NIFTY 50

The NIFTY 50 is a benchmark Indian stock market index that represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange.[1][2]

| |

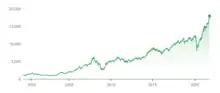

Performance of the NIFTY 50 index between 1990 and 2021 | |

| Foundation | 21 April 1997 |

|---|---|

| Operator | NSE Indices |

| Exchanges | National Stock Exchange of India |

| Trading symbol | ^NSEI |

| Constituents | 50 |

| Type | Large cap |

| Weighting method | Capitalisation-weighted |

| Related indices | NIFTY Next 50 NIFTY 500 |

| Website | www |

Nifty 50 is owned and managed by NSE Indices (previously known as India Index Services & Products Limited), which is a wholly owned subsidiary of the NSE Strategic Investment Corporation Limited.[3][4] NSE Indices had a marketing and licensing agreement with Standard & Poor's for co-branding equity indices until 2013. The Nifty 50 index was launched on 22 April 1996,[5] and is one of the many stock indices of Nifty.

The NIFTY 50 index has shaped up to be the largest single financial product in India, with an ecosystem consisting of exchange-traded funds (onshore and offshore), and futures and options at NSE and SGX.[6][7] NIFTY 50 is the world's most actively traded contract. WFE, IOM and FIA surveys endorse NSE's leadership position.[8][9] Between 2008 & 2012, the NIFTY 50 index's share of NSE market fell from 65% to 29%[10] due to the rise of sectoral indices like NIFTY Bank, NIFTY IT, NIFTY Pharma, and NIFTY Next 50.

The NIFTY 50 index covers 13 sectors of the Indian economy and offers investment managers exposure to the Indian market in one portfolio. As of January 2023, NIFTY 50 gives a weightage of 36.81% to financial services including banking, 14.70% to IT, 12.17% to oil and gas, 9.02% to consumer goods, and 5.84% to automobiles.[11][12]

Methodology

The NIFTY 50 index is a free float market capitalisation weighted index. The index was initially calculated on a full market capitalisation methodology. On 26 June 2009, the computation was changed to a free-float methodology. The base period for the NIFTY 50 index is 3 November 1995, which marked the completion of one year of operations of the equity market segment on NSE. The base value of the index has been set at 1000 and a base capital of ₹ 2.06 trillion.[13][14]

Record values

| Category | All-time highs[15] | |

|---|---|---|

| Closing | 20,192.35 | Friday, 15 September 2023 |

| Intra-day | 20,222.45 | Friday, 15 September 2023 |

Constituents

The constituents of Nifty 50 as of 13 July 2023:

