This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 247,216 times.

An employer or licensing agency may request your employment history as part of your application for employment or licensing. You also may be expected to provide your employment history when applying for benefits such as Social Security. If you've worked for a number of employers over the years, it may be difficult to remember everywhere you've worked and the exact dates when you worked there – especially if you've worked in short-term, temporary or seasonal positions. If you're drawing a blank on certain years in your employment history, you can use several methods to fill in the gaps in your memory.

Steps

Using Social Security Records

-

1Get a form to request earnings information. Since your Social Security benefits are based in part on contributions you make through the withholding of a percentage of your earnings from each paycheck, the Social Security Administration maintains a record of your work history.

- You can download the form online at http://www.ssa.gov/forms/ssa-7050.pdf. Once you've downloaded the form, you can fill it out on the computer and print it out, or you can print out a blank form and fill it out by hand.

- If you prefer, you also can ask for a paper form in person at your nearest Social Security office.

-

2Fill out the form. The form has blanks for identifying information such as your first and last name, Social Security number, and date of birth. Mark on the form that you are requesting an itemized statement of earnings and provide the range of years you want.[1]

- The itemized statement of earnings includes the names and addresses for all employers you had during the years you specify.[2]

- If you fill out the form by hand, you should only use a pen with blue or black ink.

Advertisement -

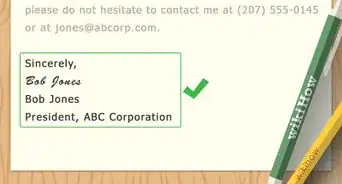

3Mail the form to the SSA along with the fee. When you've completed the form, send it to the Division of Earnings Record Operations at the address shown on the form, along with payment of $136 for a non-certified statement of earnings, or $192 for a certified statement of earnings.[3]

- If you simply need the report for your own records, there's no need to get a certified statement. Typically you would only need a certified statement if you were specifically asked for one.[4]

- You can pay the fee using credit card, check, or money order. If you choose to use a credit card, you should enter your credit card information in the credit card section on the last page of the request form.[5]

-

4Wait to receive your report. The SSA may take up to 120 days to process your request. If 120 days have passed since you sent your request and you still haven't received your report, you can call the SSA at 1-800-772-1213 and request a status update.[6]

Using IRS Records

-

1Check your own records. Since you filed a W-2 for each employer when you filed your taxes, the name and address of those employers will be included on the W-2s you submitted with your tax return each year, along with dates of employment.

- If you've kept copies of your tax returns, you can pull them up to find names and address of employers and fill in gaps in your employment history.

- If you use online tax preparation services, you can often review old tax returns by logging onto your account. Typically you'd only be able to view returns you prepared using that service, but if you can remember which services you used for which years, you may be able to get copies of all the tax returns you need free of charge.[7]

-

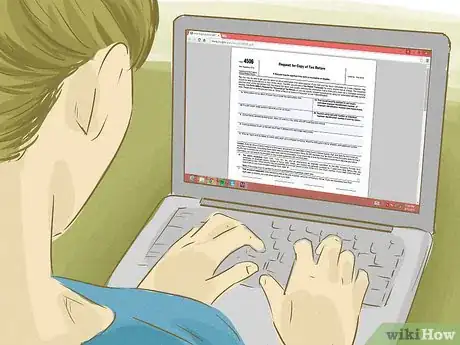

2Get IRS Form 4506. If you need names and addresses of employers to fill out your employment history, you can find them on your tax returns, which you need Form 4506 to request. The IRS makes the form available for download online at http://www.irs.gov/pub/irs-pdf/f4506.pdf.

-

3Fill out the form. You can download Form 4506, fill it out on your computer, and print it off, or you can print it and fill it out by hand.[8]

- If you fill it out by hand, make sure you only write in pen using blue or black ink.

- To complete the form, you will have to enter your name as it appeared on your tax return, along with your Social Security number. If you filed jointly, you also must include the name and Social Security number of your joint filer.[9]

- You will need to enter your current address, plus the address on your previous return if it was different.

- Enter the year or range of years for which you want copies of your tax returns.[10]

-

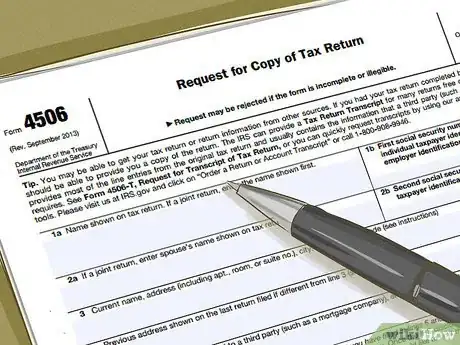

4Calculate your processing fee. The IRS charges you $50 for each return you request, so add up the number of years you've requested returns and multiply that number by 50.[11]

- You may pay the fee using either a check or money order made payable to the United States Treasury.[12]

- For example, if you've requested five years of tax returns, you must pay the IRS $250 to get those copies.

