This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 20 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 81% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 100,010 times.

By declaring a piece of property to be your 'homestead,' you may be able to protect some or all of your equity in the property from creditors.[1] This may protect you from having to sell your home in case of bankruptcy.[2] As far as the federal government and many states[3] [4] are concerned, your primary residence is automatically considered to be your homestead. However, a few states require that you create a legal document called a homestead declaration in order to make this designation official for a piece of property.

If you are looking for information on growing your own food, living off the grid, and creating a self-sustaining living environment, visit How to Homestead.

Steps

Declaring a Homestead Exemption

-

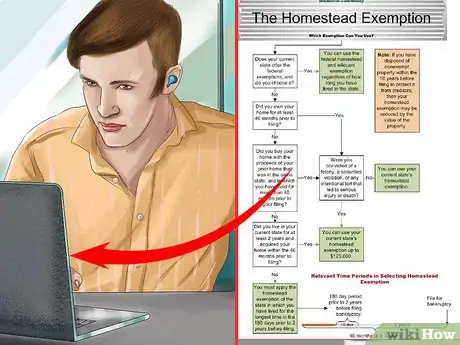

1Evaluate your state’s homesteading laws. Federal law allows you to exempt certain assets from bankruptcy proceedings so that creditors cannot claim these exempted assets. However, your right to use this law depends on the laws of your state.[5]

- If a state has implemented its own homesteading exemption, you will probably be required to follow the state’s law, and you may not be eligible to claim the federal homesteading exemption. [6]

- In other states, you may choose between claiming the state or federal exemption.

- As of the most recent adjustment in 2013, the federal homestead exemption is $22,975. [7]

-

2Determine whether your property can be declared as a homestead. Each person may only declare one homestead. You must be the owner of the property you want to declare as your homestead and it must be your principal residence. You also must have owned the property for at least 1,215 days prior to the bankruptcy filing. [8]

- In certain states, such as California, homestead exemptions apply only to "real property." This means you won't be able to declare your houseboat or motor-home a homestead under these states' homesteading laws, even if it is your principal residence. However, some states, such as Wyoming, do allow the exemption to be applied to trailers. [9]

Advertisement -

3Consider properties other than your own home. Some states will allow you to claim a homestead exemption for a property in which you do not reside if you can prove that you are the "head of the household." A "head of household” is a person who provides the majority of financial support those living in the home. [10]

- Providing support for a close family relative, such as a disabled sibling or an aging parent, may allow you to declare a homestead exemption for that relative’s home instead of your own. However, you can only declare one property as a homestead; you cannot have two homesteads at once.

Filing a Homestead Declaration

-

1Purchase or download a homestead declaration form. Only five states require you to file a homestead declaration form. States generally do not offer a standard form, so you may create your own, purchase one online, or have an attorney create one for you. Generally you must file the form in your county recorder’s office for it to be official.

- Montana does not offer a standard declaration form, but it does provide sample documents. [11]

- Nevada requires a homestead declaration form to be filed, but provides a generous exemption of $550,000 (relative to other states). [12]

- In Texas, you only need to file a homestead declaration to protect a property larger than a certain size, which varies based on location and family status. [13]

- In Vermont, resident homeowners are required to refile a homestead declaration each year.[14]

- Virginia is one of the most restrictive states when it comes to homestead exemptions. You must file a declaration, and the exemption is limited to a maximum of $10,000.[15]

-

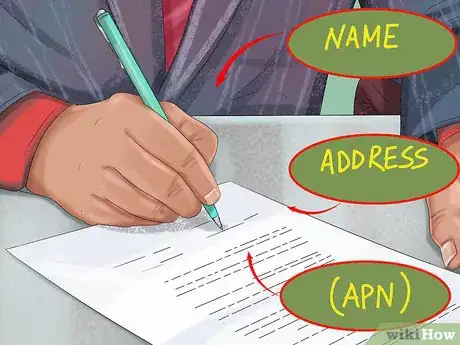

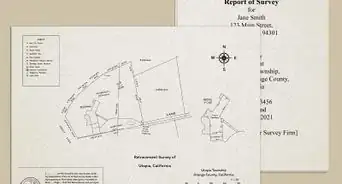

2Draw up the document or complete the form. In most cases, you will need to include your name, address of the homestead, and the Assessor's Parcel Number (APN) for your property. You may also need to describe the property, your interest in it (how the title is held), and who is living there.[16]

- The APN is the number that county assessors use to identify and catalog your property. You should be able to find the APN on the deed of your home. You can also get it from the local office that records deeds or the tax assessor’s office.

- You can find the full legal description of your property on your deed. This includes the street address as well as the dimensions and exact boundaries of the property.[17]

- Have the form notarized. Your county may or may not require this step. A notary will substantiate your declaration by confirming that you are who you say you are.

-

3File the homestead application at your county recorder's office. You may have to pay a nominal fee to file the form. You don't need to have a lawyer present, but you may find it useful to hire an attorney to guide you through the process.

- You should receive a stamped copy of the document indicating that it has been recorded.

