This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 18,029 times.

It can be frustrating when a US bank or other financial institution makes a mistake or doesn't treat you fairly, especially if you don't know where to direct your complaint to correct the situation. Generally, it's a good idea to try to solve the problem internally if at all possible. However, if the bank isn't willing or able to resolve your issue to your satisfaction, you can escalate the situation by submitting a complaint to the government agency that regulates that bank. If your complaint involves loan products, you can also submit a complaint to the Consumer Financial Protection Bureau (CFPB).[1]

Steps

Working with Customer Service

-

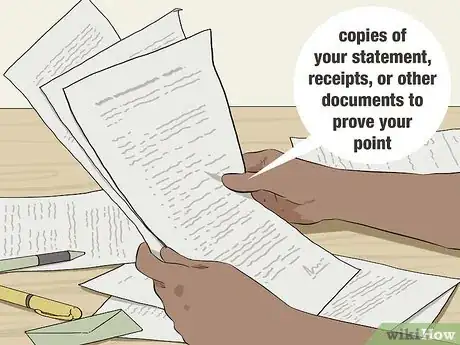

1Gather documents related to your problem. If you have a problem with fees you were charged or the way a particular transaction was handled, pull together copies of your statement, receipts, or other documents that will potentially prove your point. You will need to show these to someone at the bank.[2]

- Make copies of any documents you plan to share with the bank – don't give up your originals.

-

2Call the bank's toll-free customer service number. All banks have a toll-free customer service number you can call to resolve issues. Most of them have operators available 24-7. For general problems or complaints about the way the bank handled a particular transaction, you may be able to get your problem resolved simply by calling this number.[3]

- Before you call, organize your information so you can refer to it quickly if asked. Have a piece of paper and pen or pencil handy as well, so you can take down information such as the date and time of the call and the name of the person you spoke to.

- If the first person you talk to claims they can't help you or that the bank did not handle your situation incorrectly, don't be afraid to ask to speak to their supervisor. Keep moving up the chain, if necessary, until you're satisfied that you've gotten all you possibly can out of the bank.

Advertisement -

3Go to a local branch to discuss your issue in person. If you prefer to deal with problems face to face, you may get a better response from a bank manager at a local branch. People who work at local branches tend to be more motivated to maintain a positive image in the community and will want to have a positive relationship with you.[4]

- {If you're meeting someone face to face, remain calm and respectful. Even if you're angry about the situation, you likely won't get the bank to do what you want by making a scene in front of other customers.

Tip: If your complaint relates to a specific individual, it's best to start by complaining to someone who has direct authority over that person.

-

4Submit a written complaint if your issue is not resolved. A written letter preserves a record of your complaint so you can prove that you attempted to resolve the problem within the bank and they refused to work with you. In your letter, describe in detail the subject matter of the complaint and the steps you've taken to resolve it.[5]

- If you need some help, you can use the sample complaint letter at https://www.usa.gov/complaint-letter to help you formulate your letter.

- If you're not sure where to mail your complaint, look for a contact page on the bank's website. There should be an address listed for complaints or customer service issues.

- Make a copy of your letter for your records after you've printed and signed it. Mail your letter using certified mail with return receipt requested so you'll know when the bank receives your letter.

Complaining to a Regulatory Agency

-

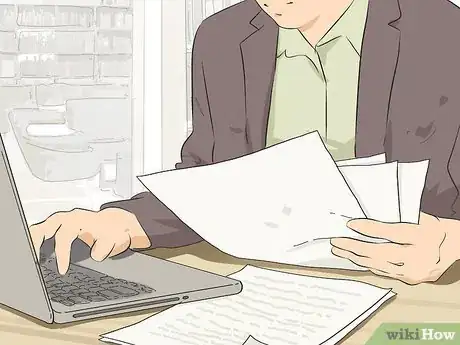

1Get together the information and documentation to support your complaint. Regulatory agencies typically expect you to document any claims you make in your complaint. Supporting documents also help the regulatory agency assess your situation and process your complaint more quickly.[6]

- Make copies of any documents you plan to send to the regulatory agency. Don't send originals, because they may not be returned.

