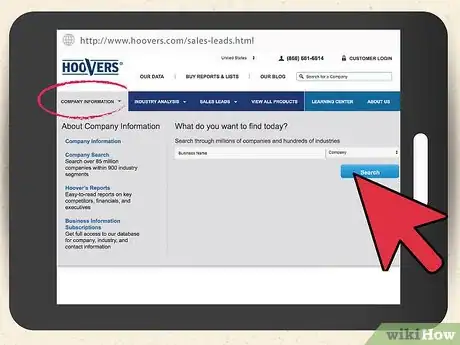

2Search for U.S. businesses. There are a number of online directories that contain business information and allow you to search by name. One place that you can search for U.S. businesses is: http://www.hoovers.com/sales-leads.htmlAdvertisement

-

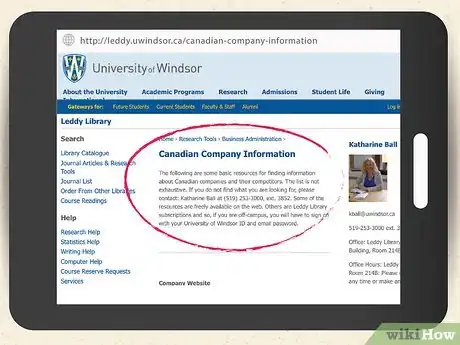

3Search for Canadian businesses. You can locate information about Canadian businesses by visiting: http://leddy.uwindsor.ca/canadian-company-information. This website provides links to several other websites that provide information on Canadian companies.

-

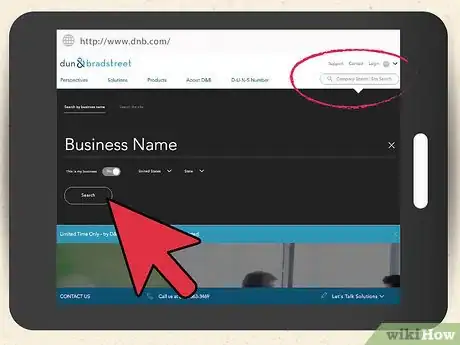

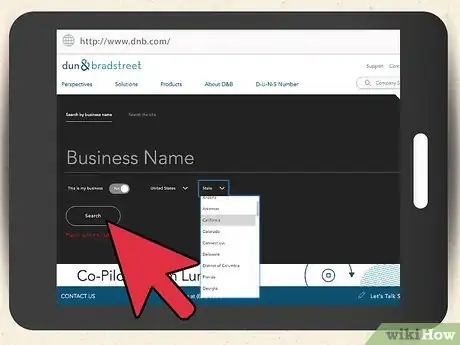

4Search Dun & Bradstreet website. This company collects business information from companies around the world.

- You must be able to provide the name of the business, the country where the business is located and in some cases the city where the business is located.

-

5Search for U.K businesses. For businesses in the U.K. you can locate business information at: https://beta.companieshouse.gov.uk/.

Running a Business Credit Report

-

1Locate a credit agency. For most countries, you can run a business credit report through an online credit agency. You can identify credit agencies by conducting an internet search for “business credit report” and the name of the country in which the business is located.

- When choosing a credit agency, you want to choose an agency that is well established and well known for its credit reporting, such as Experian or Dun & Bradstreet.

-

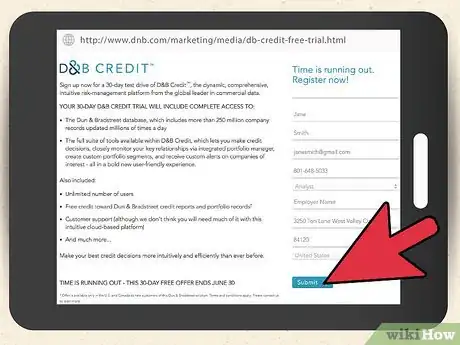

2Register with the credit agency. If the credit agency allows online credit report transactions, you will need to complete an online registration and choose a password. Generally, there is no charge for registering with the credit agency. You may be asked to provide some or all of the following information:

- Your company name and a contact name. If you are not a business, you can try registering with your own name.

- Contact information, include email address, phone number and fax number.

- Business industry.

- Credit card information.

- A user ID.

- A password.[1]

- Credit agencies that do not use an online system but work directly with the customer may request that you call them directly and request information over the phone as well as provide you with a detailed explanation of the services that they provide.[2]

-

3Search for the company. Once you have registered with the company, you will be able to conduct an online search for the business for which you want a credit report or provide this information over the phone directly to the credit agency.

- Most searches will ask you to provide information to narrow the search parameters, such as country, city, or state in addition to the business name.

