X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 9 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 38,056 times.

Learn more...

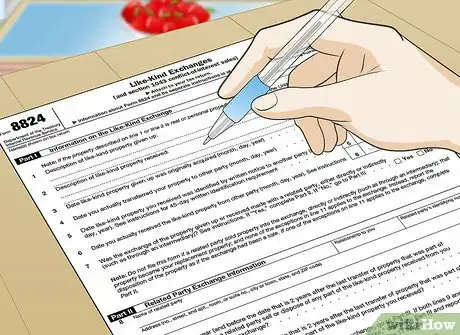

You become familiar with IRS Form 8824 if you are involved in bartering or exchanging one product for another. Admittedly, if your friend gives you a copy of a book and you give him or her a movie in return, no one will care. However, as the value rises increasingly, even the IRS wants to know what your transaction entailed. You must show you did not wrongfully profit from a transaction. You need to fill out Form 8824 to protect yourself.

Steps

Method 1

Method 1 of 1:

Filling Out Form 8824

-

1Find IRS Form 8824 on the IRS website (http://www.irs.gov).

- Make sure you use the current tax year's form.

- Understand you need to fill out one Form 8824 for each exchange you make.

-

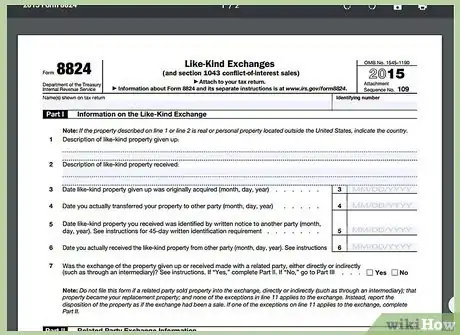

2Begin to fill out the form while you're still on the IRS website. The instructions provided walk you through the process, step by step.

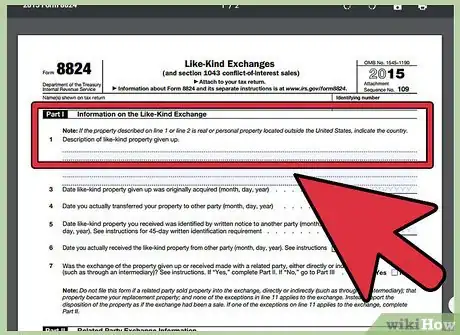

- Start with the type of item you gave up as requested in Part I, Line 1.

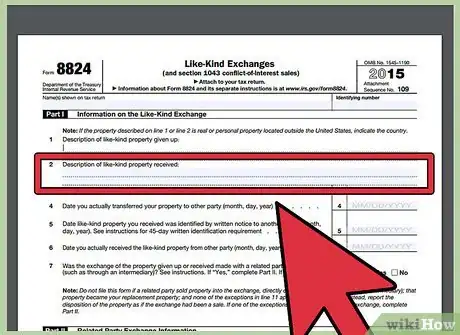

- Proceed to Line 2 in answering the remainder of the questions beginning with the article you received in return.

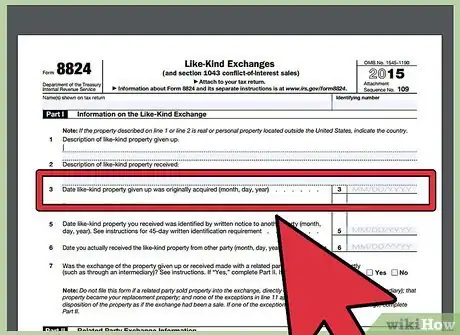

- Lines 3 through 6 explain the history of the exchange. Fill out each one with the appropriate date-related information.

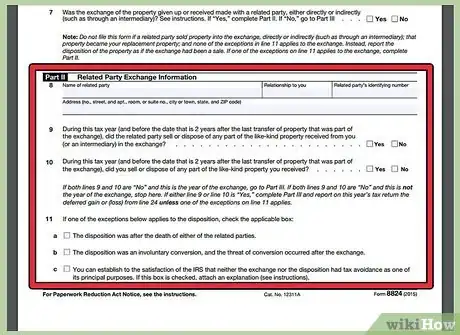

- The next few questions are in Part II and pertain to any related party who might have been involved in the transaction.

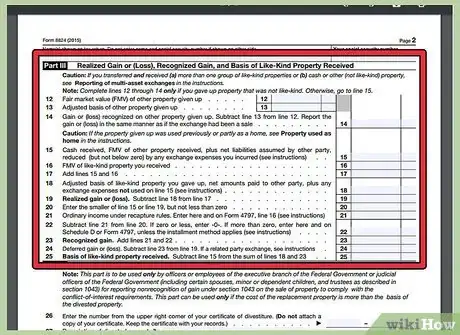

- Part III considers the actual financial value of the transaction. Lines 12 through 14 need only be completed if your transaction was not actually a "like-kind" exchange. Otherwise, go to Line 15. You most likely will not have any taxes to pay and provide this information for knowledge purposes.

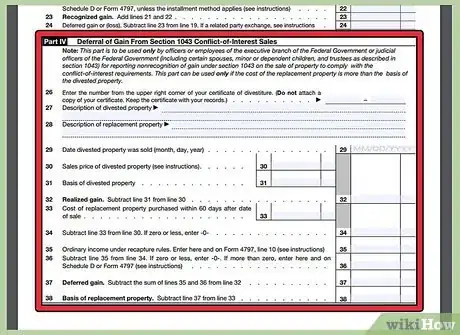

- Part IV deals with any possible "conflict of interest" issues you may incur. It will only pertain to instances where a higher replacement value takes place after noting the original item's value. This is particularly important for people in any job of power (government or otherwise) to consider.

Advertisement -

3Use actual terms of the exchange tied to any paperwork you have from it. Do not embellish it in any way.

-

4Know that this is extremely important when the trade entails stocks exchanged for anything else.

-

5Check with your accountant or tax adviser for a more in-depth explanation of the ins and outs of IRS Form 8824. Further tax form needs could easily include minimized gains on exchanged property. For this, you should ask the accountant about Form 1031.

Advertisement

Warnings

- You need Form 8824 to back up your tax history in case your transaction is ever considered to be a conflict of interest.⧼thumbs_response⧽

Advertisement

Things You'll Need

- Current year's IRS Tax Form 8824

About This Article

Advertisement