This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 10,306 times.

Learn more...

If you don’t have enough money in your checking or savings account, you can still pay off your credit card using another credit card. You can either do a balance transfer or take a cash advance and deposit it into a checking account to pay it off. Both options come with their own set of risks, so make sure whatever method you choose is right for you—and your budget!

Steps

Using an Existing Credit Card

-

1Check your credit score to see if using an existing card is beneficial. Take your credit score into consideration before you decide to do a balance transfer or take a cash advance with an existing credit card. Both processes can affect your card utilization rate and negatively impact your credit score.[1]

- Your credit score relates to how likely you are to repay debt. It’s important to have a good credit score if you plan to take out loans for large purchases (like a house or car).

- Check your credit score online on Equifax, Experian, or TransUnion.

- Getting a cash advance won’t directly affect your credit score, but the high interest rate on a cash advance can make it harder to make monthly payments on time, which will bring your score down.

-

2Determine whether or not your current card allows balance transfers. If you currently have another credit card aside from the one you’re trying to pay off, read the fine print to see if balance transfers are allowed. If you’re not sure, call a customer service agent by dialing the number on the back of your card.[2]

- Be sure to check the interest rate on your current card—the lower, the better.

- If your issuer allows balance transfers, make sure to check for any balance transfer fees.

- If transferring your balance to your existing card is feasible and beneficial, contact a customer service agent via phone or online to submit a balance transfer request.

- Some cards don’t allow balance transfers at all, so this may not be an option for you.

Advertisement -

3Ask your bank for convenience checks to take out a cash advance. Some banks already send out convenience checks, but if not, ask them to send you some. Then, use the check to write out the amount you need to cover your balance and deposit it into your checking account so you can pay off your other credit card.[3]

- Make sure your maximum amount of credit is above the amount of the balance you want to pay off.

- Using a convenience check to get a cash advance isn’t advisable if you’re struggling to keep up with bills and other monthly payments because you’ll be paying 2% to 8% interest rates on the amount from the day you take it to the day you pay it back.

Transferring the Balance to a New Card

-

1Search for a credit card that has a 0% introductory rate. Look for banks and credit unions that offer a 0% interest rate for the first chunk of time you have the card. Take note of when the 0% rate expires so you don't end up paying a regular rate.[4]

- Make sure you can pay off most (if not all) of the balance within the introductory rate.

- Look into cards that offer 12 or more months interest-free.

-

2Choose a card that allows balance transfers. Check your potential new card’s terms and conditions to see if the issuer allows balance transfers and, if so, has a credit limit high enough to cover your balance. Also check to see if there are any restrictions about transferring a balance between certain types of cards.[5]

- For example, you might not be able to transfer a balance from your Citi card onto another Citi card.

- Make sure the maximum credit limit on the card is higher than the balance you want to transfer.

-

3Sign up for a balance transfer card and wait to be approved. After finding the right card for your needs, go to the bank or issuer’s website and apply for a line of credit. If you have good credit, you’ll probably be approved. Issuers will take the following things into consideration:[6]

- The percentage of payments you make on time.

- How much of your credit line you actually use (e.g., if you only use 30% of your total available credit each month).

- How old your credit accounts are.

- How many accounts you have.

- Any derogatory marks (e.g., if you’ve ever failed to pay off a loan according to the agreement).

- How many hard inquiries you have (i.e., the number of times a creditor has checked your credit for approving a loan or credit card).

- How many 30-day delinquencies you may have, if any.

-

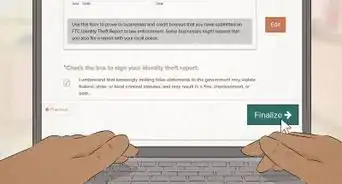

4Submit a balance transfer request with the new issuer after you’re approved. Call a customer service agent or make the request online. Give them the account number of your old account (the one you’re paying off) and let them know the dollar amount you’d like to transfer.[7]

- Note that it can take 7 to 10 days for the issuer to process the transfer so be patient and keep making payments on your old credit card so you don’t rack up late payment fees.

-

5Pay the balance transfer fee. Once your balance transfer goes through, the issuer will charge you a fee that varies from 3% to 5% of the total balance. Make sure you calculate the transfer fees into your budget.[8]

- Balance fees can be pricey. For instance, if you're transferring $10,000, you'll have to shell out $300 to $500.

- However, some issuers won't charge a transfer fee if you to request not to have one within 60 days of opening an account.

