Credit Suisse

Credit Suisse Group AG (French pronunciation: [kʁe.di sɥis], lit. 'Swiss Credit') is a global investment bank and financial services firm founded and based in Switzerland. Headquartered in Zürich, it maintains offices in all major financial centers around the world and provides services in investment banking, private banking, asset management, and shared services. It is known for strict bank–client confidentiality and banking secrecy. The Financial Stability Board considers it to be a global systemically important bank. Credit Suisse is also a primary dealer and Forex counterparty of the Federal Reserve in the United States.

Headquarters on Paradeplatz in Zürich, designed by architect Jakob Friedrich Wanner and inaugurated in 1876[1] | |

| Formerly | Schweizerische Kreditanstalt |

|---|---|

| Type | Subsidiary |

| ISIN | CH0012138530 |

| Industry | Financial services |

| Founded | 5 July 1856[2] |

| Founder |

|

| Headquarters | , Switzerland |

Area served | Worldwide |

Key people | |

| Products | Investment and private banking, asset management |

| Revenue | |

| AUM | |

| Total assets | |

| Total equity | |

Number of employees | |

| Parent | UBS Group AG |

| Capital ratio | |

| Rating | S&P: BBB- Fitch: BBB[8] Moody's: Baa2[9] |

| Website | credit-suisse.com |

Credit Suisse was founded in 1856 to fund the development of Switzerland's rail system. It issued loans that helped create Switzerland's electrical grid and the European rail system. In the 1900s, it began shifting to retail banking in response to the elevation of the middle class and competition from fellow Swiss banks UBS and Julius Bär. Credit Suisse partnered with First Boston in 1978 before buying a controlling share of the bank in 1988. From 1990 to 2000, the company purchased institutions such as Winterthur Group, Swiss Volksbank, Swiss American Securities Inc. (SASI), and Bank Leu. The biggest institutional shareholders of Credit Suisse include the Saudi National Bank (9.88%), the Qatar Investment Authority and BlackRock (about 5% each), Dodge & Cox, Norges Bank and the Saudi Olayan Group.[11]

The company was one of the least affected banks during the global financial crisis, but afterwards began shrinking its investment business, executing layoffs and cutting costs. The bank was at the center of multiple international investigations for tax avoidance (such as the famous "Suisse Secrets" scandal) which culminated in a guilty plea and the forfeiture of US$2.6 billion in fines from 2008 to 2012.[12][13] By the end of 2022, Credit Suisse had approximately CHF 1.3 trillion in assets under management.[7]

On 19 March 2023, following negotiations with the Swiss government, UBS announced its intent to acquire Credit Suisse for $3.25 billion (CHF 3 billion) in order to prevent the bank's collapse.[14][15][16] UBS completed the acquisition in June 2023.[17]

History

Early history

Credit Suisse's founder, Alfred Escher, was called "the spiritual father of the railway law of 1852", for his work defeating the idea of a state-run railway system in Switzerland in favor of privatization.[18][19] Escher founded Credit Suisse (originally called the Swiss Credit Institution, i.e., Schweizerische Kreditanstalt) jointly with Allgemeine Deutsche Credit-Anstalt on 5 July in 1856[20] primarily to provide domestic funding to railway projects, avoiding French banks that wanted to exert influence over the railway system.[21] Escher aimed to start the company with three million shares and instead sold 218 million shares in three days.[22] The bank opened on 16 July 1856 and was modeled after Crédit Mobilier, a bank funding railway projects in France that was founded two years prior, except Credit Suisse had a more conservative lending policy focused on short-to-medium term loans.[21] In its first year of operation, 25 percent of the bank's revenues was from the Swiss Northeastern Railway, which was being built by Escher's company, Nordostbahn.[23]

Credit Suisse played a substantial role in the economic development of Switzerland, helping the country develop its currency system,[22] funding entrepreneurs[19] and investing in the Gotthard railway, which connected Switzerland to the European rail system in 1882.[21] Credit Suisse helped fund the creation of Switzerland's electrical grid through its participation with Elektrobank (now called Elektrowatt), a coalition of organizations that co-financed Switzerland's electrical grid.[24] According to The Handbook on the History of European Banks, "Switzerland's young electricity industry came to assume the same importance as support for railway construction 40 years earlier."[21] The bank also helped fund the effort to disarm and imprison French troops that crossed into Swiss borders in the 1870 Franco-Prussian War.[21][23] By the end of the war, Credit Suisse had become the largest bank in Switzerland.[22]

Throughout the late 1800s, Credit Suisse set up banking and insurance companies in Germany, Brussels, Geneva and others (as SKA International) with the bank as a shareholder of each company. It created insurance companies like Swiss RE, Swiss Life (aka Rentenanstalt) and Schweiz. Credit Suisse had its first unprofitable year in 1886, due to losses in agriculture, venture investments, commodities, and international trade. The bank created its own sugar beet factory, bought 25,000 shares in animal breeding ventures and supported an export business, Schweizerische Exportgesellschaft, that experienced heavy losses for over-speculative investing.[21][23]

In the early 1900s Credit Suisse began catering to consumers and the middle-class with deposit counters, currency exchanges and savings accounts.[23] The first branch outside of Zürich was opened in 1905 in Basel.[19] The bank helped companies affected by World War I restructuring, and extended loans for reconstruction efforts.[21][25] During the 1920s depression, net profits and dividends were halved and employees took salary cuts.[26] After World War II, a substantial portion of Credit Suisse's business was in foreign reconstruction efforts.[26] Banks subsequently acquired by Credit Suisse have been linked to bank accounts used by members of the NSDAP in the 1930s.[27][28] Holocaust survivors had problems trying to retrieve assets from relatives that died in concentration camps without death certificates.[29] This led to a class action lawsuit in 1996[30] that settled in 2000 for $1.25 billion.[31][32][33][34] The Agreement on the Swiss Banks' Code of Conduct with Regard to the Exercise of Due Diligence was created in the 1970s,[19] after a Credit Suisse branch in Chiasso was exposed for illegally funneling $900 million in Italian deposits to speculative investments.[35]

Acquisitions, growth and First Boston

In 1978, White, Weld & Company dropped its partnership with Credit Suisse after it was bought by Merrill Lynch. To replace the partnership with White, Credit Suisse partnered with First Boston to create Credit Suisse First Boston in Europe and bought a 44 percent stake in First Boston's US operations.[36]

In 1987, the Group acquired the blue chip London stockbrokers Buckmaster & Moore, originally established by aristocrat Charles Armytage-Moore and sportsman Walter Buckmaster, who had met at Repton School. As stockbrokers they were very well connected, had developed a good private client business, which at one time included John Maynard Keynes.

Other Credit Suisse First Boston brands were later created in Switzerland, Asia, London, New York and Tokyo.[37][38] According to an article in The New York Times, First Boston became "the superstar of the Euromarkets" by buying stakes in American companies that wanted to issue bonds.[38] In 1988 First Boston loaned $487 million to Gibbons and Green for the purchase of the Ohio Mattress Company, which was purchased at twenty times its annual revenue. Gibbons had also borrowed $475 million in junk bonds. When the junk bonds market crashed the following year, Gibbons couldn't repay First Boston.[22] Credit Suisse injected $725 million to keep First Boston in business,[39] which ultimately led to the company being taken over by Credit Suisse. This became known as the "burning bed" deal, because the Federal Reserve overlooked the Glass–Steagall Act that requires separation between commercial and investment banks in order to preserve the stability of the financial markets.[22]

In the late 1990s, Credit Suisse executed an aggressive acquisition strategy.[19] The bank acquired Bank Leu, known as Switzerland's oldest bank, in 1990.[40][41] In 1993 Credit Suisse outbid UBS for a controlling stake in Switzerland's fifth largest bank, Swiss Volksbank in a $1.1 billion deal.[42] It also merged with Winterthur Group in 1997 for about $9 billion[43] and acquired the asset management division of Warburg, Pincus & Co. in 1999 for $650 million.[44] Donaldson, Lufkin & Jenrette was purchased for $11.5 billion in 2000.[19][45]

In 1996, Credit Suisse restructured as the Credit Suisse Group with four divisions: Credit Suisse Volksbank (later called Credit Suisse Bank) for domestic banking, Credit Suisse Private Banking, Credit Suisse Asset Management, and Credit Suisse First Boston for corporate and investment banking. The restructure was expected to cost the company $800 million and result in 7,000 lost jobs, but save $560 million a year.[46][47] While Credit Suisse First Boston had been struggling, Credit Suisse's overall profits had grown 20 percent over the prior year, reaching $664 million.[46] In 1999 Japan's Financial Supervisory Agency temporarily suspended the financial-products division's license to operate in Japan for "window dressing", the practice of selling derivatives that are often used by bank clients to hide losses.[48]

