Public good (economics)

In economics, a public good (also referred to as a social good or collective good)[1] is a good that is both non-excludable and non-rivalrous. For such goods, users cannot be barred from accessing or using them for failing to pay for them. Also, use by one person neither prevents access of other people nor does it reduce availability to others.[1] Therefore, the good can be used simultaneously by more than one person.[2] This is in contrast to a common good, such as wild fish stocks in the ocean, which is non-excludable but rivalrous to a certain degree. If too many fish were harvested, the stocks would deplete, limiting the access of fish for others. A public good must be valuable to more than one user, otherwise, the fact that it can be used simultaneously by more than one person would be economically irrelevant.

| Public infrastructure |

|---|

|

| Assets and facilities |

|

| Concepts |

|

| Issues and ideas |

|

| Fields of study |

|

|

Examples

|

|

Capital goods may be used to produce public goods or services that are "...typically provided on a large scale to many consumers."[3] Unlike other types of economic goods, public goods are described as “non-rivalrous” or “non-exclusive,” and use by one person neither prevents access of other people nor does it reduce availability to others.[1] Similarly, using capital goods to produce public goods may result in the creation of new capital goods. In some cases, public goods or services are considered "...insufficiently profitable to be provided by the private sector.... (and), in the absence of government provision, these goods or services would be produced in relatively small quantities or, perhaps, not at all."[3]

Public goods include knowledge,[4] official statistics, national security, common languages,[5] law enforcement, public parks, free roads, television and radio broadcasts.[6] Additionally, flood control systems, lighthouses, and street lighting are also common social goods. Collective goods that are spread all over the face of the earth may be referred to as global public goods.[7] For instance, knowledge is well shared globally. Information about men, women and youth health awareness, environmental issues, and maintaining biodiversity is common knowledge that every individual in the society can get without necessarily preventing others access. Also, sharing and interpreting contemporary history with a cultural lexicon, particularly about protected cultural heritage sites and monuments are other sources of knowledge that the people can freely access.

Public goods problems are often closely related to the "free-rider" problem, in which people not paying for the good may continue to access it. Thus, the good may be under-produced, overused or degraded.[8] Public goods may also become subject to restrictions on access and may then be considered to be club goods; exclusion mechanisms include toll roads, congestion pricing, and pay television with an encoded signal that can be decrypted only by paid subscribers.

There is a good deal of debate and literature on how to measure the significance of public goods problems in an economy, and to identify the best remedies.

Academic literature on public goods

Paul A. Samuelson is usually credited as the economist who articulated the modern theory of public goods in a mathematical formalism, building on earlier work of Wicksell and Lindahl. In his classic 1954 paper The Pure Theory of Public Expenditure,[9] he defined a public good, or as he called it in the paper a "collective consumption good", as follows:

[goods] which all enjoy in common in the sense that each individual's consumption of such a good leads to no subtractions from any other individual's consumption of that good...

A Lindahl tax is a type of taxation brought forward by Erik Lindahl, an economist from Sweden in 1919. His idea was to tax individuals, for the provision of a public good, according to the marginal benefit they receive. Public goods are costly and eventually someone needs to pay the cost.[10] It is difficult to determine how much each person should pay. So, Lindahl developed a theory of how the expense of public utilities needs to be settled. His argument was that people would pay for the public goods according to the way they benefit from the good. The more a person benefits from these goods, the higher the amount they pay. People are more willing to pay for goods that they value. Taxes are needed to fund public goods and people are willing to bear the burden of taxes.[11] Additionally, the theory dwells on people's willingness to pay for the public good. From the fact that public goods are paid through taxation according to the Lindahl idea, the basic duty of the organization that should provide the people with this services and products is the government.[12] The services and public utility in most cases are part of the many governmental activities that government engage purely for the satisfaction of the public and not generation of profits.[13] In the introductory section of his book, Public Good Theories of the Nonprofit Sector, Bruce R. Kingma stated that;

