This article was co-authored by Alan Mehdiani, CPA. Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

This article has been viewed 110,737 times.

When browsing in your favorite department store, the prices listed aren't actually telling you the total cost. Most cities and states charge a sales tax, driving the price of a cool new jacket or a fabulous piece of jewelry past what is listed on the tag. Depending on where you are sales tax may differ, so it's important to be able to quickly and easily figure out how much you'll be charged at checkout. Follow one of these easy methods to figure out your final tab.

Steps

Calculating the Exact Amount of Sales Tax

-

1Determine the sales tax rate in your location. You can look it up online or ask a sales associate what it will be. While states usually set a statewide sales tax, some municipalities add their own taxes on top of that. This means that the sales tax rate can vary drastically when moving between different cities or counties.[1]

- Sales tax is not charged on all items you buy. Check online to see what is, and is not, taxed in your area.

-

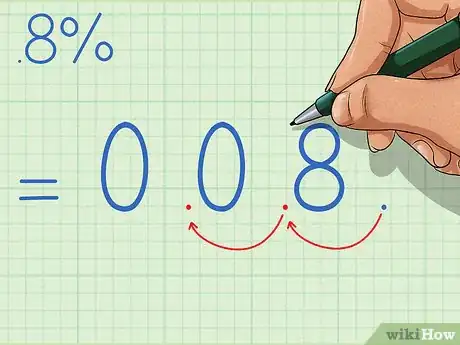

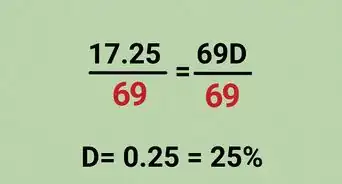

2Convert the sales tax percentage into a decimal figure. Take the percent number and imagine a decimal point after it. Now move that decimal point two spaces to the left, giving you the decimal equivalent of the sales tax percentage. For example, if the sales tax rate is 8%, the decimal figure will be .08.[2]Advertisement

-

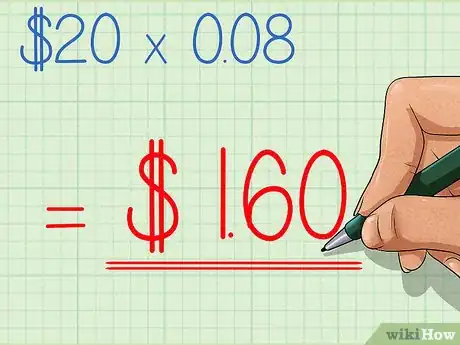

3Multiply the price of the item by the decimal figure you calculated in the previous step. This calculation will give you the amount of tax that will be charged for your purchase. For example, if the item you want to buy is $20, multiply 20 times .08 and you get 1.6. That means you will have to pay $1.60 in sales tax.[3]

-

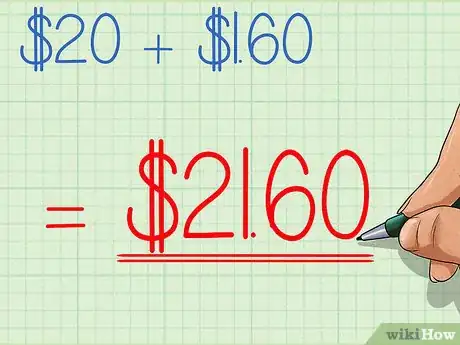

4Add the amount of tax you calculated to the listed price. This will give you the total price you will have to pay at the register. Using our same example once again, if you will be charged $1.60 on your $20 item, simply add 1.6 to 20, for a total of $21.60.

Estimating the Amount of Sales Tax

-

1Round the sales tax rate to 10%. No matter what the actual tax rate is, this will make your multiplication much simpler. The goal in estimating sales tax is to make the math simple enough to do in your head. Don't bother with exact amounts, just estimate well enough to make sure you have enough money to pay for what you want to buy. By using an estimate of 10% it will mean that, in most cases, you are rounding up, making your estimate more than you will actually pay.[4]

- If you are actually rounding the tax rate down, make sure to remember that your estimate will be a little bit less than you will need to pay.

-

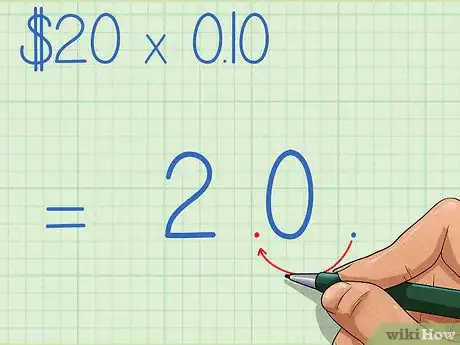

2Move the decimal point in the cost of your item one space to the left. This will give you a good, quick estimate of how much tax you will be charged. No need for complicated calculations, just move the decimal over and that will give you 10% of the cost on the tag.[5]

- In doing this, you are actually multiplying the cost of your item by the decimal equivalent of 10%, which is obviously really easy! For example, .10 times $20 equals $2.

-

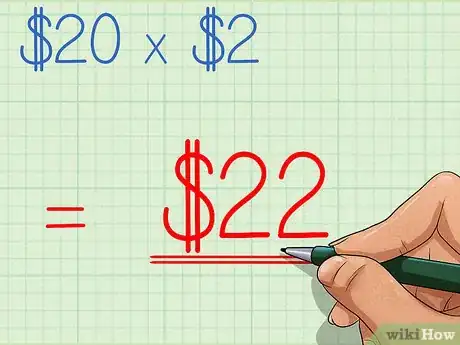

3Add the estimated tax to the cost of the item. Because we rounded up, your estimate will probably be higher than the tax actually charged, but you will know you can afford to pay the total cost. To use our example from the previous step one more time, $20 plus $2 makes the estimated total cost including tax $22.

Community Q&A

-

QuestionWhat's the tax on $34 with sales tax being 8.75%?

Community AnswerAbout $37.06. I rounded the .75 up because that’s what they do in stores, so it's 9%.

Community AnswerAbout $37.06. I rounded the .75 up because that’s what they do in stores, so it's 9%.

References

- ↑ https://www.salestaxinstitute.com/resources/rates

- ↑ https://www.dummies.com/education/math/basic-math/how-to-calculate-percentages/

- ↑ https://www.dummies.com/education/math/basic-math/how-to-calculate-percentages/

- ↑ https://medium.com/i-math/how-to-tackle-difficult-percentages-mentally-b1f5f29eb503

- ↑ https://medium.com/i-math/how-to-tackle-difficult-percentages-mentally-b1f5f29eb503

- ↑ https://www.avalara.com/us/en/blog/2016/01/native-americans-and-sales-taxes.html

- ↑ http://www.salestaxinstitute.com/resources/rates

About This Article

To add sales tax, start by determining the sales tax rate in your city and converting it into a decimal. If, for example, your city’s tax rate is 8%, you would convert it to 0.08. Next. multiply the decimal by the price of the item you want to buy in order to calculate your sales tax. For example, if your item is $20, multiply 20 by 0.08 to get $1.60, which is the sales tax. Finally, add $1.60 to $20 to get $21.60, which is the total price you would need to pay at the register. To learn more, like how to estimate your sales tax when you don’t have a calculator, read on!