In the 2000s, Credit Suisse executed a series of restructures. In 2002 the bank was consolidated into two entities: Credit Suisse First Boston for investments and Credit Suisse Financial Services. A third unit was added in 2004 for insurance.[19] Credit Suisse restructured again in 2004 under what it calls the "one bank" model. Under the restructuring, every board had a mix of executives from all three divisions. It also changed the compensation and commission models to encourage cross-division referrals and created a "solution partners" group that functions between the investment and private banking divisions.[49] Following the restructure Credit Suisse's private banking division grew 19 percent per year despite the economic crisis. The firm bumped long-time rival UBS off the number one position in Euromoney's private banking poll.[49] In 2006, Credit Suisse acknowledged misconduct for helping Iran and other countries hide transactions from US authorities and paid a $536 million settlement.[50][51] The same year it merged Bank Leu AG, Clariden Holding AG, Bank Hofmann AG and BGP Banca di Gestione Patrimoniale into a new company called Clariden Leu.[52]

The increasing importance of sustainability and the related commitments and liabilities of international standards such as the UNGC, of which the bank is a member, lead to increasingly sophisticated and ambitious risk management over the years. Credit Suisse operates a process which since 2007 uses RepRisk, a Swiss provider of ESG Risk analytics and metrics, to screen and evaluate environmental and social risks of risky transactions and due diligence.[53]

In 2009, Yellowstone Club founder Tim Blixseth sued Credit Suisse when the bank attempted to collect on $286 million in loan debt during Yellowstone's bankruptcy proceedings.[54] The debtor had borrowed more than $300 million for the business, but used a large portion of it for personal use before eventually filing for bankruptcy.[55] Four lawsuits were filed from other resorts seeking $24 billion in damages alleging Credit Suisse created loans with the intention of taking over their properties upon default.[56]

Post-financial crisis

According to The Wall Street Journal in 2008, "Credit Suisse survived the credit crisis better than many competitors."[51] Credit Suisse had $902 million in writedowns for subprime holdings and the same amount for leveraged loans,[57] but it did not have to borrow from the government.[58] Along with other banks, Credit Suisse was investigated and sued by US authorities in 2012 for bundling mortgage loans with securities, misrepresenting the risks of underlying mortgages during the housing boom.[59][60] Following the crisis, Credit Suisse cut more than one-trillion in assets and made plans to cut its investment banking arm 37 percent by 2014. It reduced emphasis on investment banking and focused on private banking and wealth management.[61][62] In July 2011, Credit Suisse cut 2,000 jobs in response to a weaker than expected economic recovery[63] and later merged its asset management with the private bank group to cut additional costs.[64]

We sell [bank] safety not bank secrecy. Being a safe haven in a world that is becoming increasingly dangerous and volatile is no bad place to be.

— Tidjane Thiam, chief executive of Credit Suisse, in a 2018 interview with the Bloomberg Markets[65]

A series of international investigations took place in the early 2000s regarding the use banking secrecy in Credit Suisse accounts for tax evasion. In 2008, the Brazilian government investigated 13 former and current Credit Suisse employees.[19] The investigation led to arrests that year and in 2009 as part of a larger crackdown in Brazil.[66][67] Four Credit Suisse bankers were accused of fraud by the US Justice Department in 2011 for helping wealthy Americans avoid taxes.[68][69] In 2012, German authorities found that citizens were using insurance policies of a Bermuda-based Credit Suisse subsidiary to earn tax-free interest.[70] In November 2012, Credit Suisse's asset management division was merged with the private banking arm.[71] In September 2012, the Swiss government gave banks like Credit Suisse permission to provide information to the US Justice Department for tax evasion probes.[72] In February 2014, it agreed to pay a fine of $197 million after one of its businesses served 8,500 US clients without registering its activities, leading to suspicion as to whether it was helping Americans evade taxes. It was one of 14 Swiss banks under investigation.[73] Separately, in 2013, German authorities began to probe Credit Suisse, its private bank subsidiary Clariden Leu, and its regional subsidiary Neue Aargauer Bank for helping German citizens evade taxes.[74] In 2012, the bank eventually entered into a €150 million settlement with the government.[75]

In March 2014, Credit Suisse denied claims it had been drawn into a Swiss competition probe investigating potential collusion to manipulate foreign exchange rates (Forex scandal) by various Swiss and foreign banks.[76] In May 2014, Credit Suisse pleaded guilty to conspiring to aid tax evasion. It was the most prominent bank to plead guilty in the United States since Drexel Burnham Lambert in 1989 and the largest to do so since the Bankers Trust in 1999.[77] "Credit Suisse conspired to help US citizens hide assets in offshore accounts in order to evade paying taxes. When a bank engages in misconduct this brazen, it should expect that the Justice Department will pursue criminal prosecution to the fullest extent possible, as has happened here," Attorney General Eric H. Holder said at the time.[13] Holder also said "This case shows that no financial institution, no matter its size or global reach, is above the law." Credit Suisse shares rose 1% on the day the $2.6 billion penalty was announced.[78]

In March 2015, it was announced that Tidjane Thiam, the CEO of Prudential would leave to become the next CEO of Credit Suisse.[79] In September 2016, Brian Chin was appointed Chief Executive of Global Markets and joined the executive board of the bank. At this time, it was also announced that Eric M. Varvel was appointed president and CEO of Credit Suisse Holdings (USA).[80]

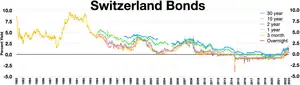

As of 2018, share prices of Credit Suisse and other Swiss banks including UBS remained mostly stagnant or flat since the 2008 financial crisis. This is seen as a result of the aftermath of the collapse of Lehman Brothers, which caused a large loss in consumer and market participant trust and confidence in the banking industry. The loss in confidence is reflected in the large loss of share prices across the Swiss banking sector after 2008, which have not recovered to pre-financial crisis levels.[81]

In August 2019, Credit Suisse announced the formation of a new "direct banking" business unit under their Switzerland division (Swiss Universal Bank, SUB), focusing on digital retail products. The step is seen as a reaction to the emergence of FinTech competitors such as N26 or Revolut in Switzerland and shall help to better attract young clients.[82] In July 2020, Thomas Gottstein, the new CEO of the company, announced restructuring; it was influenced as a result of the trading surge in Q2 of 2020, amid the COVID-19 pandemic. The planned restructuring is set "to reduce costs and improve efficiencies" and features some reverts of alterations brought by the previous CEO, Thiam. According to Gottstein, "These initiatives should also help to provide resilience in uncertain markets and deliver further upside when more positive economic conditions prevail."[83]

On 9 February 2023, the bank reported an annual loss of CHF 7.3 bn, the biggest loss since the 2008 global financial crisis.[84] On 14 March of that same year, Credit Suisse published its annual report for 2022 saying it had identified “material weaknesses” in controls over financial reporting.[85]

Collapse

On 15 March 2023, Credit Suisse' share price dropped nearly 25 percent after Saudi National Bank, its largest investor, said it could not provide more financial assistance.[86] The market price of the bank's unsecured bonds set for maturity in 2027 dropped to a low of 33 percent of their par value on that day, down from being valued at 90 percent of their par value at the beginning of the month.[87][88]

Later in the same week, Credit Suisse sought to shore up their finances by taking a loan of 50 billion Swiss francs from the Swiss National Bank (SNB);[89][90] the bank later proceeded to buy three billion Swiss francs of its own debt and to put the Baur en Ville hotel in Zürich for sale.[91] However, this intervention did not stop investors and customers from pulling their money out of Credit Suisse, with outflows topping 10 billion Swiss francs during the week,[92][93] and almost $69 billion (approximately 61 billion Swiss francs) in withdrawals during the first calendar quarter.[94] The situation was so compromised that the SNB and the Swiss government started discussions to fast-track the bank's acquisition by UBS.[95][96][97][98] On 19 March 2023, UBS announced a deal had been reached to acquire Credit Suisse for US$3.25 billion (CHF 3 billion) in an all-stock deal.[99]

European regulators have criticized the moral hazard of the AT1 bondholders suffering in the loss[100] of their capital rather than the shareholders of the bank.[101]

According to financial analysts, economic sanctions imposed by Switzerland on Russian individuals and businesses had a significant impact on the demise of the bank. According to Bloomberg News, Credit Suisse held about $33 billion for Russian clients, 50% more than UBS.[102]

In late April 2023, the political and economic fall-out had been evaluated by a number of economic analysts, particularly the resulting lack of banking competition in Switzerland's economy. The take-over by UBS had limited the choice of lenders, particularly for smaller and medium sized companies. Credit Suisse's international reach had affected the employment situation in Europe as well as other regions. The Swiss economy as such also relies on a number of heavily capitalised state banks that have been a significant lender to those smaller enterprises, particularly after the demise of CS.[103][104]

Post-acquisition

On 27 June 2023, UBS announced its intention to cut more than half of Credit Suisse's workforce.[105]

Leadership history

Chairpeople

- Otto Aeppli, March 1977–May 1983

- Rainer Gut, May 1983–May 2000

- Lukas Mühlemann, May 2000–December 2002

- Walter Kielholz, January 2003–April 2009

- Hans-Ulrich Doerig, April 2009–April 2011

- Urs Rohner, April 2011–April 2021

- António Horta-Osório, April 2021–January 2022

- Axel Lehmann, January 2022–present

Chief executives

- Rainer Gut, 1977–1983

- Robert A. Jeker, 1983–1993

- Josef Ackermann, 1993–1996

- Lukas Mühlemann, January 1997–December 2002

- John J. Mack, January 2003–July 2004

- Oswald Grübel, January 2003–May 2007 (co-CEO with Mack in 2003–2004)

- Brady Dougan, May 2007–June 2015

- Tidjane Thiam, June 2015–February 2020

- Thomas Gottstein, February 2020–July 2022

- Ulrich Körner, July 2022–present

Corporate structure

Credit Suisse Group AG, is organised as a joint-stock company registered in Zürich that operates as a holding company. It owns the Credit Suisse bank and other interests in the financial services business. Credit Suisse is governed by a board of directors, its shareholders, and independent auditors. The Board of Directors organise the annual General Meeting of Shareholders while investors with large stakes in the company determine the agenda. Shareholders elect auditors for one-year terms,[106] approve the annual report and other financial statements, and have other powers granted by law.[106] Shareholders elect members of the board of directors to serve a three-year term based on candidates nominated by the Chairman's and Governance Committee and the Board of Directors meet six times a year to vote on company resolutions.[107] The Board sets Credit Suisse's business strategies and approves its compensation (remuneration) principles based on guidance from the compensation committee. It also has the authority to create committees that delegate specific management functions.