In the Weisbrod model nonprofit organizations satisfy a demand for public goods, which is left unfilled by government provision. The government satisfies the demand of the median voters and therefore provides a level of the public good less than some citizens'-with a level of demand greater than the median voter's-desire. This unfilled demand for the public good is satisfied by nonprofit organizations. These nonprofit organizations are financed by the donations of citizens who want to increase the output of the public good.[14]

Terminology, and types of goods

Non-rivalrous: accessible by all while one's usage of the product does not affect the availability for subsequent use.[12]

Non-excludability: that is, it is impossible to exclude any individuals from consuming the good.

Pure public: when a good exhibits the two traits, non-rivalry and non-excludability, it is referred to as the pure public good.

Impure public goods: the goods that satisfy the two public good conditions (non-rivalry and non-excludability) only to a certain extent or only some of the time.

Private good: The opposite of a public good which does not possess these properties. A loaf of bread, for example, is a private good; its owner can exclude others from using it, and once it has been consumed, it cannot be used by others.

Common-pool resource: A good that is rivalrous but non-excludable. Such goods raise similar issues to public goods: the mirror to the public goods problem for this case is the 'tragedy of the commons'. For example, it is so difficult to enforce restrictions on deep-sea fishing that the world's fish stocks can be seen as a non-excludable resource, but one which is finite and diminishing.

Club goods: are the goods that excludable but are non-rivalrous such as private parks.

Mixed good: final goods that are intrinsically private but that are produced by the individual consumer by means of private and public good inputs. The benefits enjoyed from such a good for any one individual may depend on the consumption of others, as in the cases of a crowded road or a congested national park.[15]

Definition matrix

| Excludable | Non-excludable | |

| Rivalrous | Private goods food, clothing, cars, parking spaces |

Common-pool resources fish stocks, timber, coal, free public transport |

| Non-rivalrous | Club goods cinemas, private parks, satellite television, public transport |

Public goods free-to-air television, air, national defense, free and open-source software |

Challenges in identifying public goods

The definition of non-excludability states that it is impossible to exclude individuals from consumption. Technology now allows radio or TV broadcasts to be encrypted such that persons without a special decoder are excluded from the broadcast. Many forms of information goods have characteristics of public goods. For example, a poem can be read by many people without reducing the consumption of that good by others; in this sense, it is non-rivalrous. Similarly, the information in most patents can be used by any party without reducing consumption of that good by others. Official statistics provide a clear example of information goods that are public goods, since they are created to be non-excludable. Creative works may be excludable in some circumstances, however: the individual who wrote the poem may decline to share it with others by not publishing it. Copyrights and patents both encourage the creation of such non-rival goods by providing temporary monopolies, or, in the terminology of public goods, providing a legal mechanism to enforce excludability for a limited period of time. For public goods, the "lost revenue" of the producer of the good is not part of the definition: a public good is a good whose consumption does not reduce any other's consumption of that good.[16] Public goods also incorporate private goods, which makes it challenging to define what is private or public. For instance, you may think that the community soccer field is a public good. However, you need to bring your own cleats and ball to be able to play. There is also a rental fee that you would have to pay for you to be able to occupy that space. It is a mixed case of public and private goods.

Debate has been generated among economists whether such a category of "public goods" exists. Steven Shavell has suggested the following:

when professional economists talk about public goods they do not mean that there are a general category of goods that share the same economic characteristics, manifest the same dysfunctions, and that may thus benefit from pretty similar corrective solutions...there is merely an infinite series of particular problems (some of overproduction, some of underproduction, and so on), each with a particular solution that cannot be deduced from the theory, but that instead would depend on local empirical factors.[17]

There is a common misconception that public goods are goods provided by the public sector. Although it is often the case that government is involved in producing public goods, this is not always true. Public goods may be naturally available, or they may be produced by private individuals, by firms, or by non-state groups, called collective action.[18]

