This article was co-authored by Dhenu Maru. Dhenu Maru is an Immigration Lawyer, as well as the Founder and CEO of SwagatUSA, LLC. With over 10 years of experience, she specializes in family immigration and business immigration. She earned her law degree from Loyola University Chicago School of Law and her BA in Philosophy & Child Development from Tufts University. She was named a Rising Star by Super Lawyers for 2017, 2018, and 2019. She earned the title of Super Lawyer in 2021 and has been selected again for 2023.

This article has been viewed 106,602 times.

Admittedly, making money without a Social Security Card can be difficult, as a Social Security Card is required to file an income tax return. There are, however, ways to make smaller amounts of money fairly quickly without needing a Social Security Card. If you are not eligible to receive a Social Security Number, you may still apply for an Individual Identification Number (ITIN). You can also make a little money by working small cash-based jobs, and by identifying and selling items that you may not need, or that are redundant.

Steps

Applying for an ITIN

-

1Understand what an Individual Taxpayer Identification Number is. An ITIN is a number issued only to individuals who do not qualify for a Social Security Number, but who have tax reporting or filing requirements. While a Social Security Number is necessary for employment, it is possible to legally start a business with only an ITIN.[1]

- It is important to note that an ITIN does not authorize work in the United States, nor does it permit eligibility for Social Security.

- For individuals not eligible for a Social Security Number, the ITIN can be a useful way to create legally create income via entrepreneurship.[2]

-

2Determine if you qualify for an ITIN. If you are not eligible to obtain a Social Security Number, but still have tax reporting requirements (like owning a small business, for example), you qualify for an ITIN number.[3]

- Examples of individuals who would meet these requirements include non-resident aliens, resident aliens, and spouses or dependents of resident/non-resident aliens.

- A resident alien refers to any individual who is not a United States citizen, but who has passed the green card or the substantial presence test. A non-resident alien refers to a non-citizen who has not passed the green card or the substantial presence test.

Advertisement -

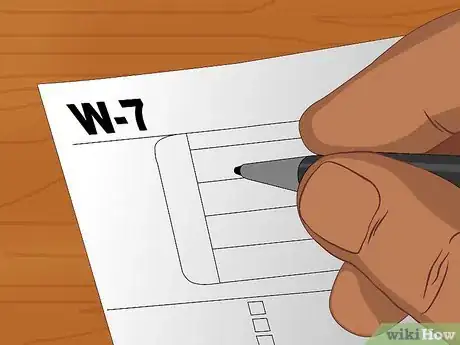

3Apply for an ITIN number. If you meet the above requirements, and have tax reporting requirements, or are interested in starting some sort of business that will have tax reporting requirements, you will need to apply for an ITIN number.

- To apply, you will need to fill out a W-7 Form, which can be found on the IRS website. Simply fill out the form, and attach it to a valid federal income tax return. You will also need to include your proof of identity (either or originals or copies) , and foreign status documents.[4]

- Mail your information to the following address: Internal Revenue Service, Austin Service Center ITIN Operation, P.O. Box 149342, Austin, TX 78714-9342

- If you need assistance with your application and are in the United States, contact the IRS at 1-800-829-1040. If you are outside of the United States, contact the IRS at 267-941-1000

- Note that you can apply for an ITIN at any time of the year, but since you need to attach a federal tax return to your W-7 Form, make sure to apply before the due date for the tax return as to avoid any penalties.[5] .

Selling Items to Raise Cash

-

1Identify unused or unnecessary items. One of the easiest ways to raise cash quickly is by selling items. The first step with regards to selling items involves identifying items to sell, and often, this can be the most difficult step.The solution involves identifying items that are of little to no use, and are being kept for sentimental or other reasons.

- One suggestion is to ask yourself, "If I lost everything I have, what would I replace?". This question is important because it makes one think of possessions in terms of utility, that is to say, what they do for you.[6] .

- Make a list of all the items that come to mind first. Most likely, these are the items that are critical to your quality of life or survival. You may for example list a computer and cell-phone as being items to immediately replace.

- By doing this, you can determine which items are absolutely necessary. Any items not on this list can be seen as eligible for sale.

