People's Bank of China

The People's Bank of China (officially PBC[3] or informally PBOC;[4] Chinese: 中国人民银行) is the central bank of the People's Republic of China, responsible for carrying out monetary policy and regulation of financial institutions in China,[note 1] as determined by the People's Bank Law and the Commercial Bank Law. It is the 25th-ranked cabinet-level executive department of the State Council.

Beijing Headquarters of the People's Bank of China | |

| Headquarters | |

|---|---|

| Coordinates | Beijing 39°54′24″N 116°21′14″E |

| Established | 1 December 1948 |

| Key people | |

| Central bank of | |

| Currency | Renminbi (RMB) CNY (ISO 4217) |

| Reserves | US$3.31 trillion (2022)[1] |

| Reserve requirements | 7.6% (March 2023)[2] |

| Bank rate | 3.5% (August 2023) |

| Website | www |

| People's Bank of China | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Chinese name | |||||||||||||||||||||

| Simplified Chinese | 中国人民银行 | ||||||||||||||||||||

| Traditional Chinese | 中國人民銀行 | ||||||||||||||||||||

| Literal meaning | China People Bank | ||||||||||||||||||||

| |||||||||||||||||||||

| Alternative Chinese name | |||||||||||||||||||||

| Simplified Chinese | 人民银行 | ||||||||||||||||||||

| Traditional Chinese | 人民銀行 | ||||||||||||||||||||

| Literal meaning | People Bank | ||||||||||||||||||||

| |||||||||||||||||||||

| Second alternative Chinese name | |||||||||||||||||||||

| Chinese | 央行 | ||||||||||||||||||||

| Literal meaning | Central Bank | ||||||||||||||||||||

| |||||||||||||||||||||

| Tibetan name | |||||||||||||||||||||

| Tibetan | ཀྲུང་གོ་མི་དམངས། མི་རྣམས།དངུལ་ཁང་། | ||||||||||||||||||||

| |||||||||||||||||||||

| Zhuang name | |||||||||||||||||||||

| Zhuang | Cunghgoz Yinzminz Yinzhangz | ||||||||||||||||||||

| Mongolian name | |||||||||||||||||||||

| Mongolian Cyrillic | Дундад Улсын Ардын Банк | ||||||||||||||||||||

| Mongolian script | ᠳᠤᠮᠳᠠᠳᠤ ᠤᠯᠤᠰ ᠤᠨ ᠠᠷᠠᠳ ᠤᠨ ᠪᠠᠩᠬᠢ | ||||||||||||||||||||

| |||||||||||||||||||||

| Uyghur name | |||||||||||||||||||||

| Uyghur | جۇڭگو خەلق بانكا | ||||||||||||||||||||

| |||||||||||||||||||||

| Portuguese name | |||||||||||||||||||||

| Portuguese | Banco Popular da China | ||||||||||||||||||||

.svg.png.webp) |

|---|

|

|

The PBC was established in 1948 with the merger of the Huabei Bank, the Beihai Bank and Northwestern Farmers' Bank. After the proclamation of the PRC in 1949, it became the nation's central bank. In 1969, the PBC was demoted to a bureau of the Ministry of Finance, an arrangement that lasted until August 1979. The PBC was extensively reformed during the 1990s, when its provincial and local branches were abolished, instead opening nine regional branches. These reforms were reversed in 2023, when the regional branches were abolished and the provincial branches restored.

Though operating with some autonomy, the PBC lacks central bank independence, and is required to implement the policies of the Chinese Communist Party (CCP). The PBC is led by a governor, assisted by deputy governors, and the CCP Committee Secretary; both posts are currently held by Pan Gongsheng.