The theoretical concept of public goods does not distinguish geographic region in regards to how a good may be produced or consumed. However, some theorists, such as Inge Kaul, use the term "global public good" for a public good which is non-rivalrous and non-excludable throughout the whole world, as opposed to a public good which exists in just one national area. Knowledge has been argued as an example of a global public good,[4] but also as a commons, the knowledge commons.[19]

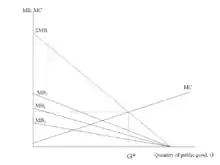

Graphically, non-rivalry means that if each of several individuals has a demand curve for a public good, then the individual demand curves are summed vertically to get the aggregate demand curve for the public good. This is in contrast to the procedure for deriving the aggregate demand for a private good, where individual demands are summed horizontally.

Some writers have used the term "public good" to refer only to non-excludable "pure public goods" and refer to excludable public goods as "club goods".[20]

Digital Public Goods

Digital public goods include software, data sets, AI models, standards and content that are open source.

Use of the term “digital public good” appears as early as April, 2017 when Nicholas Gruen wrote Building the Public Goods of the Twenty-First Century, and has gained popularity with the growing recognition of the potential for new technologies to be implemented at scale to effectively serve people. Digital technologies have also been identified by countries, NGOs and private sector entities as a means to achieve the Sustainable Development Goals (SDGs).

A digital public good is defined by the UN Secretary-General's Roadmap for Digital Cooperation, as: “open source software, open data, open AI models, open standards and open content that adhere to privacy and other applicable laws and best practices, do no harm, and help attain the SDGs.”

Examples

Common examples of public goods include

- public fireworks

- clean air and other environmental goods

- information goods, such as official statistics

- open-source software

- authorship

- public television

- radio

- invention

- herd immunity

- Wikipedia

| Class and type of Good | Nonexcludable | Nonrival | Common problem |

|---|---|---|---|

| Ozone Layer | Yes | No | Overuse |

| Atmosphere | Yes | No | Overuse |

| Universal human rights | Partly | Yes | Underuse (Repression) |

| Knowledge | Partly | Yes | Underuse (lack of access) |

| Internet | Partly | Yes | Underuse (Entry Barriers) |

Shedding light on some mis-classified public goods

- Some goods, like orphan drugs, require special governmental incentives to be produced, but cannot be classified as public goods since they do not fulfill the above requirements (non-excludable and non-rivalrous.)

- Law enforcement, streets, libraries, museums, and education are commonly misclassified as public goods, but they are technically classified in economic terms as quasi-public goods because excludability is possible, but they do still fit some of the characteristics of public goods.[22][23]

- The provision of a lighthouse is a standard example of a public good, since it is difficult to exclude ships from using its services. No ship's use detracts from that of others, but since most of the benefit of a lighthouse accrues to ships using particular ports, lighthouse maintenance can be profitably bundled with port fees (Ronald Coase, The Lighthouse in Economics 1974). This has been sufficient to fund actual lighthouses.

- Technological progress can create new public goods. The most simple examples are street lights, which are relatively recent inventions (by historical standards). One person's enjoyment of them does not detract from other persons' enjoyment, and it currently would be prohibitively expensive to charge individuals separately for the amount of light they presumably use.

- Official statistics are another example. The government's ability to collect, process and provide high-quality information to guide decision-making at all levels has been strongly advanced by technological progress. On the other hand, a public good's status may change over time. Technological progress can significantly impact excludability of traditional public goods: encryption allows broadcasters to sell individual access to their programming. The costs for electronic road pricing have fallen dramatically, paving the way for detailed billing based on actual use.