Credit Suisse has two divisions, Private Banking & Wealth Management and Investment Banking. A Shared Services department provides support functions like risk management, legal, IT, and marketing to all areas. Operations are divided into four regions: Switzerland, Europe, the Middle East, and Africa, the Americas, and the Asian Pacific. Credit Suisse Private Banking has wealth management, corporate and institutional businesses. Credit Suisse Investment Banking handles securities, investment research, trading, prime brokerage, and capital procurement. Credit Suisse Asset Management sells investment classes, alternative investments, real-estate, equities, fixed income products, and other financial products.[108]

On 9 May 2023, Credit Suisse announced that it would continue its banking operations but under the hospice of UBS in order to fulfill its financial obligations towards existing clients as well as employees of both banks. CEO Ulrich Körner will join UBS's executive board.[109]

Ownership

In August 2022, it was revealed that the largest shareholder of Credit Suisse was in fact American, namely Harris Associates, holding over 10% of the shares of the group. Harris Associates itself is owned by French bank Natixis.[110]

As of 25 January 2023, Saudi National Bank, an anchor investor, held a 10 per cent stake, Qatar Investment Authority (QIA) boosted its stake in the Credit Suisse Group to 6.87 per cent and Harris Associates reported a holding of below 3 per cent.[111] Harris Associates reported having exited all its Credit Suisse positions by March 2023.[112] Credit Suisse stock (CS) in the NYSE fell from $2.50 to $1.88 a share on 15 March 2023.[113]

On 19 March 2023, fellow Swiss bank group UBS agreed to buy Credit Suisse for more than US$3 billion.[99] The purchase of Credit Suisse by UBS has reportedly averted a greater crisis, according to SNB.[114]

Financial products

| Credit Suisse products | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Credit Suisse endorses a strategy called bancassurance of trying to be a single company that offers every common financial services product.[115][116] The investment bank is intended for companies and wealthy individuals with more than 50,000 euro.[117]

Credit Suisse developed the CreditRisk+ model of risk assessment in loans, which is focused exclusively on the chance of default based on the exogenous Poisson method.[118] As of 2002 about 20 percent of Credit Suisse's revenue was from its insurance business it gained through the 1997 acquisition of Winterthur.[119] The investment bank's insurance products are primarily popular in the domestic market and include auto, fire, property, life, disability, pension and retirement products among others.[120] Historically 20–40 percent of the bank's revenue has been from private banking services, one of its higher profit-margin divisions.[121]

Credit Suisse produces one of the six hedge funds following European stock indices that are used to evaluate the performance of the markets.[122][123] The investment bank also has a 30 percent ownership in hedge fund investment firm York Capital Management. York sells hedge funds independently to its own clients, while Credit Suisse also offers them to private banking clients.[124] Credit Suisse manages the financial instruments of the Dow Jones Credit Suisse long/short equity index (originally called Credit Suisse/Tremont Hedge Fund Indexes).[125]

According to a 2011 article in Seeking Alpha, Credit Suisse's investment managers favor financial, technology and energy sector stocks.[126] The bank's head of equity investments in Europe said the team focuses on "value with an emphasis on free cashflow". She also has an interest in companies undergoing management changes that may influence the stock price.[127] According to a story in The Wall Street Journal, the head of Credit Suisse's International Focus Fund keeps a portfolio of only 40–50 stocks, instead of the industry-norm of more than 100.[128] Credit Suisse publishes its investment advice in four publications: Compass, Viewpoints, Research and the Credit Suisse Investment Committee Report.[129]

On 5 May 2023, Credit Suisse announced it would buy Ecuadorian bonds worth $1.6 billion in a debt-for-nature swap that costs the Swiss bank only $644 million. As a result, the government of Ecuador pledged to spend about $18 million annually for two decades on conservation in the Galapagos islands, a UNESCO world heritage site. The bond purchase was below 55% of the purchase value and below 35.5% for the consecutive 5 year-intervals after 2025. Underwriters for that deal is the Inter-American Development Bank (IDB) and the U.S. International Development Finance Cooperation, therefore limiting the risk for Credit Suisse. The deal effectively saves Ecuador from liquidity shortages due to an estimated public debt of $66.8 billion. In April 2020, Ecuador repaid $1 billion of loans made two years earlier by Goldman Sachs and Credit Suisse.[130]

Reputation and rankings

The reputation of the bank is controversial. From the 1940s until into the 2010s, beside regular customers, Credit Suisse offered criminals, corrupt politicians and controversial secret service chiefs a safe haven for their assets, despite all public declarations of a "white money" strategy.[131]

Until its acquisition by UBS in 2023, Credit Suisse was a member of Wall Street's bulge bracket, a list of the largest and most profitable banks. The company was one of the world's most important banks, upon which international financial stability depends.[132][133] The bank was also one of Fortune Magazine's most admired companies.[134]

As of 2004, Credit Suisse was first in volume of high-yield transactions, second for corporate high-yield bond insurance and third for IPO underwriting.[135] As of 2012, Credit Suisse was recognised as the world's best private bank by Euromoney's Global Private Banking Survey[136] and as the best European Equity Manager by Global Investors.[127] In polls by Euromoney, it has been ranked as the top private bank and the best bank in Switzerland.[49] in 1995, the Securities Data Company ranked Credit Suisse as the fourth best place for financial advice for mergers and acquisitions in the US and sixth for domestic equity issues.[46] Credit Suisse was recognized by the Asset Triple A Awards and in 2005 it was ranked as the second best prime broker by Institutional Investor.[135]

An investigation in February 2022 by The Guardian following the Suisse Secrets leaks revealed that Credit Suisse was holding bank accounts for many criminals, fraudsters and corrupt politicians.[137]

In early September 2023, UBS had clearly profited from the takeover as its stocks were increasingly valuable. From April to July, UBS made a record profit of 29.2 billion CHF and its stocks, which were initially depressed after the fusion, were traded at much higher prices. The record profit was based on the difference between the purchase price of Credit Suisse stocks and the apparently higher value of its assets.[138]

Controversies

Mismarking, 2007

In 2007, two Credit Suisse traders pleaded guilty to mismarking their securities positions to overvalue them by $3 billion, avoid losses, and increase their year-end bonuses.[139][140][141] Federal prosecutors and the Securities and Exchange Commission charged that the traders' goal was to obtain lavish year-end bonuses that the mismarking would lead to.[142][143] The traders engaged in what The New York Times called "a brazen scheme to artificially increase the price of bonds on their books to create fictitious profits".[139] A team of traders, facing an inquiry from Credit Suisse's internal controls Price Testing group, justified their bond portfolio's inflated value by obtaining "independent" marks from other banks' trading desks.[139][144]

The traders secured sham "independent" marks for illiquid securities that they held position in from friends who worked at other financial firms.[143][139][144] Their friends generated prices that valued a number of bonds at the prices that the traders requested, which the traders then recorded as the true value of the bonds.[139][144] The bank was not charged in the case.[139] Credit Suisse's outside auditor discovered the mismarkings during an audit.[145] Credit Suisse took a $2.65 billion write-down after discovering their traders' mismarking.[143]

International Emergency Economic Powers Act and New York State Law violations, 2009

On 16 December 2009, it was announced that the US Department of Justice (DOJ) reached a settlement with Credit Suisse over accusations that the bank assisted residents of International Emergency Economic Powers Act sanctioned countries to wire money in violation of the Act as well as New York law from 1995 to 2006. The settlement resulted in Credit Suisse forfeiting $536 million.[146]

US tax fraud conspiracy, 2014, 2023

In 2014, Credit Suisse pleaded guilty to conspiring with Americans to file false tax returns. Credit Suisse subsequently paid $2.6 billion in fines and restitution.[147] It was reported in 2022 that the US DOJ had opened an investigation into whether the bank continued to assist clients hide assets from tax authorities despite the terms of the 2014 settlement.[148] According to the DOJ in 2023, Credit Suisse violated a plea agreement with US authorities by failing to report secret offshore accounts that wealthy Americans used to avoid paying taxes.[149]