History

The bank was established on December 1, 1948, based on the consolidation of the Huabei Bank, the Beihai Bank and Northwestern Farmers' Bank.[5]: 37 The headquarters was first located in Shijiazhuang, Hebei, and then moved to Beijing in 1949. Between 1950 and 1978 the PBC was the only bank in the People's Republic of China and was responsible for both central banking and commercial banking operations.[6]: 225 All other banks within Mainland China such as the Bank of China were either organized as divisions of the PBC[7] or were non-deposit taking agencies.[8][9]

From 1952 to 1955 government shares were added to private banks to make state-private banks, until under the first Five Year plan from 1955 to 1959 the PBC had complete control of the private banks, making them branches of the PBC, closely resembling the vision of Vladimir Lenin. With aid from the Soviet Union, the shares of private enterprises and with them industrial output followed a similar path, forming a Soviet-style planned economy.

During the Cultural Revolution, the PBC suspended its commercial banking service.[5]: 38 In 1969, the State Council approved the consolidation of PBC's headquarters as a bureau within the Ministry of Finance.[5]: 38 Local PBC branches were merged into local government finance departments.[5]: 38 This effective demotion of the PBC lasted for a decade until August 1979, when the PBC was separated from the Ministry.[5]: 42

With the exception of special allocations for rural development, the monolithic PBC dominated all business transactions and credit until 1978,[10] when, as part of the Chinese economic reforms, the State Council split off the commercial banking functions of the PBC into four independent but state-owned banks, including the Industrial and Commercial Bank of China (ICBC), the Bank of China (BOC), the Agricultural Bank of China (ABC), and the China Construction Bank (CCB).[11] In September 1983, the State Council promulgated that the PBC would function exclusively as the central bank of China and no longer undertake commercial banking activities.[5]: 42

Chen Yuan was instrumental in modernizing the bank in the early 1990s. Its central bank status was legally confirmed on March 18, 1995, by the 3rd Plenum of the 8th National People's Congress, and was granted a higher degree of independence than other State Council ministries by an act that year.[12]

In 1996 and 1996, the PBC established fundamental regulations on loans and consumer credit.[13]: 20

In 1998, the PBC underwent a major restructuring. All provincial and local branches were abolished, and the PBC opened nine regional branches, whose boundaries did not correspond to local administrative boundaries.[14]

In 2003, the Standing Committee of the National People's Congress approved an amendment law for strengthening the role of PBC in the making and implementation of monetary policy for safeguarding the overall financial stability and provision of financial services.

In 2006, the PBC established the Credit Reference Centre to provide financial credit reporting.[13]: 47

During the Great Recession, the PBC helped address bank liquidity crisis by signing swap agreements with numerous other countries to provide them with liquidity based on the renminbi.[15]: 267 As of 2021, China has swap agreements with 40 countries.[15]: 271 The PBC underwent through another major restructuring in 2023, with the abolishment of the regional arms and reopening of the previous provincial and local branches.[14] Additionally, its county-level branches were absorbed by city-level branches.[16] The oversight over financial holding companies and financial consumer protection was also transferred from the PBC to the newly established National Administration of Financial Regulation.[16] The new branches were inaugurated on 18 August 2023.[17]

Management

The PBC is a cabinet-level executive department of the State Council.[12] The top management of the PBC are composed of the governor and a certain number of deputy governors. The governor is nominated by the premier of the State Council, who is then approved by the National People's Congress or its Standing Committee and appointed by the president.The deputy governors of the PBC are appointed to or removed from office by the premier.[18]

The PBC adopts the governor responsibility system under which the governor supervises the overall work of the PBC while the deputy governors provide assistance to the governor to fulfill his or her responsibility. The current governor is Pan Gongsheng. Deputy governors of the management team include: Wang Huaqing, Fan Yifei, Guo Qingping, Zhang Xiaohui, and Yang Ziqiang.[19] Former top-level managers include: Hu Xiaolian, Liu Shiyu, Li Dongrong and Jin Qi.