- Think in terms of needs, and make sure you have the minimum amount of items only to accomplish said needs. For example, entertainment may be a key need. To accomplish this, a computer and a smartphone probably suffice, making your TV redundant. Another example would be with regards to clothing. You need shoes for example, and likely shoes for different functions (like running shoes and dress shoes), but you likely do not need three pairs for each category.

-

2Determine which price to sell items for. Once you determine items that you do not need, it is time to determine how to price them. Your goal here is the maximize the value you get for each sold item, to increase your cash.[7]

- Find out the replacement value of the item assuming you are replacing it with a brand new version. For example, if the item is a snare drum for a drum kit, look online or at local stores to determine its current price. If the item is difficult to find, use similar quality items for reference.

- Find out the used value of the item. Use Amazon, Ebay, or Craigslist. Make sure to take note of the quality of the typical item being sold, as well as the quantity of sellers.

- Use the above information to price your item. If you notice your item is higher quality than most used items, price it above the typical sale price seen, and closer to what the new price would be. If you notice there are very few sellers of your item new or used, and your item is of higher quality, you may be able to get away with very close to new prices assuming your item has a decent demand.

-

3Identify online locations to sell your item. Once you have a general price determined, it is important to determine where to sell it. There are multiple websites available and each has different advantages depending on the product being sold.[8]

- Amazon Marketplace is an excellent choice for selling electronics, household items, and small appliances. Amazon lets you list the quality of the item, assists in price setting, and has a vibrant marketplace of potential buyers. Most importantly, Amazon will list your item under their particular listing for a product. This means anybody searching your product new will also see your used item to compare as an alternative.

- eBay is also a viable alternative, but it takes more effort to ensure your item is easily found. Typically, eBay is more useful for valuable items.

- Craiglist can be useful for nearly any classification of item, and the website allows you to sell your item directly to your local community.This can be useful for clothing especially, as potential buyers can examine the clothing before purchasing.

- For Craigslist, consider selling in bulk. For example, post an ad saying "10 slightly used but in good condition male t-shirts for sale". Craiglist is also very useful for large appliances or furniture. Selling locally saves the buyer from shipping fees, and saves you from the complexities of packaging and sending large items.

-

4Consider holding a yard sale. Holding a yard sale can be an efficient way of selling large quantities of items in one day, thereby allowing you to quickly raise cash. To advertise your yard sale, print flyers and place them around your neighborhood and city to attract potential buyers.

- Yard sales can be useful for selling toys, furniture, appliances, and other miscellaneous items. Toys and children's items sell especially well compared to online, because there are few sites dedicated specifically to these products. It is also a handy way for buyers to purchase multiple items quickly and easily.

-

5Sell your unused gift cards. If you have gift cards lying around with unused balances, sell them online. Several websites specialize in buying and selling gift card balances at discounted prices. GiftCardGranny.com is an especially helpful brokerage service that can connect you with top-paying companies looking to buy gift card balances. You can receive up to 90% of the card's face value doing this.

-

6Consider pawn shops. Pawn shops offer short-term cash loans secured on just about anything of value that you can give them. Electronics and jewelry are two popular choices to pawn. If you don't pay the loan back within the time allowed, the pawn shop repossesses your item and you keep the money. You will need to show a photo ID at the pawn shop, but you won't need a Social Security Card.

Working Cash-Based Jobs

-

1Understand the rules. While employers will require an SSN, it is possible to make small amounts of money as a self-employed person without having an SSN.[9]

- The typical rule is that if you earn more than $400 in the course of a year as a self-employed person, you are required to file a return, and would therefore require an SSN.

- Note that while it may be tempting to be paid in cash for doing small jobs, or even running a small business, this is ultimately illegal. The IRS can audit you, and will be able to identify unreported cash income using your bank statements, or by noting any discrepancies between income and lifestyle or assets.

-

2Determine small jobs you can do to make money. It is possible to make under $400 without reporting, and therefore you can find jobs that would pay under that. There are multiple options to consider.

- Quick jobs include babysitting, mowing lawns, shoveling snow, walking dogs, or doing small repairs or odd jobs for friends or family.