Public goods are not restricted to human beings.[24] It is one aspect of the study of cooperation in biology.[25]

Free rider problem

The free rider problem is a primary issue in collective decision-making.[26] An example is that some firms in a particular industry will choose not to participate in a lobby whose purpose is to affect government policies that could benefit the industry, under the assumption that there are enough participants to result in a favourable outcome without them. The free rider problem is also a form of market failure, in which market-like behavior of individual gain-seeking does not produce economically efficient results. The production of public goods results in positive externalities which are not remunerated. If private organizations do not reap all the benefits of a public good which they have produced, their incentives to produce it voluntarily might be insufficient. Consumers can take advantage of public goods without contributing sufficiently to their creation. This is called the free rider problem, or occasionally, the "easy rider problem". If too many consumers decide to "free-ride", private costs exceed private benefits and the incentive to provide the good or service through the market disappears. The market thus fails to provide a good or service for which there is a need.[27]

The free rider problem depends on a conception of the human being as homo economicus: purely rational and also purely selfish—extremely individualistic, considering only those benefits and costs that directly affect him or her. Public goods give such a person an incentive to be a free rider.

For example, consider national defence, a standard example of a pure public good. Suppose homo economicus thinks about exerting some extra effort to defend the nation. The benefits to the individual of this effort would be very low, since the benefits would be distributed among all of the millions of other people in the country. There is also a very high possibility that he or she could get injured or killed during the course of his or her military service. On the other hand, the free rider knows that he or she cannot be excluded from the benefits of national defense, regardless of whether he or she contributes to it. There is also no way that these benefits can be split up and distributed as individual parcels to people. The free rider would not voluntarily exert any extra effort, unless there is some inherent pleasure or material reward for doing so (for example, money paid by the government, as with an all-volunteer army or mercenaries).

The free-riding problem is even more complicated than it was thought to be until recently. Any time non-excludability results in failure to pay the true marginal value (often called the "demand revelation problem"), it will also result in failure to generate proper income levels, since households will not give up valuable leisure if they cannot individually increment a good.[28] This implies that, for public goods without strong special interest support, under-provision is likely since cost-benefit analysis is being conducted at the wrong income levels, and all of the un-generated income would have been spent on the public good, apart from general equilibrium considerations.

In the case of information goods, an inventor of a new product may benefit all of society, but hardly anyone is willing to pay for the invention if they can benefit from it for free. In the case of an information good, however, because of its characteristics of non-excludability and also because of almost zero reproduction costs, commoditization is difficult and not always efficient even from a neoclassical economic point of view.[29]

Efficient production levels of public goods

The Pareto optimal provision of a public good in a society occurs when the sum of the marginal valuations of the public good (taken across all individuals) is equal to the marginal cost of providing that public good. These marginal valuations are, formally, marginal rates of substitution relative to some reference private good, and the marginal cost is a marginal rate of transformation that describes how much of that private good it costs to produce an incremental unit of the public good. This contrasts to the Pareto optimality condition of private goods, which equates each consumer's valuation of the private good to its marginal cost of production.[9][30]

For an example, consider a community of just two consumers and the government is considering whether or not to build a public park. One person is prepared to pay up to $200 for its use, while the other is willing to pay up to $100. The total value to the two individuals of having the park is $300. If it can be produced for $225, there is a $75 surplus to maintaining the park, since it provides services that the community values at $300 at a cost of only $225.

The classical theory of public goods defines efficiency under idealized conditions of complete information, a situation already acknowledged in Wicksell (1896).[31] Samuelson emphasized that this poses problems for the efficient provision of public goods in practice and the assessment of an efficient Lindahl tax to finance public goods, because individuals have incentives to underreport how much they value public goods.[9] Subsequent work, especially in mechanism design and the theory of public finance developed how valuations and costs could actually be elicited in practical conditions of incomplete information, using devices such as the Vickrey–Clarke–Groves mechanism. Thus, deeper analysis of problems of public goods motivated much work that is at the heart of modern economic theory.[32]

Local public goods

The basic theory of public goods as discussed above begins with situations where the level of a public good (e.g., quality of the air) is equally experienced by everyone. However, in many important situations of interest, the incidence of benefits and costs is not so simple. For example, when people keep an office clean or monitor a neighborhood for signs of trouble, the benefits of that effort accrue to some people (those in their neighborhoods) more than to others. The overlapping structure of these neighborhoods is often modeled as a network.[33] (When neighborhoods are totally separate, i.e., non-overlapping, the standard model is the Tiebout model.)

