This article was co-authored by Trent Larsen, CFP® and by wikiHow staff writer, Jennifer Mueller, JD. Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

There are 15 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 18,173 times.

A family vacation is a perfect time to get away from the daily routine, have some adventures, and make some memories. Saving for a vacation can be stressful, though. You already know about budgeting, but sometimes it can be tough to find spots where you can cut expenses. Never fear! We here at wikiHow have some great ideas you can use to free up money you're already making for your vacation fund, plus bring in some more.

Steps

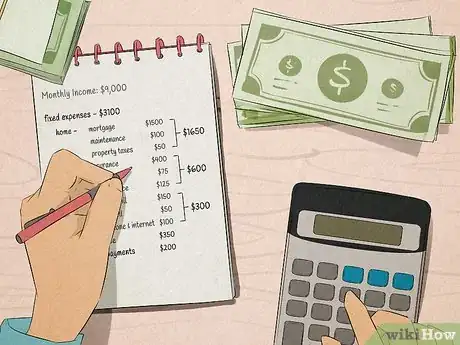

Budget so you can cut expenses down.

-

Careful planning helps control ballooning vacation costs. When you start planning your trip, look at the things you want to do and plan well in advance. Get input from everyone in the family, then start looking online for deals and offers. If you're flexible with your dates, you can often get better prices mid-week than on weekends.[1] X Research source

- Transportation, meals, and accommodations are going to be your biggest expenses—together, they might make up close to half of the total cost of your vacation. The good news is these are also areas where you can get some of the biggest discounts if you plan ahead.

- One option is to let each family member choose 1 thing that they really want to do. Then you can schedule your vacation based on the best days to do those things. For example, you might find that you get the cheapest tickets if you fly on Wednesday and the museum you want to visit has discount rates on Thursdays.

- Don't forget to include incidental expenses and souvenirs in your budget—these can add up if you're not paying attention.

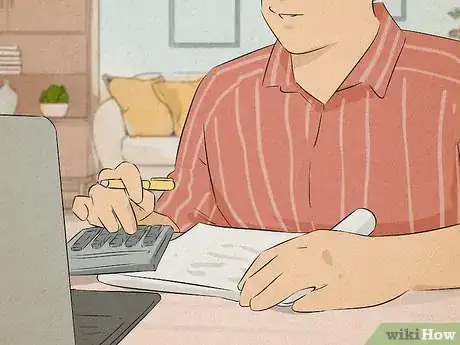

Create a savings plan so you can set monthly goals.

-

Divide your total vacation cost by the number of months you have. This gives you a basic idea of how much money you and your family need to save each month to reach your goal and cover your entire vacation. Plan some sort of reward or celebration for each monthly goal you hit—it doesn't have to cost money! It can just be something you all enjoy doing.[2] X Research source

- For example, suppose you're going on vacation in 7 months, and you've determined your vacation is going to cost $7,000. That means you need to save at least $1,000 a month toward your vacation expenses.

- Take note of expenses that need to be paid before you leave. For example, if you have to pay half the cost of your accommodations at least 30 days before you get there, that money is actually due earlier. Adjust your monthly goals so you can make sure the money will be there when you need it.

- This is a lot easier if you've started planning close to a year before you're going to head out, but even if you've only got a couple of months to save, it's still doable! You might just need to look for more ways to bring in extra money to make it work.

Open a dedicated savings account to make saving easier.

-

Set up an automatic transfer to this account each pay period. Go back through your budget and figure out how much money you can contribute each pay period without getting yourself in trouble. Even if it's only $20, it'll add up over time![3] X Expert Source

Certified Financial Planner Expert Interview. 22 July 2020. An automatic transfer through your bank means you don't even have to think about it—it's already done.[4] X Research source- If you're earning cash for different side projects, get in the habit of making a deposit to your vacation account every week or so.

- Divide the total amount you want to save by the number of weeks you have until your trip to get the amount you need to save per week. You might even make a chart to put on the refrigerator or family bulletin board that shows the amount saved each week and whether you're on track to meet your goal.

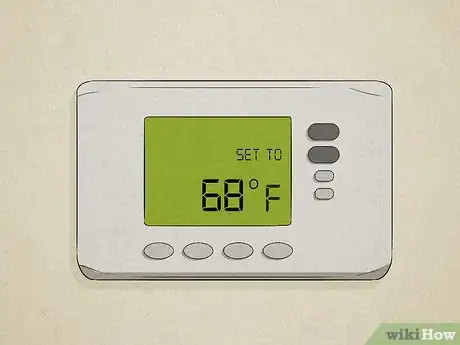

Adjust your thermostat to save on heating or cooling costs.

-

Just a few degrees can make a difference in your utility bill. According to the US Department of Energy, you can save as much as 10% per year simply by adjusting your thermostat 7-10 degrees (up in the summer, down in the winter) for 8 hours a day. Make it a habit to adjust the thermostat when everyone's going to be gone, or when you go to bed at night.[5] X Trustworthy Source U.S. Department of Energy Official site for the U.S. Department of Energy, which provides resources related to energy safety, conservation, and efficiency Go to source

- Compare your bill to your bill for the same month last year—you can pocket the difference towards your vacation. For example, if last year's November heating bill was $100 and this year's bill is $90, that's $10 toward your vacation.