Malaysia Development Berhad scandal, 2015

In September 2015 Hong Kong police began investigations regarding $250 million in Credit Suisse branch deposits in Hong Kong linked to former Malaysia's Prime Minister Najib Razak and Malaysian sovereign wealth fund, 1Malaysia Development Berhad (1MDB).[150] In 2017, Singapore fined Credit Suisse a total of S$0.7m (£0.4m, $0.5m, €0.45m).[151] In May 2017, Reuters reported that "Swiss financial watchdog FINMA ... had conducted "extensive investigations" into Credit Suisse's dealings surrounding 1MDB".[152] In 2019 FINMA issued a complaint to Credit Suisse.[153]

Mozambique secret loans scandal, 2017

Between 2012 and 2016, Credit Suisse brokered US$1.3 billion of loans with Mozambican finance minister Manuel Chang, to develop the country's tuna fishing industry. The loans were issued as bonds to be paid off by the income from tuna fishing as well as the country's nascent natural gas industry. Chang lied to investors, his own government, the IMF and the banks issuing the loans, including Credit Suisse.[154] Credit Suisse was fined almost US$500 million by UK, US and European regulators for a lack of transparency in the issuing of the bonds, for kickbacks benefitting Credit Suisse bankers and for enabling loans likely to be embezzled by Mozambican officials, including Chang. In October 2021, Credit Suisse pled guilty to wire fraud and agreed to forgive US$200 million in debt owed by Mozambique to the bank.[155]

US Foreign Corrupt Practices Act violation, 2018

On 5 July 2018, Credit Suisse agreed to pay a $47 million fine to the US Department of Justice and $30 million to resolve charges of the US Securities and Exchange Commission (SEC). The SEC's investigation said that the banking group sought investment banking business in the Asia-Pacific region by hiring and promoting more than one hundred Chinese officials and related people in violation of the Foreign Corrupt Practices Act.[156][157]

Climate controversy, 2018

.jpg.webp)

In November 2018, about a dozen climate activists played tennis inside Credit Suisse agencies (of Lausanne, Geneva and Basel simultaneously), disrupting operations as a protest against the bank's investments in fossil fuels.[158][159] Credit Suisse lodged a complaint and the activists from Lausanne were tried in January 2020 and fined 21,600 CHF. They were later cleared of all charges in what a Swiss media outlet considered a 'historical decision'.[160][161][158][159][162]

The tennis theme was chosen to urge Swiss tennis star Roger Federer to break his connection with Credit Suisse as a sponsor due to the company's participating in the climate crisis (notably by multiplying 16-fold its financing for coal from 2016 to 2017).[158][159] On 11 January 2020, Federer published a statement saying: "[...] I have a great deal of respect and admiration for the youth climate movement, and I am grateful to young climate activists for pushing us all to examine our behaviours", and further committed to a dialogue with his sponsors on social issues.[163]

On 24 January 2020, following the trial, the climate activist group emitted a press statement requesting a transparent, televised debate with the CEO of Credit Suisse. With no answer from the bank, they created a website under the name "DiscreditSuisse" hosting content pertaining to Credit Suisse's record on climate issues.[164]

Private spying scandal, 2019

In 2019, a senior executive who was leaving the firm discovered that Pierre-Olivier Bouée, the chief operating officer (COO) of Credit Suisse at the time, had hired private detectives to follow him to see if he was wooing Credit Suisse clients.[165] Bouée was fired, and a private investigator involved in the surveillance apparently killed himself.[165]

Greensill Capital, 2021

In March 2021, Credit Suisse closed and liquidated several supply-chain investment funds tied to the activities of Greensill Capital. The investors in the funds, which totalled assets of approximately $10 billion, were expected to lose $3 billion as of March 2021.[166] Credit Suisse has returned around $5.9 billion to investors in its Greensill-linked funds.[167]

Archegos Capital, 2021

In April 2021, at least seven executives were removed from their posts after Credit Suisse reported losses of $4.7 billion linked to its prime brokerage services provided to Archegos Capital. The executives who departed included Lara Warner, the group's chief risk and compliance officer, and Brian Chin, head of the investment bank.[168] Just prior to Credit Suisse's 2021 Annual General Meeting, Andreas Gottschling, head of the board's risk committee, also stood down.[169] In July 2023, Credit Suisse's parent UBS was fined $269 million by the Federal Reserve and $119 million by the Bank of England for its failure in risk management.[170]

Forex manipulations conviction, 2021

In 2021, Credit Suisse was fined €83.3 million for forex rates manipulation by the European Union Commission on Competition because of its participation in a cartel detrimental to EU consumers and involving several other large international banks.[171][172] In October 2022, a US jury found that Credit Suisse did not collude with other banks to manipulate forex rates, in a class-action trial.[173][174]

Drug money laundering scandal, 2022

On 7 February 2022, it was announced that Credit Suisse would be tried in the first criminal trial of a major bank in Switzerland. Swiss prosecutors are seeking around 42 million Swiss francs ($45 million) in compensation from Credit Suisse for allowing a Bulgarian cocaine trafficking gang around Evelin Banev to launder millions of Euros of cash between 2004 and 2008.[175] On 27 June 2022, the bank as well as one of its former employees was found guilty by the Federal Criminal Court of Switzerland for not doing enough to prevent the crime from taking place.[176] The court imposed a fine of CHF 2 million and ordered the confiscation of assets worth more than CHF 12 million that the drug gang held in accounts at the bank; and to relinquish over CHF 19 million — the amount that could not be confiscated due to internal deficiencies at the bank.[176] The bank said it would appeal against the verdict.[176]

Suisse secrets leak, 2022

In February 2022, details of 30,000 customers holding over 100bn Swiss francs (£80bn) in accounts at the bank were leaked to the Süddeutsche Zeitung, and became known as "Suisse Secrets".[177] Among those with accounts at the bank were a human trafficker,[178] a torturer, drug traffickers and a Vatican-run account that allegedly invested €350m fraudulently in London property.[177] On 20 February, Credit Suisse said it "strongly rejects" allegations of wrongdoing.[179]

Russian oligarch loans documents destruction after invasion of Ukraine, 2022

Following Swiss sanctions on Russia during the 2022 Russian invasion of Ukraine, Credit Suisse issued legal requests asking hedge funds and other investors to destroy documents linking Russian oligarchs to yacht loans, a move for which they faced considerable criticism.[180] The US House Oversight Committee launched a probe into the firm demanding documents linked to the bank's compliance with sanctions on Russian oligarchs.[181]

Social media rumours, 2022

In early October 2022, Credit Suisse stocks came under considerable pressure when rumours on social media projected the demise of the bank. According to financial analysts, the bank has a “strong capital base and liquidity position”. Nevertheless, the Swiss National Bank vowed to follow the situation closely. European finance experts in particular talked of a "self-fulfilling risk" since liquidity is not a problem for the Swiss bank. CS had suffered severe losses in 2021 from the Archegos and Greensill financial scandals that implicated former Archegos executives with racketeering conspiracy, securities fraud and wire fraud.[182]

On 7 October 2022, the bank offered to buy back US$3 billion worth of debt, and put Zurich's Savoy Hotel on sale, which was later purchased by wealthy Arab officials.[183] The bank's current chairman, Axel Lehmann, also assured investors that the bank was stable after wealthy clients began moving their assets out of the bank.[184] In the fall-out from the falling stock prices, insiders believed that Saudi prince Mohammed bin Salman was looking to invest almost US$500 million into the bank, but had to withdraw his offer due to regulatory concerns.[185]

NSDAP accounts, 2023

In 2023 Credit Suisse stopped internal investigation into its Nazi clients and other Nazi-linked accounts facing much condemnation of the U.S. Senate Budget Committee and Holocaust survivors among others.[186] According to the most recent Senate report at least 14 of these stayed open until 2000s.[187] In 1996 and 1997, both the Bergier Commission and the Volcker Committee had investigated the same remaining accounts related to the Swiss banks' dealing with Nazi Germany. Those settlements had resulted in the payment of USD 1.288 billion by UBS, Credit Suisse and other Swiss banks to 458,400 Holocaust victims, and 198,000 victims of the Slave Labor Class action lawsuit.[188]

Work environment

Credit Suisse is more internationally minded than most European banks.[33][135] According to WetFeet's Insider Guide, Credit Suisse offers more travel opportunities, greater levels of responsibility and more client interaction than new employees get at competing firms but is known for long hours. Analysts report 60- to 110-hour work-weeks.

Roles and responsibilities are less stringent and the environment is pleasant despite hours being "the most grueling on Wall Street".[189] Vault's Insider's Guide reached similar conclusions, noting above-average training, executive access and openness matched with reports of 80- to 100-hour work-weeks.[135]

In 2023, the bank made moves to pay bonuses to top executives and senior bankers upfront but included an added condition that they needed to stay with the bank for three years or else they would need to pay the bonus, or some of the bonus, back to the company.[190][191] Later the Swiss federal government, as well as the last General Assembly of Credit Suisse shareholders voted to withdraw or seriously reduce bonus payments to top management.[192]

See also

References

- André Roegger. "Paradeplatz - Zurich". Credit Suisse.

