X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 20,365 times.

Learn more...

If you need to raise funding for your start-up, AngelList can be a great way to get in touch with investors. Keep reading for tips on how to make your profile stand out so you can get the money you need for your company!

Steps

Part 1

Part 1 of 3:

Make Your Profile Appealing

-

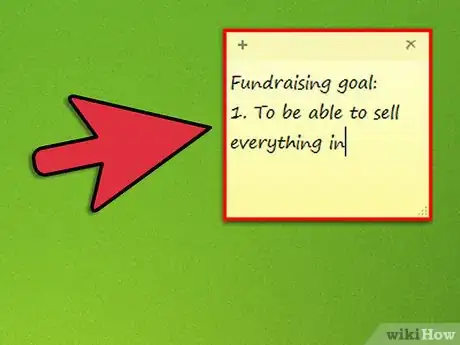

1Clearly state your fundraising goal. Be up front about how much you want to raise in your current round of fundraising. It will be a waste of time and resources for both you and your potential investor if you are asking for something they aren’t willing to give. You should have already spent time determining your goals for your initial investment round while creating your business plan, but double check to make sure that you aren’t over- or under-reaching.

-

2Use all four markets. You can choose up to four markets with which to describe your company. Investors following those markets will be able to come across your startup more easily, so it is wise to utilize all four.

- Don’t create a new market! If you create a new one, no investors will be following it, and it can prevent potential investors from finding your company.

Advertisement -

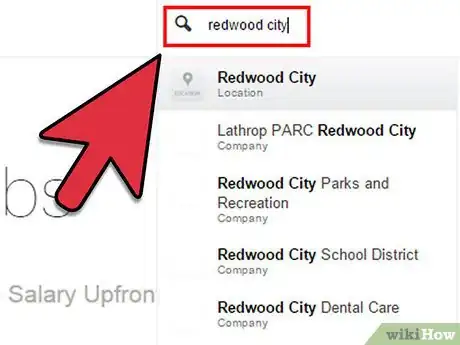

3Choose a semi-broad location. Many investors like to invest in local companies, and will search for companies in their area. If you make your location “Redwood City” for example, you may be preventing investors located in a slightly wider radius from finding you. A better strategy would be to list “Bay Area” or “Silicon Valley”, but take care not to go too wide - “California” will not give a clear idea of where you are located.

-

4Add every member of your team. Your team’s network will be notified when you add them to your company, which will increase the number of people who visit your profile.

-

5Ask your current backers to join AngelList. By having them follow and endorse you, you show the Angel network that some people have already found your company worth investing in. Companies with an existing base and traction tend to do better than companies with no following.

Advertisement

Part 2

Part 2 of 3:

Create a Dream Team of Investors

-

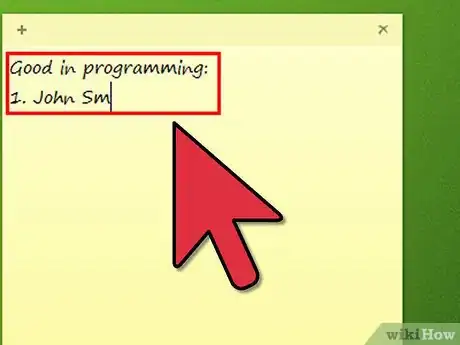

1Examine your team for gaps in knowledge. Make a list of each person's strengths and areas of expertise, and look for areas that you could use advice in. Jot down these gaps - it would be beneficial to you to find investors that can fill those.