| Company Name | Symbol | Sector[16] |

|---|---|---|

| Adani Enterprises | ADANIENT | Diversified |

| Adani Ports & SEZ | ADANIPORTS | Infrastructure |

| Apollo Hospitals | APOLLOHOSP | Healthcare |

| Asian Paints | ASIANPAINT | Consumer Durables |

| Axis Bank | AXISBANK | Banking |

| Bajaj Auto | BAJAJ-AUTO | Automobile |

| Bajaj Finance | BAJFINANCE | Financial Services |

| Bajaj Finserv | BAJAJFINSV | Financial Services |

| Bharat Petroleum | BPCL | Energy - Oil & Gas |

| Bharti Airtel | BHARTIARTL | Telecommunication |

| Britannia Industries | BRITANNIA | Consumer Goods |

| Cipla | CIPLA | Pharmaceuticals |

| Coal India | COALINDIA | Energy - Coal |

| Divi's Laboratories | DIVISLAB | Pharmaceuticals |

| Dr. Reddy's Laboratories | DRREDDY | Pharmaceuticals |

| Eicher Motors | EICHERMOT | Automobile |

| Grasim Industries | GRASIM | Materials |

| HCLTech | HCLTECH | Information Technology |

| HDFC Bank | HDFCBANK | Banking |

| HDFC Life | HDFCLIFE | Financial Services |

| Hero MotoCorp | HEROMOTOCO | Automobile |

| Hindalco Industries | HINDALCO | Metals |

| Hindustan Unilever | HINDUNILVR | Consumer Goods |

| ICICI Bank | ICICIBANK | Banking |

| IndusInd Bank | INDUSINDBK | Banking |

| Infosys | INFY | Information Technology |

| ITC | ITC | Consumer Goods |

| JSW Steel | JSWSTEEL | Metals |

| Kotak Mahindra Bank | KOTAKBANK | Banking |

| Larsen & Toubro | LT | Construction |

| LTIMindtree | LTIM | Information Technology |

| Mahindra & Mahindra | M&M | Automobile |

| Maruti Suzuki | MARUTI | Automobile |

| Nestlé India | NESTLEIND | Consumer Goods |

| NTPC | NTPC | Energy - Power |

| Oil and Natural Gas Corporation | ONGC | Energy - Oil & Gas |

| Power Grid | POWERGRID | Energy - Power |

| Reliance Industries | RELIANCE | Diversified |

| SBI Life Insurance Company | SBILIFE | Financial Services |

| State Bank of India | SBIN | Banking |

| Sun Pharma | SUNPHARMA | Pharmaceuticals |

| Tata Motors | TATAMOTORS | Automobile |

| Tata Steel | TATASTEEL | Metals |

| Tata Consultancy Services | TCS | Information Technology |

| Tata Consumer Products | TATACONSUM | Consumer Goods |

| Tech Mahindra | TECHM | Information Technology |

| Titan Company | TITAN | Consumer Durables |

| UltraTech Cement | ULTRACEMCO | Materials |

| UPL | UPL | Chemicals |

| Wipro | WIPRO | Information Technology |

Index changes

Changes in index constituents since Nifty 50 adopted free float criteria in 2009:

| Former Constituent | Symbol | Sector | Replaced By | Symbol_2 | Date of Replacement | Ref |

|---|---|---|---|---|---|---|

| ABB India | ABB | Engineering | Bajaj Auto | BAJAJ-AUTO | 1 October 2010 | [17] |

| Idea Cellular | IDEA | Telecommunication | Dr. Reddy's Laboratories | DRREDDY | ||

| Unitech | UNITECH | Realty | Sesa Goa | VEDL | ||

| Suzlon | SUZLON | Energy - Power | Grasim Industries | GRASIM | 25 March 2011 | [18] |

| Reliance Capital | RELCAPITAL | Financial Services | Coal India | COALINDIA | 10 October 2011 | [19] |

| Reliance Communications | RCOM | Telecommunication | Asian Paints | ASIANPAINT | 27 April 2012 | [20] |

| Reliance Power | RPOWER | Energy - Power | Bank of Baroda | BANKBARODA | ||

| Steel Authority of India | SAIL | Metals | Lupin | LUPIN | 28 September 2012 | [21] |

| Sterlite Industries | STERLITE | Metals | UltraTech Cement | ULTRACEMCO | ||

| Siemens | SIEMENS | Engineering | IndusInd Bank | INDUSINDBK | 1 April 2013 | [22] |

| Wipro | WIPRO | Information Technology | NMDC | NMDC | ||

| Reliance Infrastructure | RELINFRA | Construction | Wipro | WIPRO | 27 September 2013 | [23] |

| JP Associates | JPASSOCIAT | Construction | Tech Mahindra | TECHM | 28 March 2014 | [24] |

| Ranbaxy Laboratories | RANBAXY | Pharmaceuticals | United Spirits | MCDOWELL-N | ||

| United Spirits | MCDOWELL-N | Consumer Goods | Zee Entertainment Enterprises | ZEEL | 19 September 2014 | [25] |