While operating with some degree of autonomy, the PBC does not have central bank independence and is politically required to implement the policies of the Chinese Communist Party (CCP).[20] The CCP committee secretary of the PBC is the most powerful position in the bank and can hold more sway than the governor. The current CCP committee secretary is Pan Gongsheng.[21]

Structure

The PBC has branches in each 31 provincial-level administrative divisions in China, branches in five cities (Shenzhen, Dalian, Ningbo, Qingdao, and Xiamen), and 317 branches in prefecture-level divisions.[17] It has 6 overseas representative offices (PBC Representative Office for America, PBC Representative Office (London) for Europe, PBC Tokyo Representative Office, PBC Frankfurt Representative Office, PBC Representative Office for Africa, Liaison Office of the PBC in the Caribbean Development Bank).

The PBC Monetary Policy Committee is an advisory body chaired by the PBC governor. It typically includes the directors and deputy directors of other financial agencies, as well as a few influential academic economists.[22]

Departments

The PBC consists of functional departments (bureaus) as below:[23]

- General Administration Department (General Office of the CCP PBC Committee)

- Legal Affairs Department

- Monetary Policy Department

- Macroprudential Policy Bureau

- Financial Market Department

- Financial Stability Bureau

- Statistics and Analysis Department

- Accounting and Treasury Department

- Payment System Department

- Technology Department

- Currency, Gold and Silver Bureau

- State Treasury Bureau

- International Department

- Internal Auditing Department

- Human Resources Department (Organization Division of the CCP PBC Committee)

- Research Bureau

- Credit Information System Bureau

- Anti-Money Laundering Bureau (Security Bureau)

- Financial Consumer Protection Bureau

- Education Department of the CCP PBC Committee

- CCP Committee of the PBC Head Office (Office of Inspections)

- Retired Staff Management Bureau

- Office of Senior Advisors

- Staff Union Committee

- Youth League

The following enterprises and institutions are directly under the PBC:[24]

- China Anti-Money Laundering Monitoring and Analysis Center

- PBC Graduate School

- China Financial Publishing House

- Financial News

- China National Clearing Center

- China Banknote Printing and Minting Corporation

- China Gold Coin Incorporation

- China Financial Computerization Corporation

- China Foreign Exchange Trade System

Microfinance

Financial inclusion

The PBC is active in promoting financial inclusion policy and a member of the Alliance for Financial Inclusion.[25]

Interest rates

Previously, interest rates set by the bank were always divisible by nine, instead of by 25 as in the rest of the world.[26][27] However, since the central bank began to increase rates by 0.25 percentage points on October 19, 2010, this is no longer the case.

PBC latest interest rate changes:[28]

| Change date | Interest rate |

|---|---|

| Aug 21, 2023[29] | 3.450% |

| June 20, 2023[30] | 3.550% |

| August 20, 2022 | 3.650% |

| January 20, 2022 | 3.700% |

| December 20, 2021 | 3.800% |

| April 20, 2020 | 3.850% |

| February 20, 2020 | 4.050% |

| November 20, 2019 | 4.150% |

| September 20, 2019 | 4.200% |

| August 20, 2019 | 4.250% |

| October 23, 2015 | 4.350% |

| August 25, 2015 | 4.600% |

| June 27, 2015 | 4.850% |

| May 10, 2015 | 5.100% |

| February 28, 2015 | 5.350% |

| November 21, 2014 | 5.600% |

| July 6, 2012 | 6.000% |

| June 8, 2012 | 6.310% |

| July 7, 2011 | 6.560% |

| April 6, 2011 | 6.310% |

| February 9, 2011 | 6.060% |

| December 26, 2010 | 5.810% |

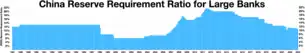

Reserve requirement ratio

PBC latest reserve requirement ratio (RRR) changes:

| Change date | Reserve requirement ratio | Extra cash for financial system |

|---|---|---|

| December 2008 | 21.0% | |

| December 2011 | 20.5% | 350 billion yuan ($55 billion)[31] |

| May 2012 | 20.0% | 400 billion yuan ($63.4 billion)[32] |

| February 2015 | 19.5% | 600 billion yuan ($96 billion)[33] |

| April 2015 | 18.5% | 1.5 trillion yuan ($240 billion)[34] |

| August 2015 | 18.0% | 650 billion yuan ($101 billion) |

| March 2023 | 7.6% |

Foreign-exchange reserves

Foreign-exchange reserves from 2004:[35][36]