Leveraging a Homestead Exemption

-

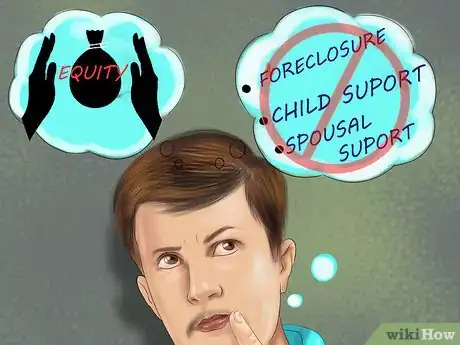

1Evaluate your circumstances. A homestead declaration or exemption will protect you in some situations, but not others. For example, it will not protect your equity in your home against foreclosure. [18] However, you may be protected from other kinds of liens or other financial claims even if you have not declared bankruptcy. [19]

- Homesteading may also not protect you from paying for legal judgments concerning child or spousal support. In Oregon, for example, a court may choose to decline a homestead exemption in order to fulfill child support payments. [20]

- A legal homestead will only protect the amount of equity that you own. For example, if you purchased a house for $90,000 and you owe $40,000, the homestead claim will only cover the $50,000 equity. This is the amount that you have paid on your mortgage.

- The exemption limit varies widely from state to state. In California, for instance, a single person who is not disabled qualifies for an exemption of up to $75,000; if the person is 65 or older, or physically or mentally disabled, the limit is increased to $175,000.[21]

-

2Consult an attorney. Declaring a homestead exemption is not complicated, but the legal circumstances that could trigger its use, such as bankruptcy and divorce, are very complex. As a result, consider consulting an attorney under these circumstances. At the very least, you should understand the important legal terms related to the homesteading process, including encumbrances, judgment liens, home equity, and exemptions.

- An encumbrance is a monetary claim that someone else has filed against your property: it keeps you from transferring property, and it may restrict your use of the space. In real estate, you might encounter encumbrances like an outstanding mortgage or unpaid property taxes.[22]

- A judgment lien on real property is created when someone sues you and wins a money settlement against you. The lien is recorded with the county recorder's office nearest your home. A judgment lien helps the judgment creditor–the person who won the suit–collect his money from you.[23] If you sell your house, that lien will get paid from any available equity.

- Home equity is the actual value of your house after you account for all liens and encumbrances. To calculate it, subtract the total of liens and encumbrances from the market value of the house. For example, if your home has a market value of $400,000, but you owe $300,000 on the house, the home equity equals $100,000. The equity in a house can change. As home values increase, equity increases. As home values decrease, equity decreases. If home values stay constant, equity still increases if you are paying down the mortgage.

-

3Avoid unintentionally voiding your homestead declaration. Your homestead exemption and its advantages last until you effectively abandon the homestead. It is common to abandon an old homestead when you declare another home your new homestead.

- Renting your home to someone else can also destroy your property’s homestead status. For example, in Florida, renting a home for more than 30 days in 2 consecutive years constitutes “abandonment” of the homestead.[24]

References

- ↑ http://www.nolo.com/dictionary/homestead-declaration-term.html

- ↑ http://www.nolo.com/legal-encyclopedia/bankruptcy-homestead-exemption-protect-home-equity.htm

- ↑ http://app.leg.wa.gov/rcw/default.aspx?cite=6.13.040

- ↑ http://www.nolo.com/legal-encyclopedia/the-california-homestead-exemption.html

- ↑ http://www.nolo.com/legal-encyclopedia/federal-bankruptcy-exemptions-property.html

- ↑ http://www.legalconsumer.com/bankruptcy/laws/

- ↑ http://www.nolo.com/legal-encyclopedia/federal-bankruptcy-exemptions-property.html

- ↑ http://www.nolo.com/legal-encyclopedia/federal-bankruptcy-exemptions-property.html

- ↑ http://www.legalconsumer.com/bankruptcy/laws/

- ↑ http://www.alperlaw.com/asset-protection/creditors-collection-tool/head-of-household-exemption/

- ↑ http://www.montana.edu/news/4980/use-a-homestead-declaration-to-protect-home-equity

- ↑ http://www.clarkcountynv.gov/Depts/assessor/Services/Pages/Homestead.aspx

- ↑ http://www.nolo.com/legal-update/texas-homestead-exemption-no-homestead-declaration-required.html

- ↑ https://secure.vermont.gov/hd/index

- ↑ http://www.nolo.com/legal-encyclopedia/virginia-bankruptcy-homestead-exemption.html

- ↑ http://www.saclaw.org/Uploads/files/step-by-step/HomesteadDeclaration.pdf

- ↑ http://www.deedclaim.com/legal-description/

- ↑ http://www.lexisnexis.com/legalnewsroom/lexis-hub/b/commentary/archive/2008/05/07/foreclosure-and-homestead-exemptions.aspx

- ↑ http://www.nolo.com/legal-encyclopedia/can-judgment-creditor-foreclose-home.html

- ↑ http://www.oregonlaws.org/ors/18.398

- ↑ http://www.nolo.com/legal-encyclopedia/the-california-homestead-exemption.html

- ↑ http://www.investopedia.com/terms/e/encumbrance.asp

- ↑ http://www.nolo.com/legal-encyclopedia/what-is-judgment-lien.html

- ↑ http://www.miamidade.gov/pa/faq_exemptions.asp#6

About This Article

Homesteading your home can protect you from having to sell your house in case of bankruptcy. In some states, your primary residence is automatically considered your homestead, but it’s not in other states, so check the laws where you live to be sure. To file a homestead declaration, you’ll need to draw up a document that includes your name, the address of your homestead, the APN for your property, and the name of all the residents who live there. Then, you’ll need to file your document at the county recorder’s office to make it official. If you want to take advantage of a homestead exemption, consider talking to an attorney first. They’ll be able to walk you through the complex legal process and help you make a sound decision. To learn how to determine what parts of your property can be considered homestead, read more from our Legal co-author!