-

5Mail the form to the IRS along with your fees. Find the state where you lived in the years when you filed the returns you're requesting on the chart included with the form and send the form to that address.

- If you lived in two different states that show two different addresses, send your form to the address based on the state where you lived when you filed the most recent return.[13]

-

6Wait to receive your returns. The IRS may take up to 75 days to process your request.[14]

Using Your Credit Reports

-

1Understand the limitations of credit report information. Credit reporting agencies aren't in the business of keeping records of your employment history, and they only have information if it was reported to them by a credit card company.

- The information on your report may be spotty or outdated, but it might help jog your memory.

-

2Visit annualcreditreport.com. You are entitled to receive one free credit report a year, and this website is the only free credit report service authorized by the Federal Trade Commission.[15] Using another website could end up being a scam or costing you a lot of money in subscription fees.

- Although the information on your credit report may not be as thorough as the information you could get from Social Security or from the IRS, it has the benefit of being free.

- If you're looking for a job or contemplating a change in careers, it's probably a good idea to review your credit report anyway, as potential employers may pull it up when they are evaluating you for a job.[16]

-

3Contact each of the three major credit reporting agencies. Check the information available on each report, and correct inaccuracies if you see any.

- If your report contains any employment information that bothers you, normally a simple request to the reporting agency is all it takes to have it removed.[17]

- The employment information on each report may be different. For example, your Experian report will list your last known employer and occupation, but not any dates of employment. TransUnion, on the other hand, includes your current employer and occupation plus your previous employer. For both, your report includes the date your employment was last verified, the date you were hired, or the date your employment was reported.[18]

Playing Detective

-

1Search online for old resumes or biographical information. It's often said that once you put something on the internet, it's impossible to remove it completely. You may be able to use this to your advantage.

- Use a search engine to look for your full name and any other versions of your name that you've used in the past. You can narrow this search by including other information such as the name of the city or state where you lived at the time.

- Look not only for actual documents that would display your work history, but also for words or accounts that might jog your memory. For example, if you find an old social media account, you may read a post you made talking about a coworker that helps you remember where you were working at the time.

-

2Look through your old emails. If you maintain an archive of old emails, or if you have an old email address that you can still access, search for work-related keywords to find mention of previous employers.

-

3Check old contact lists for former managers or coworkers. If your computer or your phone archives your contacts, scroll through the list and see if it includes people from old jobs.

- You may have added the phone number of your workplace, or of a manager or coworker, and then failed to delete it when you moved on to another employer.

-

4Talk to your friends and family members. Although you may not remember that summer job you had when you were 16 years old, for example, your mother might. Friends and family can also help remind you of other details that might trigger a recollection.

References

- ↑ http://www.ssa.gov/forms/ssa-7050.pdf

- ↑ http://www.ssa.gov/forms/ssa-7050.pdf

- ↑ http://www.ssa.gov/forms/ssa-7050.pdf

- ↑ http://www.ssa.gov/forms/ssa-7050.pdf

- ↑ http://www.ssa.gov/forms/ssa-7050.pdf

- ↑ http://www.ssa.gov/forms/ssa-7050.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f4506.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f4506.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f4506.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f4506.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f4506.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f4506.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f4506.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f4506.pdf

- ↑ http://www.consumer.ftc.gov/articles/0155-free-credit-reports

- ↑ http://blogs.wsj.com/wallet/2009/07/16/answering-reader-questions-on-credit-reports/

- ↑ http://blogs.wsj.com/wallet/2009/07/16/answering-reader-questions-on-credit-reports/

- ↑ http://finance.yahoo.com/news/7-secrets-credit-report-wont-070049287.html

About This Article

If you need to provide your employment history, but can’t remember everywhere you’ve worked, try searching online for your old resumes or biographical information. Use a search engine to look for your full name and narrow the search by including other information like cities and states you’ve lived in before. In addition to public sites, look through your old emails for clues or messages from former employers. Search for work-related keywords to try and find any mention of previous places you’ve worked at. If you have no luck on the computer, reach out to friends and family. While you might not remember where you worked when you were 16, there’s a good chance that your mother does! For more tips from our co-author, like how to request employment information from the IRS, read on.