| DLF | DLF | Realty | Idea Cellular | IDEA | 27 March 2015 | [22] |

| Jindal Steel & Power | JINDALSTEL | Metals | Yes Bank | YESBANK | ||

| IDFC | IDFC | Financial Services | Bosch India | BOSCHLTD | 29 May 2015 | [25] |

| NMDC | NMDC | Metals | Adani Ports & SEZ | ADANIPORTS | 28 September 2015 | [26] |

| Cairn India | CAIRN | Energy - Oil & Gas | Aurobindo Pharma | AUROPHARMA | 1 April 2016 | [27] |

| Punjab National Bank | PNB | Banking | Bharti Infratel | INFRATEL | ||

| Vedanta | VEDL | Metals | Eicher Motors | EICHERMOT | ||

| BHEL | BHEL | Engineering | Indiabulls Housing Finance | IBULHSGFIN | 31 March 2017 | [28] |

| Idea Cellular | IDEA | Telecommunication | Indian Oil Corporation | IOC | ||

| Grasim Industries | GRASIM | Textiles | Vedanta | VEDL | 26 May 2017 | [29] |

| ACC | ACC | Cement | Bajaj Finance | BAJFINANCE | 29 September 2017 | [30] |

| Bank of Baroda | BANKBARODA | Banking | Hindustan Petroleum | HINDPETRO | ||

| Tata Power | TATAPOWER | Energy - Power | UPL | UPL | ||

| Ambuja Cements | AMBUJACEM | Cement | Bajaj Finserv | BAJAJFINSV | 2 April 2018 | [31] |

| Aurobindo Pharma | AUROPHARMA | Pharmaceuticals | Grasim Industries | GRASIM | ||

| Bosch India | BOSCHLTD | Engineering | Titan Company | TITAN | ||

| Lupin | LUPIN | Pharmaceuticals | JSW Steel | JSWSTEEL | 28 September 2018 | [32] |

| Hindustan Petroleum | HINDPETRO | Energy - Oil & Gas | Britannia Industries | BRITANNIA | 29 March 2019 | [33] |

| Indiabulls Housing Finance | IBULHSGFIN | Financial Services | Nestlé India | NESTLE | 27 September 2019 | [34] |

| Yes Bank | YESBANK | Banking | Shree Cement | SHREECEM | 19 March 2020 | [35] |

| Vedanta | VEDL | Metals | HDFC Life | HDFCLIFE | 31 July 2020 | [36] |

| Zee Entertainment Enterprises | ZEEL | Media | SBI Life Insurance Company | SBILIFE | 25 September 2020 | [30] |

| Bharti Infratel | INFRATEL | Telecommunication | Divi's Laboratories | DIVISLAB | ||

| GAIL | GAIL | Energy - Oil & Gas | Tata Consumer Products | TATACONSUM | 31 March 2021 | [37] |

| Indian Oil Corp | IOC | Energy - Oil & Gas | Apollo Hospitals | APOLLOHOSP | 31 March 2022 | [38] |

| Shree Cement | SHREECEM | Cement | Adani Enterprises | ADANIENT | 30 September 2022 | [39] |

| HDFC | HDFC | Financial Services | LTIMindtree | LTIM | 13 July 2023 | [40] |

Major single day falls

Following are some of the notable single-day falls of the NIFTY 50 Index.

| Sl. No. | Date | Fall | Probable Reason |

|---|---|---|---|

| 1 | 28 October 1997 | 88.20 points (7.87%) | Investors deserted emerging Asian shares during the Asian Financial Crisis. Crashes also occurred in Thailand, Indonesia, South Korea and Philippines. |

| 2 | 14 May 2004 | 135.10 points (7.87%) | UPA election. |

| 3 | 17 May 2004 | 193.5 points (12.24%) | UPA election. |

| 4 | 21 January 2008 | 496.50 points (8.70%) | Due to the US subprime mortgage crisis. |

| 5 | 22 January 2008 | 309.50 points (5.94%) | Due to the US subprime mortgage crisis. |

