Petrodollar recycling

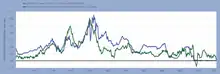

Petrodollar recycling is the international spending or investment of a country's revenues from petroleum exports ("petrodollars").[3] It generally refers to the phenomenon of major petroleum-exporting states, mainly the OPEC members plus Russia and Norway, earning more money from the export of crude oil than they could efficiently invest in their own economies.[4] The resulting global interdependencies and financial flows, from oil producers back to oil consumers, can reach a scale of hundreds of billions of US dollars per year – including a wide range of transactions in a variety of currencies, some pegged to the US dollar and some not. These flows are heavily influenced by government-level decisions regarding international investment and aid, with important consequences for both global finance and petroleum politics.[5] The phenomenon is most pronounced during periods when the price of oil is historically high.[6]

The term petrodollar was coined in the early 1970s during the oil crisis, and the first major petrodollar surge (1974–1981) resulted in more financial complications than the second (2005–2014).[7]

Capital flows

Background

Especially during the years 1974–1981 and 2005–2014, oil exporters amassed large surpluses of "petrodollars" from historically expensive oil.[1][2][8] (The word has been credited alternately to Egyptian-American economist Ibrahim Oweiss and to former US Secretary of Commerce Peter G. Peterson, both in 1973.)[9][10][11] These petrodollar surpluses could be described as net US dollar-equivalents earned from the export of petroleum, in excess of the internal development needs of the exporting countries.[12] The surpluses could not be efficiently invested in their own economies, due to small populations or being at early stages of industrialization; but the surpluses could be usefully invested in other locations, or spent on imports such as consumer products, construction supplies, and military equipment. Alternatively, global economic growth would have suffered if that money was withdrawn from the world economy, while the oil-exporting states needed to be able to invest profitably to raise their long-term standards of living.[13]

1974–1981 surge

While petrodollar recycling reduced the short-term recessionary impact of the 1973 oil crisis, it caused problems especially for oil-importing countries that were paying much higher prices for oil, and incurring long-term debts. The International Monetary Fund (IMF) estimated that the foreign debts of 100 oil-importing developing countries increased by 150% between 1973 and 1977, complicated further by a worldwide shift to floating exchange rates. Johan Witteveen, the Managing Director of the IMF, said in 1974: "The international monetary system is facing its most difficult period since the 1930s."[14] The IMF administered a new lending program during 1974–1976 called the Oil Facility. Funded by oil-exporting states and other lenders, it was available to governments suffering from acute problems with their balance of trade due to the rise in oil prices, notably including Italy and the United Kingdom as well as dozens of developing countries.[15]

From 1974 through 1981, the total current account surplus for all members of OPEC amounted to US$450 billion, without scaling-up for the subsequent decades of inflation. Ninety percent of this surplus was accumulated by the Arab countries of the Persian Gulf and Libya, with Iran also accumulating significant oil surpluses through 1978 before suffering the hardships of revolution, war and sanctions.[12]

Large volumes of Arab petrodollars were invested directly in US Treasury securities and in other financial markets of the major industrial economies, often directed discreetly by government entities now known as sovereign wealth funds.[16][17] Many billions of petrodollars were also invested through the major commercial banks of the United States, European Union, Switzerland, and the United Kingdom. In fact, the process contributed to the growth of the Eurodollar market as a less-regulated rival to US monetary markets. As the recessionary condition of the world economy made investment in corporations less attractive, bankers and well-financed governments lent much of the money directly to the governments of developing countries, especially in Latin America such as Brazil and Argentina[12] as well as other major developing countries like Turkey. The 1973 oil crisis had created a vast dollar shortage in these countries; however, they still needed to finance their imports of oil and machinery. In early 1977, when Turkey stopped heating its prime minister's office, opposition leader Suleyman Demirel famously described the shortage as: "Turkey is in need of 70 cents."[18] As political journalist William Greider summarized the situation: "Banks collected the deposits of revenue-rich OPEC governments and lent the money to developing countries so they could avoid bankruptcy."[19] In subsequent decades, many of these developing states found their accumulated debts to be unpayably large, concluding that it was a form of neocolonialism from which debt relief was the only escape.[20]

