This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 13 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 89% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 87,995 times.

This article is written for persons living in the United States. Powers of Attorney in other jurisdictions do different things and have different rules and requirements. Please make sure you are consulting the laws of your own jurisdiction if you are not living in the United States.

A power of attorney form is a legal document where a person gives his decision-making rights to another person if he is not able to make those decisions. This is sometimes necessary due to illness, accidental injury, or any event where someone is temporarily unable to make decisions. These situations, such as a debilitating car accident that results in a coma, may force you to take control over your loved one's estate or life choices for a short period of time. With some consideration of some factors, you can take some steps to create a durable power of attorney that will work for you and your loved ones.

Steps

Deciding If You Need Power of Attorney

-

1Determine the terms of the power of attorney. The person that is given the decision-making ability is the agent, also known as the attorney-in-fact. The person who gives up his ability to make decisions is known as the principal. A durable power of attorney can be used if the principal is unable to handle all or part of his affairs for a long period of time. You may also need a durable power of attorney if it is suggested that one is needed by the principal. A durable power of attorney goes into effect immediately. It continues to be valid when the person who asks for it is no longer able to make decisions.[1]

- A general power of attorney does not remain in effect after someone is unable to make decisions for themselves. If the word durable is not specified, the power of attorney is voided when the person who granted it becomes incapacitated.

- You can also get a springing durable power of attorney. This will not go into effect until the principal can no longer make his own decisions. With this process, the person must be proven to be unable to make his own decisions before the power of attorney will go into effect.[2]

- You can create a durable power of attorney for health care, which grants the agent the full rights to take care of all the principal's medical decisions when he can no longer do it himself. This includes all medical decisions from going for a check up to surgery decisions. These are often accompanied by a Living Will.

- You can also create a durable power of attorney for finances, which gives the agent full control over the principal's finances. This includes everything from opening the mail and depositing checks to filing taxes.[3]

- You can also write a full durable power of attorney that gives all of the principle's rights away, both financial and health related, to one agent.[4]

-

2Talk to your loved one. The simplest way to get power of attorney is to do so with the agreement of the person who may need to turn over his decision-making rights. If your loved one is terminally ill, a time may come when he won't be able to make financial or medical decisions. He may decide to willingly sign over power of attorney to you. If you know that your loved one might need to give you power of attorney, discuss it with him. Let him know you care and you have his best interests in mind.

- Make sure he understands what it means to sign over power of attorney. This includes what types of decisions will be made for him.[5]

- For example, a principle may want to draw up a durable power of attorney if he is diagnosed with dementia. In this case, the principal may want to set up a contract while he is still in a level state of mind and appoint his daughter as agent in order to protect himself in the future when he can no longer remember everything.

Advertisement -

3Consider alternatives to a power of attorney. For someone to grant you power of attorney, the person must be of sound mind. If your loved one is not mentally sound, but has granted power of attorney to you in a Living Will, you don't need to file for power of attorney. If your loved one is not mentally sound and has not granted power of attorney, you may need to get adult guardianship, also known as conservatorship, to take care of his affairs.[6]

- You must go to court to ask to be appointed as a conservator or guardian. To become a guardian of someone, the principle much first be labeled legally incompetent by the court. That is, he must not be able to meet his own basic needs.[7]

- You need to go to the state circuit or district court of the county where he lives. These courts make the decisions for the guardianship of those that live in the area.

- Your situation will be assessed based on your eligibility to serve as guardian, his inability to take care of himself, and the lack of other possible fitting options to guardianship.[8]

Choosing Someone for Power of Attorney

-

1Assign power of attorney. Someone you know may need to give you power of attorney for many reasons. He may want someone else to control his personal finances for a short time or for a long period of time after he is incapable of doing so himself. He may also want you to make health care decisions in the future. If someone you know is ill, or just getting older, he may want someone that he knows and trusts to be able to make decisions about the care he receives.

- For example, Bob may grant a durable power of attorney for finances to his son, Jim, for the tenure of one real estate deal. Once the deal is closed, Bob's financial decisions belong to Bob again. However, Bob can also write a durable power of attorney for finances that will give Jim all the control over his finances if he happens to become incapacitated in an accident or because of a health issue.[9]

- Some people also choose a power of attorney to have control over finances if they themselves have a spending problem. This gives the main control over certain aspects of his finances, such as a savings account or investments, to the agent.

-

2Help pick a principal. If your loved one is giving power of attorney to you or someone else, you want to make sure that that he can trust this person. The agent should also have the necessary background and understand the situation she will be put in when the power of attorney goes into effect. Consider the age, health, and location of potential agents.

- Keep in mind that the person appointed as the agent will be making extremely important decisions.

- For example, if the agent does not live near your loved one, it may be difficult for that person to have the required relationship with his banks or his doctors.

-

3Chose an agent with similar values. The principal needs to consider the agent’s religion and lifestyle choices. Although he should, first and foremost, choose someone that he trusts, he also should make sure that the person that he chooses will not refuse to carry out his wishes based on her own moral or religious views. You would want to make sure that the agent could set aside any personal beliefs in favor of your wishes.

- For example, some people are against using machines in hospitals to help keep someone alive. Some may also not believe in any resuscitation efforts, but others strongly believe in these things. You need to make sure the agent of the power of attorney is on the same page as your loved one and will make decisions according to his specifications.

- Generally, you should help your loved one choose an agent that he can talk to about what he wants and who he thinks will follow his wishes completely.