- Consider what your skills are, and target your jobs to tasks that fall within what you are good at.

-

3Advertise yourself. The best way to locate potential customers is to start by asking friends or family. They may need odd jobs done, or know somebody needs odd jobs done.

- Consider printing flyers as well, or handing them door-to-door. If, for example, you want to quickly make some money mowing lawns, you can print out posters advertising your services and price, and place them on telephone polls. You can also hand them out to individuals who you feel may need the service, such as elderly people, or individuals who have busy lifestyles.

Expert Q&A

-

QuestionCan you create income without a work authorization?

Dhenu MaruDhenu Maru is an Immigration Lawyer, as well as the Founder and CEO of SwagatUSA, LLC. With over 10 years of experience, she specializes in family immigration and business immigration. She earned her law degree from Loyola University Chicago School of Law and her BA in Philosophy & Child Development from Tufts University. She was named a Rising Star by Super Lawyers for 2017, 2018, and 2019. She earned the title of Super Lawyer in 2021 and has been selected again for 2023.

Dhenu MaruDhenu Maru is an Immigration Lawyer, as well as the Founder and CEO of SwagatUSA, LLC. With over 10 years of experience, she specializes in family immigration and business immigration. She earned her law degree from Loyola University Chicago School of Law and her BA in Philosophy & Child Development from Tufts University. She was named a Rising Star by Super Lawyers for 2017, 2018, and 2019. She earned the title of Super Lawyer in 2021 and has been selected again for 2023.

Immigration Lawyer Yes—creating income depends on where you're creating the income and whether you have a work authorization to create income. So, in other words, two things can be true at once. You may be unauthorized to work, but you can still use your ITIN number to report the income you gained while you were unauthorized to work.

Yes—creating income depends on where you're creating the income and whether you have a work authorization to create income. So, in other words, two things can be true at once. You may be unauthorized to work, but you can still use your ITIN number to report the income you gained while you were unauthorized to work. -

QuestionI am a personal trainer and I have submitted my visa forms and I am now just awaiting for the process to be completed for the green card. Would it be a problem if I advertise myself for personal training on social media etc. whilst this process is going on?

DonaganTop AnswererIt should not be a problem.

DonaganTop AnswererIt should not be a problem.

Expert Interview

Thanks for reading our article! If you'd like to learn more about making money with an ITIN, check out our in-depth interview with Dhenu Maru.

References

- ↑ http://www.irs.gov/Individuals/General-ITIN-Information

- ↑ http://america.aljazeera.com/watch/shows/real-money-with-alivelshi/articles/2014/3/27/undocumented-entrepreneursnosocialsecuritynumberowningabusiness.html

- ↑ http://www.irs.gov/Individuals/General-ITIN-Information

- ↑ http://www.irs.gov/Individuals/General-ITIN-Information

- ↑ http://www.irs.gov/Individuals/General-ITIN-Information

- ↑ http://lifehacker.com/5957609/how-to-kick-your-clutter-habit-and-live-in-a-clean-house-once-and-for-all

- ↑ http://lifehacker.com/5981335/the-complete-guide-to-selling-your-unwanted-crap-for-money

- ↑ http://lifehacker.com/5981335/the-complete-guide-to-selling-your-unwanted-crap-for-money

- ↑ http://www.forbes.com/2011/01/25/when-file-first-tax-return-dependents-personal-finance-first-1040.html

About This Article

It can be difficult to earn a living if you don’t have a social security card, but you can still make money from selling stuff or picking up short-term gigs. If you have anything valuable you don’t need, like some nice clothes, a TV, or antiques, try selling these online. Amazon Marketplace, eBay, and Craigslist are all good sites to list items. If you don’t have anything you want to sell permanently, you can bring your items to a pawn shop to get a loan. While most employers require a social security number, you can do odd jobs, like mowing lawns, babysitting, shoveling snow, walking dogs, or small repairs to make money. Put up some flyers in your neighborhood to advertise your service. You might also ask friends and family if they’ll hire you for any odd jobs. To learn how to apply for a taxpayer identification number, read on!