An example of locally public good that could help everyone, even ones not from the neighborhood, is a bus. Let's say you are a college student who is visiting their friend who goes to school in another city. You get to benefit from this services just like everyone that resides and goes to school in said city. There is also a correlation of benefit and cost that you are now a part of. You are benefiting by not having to walk to your destination and taking a bus instead. However, others might prefer to walk so they do not become a part of the problem, which is pollution due to gas given out by auto mobiles.

Recently, economists have developed the theory of local public goods with overlapping neighborhoods, or public goods in networks: both their efficient provision, and how much can be provided voluntarily in a non-cooperative equilibrium. When it comes to socially efficient provision, networks that are more dense or close-knit in terms of how much people can benefit each other have more scope for improving on an inefficient status quo.[34] On the other hand, voluntary provision is typically below the efficient level, and equilibrium outcomes tend to involve strong specialization, with a few individuals contributing heavily and their neighbors free-riding on those contributions.[33][35]

Ownership

Economic theorists such as Oliver Hart (1995) have emphasized that ownership matters for investment incentives when contracts are incomplete.[36] The incomplete contracting paradigm has been applied to public goods by Besley and Ghatak (2001).[37] They consider the government and a non-governmental organization (NGO) who can both make investments to provide a public good. Besley and Ghatak argue that the party who has a larger valuation of the public good should be the owner, regardless of whether the government or the NGO has a better investment technology. This result contrasts with the case of private goods studied by Hart (1995), where the party with the better investment technology should be the owner. However, it has been shown that the investment technology may matter also in the public-good case when a party is indispensable or when there are bargaining frictions between the government and the NGO.[38][39] Halonen-Akatwijuka and Pafilis (2020) have demonstrated that Besley and Ghatak's results are not robust when there is a long-term relationship, such that the parties interact repeatedly.[40] Moreover, Schmitz (2021) has shown that when the parties have private information about their valuations of the public good, then the investment technology can be an important determinant of the optimal ownership structure.[41]

Example of Public Good

- National defense is an example of a public good. If you safeguard the country from invasion, it is in the best interests of the entire nation.

- Fire service could be considered a public good. Because fire prevention and fire extinguishing services share the characteristics of public goods. Firstly, it is non-rivalry. Protecting society against fire doesn’t reduce the amount of the good / service available. Secondly, it is non-excusable since you can’t stop anyone ringing up for fire service.

- Flood defenses has positive consequences for the entire community, keeping the coastline safe from flooding. It is also an example of public good.

- The use of the internet is an example of public good. Once websites are made open, anyone can view them for no charge, without limiting the quantity of information available to others. Individuals can get information for free if they can get their hands on it (which is not always the case).

- The lights on the streets is also a public good. If you provide light at night, you will not be able to prevent people from consuming the good. When you walk beneath a street light, you do not limit the amount of light available to others.

- The police department is also considered as a public good. It is because that improved security and lower crime will benefit everyone in the community as a result of your efforts to maintain law and order.

- Some aspects of cybersecurity, such as threat intelligence and vulnerability information sharing, collective response to cyber-attacks, the integrity of elections, and critical infrastructure protection, have the characteristics of public goods.[42]

Quasi-Public Goods

Generally speaking, these are items that are neither exclusive nor competitive in nature. Roads are a good illustration of this. Once they have been made available, the vast majority of people can make use of them, such as those who have a driving license. However, when you utilize a road, the amount of advantage that others can receive is limited to a certain extent, as a result of increasing traffic congestion. Education is another example of a quasi-public good. Different degrees of schooling require distinct classifications. While elementary and secondary education are considered meritocracies, higher education is better regarded as a quasi-public utility. In comparison, knowledge is frequently referred to as a global public good(Chattopadhyay, 2012).