-

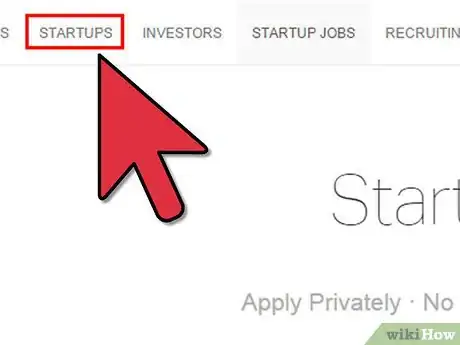

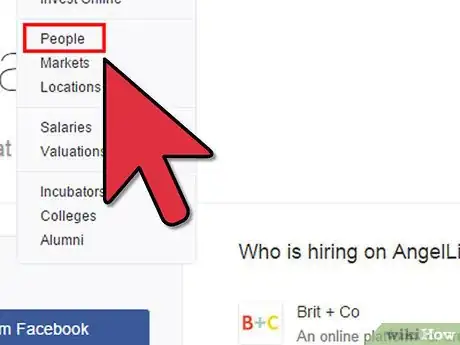

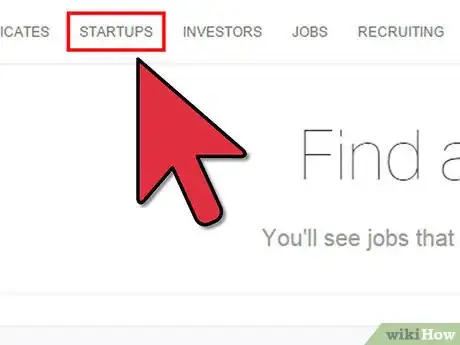

2Explore the Angel List investor network. Research angels who have invested in similar companies, especially ones who have strengths in areas you are lacking in. On AngelList, you can filter your search by sector or by company to find investors that are likely to be interested in your company.

- Contacting investors randomly is not only a waste of time and energy, it can reflect badly on your company. Showing that you have done your research on each investor and have chosen them specifically because of their experience and interests will show strategy and intelligence that will make you stand out as a success.

-

3Create a list of "Target Investors". These should be investors in your sector that have invested in similar companies in the past, have experience in areas you are lacking, and have the resources to give you what you need.

Advertisement

Part 3

Part 3 of 3:

Contact Investors

-

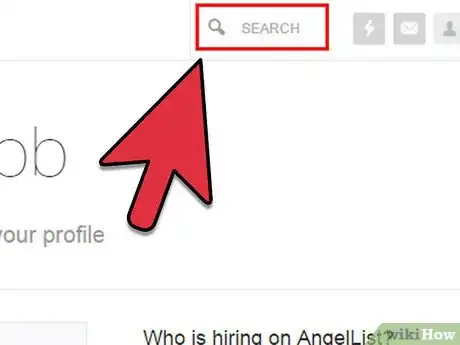

1Search for the investors on your list. In the search bar in the right corner, type in their name and click Enter.

-

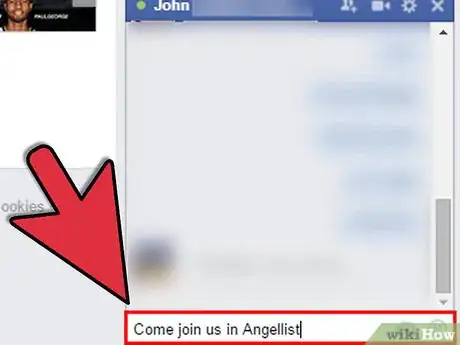

2Contact investors. You can only contact investors on AngelList that have followed your company or contacted you first. However, with some research, you may be able to find their contact information on LinkedIn, or on their website.

-

3Send them a short description of your company. Remember to keep this short and sweet. In your initial message, you should give them enough information to peak their interest and clearly show your mission, but you don't want to drown them in extra details. They can visit your profile and website if they are interested in learning more.

-

4Tell them clearly why you think they would be interested in your company. Be specific! If they have invested in related companies before, mention that.

-

5Describe why you need them. Knowing what you are lacking is important for any entrepreneur. Being clear about what you think they can bring to the company will show them why you are contacting them, specifically.

-

6Show your strengths.Make sure you mention why your investment would be a good one. How can they be sure they are making a good investment? Show your strengths, your team's successes, and your confidence.

-

7Prepare a short pitch for a video conference or phone call. If the investor is interested, they may want to talk to you personally to hear more about the company and ask questions.

Advertisement

About This Article

Advertisement