| 6 | 16 August 2013 | 234.45 points (4.08%) | Due to depreciation of the Indian rupee.[41][42] |

| 7 | 24 August 2015 | 490.95 points (5.92%) | Driven by the meltdown in the Chinese Stock market.[43] |

| 8 | 24 June 2016 | 181.85 points (2.20%) | Driven by the Brexit Referendum.[44] |

| 9 | 11 November 2016 | 229.45 points (2.69%) | Driven by the Demonetization move by the Indian Government and the 2016 US Election Results.[45] |

| 10 | 2 February 2018 | 256.30 points (2.33%) | Driven by the 2018 Union budget of India and Global breakdown. |

| 11 | 4 October 2018 | 303.20 points (2.39%) | Panic Fall, due to Oil price Increase and rupee fall against US Dollar. |

| 12 | 5 October 2018 | 282.80 points (2.67%) | Panic Fall, due to Oil price Increase and rupee fall against US Dollar. |

| 13 | 8 July 2019 | 252.55 points (2.14%) | Due to Union Budget FY 2019. |

| 15 | 3 September 2019 | 225.35 points (2.04%) | Due to Multiple PSU Bank Merger Announcements.[46][47] |

| 16 | 1 February 2020 | 373.95 points (3.11%) | Driven by the Union Budget FY 2020 and coronavirus pandemic which saw global breakdown a day before the budget.[48] |

| 17 | 9 March 2020 | 538.00 points (4.90%) | Driven by the COVID-19 pandemic.[49][50] |

| 18 | 12 March 2020 | 868.25 points (8.30%) | Driven by the COVID-19 pandemic after WHO declared it a pandemic.[51] |

| 19 | 16 March 2020 | 757.80 points (7.61%) | Driven by the COVID-19 pandemic.[52] |

| 20 | 23 March 2020 | 1135.20 points (12.98%) | Driven by the COVID-19 pandemic.[53] |

| 21 | 11 June 2020 | 214.15 points (2.12%) | Driven by the weak economic outlook as predicted by the United States Federal Reserve.[54][55] |

| 22 | 26 Feb 2021 | 568.20 points (3.76%) | Global breakdown. |

| 23 | 12 Apr 2021 | 524.05 points (3.53%) | Rise in daily COVID cases, speculation of complete lockdown in the Maharashtra state. |

| 24 | 26 Nov 2021 | 509.80 points (2.91%) | New coronavirus strain found in South Africa. |

| 25 | 20 Dec 2021 | 371.00 points (2.18%) | |

| 26 | 24 Jan 2022 | 468.05 points (2.66%) | Increasing geopolitical tensions and rising inflation (investors lost 19.33 lakh crore in market in a week). |

| 27 | 14 Feb 2022 | 531.95 points (3.06%) | Russia-Ukraine tensions, US fed aggressive statements on rate hike and ABG shipyard fraud case.[56] |

Major single day gains

Following are some of the notable single-day gains of the NIFTY 50 Index.

| Sl. No. | Date | High | Probable reason |

|---|---|---|---|

| 1 | 18 May 2009 | 651.50 points (17.74%) | Ovewhelmingly upbeat results of the 2009 Indian general election; caused multiple trading curbs. |

| 2 | 20 May 2019 | 421.10 points (3.69%) | Exit Polls of 2019 General elections. |

| 3 | 23 May 2019 | 300.90 points (2.49%) | Results of the 2019 General Elections in which NDA alliance wins. |

| 4 | 8 August 2019 | 176.95 points (1.63%) | FPI surcharge rollback.[57] |

| 5 | 26 August 2019 | 234.45 points (2.16%) | Relief measures, likely US-China trade talks begin.[58] |

| 6 | 20 September 2019 | 655.45 points (6.12%) | Indian FM announced a cut in the corporate tax rate for domestic companies and new domestic manufacturing companies.[59] |

| 7 | 23 September 2019 | 420.65 points (3.73%) | Following a corporate tax cut in India. |

| 8 | 7 April 2020 | 708.40 points (8.76%) | Positive news that infection numbers were peaking in some of the worst affected areas around the world.[60] |

| 9 | 1 Feb 2021 | 646.60 points (4.74%) | Union budget day by Nirmala Sitharaman. |

| 10 | 2 Feb 2021 | 366.65 (2.57%) | Union budget reaction. |

| 11 | 15 Feb 2022 | 509.65 points (3.03%) | Russia withdraws troops from Ukraine border.[61] |