See also

- Anti-rival good

- Excludability

- Lindahl tax, a method proposed by Erik Lindahl for financing public goods

- Private-collective model of innovation, which explains the creation of public goods by private investors

- Public bad

- Public trust doctrine

- Public goods game, a standard of experimental economics

- Public works, government-financed constructions

- Tragedy of the commons

- Tragedy of the anticommons

- Rivalry (economics)

- Quadratic funding, a mechanism to allocate funding for the production of public goods based on democratic principles

References

- Oakland, W. H. (1987). Theory of public goods. In Handbook of public economics (Vol. 2, pp. 485-535). Elsevier.

- For current definitions of public goods see any mainstream microeconomics textbook, e.g.: Hal R. Varian, Microeconomic Analysis ISBN 0-393-95735-7; Andreu Mas-Colell, Whinston & Green, Microeconomic Theory ISBN 0-19-507340-1; or Gravelle & Rees, Microeconomics ISBN 0-582-40487-8.

- Tatom, J. A. (1991). Should government spending on capital goods be raised?. Federal Reserve Bank of St. Louis Review, 73(3), 3-15. Accessed at

- Joseph E. Stiglitz, "Knowledge as a Global Public Good" in Global Public Goods, ISBN 978-0-19-513052-2

- Leach, John (2004). A Course in Public Economics. Cambridge University Press. p. 171. ISBN 978-0-521-53567-0. Retrieved 23 July 2021.

Knowledge is a pure public good: once something is known, that knowledge can be used by anyone, and its use by any one person docs not preclude its use by others.

- Kumar, V. "Why Government is Needed to Supply Public Goods?". www.newsandsociety.expertscolumn.com. Retrieved 4 October 2022.

- Cowen, Tyler (December 2007). David R. Henderson (ed.). The Concise Encyclopedia of Economics. Public Goods. The Library of Economics and Liberty. Archived from the original on 28 March 2010. Retrieved 19 February 2010.

- Rittenberg and Tregarthen. Principles of Microeconomics, Chapter 6, Section 4. p. 2 Archived 19 March 2013 at the Wayback Machine. Retrieved 20 June 2012

- Samuelson, Paul A. (1954). "The Pure Theory of Public Expenditure". Review of Economics and Statistics. 36 (4): 387–89. doi:10.2307/1925895. JSTOR 1925895.

See also Samuelson, Paul A. (1955). "Diagrammatic Exposition of a Theory of Public Expenditure". Review of Economics and Statistics. 37 (4): 350–56. doi:10.2307/1925849. JSTOR 1925849. - Gunnthorsdottir, Anna; Houser, Daniel; McCabe, Kevin (2007). "Disposition, history and contributions in public goods experiments". Journal of Economic Behavior & Organization. 62 (2): 304–315. doi:10.1016/j.jebo.2005.03.008. ISSN 0167-2681.

- Staff, Investopedia. "Lindahl Equilibrium Definition". Investopedia. Retrieved 28 October 2020.

- "Public Good | Learning to Give". www.learningtogive.org. Retrieved 28 October 2020.

- Kingma, Bruce R. (1997). "Public good theories of the non-profit sector: Weisbrod revisited". Voluntas: International Journal of Voluntary and Nonprofit Organizations. 8 (2): 135–148. doi:10.1007/BF02354191. ISSN 0957-8765. JSTOR 27927560. S2CID 154163089.

- Kingma, Bruce R. (2003), Anheier, Helmut K.; Ben-Ner, Avner (eds.), "Public Good Theories of the Nonprofit Sector", The Study of the Nonprofit Enterprise: Theories and Approaches, Nonprofit and Civil Society Studies, Boston, MA: Springer US, pp. 53–65, doi:10.1007/978-1-4615-0131-2_3, ISBN 978-1-4615-0131-2, retrieved 28 October 2020

- Sandmo, Agnar (20 March 2017). "Public Goods". The New Palgrave Dictionary of Economics. The New Palgrave Dictionary of Economics. Springer Link. pp. 10973–10984. doi:10.1057/978-1-349-95189-5_1696. ISBN 978-1-349-95188-8. Retrieved 10 December 2020.

