This article was co-authored by Trent Larsen, CFP®. Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

There are 9 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 248,932 times.

As you get older there seem to be more and more things that you want, but not enough money to get them. It could be a new cell phone or video game, some cute clothes or new makeup, or even some extra cash for a movie or date. When you are struggling to afford all the things you want, it might be time to take matters into your own hands and start saving up some money! To help you out, we've put together some tips on how to save money as a teenager as quickly as possible.

Steps

Starting to Save

-

1Open a savings account if you want to keep your money in a safe place.[1] Look for an account that offers high interest rates, which are bonuses that the bank gives you for keeping your money in one of their accounts. Get an account with no monthly service fees as well. A savings account at a local bank or credit union makes it a little easier to save your money because you can’t access it as easily.[2]

- Check with the banks in your area for the requirements to open an account. You may have to have an initial deposit, usually between $25.00 and $100.00, to open one.

- Some institutions may require that you be 18 years old to open an account or that you have a parent or guardian with you.

- You may also need some form of ID to open your account. If you don’t have an official ID card, they may accept a school ID or yearbook photo as well as other documents that your parents can help you with.[3]

-

2Wait 30 days before buying an item if it's not something you need. It’s easy to splurge and buy something on impulse. If you find yourself in this situation, force yourself to stop the purchase. If you are at the store, put the item back and leave; if you are looking online, exit out of the browser. Write down the name of the item, the price, why you want it, the name of the store, and the date.[4]

- Over the next 30 days, think about the item. Really think through why you want it, if it’s worth the price, and if you can do without.

- This waiting period will also give you time to do some research to see if you can find better deals.

- If after 30 days you decide that you still really want the item, consider purchasing it. If you decide to buy it, the delayed gratification will make getting it seem so much better!

Advertisement -

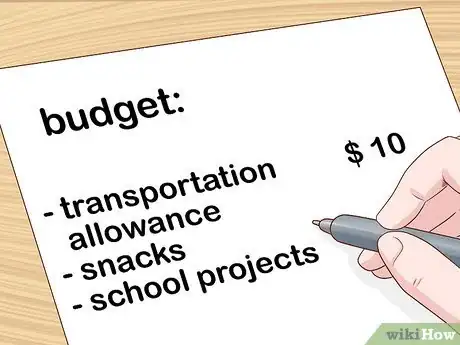

3Make a budget if you need help staying on track. Each month, figure out which things you absolutely need money for, which are negotiable, and which you can do without in order to save money.[5] Then keep track of your spending and stick to your budget. Avoid buying things that go above and beyond your allotted spending amount so that you can still work toward your goals.[6]

-

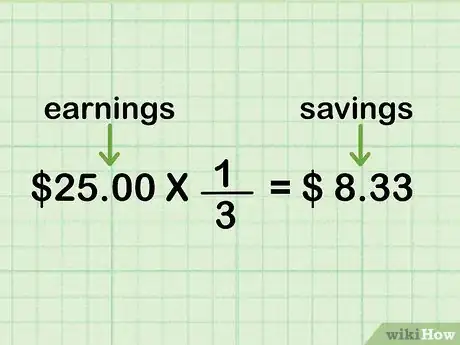

4Save at least one-third of your money if you want to build your savings. If you put all the money you earn directly into savings, it can feel like you did a lot of work for nothing, and creates the urge to want to spend it on something to show for all your hard work. To help with this, put one-third of your money into your savings as soon as you get it.[7] Allow yourself to spend the other two-thirds.[8]

- For instance, if you earn $25.00 for something, put about $8.33 into savings. This way, you can give yourself some spending money while still building up your savings.

- For larger amounts that you earn, or if you have something specific you are saving for, increase the amount you put into savings to about half. If you really have nothing to spend money on, and would just be wasting it anyway, try putting three-quarters of it into savings and spending the other one-quarter.

Making Money

-

1Do household chores if you want to earn money at home. Talk to your parents to see if you can work out a deal. You could ask for a list of chores to complete for a weekly or monthly payment, or you could request a set amount for each chore you do.[9]

- For instance, you could ask for $2.00 each time you wash the dishes and $5.00 for picking weeds.