-

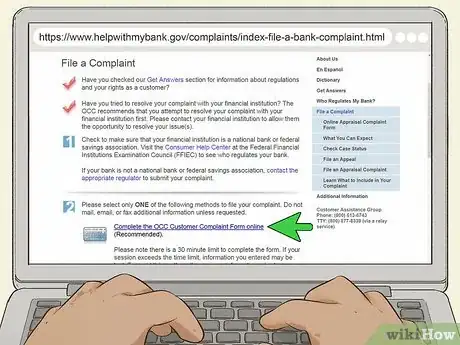

2Use the Office of the Comptroller of the Currency (OCC) if you have a complaint about a national bank. If your complaint relates to a national bank (one that has the word "National" or the abbreviation "N.A." in its name), a federal savings and loan, or a federal savings bank, the OCC regulates that bank on a federal level. To file a complaint with the OCC, go to https://www.helpwithmybank.gov/complaints/index-file-a-bank-complaint.html. From this page, you can either submit an online complaint or download the complaint form.[7]

- Make sure you have all the information and documents you need handy before you begin filling out the online complaint form. You only have 30 minutes to complete it or your session will time out and you'll have to start over.

- If you don't feel comfortable submitting your complaint online or need more time to complete the form, you can print off a copy, complete it, and mail it to Comptroller of the Currency, Customer Assistance Group, 1301 McKinney Street, Suite 3450, Houston, TX 77010.

-

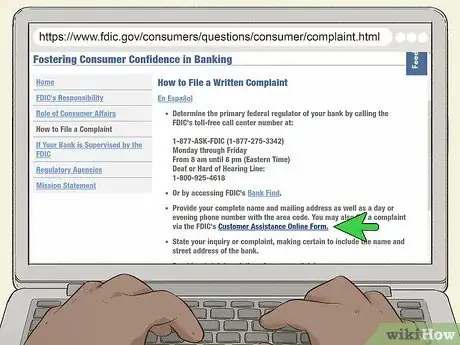

3Contact the Federal Deposit Insurance Corporation (FDIC) for state-chartered banks. To file a complaint with the FDIC, go to https://www.fdic.gov/consumers/questions/consumer/complaint.html and click the link to access the online form.[8]

- If you need to submit copies of supporting documents, mail those documents to FDIC Consumer Response Center, 1100 Walnut St., Box #11, Kansas City, MO 64106. You can also fax supporting documents to 703-812-1020.

- If you don't feel comfortable submitting the form online, you can print it off and mail it to the same address. You can also write a letter to the FDIC describing your problem, as long as it includes all the same information that you would have put on the form.

Tip: Your state's bank regulator may also be able to help you. The CFPB has a list of state bank regulators and their contact information available at https://www.consumerfinance.gov/ask-cfpb/how-do-i-find-my-states-bank-regulator-en-1637/.

-

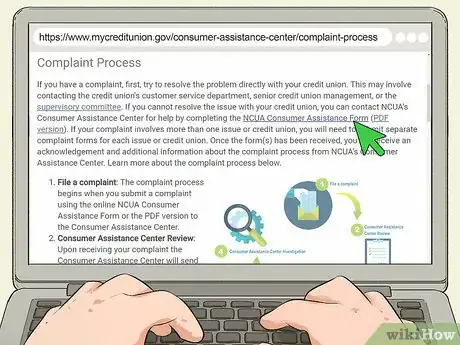

4File a complaint about a credit union with the National Credit Union Administration (NCUA). Go to https://www.mycreditunion.gov/consumer-assistance-center/complaint-process and click the link to access the online complaint form. You can also download a PDF of the form if you want to fill it out, print it, and mail it to the NCUA Consumer Assistance Center. Once your complaint is received, you'll get an acknowledgment with a case number. Use your case number to check the status of your complaint.[9]

- The NCUA will forward your complaint to the credit union for review and attempt to resolve your complaint. If the situation is not resolved within 60 days, the NCUA will begin a formal investigation.

- If you're mailing your complaint form, send it to National Credit Union Administration, Consumer Assistance Center, 1775 Duke St., Alexandria, VA 22314-3418.

-

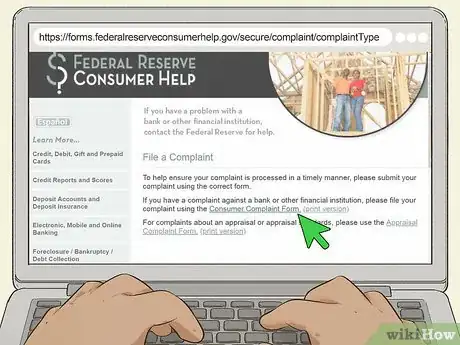

5Submit a complaint to the Federal Reserve if you can't figure out the appropriate regulatory agency. Visit the Federal Reserve Consumer Help website at https://www.federalreserveconsumerhelp.gov/. The agency handles complaints alleging that a bank is deceptive, discriminatory, or violated federal consumer protection laws and regulations. If the Federal Reserve cannot handle your complaint directly, it will forward your complaint to the appropriate agency.[10]

- To access the online complaint form, go to https://forms.federalreserveconsumerhelp.gov/secure/complaint/complaintType. You can submit your complaint directly online or download a version of the same form that you can print and mail to the Federal Reserve.

