This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 29,023 times.

A traditional wire transfer is done from one bank account to another. However, you can also use your credit card to wire money to someone. Using a money transfer website or mobile app is typically the easiest way to do this. However, many money transfer apps only allow relatively small transfers and may have a weekly or monthly maximum total you can send. To avoid these limits, use a bank or wire transfer service if you need to send a substantial amount of money. However, many banks don't do wire transfers from a credit card. Additionally, the fees to wire money from a credit card are often higher than wiring cash or money from a bank account.[1]

Steps

Using a Money Transfer App

-

1Compare available money transfer apps. The many different money transfer apps available differ in their fees, range of services, and user interface. With most money transfer apps, the recipient of the money has to set up an account on the app to receive the money, so that's something to consider.[2]

- Beyond convenience, look for an app that will allow you transfer the amount of money you want to transfer to the person you want to transfer it to and charge you the lowest possible fee.

- If you're trying to wire money internationally, you'll have fewer apps to choose from. Many money transfer apps don't support international transfers. Some of the apps that do include PayPal, OFX, and Western Union. Pay attention to the exchange rate and any markup the transfer company charges as well. Most apps have calculators that will allow you to estimate the total cost of transferring a specific amount of money.

-

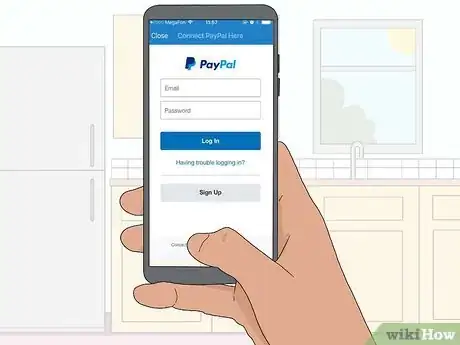

2Choose the app that best suits your needs. If you don't already have an account with the app you've decided to use, set one up so you can transfer your money. Typically, this involves providing some basic personal information, including your name, home address, email address, and phone number.[3]

- Some apps have an additional identity verification process you can complete if you want a verified account. Verified accounts typically have more privileges, including lower fees or the ability to transfer more money.

Advertisement -

3Link your credit card to your account. To link your credit card, provide the account number, date of expiration, and security code on the back. You may also have to provide the address associated with the card. After that, you should be ready to use your card.[4]

- Some apps allow you to add a card by taking a picture of the front and back of it with your smart phone camera.

- If you already have your card information on your smartphone wallet, you may be able to connect it directly from there.

Tip: Some apps do a micro-transaction to verify your credit card. Before you can use your card, you'll need to check your credit card activity and provide the money transfer app with information about the micro-transaction, including the amount and the date it went through.

-

4Provide information about the transfer you want to make. For some apps, all you need is a name, email address, or phone number to send money to someone. Other apps require additional information, depending on how the recipient is going to pick up their money.[5]

- For example, if the recipient is going to pick up the money in person, you may need to specify a location where they'll pick it up.

- If you're sending the money directly to the person's bank account, you'll need to provide the account number and routing number (also called a sort code) associated with their account. You may also have to provide the name and address of the bank.[6]

Tip: Review your transfer request carefully before you submit. Any typos or mistakes could keep the person from getting the money, and you may have difficulty reversing the transaction.

-

5Verify that the transaction went through. Most money transfer apps allow you to track the status of your transaction from your account. Transfers are typically completed within a few hours —sometimes within a few minutes.[7]

- You may also be able to see when the person actually withdraws the money or transfers it to a different account.

- If the person is picking up the money from an agent in person, you'll likely get a confirmation when the person receives their wired funds.

Completing a Wire Transfer

-

1Compare transfer costs with banks and wire services. Most banks and wire services charge an up-front fee for wire transfers, plus additional fees depending on the amount of money you want to spend and other factors, such as how fast you need the money to get there.[8]

- If you're making an international transfer, look at the exchange rate offered and any markup charged by the transfer service. A bank's exchange rate typically won't be as good as the exchange rate offered by an independent wire transfer service.

- Some credit card companies do wire transfers for account holders. However, if you do this, the amount you transfer will typically be considered a cash advance from your credit card.

