This article was co-authored by Bryan Hamby and by wikiHow staff writer, Jennifer Mueller, JD. Bryan Hamby is the owner of Auto Broker Club, a trusted auto brokerage in Los Angeles, California. He founded Auto Broker Club in 2014 out of a passion for cars and a unique talent for customizing the car dealership process to be on the buyer’s side. With 1,400+ deals closed, and a 90% customer retention rate, Bryan’s focus is to simplify the car buying experience through transparency, fair pricing, and world class customer service.

This article has been viewed 62,652 times.

Whether you want to buy a car outright or just make a large enough down payment to significantly improve your financing options, saving up for a car is a great way to get in the habit of saving! It takes some patience and discipline, but it'll be worth it when you get behind the wheel. And that sense of accomplishment can drive you on to tackle other goals. Here, we've gathered some of the best ideas you can use to save up for the car of your dreams.

Steps

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhat are some tips for people buying a car for the first time?

Bryan HambyBryan Hamby is the owner of Auto Broker Club, a trusted auto brokerage in Los Angeles, California. He founded Auto Broker Club in 2014 out of a passion for cars and a unique talent for customizing the car dealership process to be on the buyer’s side. With 1,400+ deals closed, and a 90% customer retention rate, Bryan’s focus is to simplify the car buying experience through transparency, fair pricing, and world class customer service.

Bryan HambyBryan Hamby is the owner of Auto Broker Club, a trusted auto brokerage in Los Angeles, California. He founded Auto Broker Club in 2014 out of a passion for cars and a unique talent for customizing the car dealership process to be on the buyer’s side. With 1,400+ deals closed, and a 90% customer retention rate, Bryan’s focus is to simplify the car buying experience through transparency, fair pricing, and world class customer service.

Professional Auto Broker

-

QuestionDo I need to know my credit score to buy a car?

Bryan HambyBryan Hamby is the owner of Auto Broker Club, a trusted auto brokerage in Los Angeles, California. He founded Auto Broker Club in 2014 out of a passion for cars and a unique talent for customizing the car dealership process to be on the buyer’s side. With 1,400+ deals closed, and a 90% customer retention rate, Bryan’s focus is to simplify the car buying experience through transparency, fair pricing, and world class customer service.

Bryan HambyBryan Hamby is the owner of Auto Broker Club, a trusted auto brokerage in Los Angeles, California. He founded Auto Broker Club in 2014 out of a passion for cars and a unique talent for customizing the car dealership process to be on the buyer’s side. With 1,400+ deals closed, and a 90% customer retention rate, Bryan’s focus is to simplify the car buying experience through transparency, fair pricing, and world class customer service.

Professional Auto Broker To buy a car, you have financing options. If you are paying cash, your credit score won’t matter. If your credit score is under 620, you’ll be subject to subprime rates, typically between 17% to 22%. Ideally, you have a credit score of 720 or above, which will get you the best interest rate. With this credit score, typically, new cars will be between 0% to 5% and used cars will be between 1.99% to 6.99%.

To buy a car, you have financing options. If you are paying cash, your credit score won’t matter. If your credit score is under 620, you’ll be subject to subprime rates, typically between 17% to 22%. Ideally, you have a credit score of 720 or above, which will get you the best interest rate. With this credit score, typically, new cars will be between 0% to 5% and used cars will be between 1.99% to 6.99%. -

QuestionHow do you pay for a car when buying from a private seller?

Bryan HambyBryan Hamby is the owner of Auto Broker Club, a trusted auto brokerage in Los Angeles, California. He founded Auto Broker Club in 2014 out of a passion for cars and a unique talent for customizing the car dealership process to be on the buyer’s side. With 1,400+ deals closed, and a 90% customer retention rate, Bryan’s focus is to simplify the car buying experience through transparency, fair pricing, and world class customer service.

Bryan HambyBryan Hamby is the owner of Auto Broker Club, a trusted auto brokerage in Los Angeles, California. He founded Auto Broker Club in 2014 out of a passion for cars and a unique talent for customizing the car dealership process to be on the buyer’s side. With 1,400+ deals closed, and a 90% customer retention rate, Bryan’s focus is to simplify the car buying experience through transparency, fair pricing, and world class customer service.

Professional Auto Broker

References

- ↑ Bryan Hamby. Car Buying Expert. Expert Interview. 11 June 2019.

- ↑ https://www.moneyadviceservice.org.uk/en/articles/saving-money-for-a-car

- ↑ Bryan Hamby. Car Buying Expert. Expert Interview. 11 June 2019.

- ↑ https://www.moneyadviceservice.org.uk/en/articles/saving-money-for-a-car

- ↑ https://www.moneyadviceservice.org.uk/en/articles/saving-money-for-a-car

- ↑ https://www.greedyrates.ca/blog/how-to-save-for-a-car/

- ↑ https://www.greedyrates.ca/blog/how-to-save-for-a-car/

- ↑ https://www.greedyrates.ca/blog/how-to-save-for-a-car/

- ↑ https://www.greedyrates.ca/blog/how-to-save-for-a-car/

- ↑ https://www.womansday.com/life/work-money/g19666210/how-to-save-money-for-house-car/?slide=1

- ↑ Bryan Hamby. Car Buying Expert. Expert Interview. 11 June 2019.

- ↑ https://www.nerdwallet.com/article/finance/credit-score-needed-to-buy-car

About This Article

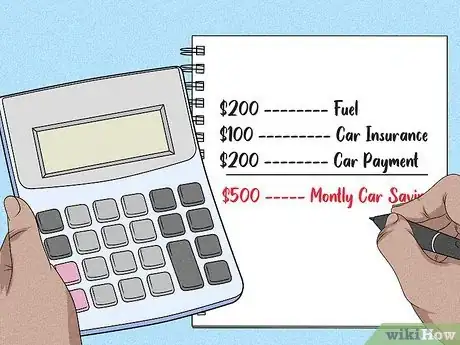

To save up for a car, set aside a set amount of your paycheck every month for your savings. Also, try to only spend money on the things you need, and avoid spending money on things like going out with your friends or eating out. You can also save more money by looking online for coupons and deals for everyday items you buy, like groceries. If you need motivation, print out a picture of the car you want and keep it in your wallet as a reminder of what you're saving for. To learn how to determine how much money you need to save up for your car, keep reading!