- Be sure to look at the membership requirements before you sign up for a new account so you’re not hit with any surprise fees!

-

6Pay off your debt once your balance transfer is approved. Pay off the new card on time to ensure you don't accrue further debt and rack up additional fees. Some issuers will take away the 0% interest rate if you miss even one payment.[9]

- Note that if you couldn’t transfer your entire balance, you’ll still need to make minimum payments on the old credit card account.

- Stick to your budget so you can pay off as much of your balance as possible within the introductory 0% APR period.

Getting a Cash Advance

-

1Open a credit card account that allows cash advances. Search for credit cards that have low interest rates and no fees for cash advances. It’s also important to consider any reward points you might get after spending a certain amount and if there are any annual fees for the account.[10]

- When it comes to fees, credit unions tend to be a bit more customer-friendly than banks.

- Search online for various credit cards with no cash advance fees, no annual fees, and low APR.

-

2Determine the fees and interest you’ll pay for taking a cash advance. Read the fine print on your credit card agreement. It will state whether cash advances are allowed and, if so, how you go about taking a cash advance. It will also spell out some additional points you need to take into consideration:[11]

- If you need to pay a fee for taking out the advance.

- The annual percentage rate you'll need to pay for the advance.

- How interest accumulates on cash advance balances. In most cases, Interest starts adding up right away on cash advances, so make sure you can pay back the advance as quickly as possible.

-

3Go to your bank or use a full-service ATM to get the cash advance. Either visit a bank teller or go to a secure ATM to take out an advance. If you go to your bank, be sure to bring your card and a photo ID.[12]

- If you go to an ATM, you'll need a PIN number. If you don’t have one for your credit line, call the customer service number on the back of your credit card.

- Using an ATM isn’t ideal because you’ll also have to pay a transaction fee.

- Note that most issuers put a cap on how much you can get with a cash advance. For instance, if your credit limit is $5,000, you may only be able to take out an advance of $1,000 to $2,000.

- You can also take out an advance by using cash convenience checks if your bank offered that option when you started your account.

-

4Pay the fee for getting a cash advance, if necessary. Most issuers will charge you a fee for getting a cash advance, and they're often based on a percentage of your advance. That means, the more you get, the more you pay in fees. The rate typically ranges from 2% to 8%.[13]

- For instance, if you request a cash advance of $1,000, and the fee is 4%, you'll pay a fee of $40.

- Don't be afraid to ask your credit card issuer how they calculate your cash advance fee—they're required to tell you if you ask.

-

5Deposit the cash into your checking account and pay off your debt. Go to your bank and deposit the funds into your checking account. Then, use that checking account to pay off your credit card balance.[14]

- To minimize interest charges, make a dedicated effort to pay off your cash advance as soon as possible.

Warnings

- If you're in so much debt that you're constantly having to shuffle funds around to make ends meet, consider talking to someone about debt relief.⧼thumbs_response⧽

References

- ↑ https://www.experian.com/blogs/ask-experian/can-you-pay-off-one-credit-card-another/

- ↑ https://www.creditkarma.com/credit-cards/i/how-to-do-a-balance-transfer/#read

- ↑ https://creditcards.usnews.com/articles/how-to-get-a-cash-advance-from-your-credit-card

- ↑ https://www.nerdwallet.com/blog/credit-cards/the-best-way-to-consolidate-your-debt/

- ↑ https://www.creditkarma.com/credit-cards/i/how-to-do-a-balance-transfer/#read

- ↑ https://www.creditkarma.com/credit-cards/i/credit-karma-approval-odds/

- ↑ https://www.creditkarma.com/credit-cards/i/how-to-do-a-balance-transfer/#read

- ↑ https://www.nerdwallet.com/blog/top-credit-cards/no-balance-transfer-fee-credit-cards/

- ↑ https://www.nerdwallet.com/blog/credit-cards/can-i-use-credit-card-to-pay-another-credit-card/

- ↑ https://www.nerdwallet.com/blog/credit-cards/what-is-a-cash-advance/

- ↑ https://www.thebalance.com/credit-card-cash-advance-fee-explained-959991

- ↑ https://creditcards.usnews.com/articles/how-to-get-a-cash-advance-from-your-credit-card

- ↑ https://creditcards.usnews.com/articles/how-to-get-a-cash-advance-from-your-credit-card

- ↑ https://creditcards.usnews.com/articles/how-to-get-a-cash-advance-from-your-credit-card