| Year & month | Foreign-exchange reserves (US$ billion) |

|---|---|

| 2004-01 | 415.7 |

| 2004-02 | 426.6 |

| 2004-03 | 439.8 |

| 2004-04 | 449 |

| 2004-05 | 458.6 |

| 2004-06 | 470.6 |

| 2004-07 | 483 |

| 2004-08 | 496.2 |

| 2004-09 | 514.5 |

| 2004-10 | 542.4 |

| 2004-11 | 573.9 |

| 2004-12 | 609.9 |

| 2005-01 | 623.6 |

| 2005-02 | 642.6 |

| 2005-03 | 659.1 |

| 2005-04 | 670.8 |

| 2005-05 | 691 |

| 2005-06 | 711 |

| 2005-09 | 769 |

| 2005-12 | 818.9 |

| 2006-01 | 845.2 |

| 2006-02 | 853.7 |

| 2006-03 | 875.1 |

| 2006-04 | 895 |

| 2006-05 | 925 |

| 2006-06 | 941.1 |

| 2006-07 | 954.6 |

| 2006-08 | 972 |

| 2006-09 | 987.9 |

| 2006-10 | 1009.6 |

| 2006-11 | 1038.8 |

| 2006-12 | 1066.3 |

| 2007-01 | 1104.7 |

| 2007-02 | 1157.4 |

| 2007-03 | 1202 |

| 2007-04 | 1246.6 |

| 2007-05 | 1292.7 |

| 2007-06 | 1332.6 |

| 2007-07 | 1385.2 |

| 2007-08 | 1408.6 |

| 2007-09 | 1433.6 |

| 2007-10 | 1454.9 |

| 2007-11 | 1497 |

| 2007-12 | 1528.2 |

| 2008-01 | 1589.8 |

| 2008-02 | 1647.1 |

| 2008-03 | 1682.2 |

| 2008-04 | 1756.7 |

| 2008-05 | 1797 |

| 2008-06 | 1808.8 |

| 2008-07 | 1845.2 |

| 2008-08 | 1884.2 |

| 2008-09 | 1905.6 |

| 2008-10 | 1879.7 |

| 2008-11 | 1884.7 |

| 2008-12 | 1946 |

| 2009-01 | 1913.5 |

| 2009-02 | 1912.1 |

| 2009-03 | 1952.7 |

| 2009-04 | 2008.9 |

| 2009-05 | 2089.5 |

| 2009-06 | 2131.6 |

| 2009-07 | 2174.6 |

| 2009-08 | 2210.8 |

| 2009-09 | 2272.6 |

| 2009-10 | 2328.3 |

| 2009-11 | 2388.8 |

| 2009-12 | 2399.2 |

| 2010-01 | 2415.2 |

| 2010-02 | 2424.6 |

| 2010-03 | 2447.1 |

| 2010-04 | 2490.5 |

| 2010-05 | 2439.5 |

| 2010-06 | 2454.3 |

| 2010-07 | 2538.9 |

| 2010-08 | 2547.8 |

| 2010-09 | 2648.3 |

| 2010-10 | 2760.9 |

| 2010-11 | 2767.8 |

| 2010-12 | 2847.3 |

| 2011-01 | 2931.7 |

| 2011-02 | 2991.4 |

| 2011-03 | 3044.7 |

| 2011-06 | 3197.5 |

| 2011-07 | 3245.3 |

| 2011-08 | 3262.5 |

| 2011-09 | 3201.7 |

| 2011-10 | 3273.8 |

| 2011-11 | 3220.9 |

| 2011-12 | 3181.1 |

| 2012-01 | 3253.6 |

| 2012-02 | 3309.7 |

| 2012-03 | 3305 |

| 2012-04 | 3298.9 |

| 2012-05 | 3206.1 |

| 2012-06 | 3240 |

| 2012-07 | 3240 |

| 2012-08 | 3272.9 |

| 2012-09 | 3285.1 |

| 2012-10 | 3287.4 |

| 2012-11 | 3297.7 |

| 2012-12 | 3311.6 |

| 2013-01 | 3410 |

| 2013-02 | 3395.4 |

| 2013-03 | 3442.6 |

| 2013-04 | 3534.5 |

| 2013-05 | 3514.8 |

| 2013-06 | 3496.7 |

| 2013-07 | 3547.8 |

| 2013-08 | 3553 |

| 2013-09 | 3662.7 |

