wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 13 people, some anonymous, worked to edit and improve it over time.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 92% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 63,074 times.

Learn more...

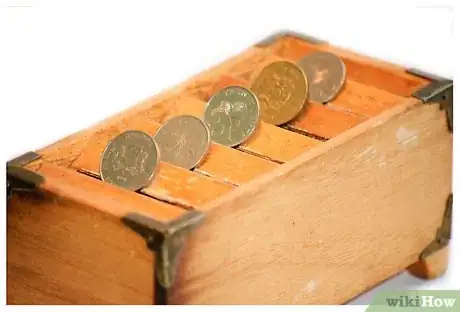

Frugality is a lifestyle of living well within your means. It means spending less than you make so that when a crisis arises, you can weather it calmly knowing you have both the savings to survive and practice using your money wisely. Many individual decisions add up to a lifestyle of frugality. While some decisions may save hundreds of dollars, others may only save ten cents. However, keep in mind if you take care of the pennies, the dollars will take care of themselves.

Steps

Reducing spending

-

1Review your spending habits. Every expense is fixed, variable, or discretionary. Fixed expenses are mandatory expenses that are always the same and cannot be influenced by your decisions. Examples include rent and health insurance. Variable expenses are mandatory expenses that you can influence the cost of. Examples include utility bills and transportation costs. Discretionary expenses are expenses that could be eliminated entirely if needed. Examples include alcohol, entertainment, and restaurant meals.

-

2Reduce your spending.

- Eliminate discretionary expenses that do not provide you with pleasure. For example, do not participate in the office gift exchange if you do not enjoy it.

- Cut back on discretionary expenses that provide you with pleasure to maximize your enjoyment to dollar ratio. For example, eating one nice meal each month in a sit down restaurant instead of taking a weekly trip to McDonalds may save you $10, and it will give you more pleasure for the money that you do spend.

- Think of ways to cut your variable expenses. Use the tips below. Think creatively about ways to reduce expenses.

-

3Cut your spending further. Every budget has a little fat. Trim yours slightly more. Incorporate a new tip every few weeks. Decide what works for you and stick with it.

Removing debt

-

1Get out of debt. Debt costs you a lot of extra money. It may be wise to eliminate all discretionary spending until you are out of debt. Interest on debt does not provide you with pleasure, and going into debt is optional.

-

2Use only cash to make payments. Work out how much you need for spending on food, fuel and fun for the month - this is after you have paid bills and transferred savings. Once you have done this, knock off £50 pounds and transfer it into savings - that's only £12 a week that you'll be short and this can be easily absorbed in some frugal food shopping - if you don't need it, don't buy it.

- Withdraw the amount decided upon from the bank after each pay day.

- Split the amount withdrawn into the number of weeks until your next pay day and put it into separate envelopes and seal them. By doing this, you'll be less likely to dip into them. (Each envelope is only to be opened at the end of each week.)

- Try to live on less than you have budgeted for each week - treat it as a competition with yourself - saving money starts to become addictive, but it is important once a month to do something nice that doesn't cost too much, so budget for this too - go to the cinema; have a meal out; brunch with friends or family; go for a walk and have a drink in the beer garden before walking home; pay for a gym subscription or something else that floats your boat - always go dutch.

- Remember - only buy things that you have the cash for in that week's money, or, save over to next week what you have towards the item and buy it then... you may have to do this for a couple of weeks, or longer, until you have enough money, but there is something very satisfying in buy in cash and knowing that you don't owe anyone anything for it and that the item is 100% yours.

- At the end of each week or month, pay what you have managed to save off something that you owe, or into a savings account - you'll be surprised at how quickly you clear debt, or how quickly it adds up in savings.

Saving

-

1Save for items you want to buy. Only buy items you have money in hand for. Do not finance, use payment plans, or carry a balance on a credit card. Paying cash will save you money.

-

2Celebrate your success! Enjoy the things you own knowing you worked hard for them. Notice your peace of mind knowing there is money in the bank. Share your cost cutting tips with other frugal people. Think of the frugal lifestyle in positive ways.

References

- investorstimes.blogspot_com/ – research source