- Demsetz, Harold (October 1970). "Full Access The Private Production of Public Goods". Journal of Law and Economics. 13 (2): 293–306. doi:10.1086/466695. JSTOR 229060. S2CID 154885952.

- Boyle, James (1996). Shamans, Software, and Spleens: Law and the Construction of the Information Society. Cambridge, Mass.: Harvard University Press. pp. 268. ISBN 978-0-674-80522-4.

- Touffut, J.P. (2006). Advancing Public Goods. The Cournot Centre for Economic Studies. Edward Elgar Publishing, Incorporated. p. 26. ISBN 978-1-84720-184-3. Retrieved 27 August 2018.

- Hess, Charlotte; Ostrom, Elinor (2007). Understanding Knowledge as a Commons: From Theory to Practice. Cambridge: Massachusetts Institute of Technology. pp. 12–13. ISBN 978-0-262-08357-7.

- James M. Buchanan (February 1965). "An Economic Theory of Clubs". Economica. 32 (125): 1–14. doi:10.2307/2552442. JSTOR 2552442.

- Labaree, David F. (23 June 2016). "Public Goods, Private Goods: The American Struggle Over Educational Goals". American Educational Research Journal. 34: 39–81. doi:10.3102/00028312034001039. S2CID 36278539.

- Pucciarelli F., Andreas Kaplan (2016) Competition and Strategy in Higher Education: Managing Complexity and Uncertainty, Business Horizons, Volume 59

- Campbell R. McConnell; Stanley L. Brue; Sean M. Flynn (2011). Economics: Principles, Problems, and Policies (19th ed.). McGraw-Hill/Irwin. p. 104. ISBN 978-0-07-351144-3.

- Julou, Thomas; Mora, Thierry; et al. (2013). "Cell–cell contacts confine public goods diffusion inside Pseudomonas aeruginosa clonal microcolonies". Proceedings of the National Academy of Sciences of the United States of America. 110 (31): 12–577–12582. Bibcode:2013PNAS..11012577J. doi:10.1073/pnas.1301428110. PMC 3732961. PMID 23858453.

- West SA, Griffin AS, Gardner A (2007). "Evolutionary explanations for cooperation". Current Biology. 17 (16): R661–R672. doi:10.1016/j.cub.2007.06.004. PMID 17714660. S2CID 14869430.

- Furusawa, Konishi, T, H (2011). "Contributing or free-riding? Voluntary participationin a public good economy". Theoretical Economics. 6 (2): 219–256. doi:10.3982/TE567.

- Ray Powell (June 2008). "10: Private goods, public goods and externalities". AQA AS Economics (paperback ed.). Philip Allan. p. 352. ISBN 978-0-340-94750-0.

- Graves, P. E., "A Note on the Valuation of Collective Goods: Overlooked Input Market Free Riding for Non-Individually Incrementable Goods Archived 30 June 2013 at the Wayback Machine", The B.E. Journal of Economic Analysis & Policy 9.1 (2009).

- Babe, Robert (1995). "Chapter 3". Essay in Information, Public Policy and Political Economy. University of Ottawa: Westview Press.

- Brown, C. V.; Jackson, P. M. (1986), "The Economic Analysis of Public Goods", Public Sector Economics, 3rd Edition, Chapter 3, pp. 48–79.

- Wicksell, Knut (1958). "A New Principle of Just Taxation". In Musgrave and Peackock (ed.). Classics in the Theory of Public Finance. London: Macmillan.

- Maskin, Eric (8 December 2007). "Mechanism Design: How to Implement Social Goals" (PDF). Nobel Prize Lecture.