- Many banks don't allow wire transfers using a credit card. Instead, you have to transfer the money from your bank account. However, you may be able to do a cash advance on your credit card, deposit that money to your bank account, and then complete the wire transfer.

- Most wire transfer services charge an additional fee for credit card transactions. It may be a flat fee or a percentage of the total amount you're transferring.

Tip: If a wire service has more than one way to send a wire transfer, some ways may be less expensive than others. For example, the service might charge lower fees if you come into a local office and complete the transfer in person rather than doing it over the internet.

-

2Choose the wire transfer provider you want to use. If you're using an online wire transfer service, you'll likely have to set up an account before you can transfer money. Most banks and credit unions will do a wire transfer if you already have an account there.[9]

- Make sure the service you choose is available where the recipient lives, especially if you're transferring money internationally.

-

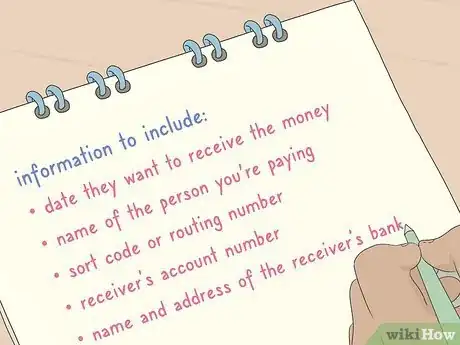

3Write down the information you'll need to send the wire transfer. In addition to your own credit card information, you'll need information about the recipient. If you're transferring money to their bank account, you'll need the account and routing or sort code number, plus the name and address of the bank to which the money is being transferred.[10]

- Double-check your information with the recipient and make sure you've got it correct. A mistake could mean they never get the money, and you may not be able to reverse the transaction.

-

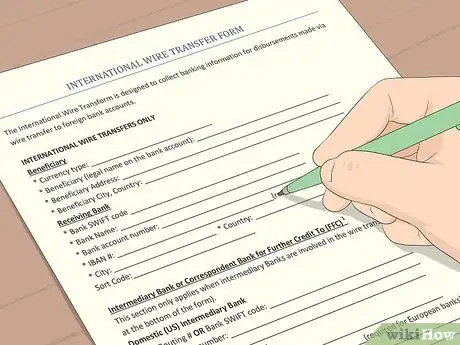

4Complete the wire transfer paperwork. Wire transfer services typically have a form you can use to provide information about the transfer, including your name and address, credit card number, the name and address of the recipient, and the amount of the transfer.[11]

- For international wire transfers, you can transfer a specific amount of your home currency or the recipient's currency. Your money will then be exchanged for the recipient's currency.

-

5Keep your receipt until the transfer is complete. If something goes wrong with the transfer, you can only reverse the transaction or re-send the money if you have the receipt. If you wired the money directly from your credit card, you'll also want to check your credit card transactions to confirm that the money has been withdrawn from your credit card.[12]

- If you use an independent wire transfer service, the transaction may be complete on the same day. However, some transfers may take 2 to 3 days, depending on the amount of money transferred and whether banks are open when you initiate the transfer.

- Your receipt may have a confirmation number that the recipient needs to provide to pick up the money — especially if they're picking it up in person.

Warnings

- If you wire money from a credit card, some credit card companies consider this a cash advance rather than a regular purchase. You may incur fees or be charged a higher interest rate. Your credit card company also may limit the amount of money you can take as a cash advance.⧼thumbs_response⧽

References

- ↑ https://www.thesimpledollar.com/banking/how-to-wire-money-in-five-steps/

- ↑ https://www.nerdwallet.com/blog/banking/faq-send-money-individual/

- ↑ https://www.nerdwallet.com/blog/banking/faq-send-money-individual/

- ↑ https://www.nerdwallet.com/blog/banking/best-ways-to-wire-money-internationally/

- ↑ https://smartasset.com/checking-account/how-to-send-money-to-someone-without-a-bank-account

- ↑ https://www.thesimpledollar.com/banking/how-to-wire-money-in-five-steps/

- ↑ https://www.thesimpledollar.com/banking/how-to-wire-money-in-five-steps/

- ↑ https://smartasset.com/checking-account/how-to-send-money-to-someone-without-a-bank-account

- ↑ https://www.nerdwallet.com/blog/banking/faq-send-money-individual/