- "Who we are". Credit Suisse. Retrieved 21 March 2023.

- Larsen, Peter Thal (17 January 2022). "New Credit Suisse chair has grim streak to break". Reuters.com. Archived from the original on 17 January 2022. Retrieved 17 January 2022.

- "Violations de la quarantaine – António Horta-Osório quitte la présidence de Credit Suisse". Tdg.ch. 17 January 2022. Archived from the original on 17 January 2022. Retrieved 17 January 2022.

- "Credit Suisse CEO resigns as bank posts 2Q loss". Associated Press News. 27 July 2022. Archived from the original on 27 July 2022. Retrieved 27 July 2022.

- Gleeson, Colin (22 August 2022). "Bank of Ireland's Francesca McDonagh appointed COO of Credit Suisse". The Irish Times. Archived from the original on 2 September 2022.

- "Earnings Release 4Q22" (PDF). Credit Suisse. Archived (PDF) from the original on 9 February 2023. Retrieved 9 February 2022.

- "Fitch Downgrades Credit Suisse Group to 'BBB'; Outlook Negative". Fitch Ratings. Archived from the original on 13 August 2022. Retrieved 13 August 2022.

- "Fitch Downgrades Credit Suisse Group to 'BBB'; Outlook Negative". Fitch Ratings. Archived from the original on 3 September 2022. Retrieved 3 September 2022.

- "NEW YORK – Credit Suisse – Großaktionär Harris Associates hat seine Beteiligung an der schweizerischen Großbank fast verdoppelt". 10 August 2022. Archived from the original on 11 August 2022. Retrieved 10 August 2022.

- "Credit Suisse Pleads Guilty to Conspiracy to Aid and Assist U.S. Taxpayers in Filing False Returns". Department of Justice. 19 May 2014. Archived from the original on 11 April 2021. Retrieved 19 June 2016.

- "Credit Suisse fined $2.6bn in US tax evasion case". Switzerland News.Net. Archived from the original on 21 May 2014. Retrieved 20 May 2014.

- "UBS agrees $3.25bn rescue deal for rival Credit Suisse". Financial Times. 19 March 2023. Archived from the original on 19 March 2023. Retrieved 19 March 2023.

- "UBS Agrees to Buy Credit Suisse for More Than $3 Billion". The Wall Street Journal. 19 April 2023. Archived from the original on 19 March 2023. Retrieved 19 March 2023.

- swissinfo.ch/mga (19 March 2023). "Credit Suisse agrees to CHF3bn takeover by rival Swiss bank UBS". SWI swissinfo.ch. Retrieved 20 March 2023.

- Halftermeyer, Marion (11 June 2023). "UBS Completes Credit Suisse Takeover to Create Swiss Bank Titan". Bloomberg News.

- B. H. Meyer; Hans Dietler (1899). "The Regulation and Nationalization of the Swiss Railways". Annals of the American Academy of Political and Social Science. Sage. 13 (2): 1–30. doi:10.1177/000271629901300201. ISSN 0002-7162. JSTOR 1009453. S2CID 143907491. Archived from the original on 29 July 2020. Retrieved 29 June 2019.

- Henri B. Meier; John E. Marthinsen; Pascal A. Gantenbein (1 October 2012). Swiss Finance: Capital Markets, Banking, and the Swiss Value Chain. John Wiley & Sons. p. 89. ISBN 978-1-118-22508-0.

- Joseph., Jung (2000). From Schweizerische Kreditanstalt to Credit Suisse Group : the history of a bank. Zurich: NZZ Verlag. ISBN 3858238910. OCLC 45803230.

- Pohl, Manfred (1994). Handbook on the History of European Banks. Edward Elgar Publishing. p. 1016. ISBN 978-1-85278-919-0.

- Sandy Franks; Sara Nunnally (2010). Barbarians of Wealth: Protecting Yourself from Today's Financial Attilas. John Wiley & Sons. p. 198. ISBN 978-0-470-94658-9.

- Jung, Joseph (2000). From Schweizerische Kreditanstalt to Credit Suisse Group: The History of a Bank. NZZ Verlag. ISBN 3-85823-891-0.

- Hausman, William J.; Hertner, Peter; Wilkins, Mira (2008). Global Electrification: Multinational Enterprise and International Finance in the History of Light and Power, 1878–2007. Cambridge University Press. p. 98. ISBN 978-0-521-88035-0.

- Hill, Kelly (1999). Cases in Corporate Acquisitions, Buyouts, Mergers, and Takeovers. Gale. ISBN 0-7876-3894-3. Archived from the original on 19 March 2023. Retrieved 4 July 2015.

- Meier, P. J. (June 1960). "Reviewed Work: Schweizerische Kreditanstalt 1856–1956 by Walter Adolph Jöhr". The Journal of Economic History. Cambridge University Press. 20 (2): 328. JSTOR 2114865.

- "Nazi name lists in Argentina may reveal loot in Swiss bank". BBC News. 5 March 2020. Archived from the original on 13 April 2021. Retrieved 13 April 2021.

- Deters, Jannik (6 March 2020). "Dokumentenfund in Argentinien: Credit Suisse soll milliardenschwere Nazi-Konten öffnen". Wiwo.de (in German). Archived from the original on 9 June 2021. Retrieved 13 April 2021.

- Jung, Joseph (2002). Credit Suisse Group Banks in the Second World War: A Critical Review (2nd ed.). Neue Zürcher Zeitung. ISBN 3-85823-994-1.

- Honan, William H. (16 April 1999). "Estelle Sapir, 73, Who Fought Bank Over Holocaust Assets". The New York Times. Archived from the original on 24 May 2013. Retrieved 12 October 2012.

- Atkinson, Mark (4 August 2000). "Swiss banks agree $1.25bn Holocaust deal". The Guardian. Archived from the original on 11 March 2021. Retrieved 12 October 2012.

- Vischer, Frank (2001). "Der Handel mit ausländischen Wertpapieren während des Krieges und die Probleme der deutschen Guthaben in der Schweiz sowie der nachrichtlosen Vermögen aus rechtlicher Sicht". Die Schweiz, der Nationalsozialismus und das Recht, Bd. 2. Chronos. ISBN 978-3-0340-0619-4.

- Andrews, Edmund L. (23 October 1998). "International Business: When the Sure-Footed Stumble; Swiss Banks Stagger After Several Investing Missteps". The New York Times. Archived from the original on 20 December 2013. Retrieved 27 August 2012.

- "Wiesenthal Centre Reveals 12,000 Names of Nazis in Argentina, Many of Whom Apparently Had Accounts Transferred to Credit Suisse". Wiesenthal.com. Archived from the original on 24 August 2020. Retrieved 28 August 2020.

- "Banking: Suicide in Switzerland". Time. Vol. 109, no. 21. 23 May 1977. p. 82. Archived from the original on 24 February 2021. Retrieved 29 November 2013.

- Gambee, Robert (1999). Wall Street: Financial Capital. W. W. Norton & Company. p. 123. ISBN 978-0-393-04767-7.

- Crabbe, Matthew (January 1989). "Gut's Secret Money". Euromoney. Archived from the original on 18 May 2013. Retrieved 27 August 2012.

- Greenhouse, Steven (10 April 1989). "Swiss Bank Turns Aggressive". The New York Times. pp. D1–D2. Archived from the original on 8 March 2021. Retrieved 27 August 2012.

- Grant, Linda (19 August 1996). "Will CS First Boston Ever Win?". Fortune. pp. 30–34. Archived from the original on 3 December 2013. Retrieved 27 August 2012.

- Cooper, Ron (14 October 1991). "Gut Instincts". Forbes. Vol. 148, no. 8. pp. 169–170.

- Thomasson, Emma (15 November 2011). "Update 5-C: Suisse ends oldest Swiss bank brand Leu". Reuters. Archived from the original on 10 March 2016. Retrieved 21 November 2012.

- "Offer Made to Create Largest Swiss Bank Group". The New York Times. 6 January 1993. Archived from the original on 4 March 2016. Retrieved 21 November 2012.

- Olson, Elizabeth (21 June 2002). "Credit Suisse's Insurance Unit To Get Infusion of $1.1 Billion". The New York Times. Archived from the original on 24 May 2013. Retrieved 30 November 2012.

- Gasparino, Charles (16 February 1999). "Credit Suisse Agrees to Purchase Unit of Warburg Pincus for $650 Million". The Wall Street Journal. p. B14.

- Fairlamb, David; Rossant, John; Thornton, Emily (11 September 2000). "This Bank Keeps Growing And Growing And ..." Business Week. p. 134. Archived from the original on 3 December 2013. Retrieved 3 October 2012.

- Tagliabue, John (29 November 1996). "Taking the Challenge of Streamlining Credit Suisse". The New York Times. pp. D9, D14. Archived from the original on 20 December 2013. Retrieved 27 August 2012.

- "Credit Suisse Restructures". The Banker. August 1996. p. 5.

- Strom, Stephanie (30 July 1999). "Japan Revokes Credit Suisse Unit's Banking License". The New York Times. Archived from the original on 20 December 2013. Retrieved 27 August 2012.

