wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 26 people, some anonymous, worked to edit and improve it over time.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article has 21 testimonials from our readers, earning it our reader-approved status.

This article has been viewed 372,726 times.

Learn more...

You want to throw your hat into the banking ring—but is it even possible to plant roots in such a difficult industry? Don't worry! Many community-oriented banks are opening across the country. With careful planning, the task of opening a bank might not be as impossible as you think.

Steps

Determine a need.

Appoint a board of directors.

-

Typically, this is five to thirteen people. The board of directors oversees the strategic plan of the bank, and makes sure employees at all levels comply with company policies and federal regulations.[1] X Research source

- Board members should not be directly involved with the bank, and a few should have previous banking experience.

- Appoint a few members over the regulation level in case someone drops out for any reason.

Make sure you have the starting capital.

-

This amount can run anywhere from 12 to 20 million dollars.[2] X Research source This money can come from various places. If your board of directors are community business owners, they might be willing to invest the money. Other sources of capital include private equity funds, founders groups, a bank holding company, supporting financial institutions, and special funding available for community banks.[3] X Research source

- Starting capital ensures all the banks operations and gives the bank a certain amount of collateral.

- Capital guidelines are found through the primary regulator, either Federal Reserve, FDIC, or OCC.[4] X Research source

Create a business summary plan.

-

A financial projection is required during the charter application process. This may require a three to five year business plan and projection.

- You need to demonstrate that a new bank would profit. Showing the plans for growth shows investors what they can expect as a return on their investment (ROI).

- Before you can open a bank, you have to prove you've done research into your competitor's businesses and that you can either come up with a comparable product or somehow provide a beneficial service no one else has thought up yet.

Hire a legal team.

Establish a risk management infrastructure.

-

This must be done before the bank is opened. A risk management structure "identifies, measures, monitors, and controls the risks involved in an institution's various products and lines. These risks include, but are not limited to, credit, market, liquidity, operational, legal, and reputational risk."[5] X Research source Hire the best people who know how to assess for risk and keep policy and procedures in place that keep your employees aware of the next scheme, fraud, or bad decision.

Hire a public face.

-

A community reinvestment specialist responds when your bank is called to show how the bank is contributing to the community. They must be knowledgeable of the rules and regulations in place and be able to respond appropriately to concerns for the bank. They must also report in their meetings with you the ways in which the bank would be appropriately steered toward investment efforts.

Apply for all charters.

-

These include both federal and state legal charters. The Office of the Comptroller of the Currency grants federal documents. You can find a list and instructions on the OCC website. The state can issue the state charter.

- A bank must also be approved for deposit insurance by the Federal Deposit Insurance Corporation.[6] X Research source

Find and purchase a place.

-

Now that you have completed all the initial steps and gotten your bank approved, you need to find a suitable place. It's of vital important for you to familiarize yourself with all potential customers and competitors around you. Ideally, look for a place with smooth traffic, a position with a great deal of markets and residential buildings, and a location that doesn't have a lot of competition. Make sure there is enough room for:

- At least three personal banker offices

- A seating area

- An inside teller area

- A drive-thru teller

- A vault. This can be accessible to both the tellers and deposit box customers, or the bank can house separate vaults. The vault needs to be far into the bank, not near the door.

- An internal and an external ATM

- A security guard station

Come up with an elevator speech.

Establish the appropriate relationships.

Establish what the bank will offer.

-

Doing an analysis of your community and its demographics can help you determine what services the bank should offer. If you are striving for a community bank approach, offer:

- Checking

- Savings

- Mortgage Loans

- Small Business Loans

- Investment and Planning

- CDs and other short/long-term savings methods

- If you are striving for a larger industrial bank, to the above options you will add:

- Private wealth and investment management

- Commercial loans - small (less than $1 Million), mid (between $1 Million and $5 Million) and large Targets (above $5 Million in revenue)

- Commercial DDAs

- International Banking

- Online banking

Invest in your community.

-

Growing the money means spending the money. Your bank customers depend upon you to know when to apply the money to a construction loan for a new hospital and when to put the money into a growing investment. Risk is always a factor, but knowing what is an acceptable risk is part of the game.

- Still, make sure that you always have 10-20% of your overall money held in reserve as a protection for the worst events.

Hire excellent employees.

-

For many banks starting out, reputation and word of mouth is pivotal in their survival. Having competent bankers with strong financial and banking backgrounds gives the customers confidence when placing their money. Placing friendly tellers with excellent customer service skills leaves a lasting impression on the customers, making them want to return.

Glossary of Banking Business Terms

Community Q&A

-

QuestionIs a bank a profitable business?

Community AnswerIf the bank turns out well, it can turn out to be a very profitable business, However, keep in mind that there is lots of competition from experienced banks that have been around for longer. Also, if you want to start a new bank from scratch, you need to have a lot of money.

Community AnswerIf the bank turns out well, it can turn out to be a very profitable business, However, keep in mind that there is lots of competition from experienced banks that have been around for longer. Also, if you want to start a new bank from scratch, you need to have a lot of money. -

QuestionIs there a minimum age I need to be before starting a bank?

Community AnswerIn most jurisdictions, it 18 years or older.

Community AnswerIn most jurisdictions, it 18 years or older. -

QuestionDo I have to have a bachelor's degree to open a bank?

Community AnswerConsider getting a bachelor's or MBA before starting a bank. In most cases an MBA will suffice to teach you enough to know how to run a financial business. Surround yourself by people who are already well experienced in banking, people whose advice you trust.

Community AnswerConsider getting a bachelor's or MBA before starting a bank. In most cases an MBA will suffice to teach you enough to know how to run a financial business. Surround yourself by people who are already well experienced in banking, people whose advice you trust.

You Might Also Like

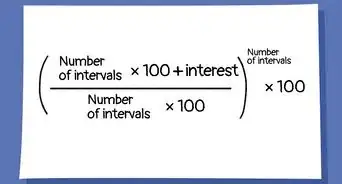

How to Find the Effective Interest Rate

How to Find the Effective Interest Rate

How to Use ATMs to Get Cash, Access Bank Accounts, & More

How to Use ATMs to Get Cash, Access Bank Accounts, & More

How to Submit Damaged Money for Reimbursement

How to Submit Damaged Money for Reimbursement

Using ATMs and Money Orders to Deposit Cash to Your USAA Account

Using ATMs and Money Orders to Deposit Cash to Your USAA Account

References

- ↑ http://www.fedpartnership.gov/bank-life-cycle/start-a-bank/board-of-directors-profile.cfm

- ↑ http://www.huffingtonpost.com/2010/03/19/how-to-start-your-own-ban_n_497261.html

- ↑ http://www.fedpartnership.gov/bank-life-cycle/topic-index/capital-requirements.cfm

- ↑ http://www.federalreserve.gov/faqs/banking_12779.htm

- ↑ http://www.fedpartnership.gov/bank-life-cycle/topic-index/risk-management.cfm

- ↑ http://www.federalreserve.gov/faqs/banking_12779.htm

About This Article

Although opening a bank is a complicated process, you can get started by determining what type of bank you should open based on the services you’d like to offer. For example, if you’d like to offer personalized service to people who currently have to deal with large, institutional banks, consider opening a community bank. Once you know what kind of bank you want to open, create a business plan to show how investors will get a return on their money, and start looking for potential investors, like private equity funds or founders groups. To learn more, like how to find the right location for your bank, keep reading!