- Bramoullé, Yann; Kranton, Rachel (July 2007). "Public goods in networks". Journal of Economic Theory. 135 (1): 478–494. doi:10.1016/j.jet.2006.06.006.

- Elliott, Matthew; Golub, Benjamin (2019). "A Network Approach to Public Goods". Journal of Political Economy. 127 (2): 730–776. doi:10.1086/701032. ISSN 0022-3808. S2CID 158834906.

- Galeotti, Andrea; Goyal, Sanjeev (September 2010). "The Law of the Few". American Economic Review. 100 (4): 1468–1492. doi:10.1257/aer.100.4.1468. ISSN 0002-8282.

- Hart, Oliver (1995). Firms, Contracts, and Financial Structure. Oxford University Press.

- Besley, Timothy; Ghatak, Maitreesh (2001). "Government Versus Private Ownership of Public Goods". The Quarterly Journal of Economics. 116 (4): 1343–72. CiteSeerX 10.1.1.584.6739. doi:10.1162/003355301753265598. ISSN 0033-5533. S2CID 39187118.

- Halonen-Akatwijuka, Maija (2012). "Nature of human capital, technology and ownership of public goods". Journal of Public Economics. Fiscal Federalism. 96 (11–12): 939–45. CiteSeerX 10.1.1.173.3797. doi:10.1016/j.jpubeco.2012.07.005. S2CID 154075467.

- Schmitz, Patrick W. (2015). "Government versus private ownership of public goods: The role of bargaining frictions". Journal of Public Economics. 132: 23–31. doi:10.1016/j.jpubeco.2015.09.009.

- Halonen-Akatwijuka, Maija; Pafilis, Evagelos (2020). "Common ownership of public goods". Journal of Economic Behavior & Organization. 180: 555–578. doi:10.1016/j.jebo.2020.10.002. ISSN 0167-2681. S2CID 169842255.

- Schmitz, Patrick W. (2021). "Optimal ownership of public goods under asymmetric information". Journal of Public Economics. 198: 104424. doi:10.1016/j.jpubeco.2021.104424. ISSN 0047-2727. S2CID 236397476.

- Kianpour, Mazaher; Kowalski, Stewart; Øverby, Harald (2022). "Advancing the concept of cybersecurity as a public good". Simulation Modelling Practice and Theory. 116. doi:10.1016/j.simpat.2022.102493. ISSN 1569-190X.

- Chattopadhyay, Saumen (2012). Education and Economics: Disciplinary Evolution and Policy Discourse. Oxford University Press. ISBN 9780198082255.

Bibliography

- Coase, Ronald (1974). "The Lighthouse in Economics". Journal of Law and Economics. 17 (2): 357–376. doi:10.1086/466796. S2CID 153715526.

Further reading

- Acoella, Nicola (2006), ‘Distributive issues in the provision and use of global public goods’, in: ‘Studi economici’, 88(1): 23–42.

- Anomaly, Jonathan (2015). "Public Goods and Government Action". Politics, Philosophy & Economics. 14 (2): 109–128. doi:10.1177/1470594X13505414. hdl:10161/9732. S2CID 154904308.

- Lipsey, Richard (2008). Economics (11 ed.). pp. 281–283.

- Zittrain, Jonathan, The Future of the Internet: And How to Stop It. 2008

- Lessig, Lawrence, Code 2.0, Chapter 7, What Things Regulate

External links

| Library resources about Public good (economics) |

- Public Goods: A Brief Introduction, by The Linux Information Project (LINFO)

- Cowen, Tyler (2008). "Public Goods". In David R. Henderson (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0-86597-665-8. OCLC 237794267.

- Global Public Goods – analysis from Global Policy Forum

- The Nature of Public Goods

- Hardin, Russell, "The Free Rider Problem", The Stanford Encyclopedia of Philosophy (Spring 2013 Edition), Edward N. Zalta (ed.)