Giving a Power of Attorney

-

1Check your state's requirements. Requirements for a durable power of attorney are similar in most states, but some have special forms to fill out. Usually, the document giving power of attorney must clearly indicate the person granting the power, clearly name the person who will have the specified powers, and specify exactly what legal acts the decision maker is entitled to perform.

- You should research the requirements in your state.[10]

- If your situation is complicated and you're unsure how to proceed, hire an attorney to help you and your loved one carry out the proper requirements for granting power of attorney.

-

2Obtain a power of attorney form. In most states, the forms don't have to be government-written legal documents. To avoid any confusion and to make sure that everyone involved knows exactly what rights are being given, it's a good idea to use a state-issued form as a template. You can use a template of a state form to write your own power of attorney document.

- You may be able to download a power of attorney form from various state websites, including departments of health, state bar associations, county bar associations or other agencies.[11]

-

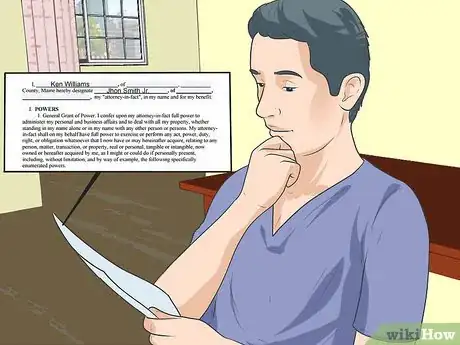

3Name the parties and the powers granted. The form should have the full names of both people involved in the power of attorney agreement. The first name and last name should be listed as well as any addition to the name, such as Jr. or III. The form should say exactly what rights the agent will take over. In a clear and specific manner, document the rights being granted to the agent; when those rights will take effect; and when, if ever, those rights will stop.

- Make sure the form says whether the rights are springing durable or durable. You should also know which powers can't be given under your state's law. For example, an agent cannot draft a will for the principal under state law even if the power of attorney document grants that power.

- For example, the person giving away his rights can specify in the power of attorney form that the decision maker will not have power over him until the principal is 75 years old, but once he reaches that age, the decision maker will have the specified powers, regardless of the principal’s capacity.

- Alternate decision makers can also be named. This is in case the first decision maker is unable or unwilling to act on his authority.

-

4Gather witnesses. In some states it is necessary to have the signing of the document witnessed by one or two people. If this is the case in your state, make sure you have witnesses there when you and the decision-maker sign the document. Make sure that the witnesses watch you and your loved one sign the durable power of attorney document. If the witnesses don't pay attention, they will not be able to say that document is real if it is questioned.

Protecting Your Power of Attorney Document

-

1Consider hiring an attorney. An attorney may notice legal issues that people who aren't trained in legal matters would not think to add or leave out. An attorney may see that the form uses wording that could been seen as open ended. This could lead to confusion. If the document is durable, it's important to make sure that both people are in agreement about what responsibilities and authorities are being given.

- For example, instead of saying that the agent “has the rights to the principal’s finances,” say that the agent “has the rights to withdraw money and make payments from the principal’s three bank accounts: bank account X, bank account Y, and bank account Z.”

-

2Get the document notarized. Some states need the people involved to sign the document in front of a notary. However, even if your state does not require this, having the signature of the person giving away his rights notarized gets rid of any doubt about the validity of that signing. This is because the notary has to verify the identity of the people involved before he witnesses the signatures. Since this is the case, notarizing the power of attorney document reduces the chance that it will be brought into question by anyone who may have a problem with its validity.[15]

-

3Save the power of attorney document. A power of attorney is not filed at any governmental agency. You need to have it on hand to show it every time you need to use it. You can get a safety deposit box that is accessible only by the decision-maker and someone else close to him. You can also keep it in a safe in your home. This way, the document will be safe until the time comes when you need to bring it out.

References

- ↑ http://m.wikihow.com/Sample/Durable-Power-of-Attorney

- ↑ http://www.nolo.com/legal-encyclopedia/durable-financial-power-of-attorney-29936.html

- ↑ http://www.nolo.com/legal-encyclopedia/durable-power-of-attorney-health-finances-29579.html

- ↑ http://www.nolo.com/legal-encyclopedia/durable-power-of-attorney-health-finances-29579.html

- ↑ http://info.legalzoom.com/become-power-attorney-disabled-person-20628.html

- ↑ http://www.nolo.com/legal-encyclopedia/question-make-power-of-attorney-mother-28261.html

- ↑ Elder Law: Cases and Materials, LexisNexis, Fifth Edition (See chapter 9, “Guardianship”)

- ↑ http://www.nolo.com/legal-encyclopedia/conservatorships-adult-guardianships-30063.html

- ↑ http://www.nolo.com/legal-encyclopedia/durable-power-of-attorney-health-finances-29579.html

- ↑ http://www.uslegalforms.com/powerofattorney/?_ga=1.197948463.1676299220.1423340119

- ↑ https://www.dhs.wisconsin.gov/forms/advdirectives/f00085.pdf

- ↑ http://statelaws.findlaw.com/health-care-laws/durable-power-of-attorney.html

- ↑ http://www.eko-law.com/florida-attorney-blog/florida-power-of-attorney-law/?_ga=1.195319852.1676299220.1423340119

- ↑ http://www.utahlegalservices.org/public/legal_problem-en-us/senior/powers-of-attorney/how-do-i-create-a-power-of-attorney?_ga=1.261043469.1676299220.1423340119

- ↑ http://info.legalzoom.com/appoint-power-attorney-22161.html