2005–2014 surge

In the 2005–2014 petrodollar surge, financial decision-makers were able to benefit somewhat from the lessons and experiences of the previous cycle. Developing economies generally stayed better balanced than they did in the 1970s; the world economy was less oil-intensive; and global inflation and interest rates were much better contained. Oil exporters opted to make most of their investments directly into a diverse array of global markets, and the recycling process was less dependent on intermediary channels such as international banks and the IMF.[22][23][24]

Thanks to the historic oil price increases of 2003–2008, OPEC revenues approximated an unprecedented US$1 trillion per year in 2008 and 2011–2014.[2] Beyond the OPEC countries, substantial surpluses also accrued to Russia and Norway,[8] and sovereign wealth funds worldwide amassed US$7 trillion by 2014–2015.[25] Some oil exporters were unable to reap the full benefits, as the national economies of Iran, Iraq, Libya, Nigeria and Venezuela all suffered from multi-year political obstacles associated with what economists call the "resource curse".[26][27] Most of the other large exporters accumulated enough financial reserves to cushion the shock when oil prices and petrodollar surpluses fell sharply again from an oil supply glut in 2014–2017.[28]

Foreign aid

Oil-exporting countries have used part of their petrodollar surpluses to fund foreign aid programs, as a prominent example of so-called "checkbook diplomacy" or "petro-Islam". The Kuwait Fund was an early leader since 1961, and certain Arab states became some of the largest donors in the years since 1974, including through the IMF and the OPEC Fund for International Development.[12][29][30] Oil exporters have also aided poorer countries indirectly through the personal remittances sent home by tens of millions of foreign workers in the Middle East,[31] although their working conditions are generally harsh.[32] Even more controversially, several oil exporters have been major financial supporters of armed groups challenging the governments of other countries.[33][34][35][36]

High-priced oil allowed the USSR to support the struggling economies of the Soviet-led bloc during the 1974–1981 petrodollar surge, and the loss of income during the 1980s oil glut contributed to the bloc's collapse in 1989.[37] During the 2005–2014 petrodollar surge, OPEC member Venezuela played a similar role supporting Cuba and other regional allies,[38] before the 2014–2017 oil downturn brought Venezuela to its own economic crisis.[39]

Petrodollar warfare

The term petrodollar warfare refers to a theory that depicts the international use of the United States dollar as the standard means of settling oil transactions as a kind of economic imperialism enforced by violent military interventions against countries like Iraq, Iran, and Venezuela, and a key hidden driver of world politics. The term was coined by William R. Clark, who has written a book with the same title.[40] The phrase oil currency war is sometimes used with the same meaning.

According to critics, the use of dollars in international oil transactions increases overall U.S. dollar demand by only a tiny fraction, and the dollar's overall status as the major international reserve currency has relatively limited tangible benefit to the United States economy as well as some drawbacks.[41][42]

Gallery of notable examples

These images illustrate the diversity of major petrodollar recycling activities, in roughly chronological order:

.jpg.webp) US Treasury securities, approximately $300 billion accumulated by OPEC governments during 1960–2015[43]

US Treasury securities, approximately $300 billion accumulated by OPEC governments during 1960–2015[43].jpg.webp)

Itaipu Dam between Brazil and Paraguay, financed by loans from petrodollar bank deposits in the 1970s[46]

Itaipu Dam between Brazil and Paraguay, financed by loans from petrodollar bank deposits in the 1970s[46]

.jpg.webp) Western grain, heavily imported by the Soviet Union to ease food shortages in the 1970s and 1980s[48]

Western grain, heavily imported by the Soviet Union to ease food shortages in the 1970s and 1980s[48]

London's Chelsea Football Club, Russian-owned between 2003 and 2022 through the Sibneft oil fortune[52][53][54]