| 2013-10 | 3736.6 |

| 2013-11 | 3789.5 |

| 2013-12 | 3821.3 |

| 2014-01 | 3866.6 |

| 2014-02 | 3913.7 |

| 2014-03 | 3948.1 |

| 2014-04 | 3978.8 |

| 2014-05 | 3983.9 |

| 2014-06 | 3993.2 |

| 2014-07 | 3966.3 |

| 2014-08 | 3968.8 |

| 2014-09 | 3887.7 |

| 2014-10 | 3852.9 |

| 2014-11 | 3847.4 |

| 2014-12 | 3843 |

| 2015-01 | 3813.41 |

| 2015-02 | 3801.5 |

| 2015-03 | 3730.04 |

| 2015-04 | 3748.14 |

| 2015-05 | 3711.14 |

| 2015-06 | 3693.84 |

| 2015-07 | 3651.31 |

| ... | ... |

| 2017-05 | 3053.57 |

| 2017-06 | 3056.79 |

| 2017-07 | 3080.72 |

| 2017-08 | 3091.53 |

| 2017-09 | 3108.51 |

| 2017-10 | 3109.21 |

| 2017-11 | 3119.28 |

| 2017-12 | 3139.95 |

| 2018-01 | 3161.46 |

| 2018-02 | 3134.48 |

| 2018-03 | 3142.82 |

| ... | ... |

| 2023-01 | 3184.46 |

| 2023-02 | 3133.15 |

| 2023-03 | 3183.87 |

| 2023-04 | 3204.77 |

| 2023-05 | 3176.51 |

| 2023-06 | 3193.00 |

| 2023-07 | 3204.27 |

See also

Notes

- Excluding special administrative regions Hong Kong and Macau.

References

- "Total reserves (includes gold, current US$) - China | Data". data.worldbank.org. Retrieved August 7, 2023.

- Tang, Frank (March 17, 2023). "China releases US$72.6 billion of liquidity with cut to banks' reserve requirement ratio". South China Morning Post. Retrieved June 20, 2023.

- "Home > About PBC". People's Bank of China. Retrieved May 31, 2022.

- "China's PBOC pledges policy support to counter pandemic woes". Reuters. May 4, 2022. Retrieved May 31, 2022.

- Liu, Zongyuan Zoe (2023). Sovereign Funds: How the Communist Party of China Finances its Global Ambitions. The Belknap Press of Harvard University Press. ISBN 9780674271913.

- Roach, Stephen S. (2022). Accidental Conflict: America, China, and the Clash of False Narratives. New Haven: Yale University Press. doi:10.12987/9780300269017. ISBN 978-0-300-26901-7. JSTOR j.ctv2z0vv2v. OCLC 1347023475.

- "History of Bank of China", Boc.cn, Retrieved 2015-11-23.

- "History", China Construction Bank webpage. Retrieved 2015-11-23.

- Zimmerman, James M. (2005). James M. Zimmerman 2010. China Law Deskbook. p.449. American Bar Association. ISBN 9781616327897.

- Chiu, Becky; Lewis, Mervyn (January 1, 2006). Reforming China's State-owned Enterprises and Banks. Edward Elgar Publishing. pp. 188–189. ISBN 978-1-84542-988-1.

- Zimmerman, James M. (2005). James M. Zimmerman 2010. China Law Deskbook. p.450. American Bar Association. ISBN 9781616327897.