- If you decide on a set amount, a good rule of thumb is for parents to pay $1.00 per year of age every week. For instance, a 15-year-old would get $15.00 a week.[10]

- Any money paid to you by your parents can vary greatly depending on your family’s circumstances. Do not demand or expect a certain amount of money, and understand that paying you an allowance may not even be an option. Instead, work together to figure out what is doable.

- If you aren’t able to get an allowance from your parents, you can try checking with other family members and neighbors. Ask if they have any chores they need help with and would be willing to pay you for.

-

2Find a gig if you want to earn money on your own terms. Think of something you enjoy doing, and then use that to earn some cash. If you like children, start babysitting; if you like animals, walk dogs or pet sit; if you like doing outdoor work, rake leaves or mow lawns. You could also clean houses or wash cars—your options here are really endless.[11]

- Start out by doing these service jobs for your parents, neighbors, and other friends and family members. Ask them to pass your name on to their friends and family to help you get even more opportunities.

- If you really get into a gig you like, consider making business cards to hand out.

- This is a flexible money-earning option. You’ll be in charge of what you do and when you do it.

-

3Get a job if you want to work regular hours. Once you create a resume, start looking online or for “help wanted” signs in your area. After you’ve decided on a couple of places you might like to work, start putting in applications at those locations.[12]

- Consider working as a barista at a nearby coffee shop, in retail at a department store, or hostessing at a restaurant. If you want a more low-key job that still has consistent pay, look into delivering newspapers.

- You’ll need to check your local laws for the minimum age requirement to work and whether or not a permit is required.

- If your family owns their own business, or you know someone who does, this can be a great place to start.

Community Q&A

-

QuestionEvery month I start with a good amount of income, but after a few days I'm back to no money. How can I manage my money?

Melissa C. WhiteleyCommunity AnswerTry creating a budget that gives you a reasonable amount of money for certain areas (like food, shopping, and savings). Then make sure you stick to it. Sticking to a budget isn't always easy, but it can be done! Check out How to Do a Monthly Budget for more help.

Melissa C. WhiteleyCommunity AnswerTry creating a budget that gives you a reasonable amount of money for certain areas (like food, shopping, and savings). Then make sure you stick to it. Sticking to a budget isn't always easy, but it can be done! Check out How to Do a Monthly Budget for more help. -

QuestionHow can I get $200 in the shortest time (or earn it online)?

Community AnswerTry finding a gig like mowing lawns or babysitting, then put as much as you can into savings. To make money online, check out the "Finding Work Online" section in wikiHow's article on making money for teenagers for more information.

Community AnswerTry finding a gig like mowing lawns or babysitting, then put as much as you can into savings. To make money online, check out the "Finding Work Online" section in wikiHow's article on making money for teenagers for more information.

References

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.nerdwallet.com/blog/banking/how-to-open-a-bank-account-what-you-need/

- ↑ https://www.privacyrights.org/consumer-guides/customer-identification-programs-financial-transactions

- ↑ https://www.getrichslowly.org/control-impulse-spending-with-the-30-day-rule/

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://handsonbanking.org/teens/budgeting/build-budget/build-your-own-budget/

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.marketwatch.com/story/5-mistakes-parents-make-when-giving-kids-an-allowance-2016-05-06

- ↑ http://money.cnn.com/2017/03/02/pf/kids-allowance/index.html

About This Article

If you’re a teenager and you want to save money, start by doing chores around the house for money, or getting a part-time job like pet sitting or mowing lawns. Then, deposit ⅓ of the money you earned working into a savings account, which will help you save money while still leaving you enough to enjoy what you’ve earned. If you’re having trouble keeping money aside, try waiting 30 days before buying an item you want to help you decide if you really need that item. For tips on choosing the best savings account, like a high-interest account, keep reading!

-Step-7-Version-3.webp)

-Step-22-Version-2.webp)

-Step-7-Version-3.webp)