London's Chelsea Football Club, Russian-owned between 2003 and 2022 through the Sibneft oil fortune[52][53][54] "Oil for doctors" program, with thousands of Cuban physicians anchoring the Venezuelan health system from 2004[55]

"Oil for doctors" program, with thousands of Cuban physicians anchoring the Venezuelan health system from 2004[55] Bottles of premium French wine, millions of which were purchased by Dubai-owned Emirates airline since 2005[56]

Bottles of premium French wine, millions of which were purchased by Dubai-owned Emirates airline since 2005[56] Turkish Telecom Corp., whose control was privatized to the Saudi Oger organization in 2005 with IMF support[57]

Turkish Telecom Corp., whose control was privatized to the Saudi Oger organization in 2005 with IMF support[57]

Cézanne painting, purchased in 2011 by the Royal Family of Qatar for a record-setting price above US$250 million[62]

Cézanne painting, purchased in 2011 by the Royal Family of Qatar for a record-setting price above US$250 million[62]_3.jpg.webp)

References

- "OPEC Revenues Fact Sheet". U.S. Energy Information Administration. January 10, 2006. Archived from the original on January 7, 2008.

{{cite web}}: CS1 maint: unfit URL (link) - "OPEC Revenues Fact Sheet". U.S. Energy Information Administration. May 15, 2017. Retrieved May 28, 2017.

- Myers, Amy; Elass, Jareer (January 2016). "War and the Oil Price Cycle". Journal of International Affairs. Retrieved April 10, 2019.

- Hertzberg, Hendrik (May 2, 2004). "In the soup - Bob Woodward's plan of attack". New Yorker. Retrieved April 10, 2019.

- Coll, Steve (August 10, 2014). "Oil and erbil". New Yorker. Retrieved April 10, 2019.

- Nsouli, Saleh M. (March 23, 2006). "Petrodollar Recycling and Global Imbalances". International Monetary Fund. Retrieved January 14, 2017.

- Kinzer, Stephen (2008). All the Shah's Men: An American Coup and the Roots of Middle East Terror. Wiley. ISBN 978-0470185490.

- "Petrodollar Profusion". The Economist. April 28, 2012. Retrieved February 7, 2016.

- "Personality: Ibrahim M. Oweiss". Washington Report on Middle East Affairs. December 26, 1983. p. 8. Retrieved January 11, 2017.

In March 1973... Two weeks after Dr. Oweiss had used the word – at an international monetary seminar held at Columbia University's Arden House in Harriman, New York – it was picked up by a prestigious economics commentator in The New York Times.

According to the Oweiss and NYT websites, it appears that these events actually occurred in March 1974. - Rowen, Hobart (July 9, 1973). "Peterson Urges Cooperation". The Washington Post. p. A1. Retrieved February 5, 2016.

He thinks the U.S. should give more study to ways in which the excess funds – he calls them petro dollars – can be soaked up.

- Popik, Barry (February 1, 2012). "Petrodollar". Retrieved January 11, 2017.

Georgetown University economics professor Ibrahim Oweiss has written about petrodollars and is credited with the word's coinage by Wikipedia, but there is insufficient documentary evidence that he used the term first in 1973. Former commerce secretary Peter G. Peterson was credited with using 'petrodollar' in a July 1973 Washington Post article.

- Oweiss, Ibrahim M. (1990). "Economics of Petrodollars". In Esfandiari, Haleh; Udovitch, A.L. (eds.). The Economic Dimensions of Middle Eastern History. Darwin Press. pp. 179–199. Retrieved January 31, 2016.

- "Petrodollar Problem". International Monetary Fund. Retrieved January 31, 2016.

- "Recycling Petrodollars". International Monetary Fund. Retrieved January 31, 2016.

- Neu, Carl Richard (August 1977). "International Balance of Payments Financing and the Budget Process". U.S. Congressional Budget Office. pp. 27–29. Retrieved February 5, 2016.