- Avery, Helen (2010). "Credit Suisse reaches the summit of private banking". Euromoney. Vol. 41, no. 490. pp. 56–60. Archived from the original on 3 December 2013. Retrieved 29 November 2013.

- Gatti, Claudio; Eligon, John (15 December 2009). "Iranian Dealings Lead to a Fine for Credit Suisse". The New York Times. Archived from the original on 5 November 2012. Retrieved 20 November 2012.

- Lucchetti, Aaron; Solomon, Jay (17 December 2009). "Credit Suisse's Secret Deals". The Wall Street Journal. Archived from the original on 7 January 2015. Retrieved 13 October 2012.

- Credit Suisse To Merge Private Banks To Raise Profit. Archived from 2 February 2023, by Author Virobel

- "Bankruptcy case heats up for former Oregon timber tycoon Tim Blixseth". The Oregonian. Associated Press. 24 February 2010. Archived from the original on 3 December 2013. Retrieved 30 November 2012.

- Church, Steven; Effinger, Anthony (6 April 2011). "Tim Blixseth facing forced bankruptcy over taxes". Bloomberg. Archived from the original on 6 November 2012. Retrieved 30 November 2012.

- Stempel, Jonathan (4 January 2010). "Credit Suisse sued over resorts, $24 billion sought". Reuters. Archived from the original on 15 August 2021. Retrieved 5 July 2021.

- Mijuk, Goran (18 January 2008). "Credit Suisse Plans to Expand Private Banking World-Wide". The Wall Street Journal. Archived from the original on 14 March 2016. Retrieved 21 October 2012.

- Simonian, Haig (11 February 2009). "Credit Suisse losses widen to SFr8bn". Financial Times. Archived from the original on 19 March 2023. Retrieved 9 October 2012.

- "New York Sues Credit Suisse Over Mortgages". The New York Times. Reuters. 20 November 2012. Archived from the original on 28 November 2012. Retrieved 29 November 2012.

- Freifeld, Karen; Frankel, Alison (4 October 2012). "Exclusive: Credit Suisse probed over mortgages – sources". Reuters. Archived from the original on 6 March 2016. Retrieved 4 October 2012.

- Greil, Anita; Lucchetti, Aaron (26 September 2012). "Credit Suisse May Revamp Asset-Management Unit". The Wall Street Journal. Archived from the original on 29 July 2020. Retrieved 29 November 2012.

- Kandell, Jonathan (March 2012). "Swiss Banks Adjusting To Radical New Regulations". Institutional Investor. Vol. 46, no. 2. p. 33. Archived from the original on 3 December 2013. Retrieved 29 November 2013.

- Murphy, Megan (28 July 2011). "Credit Suisse to axe 2,000 jobs". Financial Times. Archived from the original on 19 March 2023. Retrieved 20 November 2012.

- Logutenkova, Elena (20 November 2012). "Credit Suisse to Revamp Investment Banking, Private Bank". BusinessWeek. Archived from the original on 28 November 2012. Retrieved 29 November 2012.

- Bloomberg Surveillance (24 January 2018). "Tidjane Thiam Says Markets and Volatility Are Going Up". Bloomberg News. Archived from the original on 2 March 2018. Retrieved 24 January 2018.

- Barreto, Elzio (23 April 2008). "Credit Suisse banker arrested in Brazil tax probe". Reuters. Archived from the original on 10 March 2016. Retrieved 19 January 2013.

- "Brazil Arrests 19 In Tax Evasion Scheme". CBS News. Associated Press. 11 February 2009. Archived from the original on 3 December 2013. Retrieved 19 January 2013.

- Browning, Lynnley; Werdigier, Julia (23 February 2011). "U.S. Accuses Four Bankers Connected to Credit Suisse of Helping Americans Evade Taxes". The New York Times. Archived from the original on 20 December 2013. Retrieved 19 November 2012.

- Voreacos, David (15 August 2011). "Credit Suisse May Settle U.S. Probe by Admitting Wrongdoing, Paying Fine". Bloomberg. Archived from the original on 6 November 2012. Retrieved 20 November 2012.

- Crawford, David; Saunders, Laura (11 July 2012). "Clients of Swiss Bank Raided in Tax Probe". The Wall Street Journal. Archived from the original on 15 February 2017. Retrieved 3 August 2017.

- Bart, Katharina (20 November 2012). "Credit Suisse shuffles top executives, merges units". Reuters. Archived from the original on 8 March 2016. Retrieved 23 November 2012.

- Greil, Anita (17 September 2012). "Credit Suisse to Give More Files". The Wall Street Journal. Archived from the original on 24 February 2017. Retrieved 7 September 2013.

- Schoenberg, Tom; Voreacos, David (21 February 2014). "Credit Suisse to Pay $197 Million in SEC U.S. Client Case". Bloomberg. Archived from the original on 21 May 2014. Retrieved 27 March 2014.

- Han Shih, Toh (20 April 2013). "German prosecutors probe Credit Suisse tax evasion". South China Morning Post. Archived from the original on 3 December 2013. Retrieved 7 September 2013.

- Crawford, David (8 November 2012). "Germany Probes UBS Staff on Tax-Evasion Allegations". The Wall Street Journal. Archived from the original on 8 February 2015. Retrieved 18 January 2014.

- "Credit Suisse AG says not subject to Swiss competition foreign exchange probe". Economic Times. 31 March 2014. Archived from the original on 1 May 2014. Retrieved 8 August 2014.

- "Credit Suisse Pleads Guilty in Felony Case". Dealbook – New York Times. 19 May 2014. Archived from the original on 21 May 2014. Retrieved 20 May 2014.

- Bart, Katherina; Freifeld, Karen; Viswana, Aruna (22 May 2014). "Credit Suisse guilty plea has little immediate impact as shares rise". Business Standard. Archived from the original on 9 August 2014. Retrieved 22 May 2014.

- Milmo, Dan (10 March 2015). "Prudential's Tidjane Thiam to take top role at Credit Suisse". The Guardian. Archived from the original on 25 December 2018. Retrieved 10 March 2015.

- Ganesan, Gayathree. "Credit Suisse names new CEO of global markets". Business Insider. Archived from the original on 8 September 2016. Retrieved 9 September 2016.

- Atkins, Ralph (5 September 2018). "Switzerland's banks try to put the past behind them". Financial Times. Archived from the original on 29 July 2020. Retrieved 22 August 2020.

- "Credit Suisse rüstet gegen Smartphone-Banken auf". Handelszeitung (in German). Archived from the original on 6 September 2019. Retrieved 6 September 2019.

- Owen Walker (30 July 2020). "Credit Suisse launches restructuring after trading profit boost". Financial Times. Archived from the original on 30 July 2020. Retrieved 30 July 2020.

- Illien, Noele; Hirt, Oliver (9 February 2023). "Credit Suisse warns of more losses after sliding deep into the red". Reuters. Archived from the original on 9 February 2023. Retrieved 9 February 2023.

- "Credit Suisse finds 'material weaknesses' in financial reporting controls". Financial Times. 14 March 2023. Archived from the original on 15 March 2023. Retrieved 15 March 2023.

- Illien, Noele (15 March 2023). "Credit Suisse sheds nearly 25%, key backer says no more money". Reuters. Archived from the original on 15 March 2023. Retrieved 15 March 2023.

- Patrick, Margot; Kowsmann, Patricia; Ostroff, Caitlin (15 March 2023). "Credit Suisse Shares Plunge as Bank Storm Spreads to Europe". The Wall Street Journal. Archived from the original on 15 March 2023. Retrieved 15 March 2023.

- Patrick, Margot; Kalin, Stephen; Kowsmann, Patricia (15 March 2023). "Credit Suisse Stock Price Drops as Much as 30%". The Wall Street Journal. Archived from the original on 15 March 2023. Retrieved 15 March 2023.

- Makortoff, Kalyeena; Wearden, Graeme (16 March 2023). "Credit Suisse takes $54bn loan from Swiss central bank after share price plunge". The Guardian. Archived from the original on 16 March 2023. Retrieved 16 March 2023.

- Wearden, Graeme (16 March 2023). "Credit Suisse 'takes decisive action' by borrowing up to £41bn from central bank – business live". The Guardian. Archived from the original on 16 March 2023. Retrieved 16 March 2023.

- Smith, Elliot (16 March 2023). "Credit Suisse to buy back $3 billion in debt, sell landmark hotel as credit fears persist". CNBC. Archived from the original on 16 March 2023.

- Noonan, Laura; Morris, Stephen; Fontanella-Khan, James; Massoudi, Arash; Walker, Owen (18 March 2023). "Switzerland prepares emergency measures to deliver UBS takeover of Credit Suisse". Financial Times. Archived from the original on 18 March 2023. Retrieved 18 March 2023.

- Maley, Karen (19 March 2023). "Bank panic shows deposits have become hugely volatile". Australian Financial Review.

- Merced, Michael J. de la (24 April 2023). "Final Days at Credit Suisse Were Marked by a $69 Billion Race for the Exits". The New York Times. Retrieved 24 April 2023.

- "UBS and regulators rush to seal Credit Suisse takeover deal". Financial Times. 18 March 2023. Archived from the original on 18 March 2023. Retrieved 18 March 2023.