- If you search by business name, your search may return multiple search hits. Carefully review the returned business names and check to see whether they match the location for the business that you are seeking.

- Once you locate the correct business, select the business and you will be redirected to a new webpage outlining different report options.

- Unlike personal credit reports, usually you cannot get a free business report. There are some credit agencies that will provide a free report as an incentive to register with their company. They may require a business email address and phone number to register for the free report.

Completing the Transaction

-

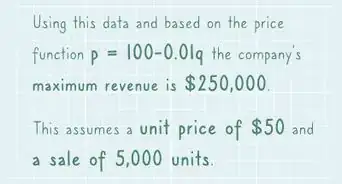

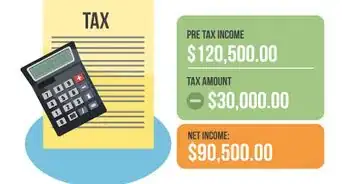

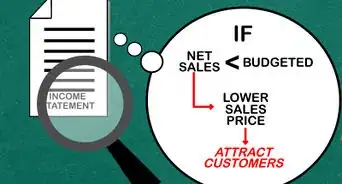

1Determine your credit report needs. You may only need one report or if you are in the practice of investigating your potential business customers or suppliers, you may need a credit report subscription. When determining your credit report needs, consider the following:

- Are you a small business attempting to attract customers with a strong business credit file?

- Is it important for your financial stability to only work with suppliers or customers with strong credit histories?

- Do you receive payment after goods and/or services are already delivered and therefore need to know that business customers are reliable?

- Do you need assistance assessing the financial stability of competitors?

-

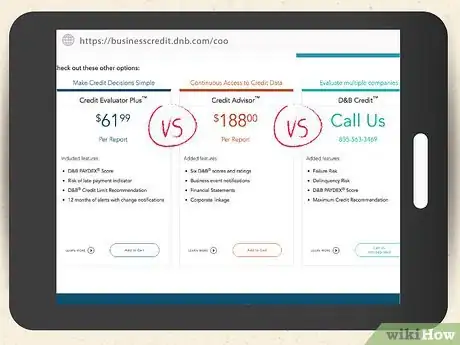

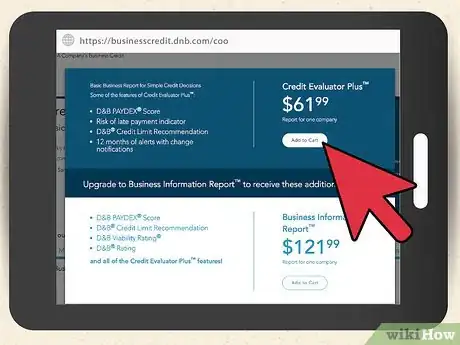

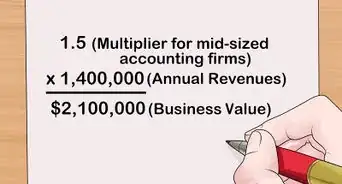

2Select a credit report. Depending on the plan you choose, you can spend anywhere from $20 for a simple one-time report to $1,500 annually to run a multitude of searches through a subscription service. Generally, reports offer the following:

- A one-time simple report may provide an overview of another company’s credit profile and a credit ranking number for the particular industry.

- An annual credit check for your own company may provide you unlimited access to your own profile so that you can closely monitor any changes in credit and keep the account updated.

- A second tier report will include a business credit report as well as more in depth financial information about the company and the business owners, as well as credit risk ratings.

- A high end credit report subscription will provide continual monitoring of a company and provide you updates as to any changes in the company’s status.[3]

- An individualized report may include all of the information discussed above, as well as interviews with employees or other specific and detailed company information. The price of the report will vary based on the amount of time spent on gathering the specific information and the type of information you are seeking.[4]

-

3Pay for and download your report. Most online credit agencies will require your credit card information before they run any reports for you. Once you select and pay for your report. Your are usually given the option to download the report or view it online.

Warnings

- Some suppliers and lenders do not report to business credit bureaus, so there companies may not provide a complete picture of the financial stability of a smaller company.⧼thumbs_response⧽

References

- ↑ https://www.dbai.dnb.com/UK/EN/RegisterFrame.html; http://sbcr.experian.com/main.aspx?link=5502

- ↑ http://www.teikoku.com/index.php/services/business-credit-reports

- ↑ http://yourbusiness.azcentral.com/can-companies-pull-credit-authorization-16204.html; http://www.experian.com/small-business/monitor-business-credit.jsp

- ↑ http://www.teikoku.com/index.php/services/business-credit-reports

-Step-04.webp)