- Spiro, David E. (1999). The Hidden Hand of American Hegemony: Petrodollar Recycling and International Markets. Ithaca: Cornell University Press. pp. 74–75. ISBN 0-8014-2884-X. Retrieved February 8, 2016.

- Wong, Andrea (May 30, 2016). "The Untold Story Behind Saudi Arabia's 41-Year U.S. Debt Secret". Bloomberg News. Retrieved May 31, 2016.

- Özel, Işık (2014). State–Business Alliances and Economic Development: Turkey, Mexico and North Africa. Routledge. p. 34. ISBN 978-1-317-81782-6. Retrieved January 31, 2016.

- Greider, William (1987). Secrets of the Temple. Simon & Schuster. p. 340. ISBN 978-0-671-47989-3. Retrieved January 31, 2016.

- Carrasco, Enrique; McClellan, Charles; Ro, Jane (April 2007). "Foreign Debt: Forgiveness and Repudiation". The E-Book on International Finance & Development. University of Iowa. Archived from the original on June 6, 2011. Retrieved June 6, 2011.

{{cite book}}: CS1 maint: bot: original URL status unknown (link) - "Federal Reserve Economic Data graph". Federal Reserve Bank of St. Louis. Retrieved August 25, 2016.

- Lubin, David (March 19, 2007). "Petrodollars, emerging markets and vulnerability" (PDF). Citigroup. Retrieved January 31, 2016.

- "Recycling the Petrodollars". The Economist. November 10, 2005. Retrieved February 14, 2016.

- Oxford Analytica (August 11, 2008). "World Economy Less Vulnerable To Petrodollars". Forbes. Retrieved January 13, 2017.

- Bianchi, Stefania (February 22, 2016). "Sovereign Wealth Funds May Sell $404 Billion of Equities". Bloomberg News. Retrieved February 22, 2016.

- "The Resource Curse" (PDF). Natural Resource Governance Institute. March 2015. Retrieved January 22, 2017.

- Aguilera, Roberto F.; Radetzki, Marian (2015). The Price of Oil. Cambridge University Press. pp. 87–89. ISBN 978-1-31643242-6. Retrieved January 22, 2017.

- Blas, Javier (April 13, 2015). "Oil-Rich Nations Are Selling Off Their Petrodollar Assets at Record Pace". Bloomberg News. Retrieved February 14, 2016.

- "Timeline". Kuwait Fund. Retrieved January 22, 2017.

- Hubbard, Ben (June 21, 2015). "Cables Released by WikiLeaks Reveal Saudis' Checkbook Diplomacy". The New York Times. Retrieved February 16, 2016.

- Mukherjee, Andy (February 4, 2016). "Oil's Plunge Spills Over". Bloomberg News. Retrieved February 4, 2016.

- Davis, Mike (September–October 2006). "Fear and Money in Dubai". New Left Review (41). Retrieved February 12, 2016.

Dubai is capitalized just as much on cheap labour as it is on expensive oil, and the Maktoums, like their cousins in the other emirates, are exquisitely aware that they reign over a kingdom built on the backs of a South Asian workforce.

- "Iranian General: Tehran Arming 'Liberation Armies'". Associated Press. October 27, 2008. Retrieved March 29, 2017.

- Weinberg, Leonard; Martin, Susanne (2016). The Role of Terrorism in 21st-Century Warfare. Oxford University Press. "Libya", pp. 207–208. ISBN 978-1-78499764-9. Retrieved March 29, 2017.

- Cockburn, Patrick (October 14, 2016). "US allies Saudi Arabia and Qatar are funding ISIS". The Independent. Archived from the original on May 26, 2022. Retrieved March 29, 2017.

- Pacepa, Ion Mihai (August 24, 2006). "Russian Footprints". National Review. Archived from the original on January 9, 2015.

- McMaken, Ryan (November 7, 2014). "The Economics Behind the Fall of the Berlin Wall". Mises Institute. Retrieved January 12, 2016.