- If you've filled out a paper form, mail it to Federal Reserve Consumer Help, PO Box 1200, Minneapolis, MN 55480. You can also fax your completed form to 877-888-2520.

Tip: Depending on your issue and the financial institution involved, you may be able to submit your complaint to multiple regulatory agencies at the state and federal level. The Federal Reserve can help you identify all the regulatory agencies that potentially should be involved.

Submitting a Complaint to the CFPB

-

1Gather all information related to your complaint. When you file a complaint with the CFPB, you need to tell them the type of problem you're having, what happened, what company was involved, and any individuals involved. You'll also need specific dates, amounts, and other relevant details.[11]

- When you file your complaint online, you can attach documents that support your complaint. If you have paper documents, scan them so that you can upload them with your complaint.

-

2Visit the CFPB website. The CFPB website at https://www.consumerfinance.gov/ includes information and resources that you can use to better understand your rights as a consumer. If your complaint against the bank involves a loan product, the CFPB will evaluate the information and help you find a resolution.[12]

- If you're interested in learning more about the subject of your complaint or your rights under federal law, click the "Consumer Tools" tab on the website's homepage.

- If you just want to go straight to filing your complaint, click the blue link in the top-right corner of the homepage that says "Submit a Complaint."

Tip: The CFPB also publishes the complaints it handles so you can learn more about other consumers who may have been in a similar situation. You can search these complaints under the "Data & Research" tab to find out if other consumers have had complaints about your bank and how those complaints were resolved.

-

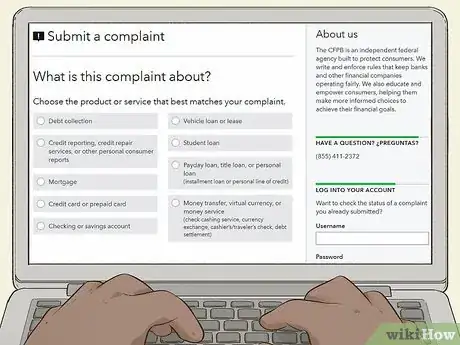

3Fill out the complaint form on the website. After you click the link to start your complaint, you'll be asked a series of questions about the issue you're having. Initially, you'll be asked to categorize your complaint by identifying the product or service your complaint involves from a list.[13]

- If the issue you're having doesn't clearly relate to any of the categories listed, the CFPB cannot help you with your complaint.

- When you file your complaint, you'll create an account at the CFPB website. You can log in to this account again if you have a different complaint in the future. You can also use this account to monitor the status of your complaint after you submit it.

-

4Wait for a response from the bank or financial institution. Once you submit your complaint, the CFPB will forward it to the bank along with any documents you attached. The CFPB will then work to get a response from the bank, usually within a couple of weeks.[14]

- If the CFPB determines another agency would be better able to handle your complaint, it will forward the information to that agency. You'll get an email letting you know that the other agency is now handling your complaint.

-

5Provide feedback about the company's response. You'll get an email from the CFPB when the bank has responded to your complaint. You can log back into your CFPB account to reply to that response and let the company know whether you feel your issue was resolved.[15]

- You have 60 days from the date the bank responds to provide feedback, so you don't have to do it immediately. If the bank has promised to return money to you, wait until you have the money before you submit feedback.

Warnings

- This article discusses filing a complaint against a US bank. If you have an issue with a bank in a different country, contact the national regulatory authority or talk to a local attorney who specializes in consumer rights.⧼thumbs_response⧽

References

- ↑ https://www.usa.gov/complaints-lender

- ↑ https://www.usa.gov/complaints-lender

- ↑ https://www.usa.gov/complaints-lender

- ↑ https://www.usa.gov/complaints-lender

- ↑ https://www.fdic.gov/consumers/assistance/protection/errorresolution.html

- ↑ https://www.federalreserveconsumerhelp.gov/about/ready-to-file-a-complaint

- ↑ https://www.usa.gov/complaints-lender

- ↑ https://www.usa.gov/complaints-lender

- ↑ https://www.usa.gov/complaints-lender

- ↑ https://www.federalreserveconsumerhelp.gov/about/before-i-file-a-complaint

- ↑ https://www.consumerfinance.gov/complaint/getting-started/

- ↑ https://www.consumerfinance.gov/complaint/

- ↑ https://www.consumerfinance.gov/complaint/process/

- ↑ https://www.consumerfinance.gov/complaint/process/

- ↑ https://www.consumerfinance.gov/complaint/process/