Annual returns

The following table shows the annual development of the NIFTY 50 since 2000.[62] The historical daily returns data can be accessed from the NSE website.[63]

| Year | Closing level | Change in Index in Points |

Change in Index in % |

|---|---|---|---|

| 2000 | 1,263.55 | −216.90 | −14.65 |

| 2001 | 1,059.05 | −204.50 | −13.94 |

| 2002 | 1,093.50 | 34.45 | 3.25 |

| 2003 | 1,879.75 | 786.25 | 71.90 |

| 2004 | 2,080.50 | 200.75 | 10.68 |

| 2005 | 2,836.55 | 756.05 | 36.34 |

| 2006 | 3,966.40 | 1,129.85 | 39.83 |

| 2007 | 6,138.60 | 2,172.20 | 54.77 |

| 2008 | 2,959.15 | −3,179.45 | −51.79 |

| 2009 | 5,201.05 | 2,241.90 | 75.76 |

| 2010 | 6,134.50 | 933.45 | 17.95 |

| 2011 | 4,624.30 | −1,510.20 | −24.62 |

| 2012 | 5,905.10 | 1,280.80 | 27.70 |

| 2013 | 6,304.00 | 398.90 | 6.76 |

| 2014 | 8,282.70 | 1,978.70 | 31.39 |

| 2015 | 7,964.35 | −318.35 | −3.84 |

| 2016 | 8,185.80 | 239.45 | 3.01 |

| 2017 | 10,530.70 | 2,344.90 | 28.65 |

| 2018 | 10,862.55 | 331.85 | 3.15 |

| 2019 | 12,168.45 | 1,305.90 | 12.02 |

| 2020 | 13,981.75 | 1,813.30 | 14.90 |

| 2021 | 17,354.05 | 3,372.30 | 24.12 |

| 2022 | 18,105.30 | 751.25 | 4.32 |

Derivatives

Trading in futures and options on the NIFTY 50 is offered by the NSE and SGX.[64][7] NSE offers weekly as well as monthly expiry options. It is the second most traded index option in the world after nifty bank [65]

NIFTY Next 50

NIFTY Next 50, also called NIFTY Junior, is an index of 50 companies whose free float market capitalisation comes after that of the companies in NIFTY 50. NIFTY Next 50 constituents are thus potential candidates for future inclusion in NIFTY 50.[66]

References

- "NSE Indices" (PDF). NSE India. Retrieved 4 March 2023.

- "Broadmarket indices - NIFTY 50 Index". nseindia.com. NSE - National stock exchange (official website). Retrieved 4 March 2023.

- "Corporate structure". Nseindia.com.

- "About NSE Indices". Nseindia.com.

- "Nse official website". Retrieved 6 January 2021.

- "NSE Equity Derivatives Contract Specifications". National Stock Exchange of India. Retrieved 16 August 2019.

- "SGX Derivatives Products Nifty Indices Futures and Options Product Information". Singapore Exchange Ltd. Retrieved 16 August 2019.

- Serah Sudhin (September 2017). "The Journey of Nifty-Fifty" (PDF). International Journal of Academic Research and Development. 2 (5): 4. Retrieved 6 January 2021.

- "NSE - PR" (PDF). Nseindia.com. Archived from the original (PDF) on 10 October 2018.

- "NIFTY 50 loses importance to sectoral indices" (PDF).

- "Nifty 50" (PDF). NSE India. Retrieved 15 February 2023.