High oil prices in the 1970s propped up the regime so well, that had it not been for Soviet oil sales, it's quite possible the regime would have collapsed a decade earlier.

- Gibbs, Stephen (August 24, 2005). "Venezuela ends upbeat Cuba visit". BBC. Retrieved November 28, 2016.

- Polanco, Anggy (July 17, 2016). "Venezuelan shoppers flock across border to Colombia". Reuters. Retrieved December 31, 2016.

- Clark, William R. (2005). Petrodollar Warfare. Canada: New Society Publishers. p. 20. ISBN 978-0-86571-514-1.

- Baker, Dean (October 7, 2009). "Debunking the Dumping-the-Dollar Conspiracy". Foreign Policy Magazine.

- Ben Bernanke (January 7, 2016). "The dollar's international role: An "exorbitant privilege"?". Brookings Institution.

- "Major Foreign Holders of Treasury Securities". U.S. Department of the Treasury. December 15, 2015. Archived from the original on January 3, 2016.

{{cite web}}: CS1 maint: unfit URL (link) - Taylor, Edward (September 18, 2014). "Kuwait Investment Authority says to expand Germany investments". Reuters. Retrieved January 17, 2017.

The KIA... is the largest shareholder in Daimler.

- Al Saleh, Anas K. (September 18, 2014). "KIA/Daimler 40th Anniversary Celebrations" (PDF). Kuwait Investment Authority. Archived from the original (PDF) on January 18, 2017. Retrieved January 17, 2017.

From a 14.6% stake of around US$329 million acquisition in December 1974, the KIA is now the largest consistent shareholder in Daimler over 40 years where our 6.9% stake is currently valued around $7 billion.

- Castor, Belmiro V.J. [in Portuguese] (2003). Brazil Is Not for Amateurs (English, 2nd ed.). Xlibris. p. 202. ISBN 978-1-46910432-4. Retrieved January 18, 2017.

International bankers... began to invest huge amounts of those petro-dollars in Brazil and other developing countries..., allowing them to finance gigantic infrastructure works like the Itaipu Hydroelectric Plant.

- "Shah Faisal Mosque". Lonely Planet. Retrieved March 29, 2017.

Most of its cost (pegged at about US$120 million today) was a gift from King Faisal of Saudi Arabia.

- Zubok, Vyadislav M. (2010). "Soviet foreign policy from détente to Gorbachev, 1975–1985". In Leffler, Melvyn P.; Westad, Odd Arne (eds.). The Cambridge History of the Cold War: Volume III, Endings. Cambridge University Press. pp. 109–110. ISBN 978-1-31602563-5. Retrieved January 18, 2017.

The former head of the Soviet planning agency, Nikolai Baibakov, recalled that 'what we got for oil and gas' was $15 billion in 1976–80 and $35 billion in 1981–85. Of this money, the Soviets spent, respectively, $14 billion and $26.3 billion to buy grain, both to feed the cattle on collective farms and to put bread on the tables of Soviet citizens.

- Mohr, Charles (August 22, 1981). "Saudi AWACS Deal Passes $8 Billion". The New York Times. Retrieved November 5, 2016.

The price of the arms sale gives increased weight to an argument that in part it should be approved because it helps to 'recycle petrodollars'.

- Feder, Barnaby J. (September 8, 1985). "Harrod's New Owner: Mohamed al-Fayed; A Quiet Acquisitor Is Caught in a Cross Fire". The New York Times. Retrieved January 16, 2017.

This was a dream come true for the family, which built its fortune... first in the oil-rich countries of the Persian Gulf.

- "Mohammed Fayed sells Harrods store to Qatar Holdings". BBC. May 8, 2010. Retrieved February 7, 2016.

- "Russian businessman buys Chelsea". BBC. July 2, 2003. Retrieved March 23, 2016.

- Critchley, Mark (April 12, 2015). "Roman Abramovich reaches 700 games as Chelsea owner – but how does his reign stack up against the rest?". The Independent. Archived from the original on May 26, 2022. Retrieved August 1, 2016.