- "Credit Suisse nella tempesta, il mercato pesa l'opzione Ubs". ilsole24ore.com. ilsole24ore.com. 18 March 2023. Archived from the original on 18 March 2023. Retrieved 18 March 2023.

- "Ubs e Credit Suisse trattano la fusione, al lavoro anche le autorità Usa". ilsole24ore.com. ilsole24ore.com. 18 March 2023. Archived from the original on 19 March 2023. Retrieved 18 March 2023.

- "Credit Suisse Crisis Nears Finale as UBS Discussions Heat Up". Bloomberg. 18 March 2023. Retrieved 18 March 2023.

- "UBS Agrees to Buy Credit Suisse in Historic Deal to End Crisis". Bloomberg.com. 19 March 2023. Archived from the original on 19 March 2023. Retrieved 19 March 2023.

- De Paoli, Lucca; Morpurgo, Giulia (23 March 2023). "Could Credit Suisse's AT1 Wipeout End Up In Court?". Bloomberg News. Retrieved 30 March 2023.

- Foy, Simon; Gill, Oliver (20 March 2023). "Row breaks out between Brussels and the Swiss over Credit Suisse rescue deal". Daily Telegraph. Retrieved 30 March 2023.

- Benny-Morrison, Ava; Strohm, Chris; Halftermeyer, Marion (23 March 2023). "Credit Suisse, UBS Among Banks in DOJ Russia-Sanctions Probe". Bloomberg News. Retrieved 12 April 2023.

- Jucca, Lisa (24 April 2023). "Credit Suisse mess leaves scattered Swiss debris". Reuters. Retrieved 25 April 2023.

- Illien, Noele (27 March 2023). "Zurich bank looks to capitalise on Credit Suisse's demise". Reuters. Retrieved 25 April 2023.

- Halftermeyer, Marion; Benitez, Laura; Balezou, Myriam (27 June 2023). "UBS Preparing to Cut Over Half of Credit Suisse Workforce". Bloomberg News. Retrieved 27 June 2023.

- "Articles of Association of Credit Suisse Group AG" (PDF). Credit Suisse. Archived from the original (PDF) on 19 February 2013. Retrieved 20 November 2012.

- "Corporate Governance Guidelines of Credit Suisse AG" (PDF). Credit Suisse. Archived from the original (PDF) on 6 June 2013. Retrieved 20 November 2012.

- "Organizational Guidelines and Regulations of Credit Suisse Group AG and of Credit Suisse AG" (PDF). Credit Suisse. Archived from the original (PDF) on 6 June 2013. Retrieved 20 November 2012.

- Langley, William (9 May 2023). "UBS revamps leadership as it prepares to complete Credit Suisse deal". Financial Times. Archived from the original on 9 May 2023. Retrieved 9 May 2023.

- Mathilde Farine (22 March 2022). "Américain, le premier actionnaire de Credit Suisse a-t-il doublé ses parts? - Le Temps". Le Temps (in French). Archived from the original on 11 August 2022. Retrieved 12 August 2022.

- Bloomberg (25 January 2023). "Qatar Investment Authority ups its stake in Credit Suisse". Retrieved 26 January 2023.

- "Harris Associates Sells Entire Credit Suisse Stake, FT Says". SWI swissinfo.ch. 6 March 2023. Archived from the original on 7 March 2023. Retrieved 16 March 2023.

- "Credit Suisse Group AG (CS)". Yahoo.com. Archived from the original on 16 March 2023. Retrieved 17 March 2023.

- "Credit Suisse deal averted crisis, Swiss central bank says". Associated Press. 23 March 2023. Retrieved 23 March 2023.

- Langley, Alison (3 October 2002). "Credit Suisse To Prop Up Insurer Unit". The New York Times. Archived from the original on 6 March 2016. Retrieved 7 February 2017.

- Maude, David (2006). Global Private Banking and Wealth Management: The New Realities. John Wiley & Sons. ISBN 978-0-470-03053-0.

- McDonald, Oonagh; Keasey, Kevin (2003). The Future of Retail Banking in Europe: A View from the Top. John Wiley & Sons. p. 176. ISBN 978-0-470-85574-4.

- Crouhy, Michel; Galai, Dan; Mark, Robert (January 2000). "A comparative analysis of current credit risk models". Journal of Banking & Finance. 24 (1–2): 59–117. doi:10.1016/S0378-4266(99)00053-9.

- Jones, Sam (29 April 2012). "Credit Suisse fund plans London float". Financial Times. Archived from the original on 6 July 2012. Retrieved 30 November 2012.

- Plunkett, Jack W. (2005). Plunkett's Banking, Mortgages and Credit Industry Almanac 2006. Plunkett Research. p. 222. ISBN 978-1-59392-381-5.

- Fischer, Layna, ed. (2003). Excellence in Practice: Innovation and Excellence in Workflow and Business Process Management. Vol. 5. Future Strategies. p. 171. ISBN 978-0-9703509-5-4.

- Jones, Sam (11 January 2012). "Credit Suisse offers trades for eurozone shorting". Financial Times. Archived from the original on 19 March 2023. Retrieved 29 November 2013.

- Jones, Sam (17 November 2012). "Investors grapple with sector's multiple choices". Financial Times. Archived from the original on 19 March 2023. Retrieved 29 November 2012.

- Strasburg, Jenny (15 September 2010). "Credit Suisse Adds Heft in Hedge Fund as Rivals Exit". The Wall Street Journal. Archived from the original on 14 May 2015. Retrieved 29 November 2012.

- Darbyshire, Paul; Hampton, David (2012). Hedge Fund Modeling and Analysis Using Excel and VBA. John Wiley & Sons. p. 250. ISBN 978-1-119-94563-5.

- "Credit Suisse's Top Holdings: A Brief Analysis". Seeking Alpha. 29 March 2011. Archived from the original on 6 February 2013. Retrieved 21 October 2012.

- Marshall, Julian (1999). "Best European Equity Manager: Credit Suisse Asset Management". Global Investor. 119: 15.

- Ceron, Gaston (9 April 2002). "Credit Suisse Fund Manager Tries to Do More With Less". The Wall Street Journal. p. C27.

- "Investment Strategy". Credit Suisse. Archived from the original on 3 November 2012. Retrieved 21 November 2012.

- Campos, Rodrigo; Jones, Marc (5 May 2023). "Ecuador frees cash for Galapagos conservation with $1.6 billion bond buyback". Reuters. Retrieved 6 May 2023.

- tagesschau.de. ""Suisse Secrets": Credit Suisse und ihre kriminellen Kunden". tagesschau.de (in German). Archived from the original on 20 February 2022. Retrieved 20 February 2022.

- Eavis, Peter (1 November 2012). "The List That Big Banks Don't Wish to Be On". The New York Times / DealBook. Archived from the original on 8 November 2012. Retrieved 21 November 2012.

- "Update of group of global systemically important banks (G-SIBs)" (PDF). Financial Stability Board. 1 November 2012. Archived from the original (PDF) on 19 November 2012. Retrieved 19 November 2012.

- "World's Most Admired Companies: Credit Suisse". CNN Money. 2011. Archived from the original on 11 November 2012. Retrieved 21 November 2012.

- Loosvelt, Derek (2006). Vault Guide to the Top Financial Services Employers. Vault. p. 134. ISBN 978-1-58131-416-8.

- "Credit Suisse retains crown as top global private bank in benchmark Euromoney survey". Euromoney. 7 February 2012. Archived from the original on 3 December 2013. Retrieved 29 November 2012.

- Pegg, David; Makortoff, Kalyeena; Chulov, Martin; Lewis, Paul; Harding, Luke (20 February 2022). "Revealed: Credit Suisse leak unmasks criminals, fraudsters and corrupt politicians". The Guardian. Retrieved 14 May 2023.

- „UBS: Die Aktie ist nach oben ausgebrochen“ (in German). Cash. 4 September 2023. Accessed 4 September 2023.

- Peter Lattman and Peter Eavis (2 February 2012). "3 Former Traders at Credit Suisse Charged With Bond Fraud". DealBook. Archived from the original on 30 November 2020. Retrieved 8 November 2020.

- Lattman, Peter (12 April 2013). "Former Credit Suisse Executive Pleads Guilty to Inflating the Value of Mortgage Bonds". DealBook. Archived from the original on 21 April 2020. Retrieved 8 November 2020.

- Jacob Gaffney (1 February 2012). "SEC charges four Credit Suisse bankers in subprime bond fraud". Housing Wire. Archived from the original on 14 August 2021. Retrieved 8 November 2020.

- "SEC Charges Former Credit Suisse Investment Bankers in Subprime Bond Pricing Scheme During Credit Crisis". SEC.gov. 1 February 2012. Archived from the original on 11 November 2020. Retrieved 8 November 2020.

- "Former Credit Suisse traders charged with fraud; US prosecutors charged three former Credit Suisse traders with inflating the value of mortgage bonds in 2007 as the housing market deteriorated, saying they used the scheme to boost their year-end bonuses". Australian Financial Review. 2 February 2012. Archived from the original on 14 August 2021. Retrieved 8 November 2020.