Clean house and have a yard sale.

-

Put the money you make towards your trip. This is a twofer: you get rid of clutter and make some money for your family vacation. It's also a great way to get your kids involved and teach them basic business principles, such as how to price goods.[6] X Research source

- Check for other yard sales going on in your community. Go to a few before you hold yours to get some pricing ideas. Encourage your kids to compare the prices and condition of items for sale to the stuff you would offer.

- If you have collectibles or media that you're ready to part with, consider taking them to a resell store instead—you'll likely get more than you would at a yard sale. Online platforms, such as eBay and Facebook Marketplace, are good for this too.

- Clothing in good condition might sell at a brick-and-mortar consignment shop—especially designer stuff. You could also use an app, such as LetGo, Poshmark, or ThredUP.

Save money by bartering for services.

-

Talk to your neighbors and friends about skills and services you can trade. Brainstorm a list of things that you're really good at so you have something to offer in return. If you have a group of friends or neighbors, you might even set up a barter circle in which you all contribute.[7] X Research source

- For example, you might find out that your neighbor has always changed the oil in his car. He's willing to change your oil too if you're willing to watch his kids for an hour on Friday afternoons. You've just saved yourself the cost of an oil change (minus the cost of the oil itself), money you can put toward your trip.

- You might also offer to teach something in exchange for services. For example, if you're good at math, you might tutor your neighbor's kid in math in exchange for mowing your yard.

- Apps such as NextDoor and Facebook can help connect you with people in your area who are interested in trading services.

Do chores yourself instead of hiring someone.

-

If you can DIY it, you can probably save a little money to put toward your vacation. A lot of the chores you might pay someone else to do for you, such as washing your car, mowing your lawn, or cleaning your house are things you can easily learn to do yourself. Some of these things even make good family projects—get the kids involved![8] X Research source

- For example, if you normally get a manicure every 2 weeks, start doing your nails yourself and put the money you'd normally spend on your manicure towards your vacation.

- If you feel a little braver, you might also try your hand at trimming your hair (or your kids' hair)—although it's still probably best to go to a professional for more substantial cuts.

Prep meals for the week to cut down on takeout costs.

-

Takeout won't tempt you if you already have food ready to eat. Plan your meals for the week, then spend a Saturday or Sunday afternoon cooking what needs to be cooked. Arrange the food in single-serving containers you can stick in the fridge. Then, you'll always have something to eat when you're too tired or don't have time to cook.[9] X Research source

- You might designate one night a week (or every other week) for eating out—no need to completely deprive yourself and your family! The rest of the week, you can eat the food you've already made.

- If you want to spend more money on take-out and restaurants, you'll need to cut back your budget in other areas.[10]

X

Expert Source

Certified Financial Planner Expert Interview. 22 July 2020. - Get the kids to help you and you can teach them how to cook in the process. Older kids can help with the cooking, while younger kids can help put food in containers.

Join your local library for free entertainment.

-

Take the kids to free storytime and craft days. If you have younger kids, you're in luck, because libraries have tons of events for the little ones. Many libraries also offer digital subscriptions to magazines, audiobooks, ebooks, and more—all for free! Take the money you have budgeted for entertainment and save it for vacation.[11] X Trustworthy Source Understood Nonprofit organization dedicated to resources and support to people with thinking differences, such as ADHD or dyslexia Go to source

- Many libraries also have tools and spaces where you and your kids can create arts and crafts or work on other projects.

- If your library or community center has health and fitness programs available, you might also consider canceling that gym membership.

- Remember to take the money you would've otherwise spent and put it away toward your vacation. Include canceled subscriptions as well! If you cancel a print or digital magazine subscription because you get free access through the library, go ahead and sock that money away.

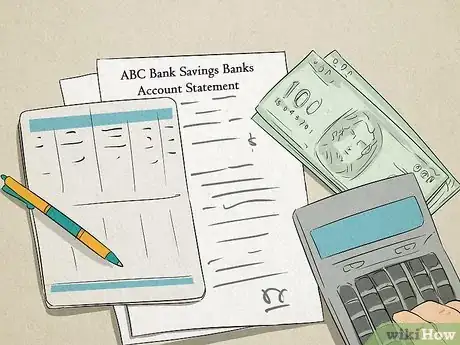

Cancel subscriptions you don't use or can do without.

-

Since the expense was already budgeted, you can think of it as free money. Go through last month's bank statement and highlight all the subscription fees that came out. Are there any that you never use? Get rid of them and save that money for vacation![12] X Trustworthy Source Federal Trade Commission Website with up-to-date information for consumers from the Federal Trade Commisson Go to source

- If you already paid for a year's subscription to something but don't use it anymore, they'll usually refund you the balance for the rest of the year when you cancel. Just shuffle that money right over to your vacation fund.

- Likewise, there might be some that you use but don't really need to. For example, if you have subscriptions to several different streaming services, maybe pick the one you like the best and cancel the others. You can always swap them around if you change your mind.