- Chiu, Becky; Lewis, Mervyn (January 1, 2006). Reforming China's State-owned Enterprises and Banks. Edward Elgar Publishing. p. 203. ISBN 978-1-84542-988-1.

- Brussee, Vincent (2023). Social Credit: The Warring States of China's Emerging Data Empire. Singapore: Palgrave MacMillan. ISBN 9789819921881.

- Wei, Lingling (March 12, 2023). "Xi Jinping Brings China's Reform Era to an End". The Wall Street Journal. ISSN 0099-9660. Retrieved September 3, 2023.

- Jin, Keyu (2023). The New China Playbook: Beyond Socialism and Capitalism. New York: Viking. ISBN 978-1-9848-7828-1.

- "What China's Powerful Financial Regulator Means for PBOC". Bloomberg News. March 8, 2023. Retrieved September 3, 2023.

- "中国人民银行各省(自治区、直辖市)分行、计划单列市分行及地(市)分行今日挂牌" [Branches of the People's Bank of China in all provinces (autonomous regions, municipalities directly under the Central Government), branches in cities specifically designated in the state plan, and prefectural (city) branches are listed today]. China News Service. August 18, 2023. Retrieved September 3, 2023.

- "Constitution of the People's Republic of China". National People's Congress. Retrieved August 8, 2022.

- "Management Team", Pbc.gov.cn, November 23, 2015. Retrieved 2015-11-23.

- Wei, Lingling (December 8, 2021). "Beijing Reins In China's Central Bank". The Wall Street Journal. ISSN 0099-9660. Retrieved August 31, 2023.

Beijing has little tolerance for any talk of central-bank independence; the monetary authority, just like any other part of the government, answers to the party.

- White, Edward; Leng, Cheng (July 1, 2023). "Western-trained banker in line to lead China's central bank". Financial Times. Retrieved July 1, 2023.

- "Decoding Chinese Politics". Asia Society. Retrieved October 2, 2023.

- "Organizational Structure". The People's Bank of China. Retrieved September 3, 2023.

- The People's Bank of China. "Enterprises and Institutions directly under the PBC". Retrieved May 29, 2012.

- "AFI members". AFI Global. October 10, 2011. Archived from the original on February 20, 2012. Retrieved February 23, 2012.

- "Calendar, Abacus Help Determine Size of Chinese Rate Increases". Bloomberg. May 18, 2007.

- "Viewpoint: The "divisible by nine" rule". Info.gov.hk. Retrieved December 4, 2017.

- "PBC base interest rate – Chinese central bank's interest rate", Global-rates.com. Retrieved 2018-05-19.

- "China cuts key interest rate as recovery falters". BBC News. August 21, 2023. Retrieved August 21, 2023.

- "China cuts lending benchmarks to revive slowing demand". Reuters. June 20, 2023. Retrieved June 20, 2023.

- "China's Reserve-Ratio Cut May Signal Economic Slowdown Deepening". Bloomberg.com. November 30, 2011. Retrieved December 4, 2017.

- "China Lowers Banks' Reserve Requirements to Support Growth". Bloomberg.com. May 12, 2012. Retrieved December 4, 2017.

- Wei, Lingling (February 5, 2015). "China Cuts Reserve Requirement Ratio". Wsj.com. Retrieved December 4, 2017.

- "Economists React: China's Aggressive Cut in Banks' Reserve Requirement Ratio". Blogs.wsj.com. April 20, 2015. Retrieved December 4, 2017.

- "China Monthly Foreign Exchange Reserves Analysis – CNGFOREX". Bloomberg.com. Retrieved December 4, 2017.

- "China's foreign exchange reserves". Archived from the original on August 12, 2015. Retrieved August 12, 2015.

Further reading

- Stephen Bell and Hui Feng. The Rise of the People's Bank of China: The Politics of Institutional Change (Harvard University Press; 2013) 384 pages; Recent history; uses interviews with key figures