wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 11 people, some anonymous, worked to edit and improve it over time.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 92% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 86,704 times.

Learn more...

A risk management policy is a helpful way to identify, reduce, and prevent potential risks. Knowing how to write a risk management policy is a central part of planning your organization's strategic objectives. We'll walk you through all the steps of creating a risk management plan to help protect your business.

Steps

-

1Identify the potential risks involved in the context of your work and for all the stakeholders.

- Consider the context of your work within the different transactions or processes. Include long-term strategic objectives and decisions, operational or day-to-day activities, financial management and controls, intellectual and information technology actions and knowledge, and compliance/regulatory issues and policy decisions.

- Write down all the things that could potentially go wrong and how that might happen. Divide this information into sections to address each individually.

-

2Analyze all the potential risks that you have identified.

- Write down how they may occur and potential methods of prevention, additional steps that could be taken to prevent them, and how those risks are evaluated and assessed regularly.

Advertisement -

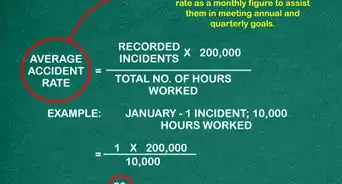

3Assess all the past incidences that your organization has encountered and how these occurrences were handled.

- Consult past records to determine how frequently incidents have happened, and how they were handled, including processes that worked and those where there were areas of improvement.

-

4Estimate the likelihood of each risk re-occurring based on the history of your organization, best practices, and peer experiences.

-

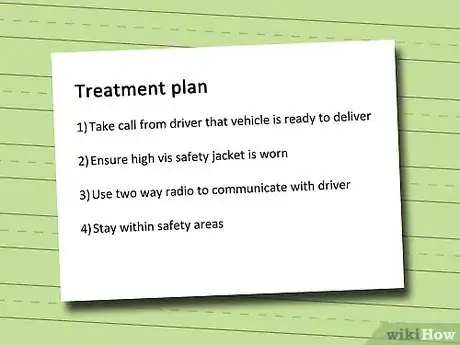

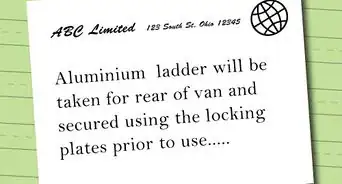

5Develop a treatment plan for all of the risks that you have identified, prioritizing the risks that you have found will be more likely to occur.

- Be sure to outline a step-by-step expectation for how each risk will be avoided, how it will be handled if it does occur, and how it will be recorded.

-

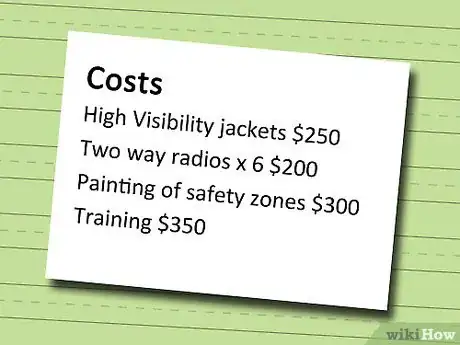

6Calculate and include a cost estimation for the steps needed to align with the risk management policy recommendations.[1] Provide this information to the internal audience when the policy is proposed.

-

7Prepare a report for both internal and external stakeholders, sharing what auditing steps are in place to revisit and evaluate the policy.

- The internal and external audiences need different information; internal audiences need to know the greatest risks, who is accountable for what, and how the process will be monitored. External audiences need to know risk management is a part of the organization's culture and how the process and policy has been laid out.

-

8Create a data tracking system to input all statistics on risk management successes and failures, training staff to use it.

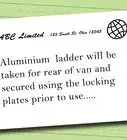

- Creating a risk assessment form for use after an incident can be a useful tool to examine whether more precautions should have been taken. This allows all the data to be recorded right after the occurrence, and for the same information to be gathered each time.

-

9Set up a regular monitoring process to review all risks and evaluate how the treatment plan has been working.

-

10Revisit the risk management policy every 6 months to evaluate its effectiveness by comparing incident occurrence rates. Revise the plan as necessary.

- Risk management planning and evaluation should be a continuous, evolving process that integrates seamlessly into a company or organization's culture.

Warnings

- Be sure to utilize the writing process as a collaborative effort and do not allow it to be a blaming or finger-pointing session. Be sure to outline from the start that it is a positive, preventative process and not a punitive one stemming from how something in the past was handled.⧼thumbs_response⧽

- After identifying risks within the organization, revisit insurance coverage amounts. Discuss with others involved with the risk management policy process and adjust coverage accordingly, if deemed necessary.⧼thumbs_response⧽

- Identifying risks and hazards shifts some responsibility to managers. After identifying risks, managers must then be willing to provide trainings, equipment, and oversight to equip staff with the ways and means to avoid those risks.⧼thumbs_response⧽