Negotiate lower rates for monthly bills.

-

Call up companies you pay monthly and ask for a better deal. If you've been with the same company for years, chances are they'll cut you a break on your service—all you have to do is ask. It helps if you're a good customer who always pays your bill on time, but even if you've had a couple of late payments, it still doesn't hurt to ask. If they're willing to give you a better rate, you can put the money you save towards your vacation.

- For example, suppose you call your cell phone company and they evaluate your usage and recommend a cheaper plan that better suits you and saves you $50 a month. That's $50 a month that can go straight into your vacation fund.

- You can also try shopping around for lower rates. If your insurance or cell phone company won't work with you, you might be able to get a better rate elsewhere.

- If the idea of negotiating makes you nervous, there are apps, such as Trim, Truebill, and BillShark, that'll do it for you! Read the fine print, though, and choose carefully—many of these services charge up to 50% of the amount they save you, and some require you to buy a subscription.[13] X Research source

Pay with cash when you go shopping to prevent overspending.

-

Withdraw the amount you have budgeted to spend and leave your plastic at home. Whether you're buying household essentials or enjoying a night out, swiping a debit or credit card is easy—parting with hard-earned cash is not. Only spending cash also ensures that you don't spend more than you have budgeted, which helps you stay on track.[14] X Research source

- Here's how this helps your vacation fund. Say you have $200 a week budgeted for groceries. Before you go to the grocery store, you make a list and pull $200 out of your bank account. When you check out, your total comes to $146.72. There's $53.28 to go toward your vacation fund.

Host a neighborhood car wash.

-

Make it a regular thing to build a steady clientele. If your neighbors know your family is going to be out there washing cars every other weekend, they'll be more likely to come to you than to go to a commercial car wash. Since this project doesn't require much initial investment (just some cleaning supplies), you'll be making money for your trip in no time, and you can get the whole family involved.[15] X Research source

- If you live in an apartment building or community, get the landlord's permission to have a car wash in the parking lot.

Sell crafts locally or online.

-

Turn family bonding into vacation dollars with simple craft projects you can sell. If you or your kids like to make things, why not sell them at a craft fair or through an online platform such as Etsy? Starting a small crafts business is also a great way to teach kids the basics of running a business, including how to calculate fair prices for the things you sell.[16] X Research source

- These things don't have to be complicated. Does one of your kids like making bracelets? They could easily sell those!

- If you're not particularly crafty, look at Etsy shops for ideas of things you could do or maybe take a class at your local library or community center.

- It's true that you'll spend some money on supplies for this venture, but hopefully you'll sell enough to turn a profit! Keep your craft money separate and use it when your supplies are running low. When it gets close to time for your trip, you can transfer the profits over to your vacation fund.

Keep a big jar for spare change.

-

Encourage everyone to put change in the jar when they come home. This is easy if you set the jar near the front door—whenever anyone comes home, they can simply empty their pockets. While it might not seem like much, it'll add up over time.[17] X Research source

- The week before your trip, take the change to your bank and get bills. Split it among family members to use as spending money for souvenirs on the trip.

Expert Q&A

-

QuestionHow should a beginner budget?

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Certified Financial Planner They should make sure that they aren't living beyond their means. They should also clarify and understand what they're spending their money on, and prevent themselves from racking up too much credit card debt.

They should make sure that they aren't living beyond their means. They should also clarify and understand what they're spending their money on, and prevent themselves from racking up too much credit card debt.

You Might Also Like

-Step-11.webp)

References

- ↑ https://www.washingtonpost.com/lifestyle/travel/how-to-set-and-stick-to-a-vacation-budget/2020/06/24/a3980212-b49b-11ea-a8da-693df3d7674a_story.html

- ↑ https://www.incharge.org/financial-literacy/budgeting-saving/how-to-set-financial-goals/

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.northeastohioparent.com/blogger/how-to-create-a-travel-fund-for-your-next-family-vacation/

- ↑ https://www.energy.gov/energysaver/thermostats

- ↑ https://www.nationsclassroomtours.com/blog/15-great-ways-for-kids-to-raise-money-for-a-school-trip/

- ↑ https://www.bbc.com/worklife/article/20200821-the-rise-of-bartering-in-a-changed-world

- ↑ https://www.moneycrashers.com/5-things-that-you-can-do-for-yourself-to-save-money/

- ↑ https://www.moneymanagement.org/blog/how-to-save-time-and-money-with-meal-prepping

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.understood.org/articles/en/9-free-public-library-resources-for-your-child-and-you

- ↑ https://www.consumer.ftc.gov/articles/getting-and-out-free-trials-auto-renewals-and-negative-option-subscriptions

- ↑ https://www.moneycrashers.com/best-bill-negotiation-services/

- ↑ https://nomoredebts.org/blog/manage-money-better/cash-only-diet-for-debt-repayment

- ↑ https://www.themint.org/kids/ways-kids-can-earn-money.html

- ↑ https://www.nationsclassroomtours.com/blog/15-great-ways-for-kids-to-raise-money-for-a-school-trip/

- ↑ https://www.self.com/story/how-to-save-money-for-vacations

About This Article