Since the Russian oligarch began pouring petro-dollars into Stamford Bridge, he has turned one of English football's underachieving clubs into an established powerhouse.

- Delaney, Miguel (February 2, 2014). "The colossal wealth of Manchester City and Chelsea is changing the landscape of British football". The Sunday Mirror. Retrieved August 1, 2016.

It should not escape notice that this is the first true title showdown, and first genuine title race, between the petrodollar clubs.

- Corrales, Javier (December 2005). "The Logic of Extremism: How Chávez Gains by Giving Cuba So Much" (PDF). Inter-American Dialogue. Archived from the original (PDF) on November 29, 2016. Retrieved November 29, 2016.

In return for oil, Cuba is sending Venezuela between 30,000 and 50,000 technical staff. As many as 30,000 Cubans in Venezuela are presumably medical doctors.

- Gaddy, James (January 5, 2017). "Emirates Has Invested $500 Million to Build a 'Fort Knox' of Wine". Bloomberg News. Retrieved January 5, 2017.

Since the Dubai-based airline began its wine program 12 years ago, it has spent more than $500 million to develop the best wine list in the sky... 'It's an investment. We look at it like a commodity.'

- Aydogdu, Hatice (November 15, 2005). "Oger Telecom signs $6.55 bln Turk Telekom deal". Reuters. Archived from the original on February 2, 2017. Retrieved January 30, 2017.

'... a long-term investment, not only in the future of Turk Telekom but also in Turkey,' Hariri said. The sale of Turk Telekom's controlling stake is a key element of Turkey's IMF-backed privatization program.

- Thomas, Landon Jr. (July 9, 2008). "Abu Dhabi buys 75% of Chrysler Building in latest trophy purchase". The New York Times. Retrieved December 29, 2016.

These funds, which maintain passive investment positions, will perform a crucial petrodollar-recycling function.

- Bagli, Charles V. (July 10, 2008). "Abu Dhabi Buys 90% Stake in Chrysler Building". The New York Times. Retrieved July 3, 2016.

- Lynch, Colum (December 11, 2009). "U.N. panel voices concern over Iran's apparent violations of arms-export embargo". The Washington Post. Retrieved March 29, 2017.

A U.N. sanctions committee expressed 'grave concern' Thursday about what it called apparent Iranian violations of a U.N. ban on arms exports.

- Harel, Amos; Stern, Yoav (August 4, 2006). "Iranian Official Admits Tehran Supplied Missiles to Hezbollah". Haaretz. Retrieved March 29, 2017.

Mohtashami Pur, a one-time ambassador to Lebanon who currently holds the title of secretary-general of the 'Intifada conference', told an Iranian newspaper that Iran transferred the missiles to the Shi'ite militia.

- Peers, Alexandra (February 2012). "Qatar Purchases Cézanne's The Card Players for More Than $250 Million, Highest Price Ever for a Work of Art". Vanity Fair. Retrieved February 19, 2016.

The money is there: the United Arab Emirates region is home to nearly 10 percent of all the world's oil reserve.

- Business Monitor International (March 2016). "Q2 2016". Kuwait Autos Report. Archived from the original on January 16, 2017. Retrieved January 13, 2017.

In 2015, Japanese carmaker Toyota retained its long-held local market leadership..., over three times its nearest rival Nissan.

{{cite journal}}:|author=has generic name (help)

Further reading

- Clark, William R. (2005). Petrodollar Warfare. New Society Publishers. ISBN 978-0-86571-514-1.

- Smolyar, Leonid (2006). Petrodollars: Tracking the Flow and Investment of Oil Windfalls (PDF) (B.Sc. Honors thesis). New York University. Archived from the original (PDF) on April 25, 2012.

- Staats, Elmer B. (1979). "The U.S.–Saudi Arabian Joint Commission on Economic Cooperation". U.S. Government Accountability Office. Retrieved January 31, 2016.