- "Sectoral weightage of CNX Nifty 50 Index" (PDF). Archived from the original (PDF) on 23 January 2014. Retrieved 14 September 2013.

- "CNX Nifty Index Methodology" (PDF). Nsdeindia.com. Retrieved 2 March 2022.

- "NSE - National Stock Exchange of India Ltd". Nseindia.com.

- "NIFTY 50 (^NSEI) Historical Data - Yahoo Finance". finance.yahoo.com. Retrieved 19 July 2023.

- "Equity Stock Watch". 1.nseindia.com. Retrieved 2 March 2022.

- "Nifty-50 to include Sesa Goa, Bajaj Auto, Dr Reddy's from Oct 1". Business Standard India. 30 September 2010. Retrieved 21 December 2021.

- "Grasim replaces Suzlon in Nifty". @businessline. Retrieved 21 December 2021.

- "Coal India to replace Reliance Capital stock in Nifty 50 from Oct 10". The Economic Times. Retrieved 21 December 2021.

- "RCom, RPower to go out of Nifty-50 from April 27". @businessline. Retrieved 21 December 2021.

- "SAIL, Sterlite make way for UltraTech, Lupin on Nifty". Hindustan Times. 27 September 2012. Retrieved 21 December 2021.

- "DLF, JSPL shares fall on exit from Nifty from March 27". The Economic Times. Retrieved 20 December 2021.

- "Wipro to enter Nifty from September 27; Reliance Infrastructure to exit". The Economic Times. Retrieved 21 December 2021.

- "Ranbaxy, JP Associates to exit Nifty from Mar 28". Business Standard India. 27 February 2014. Retrieved 21 December 2021.

- "Zee Entertainment to Replace United Spirits in Nifty From September 19". NDTV.com. Retrieved 20 December 2021.

- "Adani Ports to replace NMDC on Nifty from September 28". The Economic Times. Retrieved 20 December 2021.

- "NSE exchange to add 4 companies, drop Cairn India, Vedanta, PNB from index". The Economic Times. Retrieved 20 December 2021.

- "IOC, IBHFL to replace Idea, BHEL in NSE Nifty50 from March 31". Business Standard India. 16 February 2017. Retrieved 20 December 2021.

- "Grasim out, Vedanta in Nifty 50 index". @businessline. Retrieved 21 December 2021.

- "Divi's Labs And SBI Life Enter Nifty 50, Zee And Bharti Infratel Out". BloombergQuint. Retrieved 15 September 2020.

- "Nifty Rejig: Ambuja, Aurobindo & Bosch Out; Grasim, Titan & Bajaj Finserv Included". Moneycontrol. Retrieved 20 December 2021.

- Burugula, Pavan (29 August 2018). "JSW Steel to replace pharma firm Lupin in Nifty 50 from September 28". Business Standard India. Retrieved 20 December 2021.

- "Britannia to replace Hindustan Petroleum in Nifty 50 from 29 March". Livemint. 25 February 2019.

- Staff Writer (28 August 2019). "Nestle India to be included in NSE Nifty 50 Index". Livemint.

- "Yes Bank to be excluded from Nifty 50, Nifty bank from Thursday". Livemint.com. 16 March 2020. Retrieved 20 December 2021.

- "HDFC Life replaces Vedanta in Nifty; SBI Card enters 5 indices". The Economic Times. Retrieved 2 March 2022.

- "Tata Consumer Products To Replace GAIL In Nifty 50 From March 31". BloombergQuint. Retrieved 18 June 2021.

- "Apollo Hospitals To Replace Indian Oil In Nifty 50 From March 31". BloombergQuint. Retrieved 17 March 2022.

- "Adani Enterprises to be included in Nifty 50, replaces Shree Cement". Business Today. 1 September 2022. Retrieved 28 October 2022.

- "NSE to replace HDFC with LTIMindtree in Nifty 50 index". The Times of India. 4 July 2023. Retrieved 16 September 2023.

- "News18.com: CNN-News18 Breaking News India, Latest News, Current News Headlines". News18. Archived from the original on 20 August 2013. Retrieved 21 December 2017.

- "Sensex, Nifty reel as Brexit spooks world markets". Business Line. 24 June 2016. Retrieved 9 July 2019.

- "Global mayhem: Sensex crashes 1624 pts; Nifty breaches 7900". Moneycontrol. Retrieved 21 December 2017.

- "Sensex, Nifty reel as Brexit spooks world markets". Thehindubusinessline.com. 24 June 2016. Retrieved 21 December 2017.

- Nathan, Narendra (14 November 2016). "How demonetisation and Donald Trump's victory impact your investments". The Economic Times. Retrieved 21 December 2017.

- "Market Wrap, Sep 03: Sensex nosedives 770 pts, Nifty settles below 10,800". Business Standard India. 3 September 2019. Retrieved 6 October 2020.

- "Nifty 50 (^NSEI) historical data – Yahoo Finance". in.finance.yahoo.com. Retrieved 6 October 2020.

- "Stock market at odds with Union Budget 2020; SENSEX slips over 1,000 pts, NIFTY at 11,643". DNA India. 1 February 2020. Retrieved 1 February 2020.

- Sharma, Devansh (9 March 2020). "Pandemonium in markets, Sensex cracks over 1900 points; Yes Bank jumps 31%". Livemint.com. Retrieved 6 October 2020.

- "Market Wrap, March 9: Sensex dips 1942 pts, Nifty at 10,451". Business Standard India. 9 March 2020. Retrieved 6 October 2020.

- "Sensex, Nifty suffer biggest one-day fall amid global sell off". Thehindubusinessline.com. 12 March 2020. Retrieved 6 October 2020.

- "Market Wrap, March 16: Sensex tanks 2,713 pts, Nifty ends at 9,199". Business Standard India. 16 March 2020. Retrieved 6 October 2020.

- Guha, Ishita (23 March 2020). "Key indices suffer massive sell-off; Sensex ends down nearly 4,000 points". Livemint.com. Retrieved 6 October 2020.

- "Fed to keep buying bonds, foresees no rate hike through 2022". The Economic Times. 11 June 2020. Retrieved 11 June 2020.

- "Sensex tanks 709 points; Nifty closes below 10,000". Zee News. 11 June 2020. Retrieved 11 June 2020.

- "'Even market is red on Valentine's Day': #Stockmarketcrash triggers meme fest". BusinessToday. 14 February 2022. Retrieved 2 March 2022.

- "Closing Bell: Nifty ends above 11K, Sensex up 636 pts on possible roll-back of higher tax on FPIs". Moneycontrol.

- "Closing bell: Sensex climbs 793 pts on relief measures, likely US-China trade talks". Moneycontrol.

- "Nirmala Sitharaman press conference highlights: Corporate tax relief to help stabilise economy, says Tech Mahindra's Gurnani". Moneycontrol.

- Shah, Ami (7 April 2020). "Sensex, Nifty post biggest single-day gain; Rs 7.9 lakh crore added". The Economic Times. Retrieved 10 June 2020.

- "Russia confirms 'partial' withdrawal of troops from Ukraine border | Russia". The Guardian. 15 February 2022. Retrieved 2 March 2022.

- "S&P/CNX Nifty Index (India) Yearly Stock Returns". 1stock1.com. Retrieved 20 January 2020.

- "NSE - Historical Index Data". Nseindia.com.

- "National Stock Exchange of India Ltd". NSE. 1 April 2013. Retrieved 28 June 2020.

- {{| url=https://www.world-exchanges.org/storage/app/media/2021%20Annual%20Derivatives%20Report.pdf%7C}}

- "Archived copy" (PDF). Archived from the original (PDF) on 30 June 2020. Retrieved 28 June 2020.

{{cite web}}: CS1 maint: archived copy as title (link)