- Joe McGrath (2020). "Why Do Good People Do Bad Things? A Multi-Level Analysis of Individual, Organizational, and Structural Causes of White-Collar Crime," Archived 11 November 2020 at the Wayback Machine Seattle University Law Review.

- Andrew Hurst (19 February 2008). "Credit Suisse reveals $2.85 billion write-downs". Reuters. Archived from the original on 15 November 2020. Retrieved 8 November 2020.

- "Credit Suisse Agrees to Forfeit $536 Million in Connection with Violations of the International Emergency Economic Powers Act and New York State Law". Justice.gov. 16 December 2009. Archived from the original on 10 April 2020. Retrieved 10 April 2020.

- Drucker, Jesse; Hubbard, Ben (20 February 2022). "Vast Leak Exposes How Credit Suisse Served Strongmen and Spies". The New York Times. ISSN 0362-4331. Archived from the original on 20 February 2022. Retrieved 20 February 2022.

- "Credit Suisse faces U.S. tax probe, senate inquiry - Bloomberg News". Reuters. 11 October 2022. Retrieved 20 March 2023.

- Keaten, Jamey; Bonnell, Courtney (29 March 2023). "US: Credit Suisse violates deal on rich clients' tax evasion". ABC News. Retrieved 31 March 2023.

- "Hong Kong police launch probe into US$250 million linked to Najib". 11 September 2015. Archived from the original on 28 September 2015.

- Hastings, Kirsten (30 May 2017). "Credit Suisse and UOB fined as 1MDB probe hits two years". Archived from the original on 5 March 2022. Retrieved 5 March 2022.

- "Singapore fines Credit Suisse, UOB over 1MDB-linked dealings, wraps up review". Reuters. 30 May 2017. Archived from the original on 17 September 2020. Retrieved 15 September 2020.

- "Swiss bankers fined over 1MDB dealings". SWI swissinfo.ch. 25 November 2019. Archived from the original on 16 September 2020. Retrieved 15 September 2020.

- "Mozambique fell prey to the promise of fabulous wealth – now it can't pay nurses". The Guardian. 27 January 2017. Archived from the original on 8 November 2021. Retrieved 8 November 2021.

- "Credit Suisse fined £350m over Mozambique 'tuna bonds' loan scandal". The Guardian. Archived from the original on 25 January 2022. Retrieved 8 November 2021.

- "SEC.gov | SEC Charges Credit Suisse With FCPA Violations". sec.gov. Archived from the original on 14 February 2019. Retrieved 14 February 2019.

- Robinson, Matt; Hurtado, Patricia (5 July 2018). "Credit Suisse to Pay $77 Million to Settle Princeling Probes". Bloomberg News. Archived from the original on 14 February 2019. Retrieved 13 April 2023.

- "12 Climate Activists on Trial for Stunt at Swiss Bank Office". The New York Times. Associated Press. 7 January 2020. Retrieved 9 January 2020.

- "Fossil fuel investments: Climate activists on trial over Credit Suisse tennis stunt". Swissinfo. Reuters. 8 January 2020. Archived from the original on 9 January 2020. Retrieved 9 January 2020.

- Le Temps. "Climate Activists put Credit Swiss on its knees". Archived from the original on 23 May 2020. Retrieved 28 April 2020.

- 24Heures. "Historical acquittal for climate activists". Archived from the original on 29 April 2020. Retrieved 28 April 2020.

- Payer, Andrés (26 May 2020). "Klimawandel als strafrechtlicher Notstand (The Climate Necessity Defense in Swiss Criminal Law)". SSRN 3630780. Archived from the original on 19 March 2023. Retrieved 16 March 2023 – via papers.ssrn.com.

- "Roger Federer responds to climate crisis criticism from Greta Thunberg". The Guardian. 12 January 2020. Archived from the original on 12 January 2020. Retrieved 12 January 2020.

- "Credit Suisse, fossil bank". Archived from the original on 3 August 2020. Retrieved 22 August 2020.

- "Credit Suisse chief operating officer fired over spying scandal". the Guardian. 1 October 2019. Archived from the original on 10 February 2021. Retrieved 6 April 2021.

- Walker, Owen; Morris, Stephen (25 March 2021). "Credit Suisse pegs potential Greensill fund losses at $3bn". Financial Times. Archived from the original on 6 April 2021. Retrieved 8 April 2021.

- "Credit Suisse repays another $400 mln to Greensill-linked fund investors". Reuters. 6 August 2021. Archived from the original on 6 August 2021. Retrieved 7 August 2021.

- "Credit Suisse removes senior executives after $4.7bn Archegos losses". The Financial Times. Archived from the original on 8 April 2021. Retrieved 7 April 2021.

- "Credit Suisse crisis worst yet for banking veteran Horta-Osorio". Reuters. 30 April 2021. Archived from the original on 30 April 2021. Retrieved 1 May 2021.

- Illien, Noele; Revill, John (24 July 2023). "UBS agrees to pay $388 million over Credit Suisse's Archegos failings". Reuters.

- "Swiss banks implicated in trading cartel investigation". Swissinfo.ch. 2 December 2021. Archived from the original on 4 December 2021. Retrieved 4 December 2021.

- "'Sterling Lads' Forex Fix Earns Banks $390 Million in Fines". Swissinfo.ch. Archived from the original on 4 December 2021. Retrieved 4 December 2021.

- Godoy, Jody (20 October 2022). "U.S. jury finds Credit Suisse did not rig forex market". Reuters. Retrieved 2 April 2023.

- Van Voris, Bob (20 October 2022). "Credit Suisse Cleared of Claims It Conspired to Fix FX Rates". Bloomberg News. Retrieved 2 April 2023.

- Neghaiwi, Brenna Hughes; Koltrowitz, Silke (7 February 2022). "Credit Suisse faces money laundering charges in Bulgarian cocaine traffickers trial". Reuters. Archived from the original on 7 February 2022. Retrieved 7 February 2022 – via www.reuters.com.

- Carrel, Paul (27 July 2022). "Credit Suisse found guilty in cocaine cash laundering case". Reuters. Archived from the original on 28 June 2022. Retrieved 28 June 2022.

- Pegg, David; Makortoff, Kalyeena; Chulov, Martin; Lewis, Paul; Harding, Luke (20 February 2022). "Revealed: Credit Suisse leak unmasks criminals, fraudsters and corrupt politicians". The Guardian. Archived from the original on 22 February 2022. Retrieved 20 February 2022.

- Sampaio, Leonardo (December 2022), Suisse Secrets: Credit Suisse's information leak under the Swiss Anti-Money Laundering Act

- "Credit Suisse denies wrongdoing after client data leaked to media". Reuters. 20 February 2022. Archived from the original on 20 February 2022. Retrieved 21 February 2022.

- Smith, Robert (2 March 2022). "Credit Suisse asks investors to destroy oligarch loans documents". Financial Times. Archived from the original on 2 March 2022. Retrieved 2 March 2022.

- Patrick, Margot (28 March 2022). "Lawmakers Launch Probe of Credit Suisse Compliance With Russia Sanctions". The Wall Street Journal. Archived from the original on 28 March 2022. Retrieved 28 June 2022.

- Smith, Elliot (4 October 2022). "Credit Suisse to remain 'under pressure' but analysts wary of Lehman comparison". CNBC. Archived from the original on 6 October 2022. Retrieved 5 October 2022.

- Smith, Elliot (7 October 2022). "Credit Suisse to buy back $3 billion in debt, sell landmark hotel as credit fears persist". CNBC. Archived from the original on 7 October 2022. Retrieved 7 October 2022.

- "Credit Suisse business is stable, chairman tells broadcaster SRF". Reuters. 5 December 2022. Archived from the original on 6 December 2022. Retrieved 6 December 2022.

- Halftermeyer, Dinesh Nair and Marion (5 December 2022). "Saudi crown prince eyes $747m investment in Credit Suisse unit". The Sydney Morning Herald. Archived from the original on 2 January 2023. Retrieved 2 January 2023.

- Prentice, Chris (18 April 2023). "Credit Suisse hampered internal probe into Nazi-linked accounts, U.S. senators say". Reuters. Retrieved 20 April 2023.

- Keaten, Jamey (19 April 2023). "Credit Suisse faulted over probe of Nazi-linked accounts". Associated Press. Retrieved 20 April 2023.

- "Swiss Banks Settlement: In re Holocaust Victim Assets Litigation". Swiss Bank Claims. Retrieved 25 April 2023.

- 25 Top Financial Services Firms. WetFeet. 2008. p. 35. ISBN 978-1-58207-801-4.

- "Ex-Credit Suisse Bankers Weigh Legal Fights Over Bonus Clawbacks". Bloomberg.com. 20 January 2023. Archived from the original on 20 January 2023. Retrieved 23 January 2023.

- "Credit Suisse to pay upfront bonus to top staff -Bloomberg". Reuters. 18 January 2023. Archived from the original on 23 January 2023. Retrieved 23 January 2023.

- "Das war die letzte Generalversammlung der Credit Suisse". Schweizer Radio und Fernsehen (in German). 4 April 2023. Retrieved 12 April 2023.

External links

- Official website

- Business data for Credit Suisse: