This article was co-authored by Samantha Gorelick, CFP®. Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner™ designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.

There are 14 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 458,237 times.

Depending on where you live in the world, your minimum wage could be less than $7 a day or just below $7 an hour. If you are trying to live off your minimum wage job, you may be struggling to pay for your living expenses and your meals every month. Recently, there has been a push in the media for raising the minimum wage for the millions of people working minimum wage jobs.[1] While it may be challenging at first, with some small adjustments to your living expenses and your lifestyle, you can make the challenge of living on minimum wage more manageable.

Steps

Minimizing Your Living Expenses

-

1Reduce your housing costs. If your rent is more than you can afford right now, consider moving to a cheaper part of town. Research apartments in another building or area of the city that are cheaper than what you pay now. Even a savings of a few hundred dollars a month can make a big impact on your budget and allow you to spend that money on other necessities or expenses.[2]

- Consider downsizing your living situation if possible. For example, if you are currently living in a two bedroom apartment, perhaps a nice one bedroom may suffice. Ask yourself how much space you need as opposed to how much space you want. Even a slight reduction in this area can save money.

- Consider a new location. Look for the most affordable areas in your city, but keep in mind trade-offs exist. For example, you may save money on rent, but your transportation costs may increase. Similarly, you may save money on rent, but need to live in a less safe neighborhood. There are also states in the U.S. with a lower cost of living, so perhaps a bigger move, to another state, might be an option for you.

- You can apply for affordable or middle-income housing, but you may have to wait a while before something becomes available.[3]

- Don’t rush to move to a new city or state without a safety net like a job or a family member you can live with until you get on your feet. The benefits of a cheaper cost of living may not matter if you are in a new environment with no income.

-

2Get a roommate. In most cities and towns, finding affordable housing can be a nightmare. There may be subsidized housing available, but it will likely come with a long waiting list. So the next best thing to cheap rent is someone to share the cost of rent, as well as your utilities.[4] [5]

- If you live in a house, consider renting out an extra room, or the basement.

- Always do a background check and a references check on any potential roommates. You want to be sure you are not letting anyone dangerous or shady into your home. You will be dependent on your roommate to come up with rent every month, so make sure they can afford to live with you before you agree to be their roommate.

- Considering signing a roommate agreement for legal protection. Templates can be found online, and these agreements establish exactly who pays what, who is responsible for what, and who owns what. These agreements can help if a dispute occurs.

Advertisement -

3Seek alternative child care. Professional child-care can be extremely expensive. A more affordable option is to consider utilizing family or friends.[6]

- Consider asking a family member or trusted family friend who you can pay an affordable rate to watch your kids while you’re at work. This will likely be less than professional child care and also foster a closer relationship between your kids and your immediate family.

- While this may not be feasible, if you are in a relationship, explore the possibility of one partner staying home to watch the kids.

-

4Visit your local food bank or soup kitchen, and use food stamps. Search for your local food bank online[7] [8] and get a free hot meal. Your local soup kitchen is also a great place to get a free hot meal and save your minimum wage for your rent or other necessary expenses.

- Food stamps, also known as SNAP (Supplemental Nutrition Assistance Program) in the U.S., is a government run program that provides funds for food. Eligibility is based on your income and the benefits provided by the state you live in.[9]

- Most individuals who live on minimum wage qualify for food stamps. Depending on your eligibility and the amount of people in your household, you can receive $150 - $300 a month in food benefits.

-

5Trade, rather than pay, for services. Having trouble starting your car before work in the morning? To save money, ask a friend for help before you head to an auto repair shop. Or see if you can get a referral to someone skilled at car mechanics and complete a job or task you are good at for them as repayment.[10]

- Trading services with a friend or roommate will cut down on your expenses and allow you to solve any logistical problems through skills, rather than money.

-

6Shop for discounts. By seeking more affordable options, it is possible to save a significant amount each month. Seek out household items at your local thrift store or used clothes shops.[11] Use your local library to take out books, movies, and magazines instead of spending money at a retail shop.[12]

- When you have a limited budget, it may be hard to justify a spontaneous purchase and simple items like a new book or a new pair of shoes can seem like luxuries. Rather than depriving yourself of enjoyable items, look for the discounted or free alternative.

- Try to have fun with the hunt for discounts. Make it your mission to look for a used item in great condition at a garage sale or a thrift store, for half or one third of the price of a new item.

- Consider thrift locations like the Salvation Army or Value Village. As well, yard sales, or discount and outlet stores like TJ Maxx or Marshalls can offer attractive deals. Outlet stores like TJ Maxx or Marshalls offer brand name quality, except at up to 60% discounts since they receive inventory from overbuys at other locations. Additionally, watch for sales from other retailers as an opportunity to buy quality for less.

-

7Apply for Medicaid coverage. Health care costs can add a significant burden, and if you are a low-income person in the United States, you can apply for Medicaid. Medicaid can provide free or very low cost coverage for some individuals with low incomes.[13]

- To determine if you qualify, visit Healthcare.Gov, where you can also fill out an application.

- Qualification rules vary from state to state (each state has different eligibility requirements based on income, household size, disability status etc.). Since rules vary so significantly between states, the only way to determine if you qualify is to visit Healthcare.Gov.

-

8Reduce your debt costs. Debt repayments (be it an auto-loan or credit card debt) can take up a significant portion of monthly income. Fortunately, it is possible to reduce these costs through tactics like negotiation, debt consolidation loans, or refinancing.

- Ask your lender for a lower interest rate. It is possible to lower interest rates simply by asking your lender, and this can be especially effective for credit card debt which is often the highest interest. In a recent survey, 56% of individuals (of all credit backgrounds), who asked to have their interest rates lowered were successful. Emphasize that other lenders are willing to offer lower rates, and that you will consider switching if the rate is not matched. [14]

- Consider a debt consolidation loan. If you have a large credit card debt or multiple credit cards with debts, a debt consolidation loan allows you to take out a new loan with a lower interest rate (such as a line of credit), and transferring your debt to that loan. Due to the lower interest rate and often longer terms, you will likely have lower monthly payments.

- Refinance your car loan. If you do have a car loan, contact your lender to discuss refinancing. If interest rates have come down, there is a good chance you can get a new loan with lower interest rates, or potentially even a longer term. The end result is lower payments.

- Remember to avoid predatory loans when seeking the services mentioned. To avoid these types of loans, watch out for key warning signs like extreme interest rates (over 20%), penalties for paying off a loan early. By shopping around for lenders, you can better understand what reasonable rates are. By sticking with large, well-known financial institutions and banks, you can reduce your odds of receiving a predatory loan.

Adjusting Your Lifestyle

-

1Walk to work, bike to work, take the bus or carpool. From maintenance to insurance to parking, owning a car is a big expense when you’re living on limited funds. So if possible, sell your car and opt for walking to work if you live close enough. Another option is buying a bike to cut down on the travel time to and from work if you live miles away.[15]

- You can also invest in a bus pass and take public transit. Buying a bus pass will be more cost efficient than single rides if you plan to use the bus twice a day, five days a week.

- If you have a co-worker who lives close to you, ask them if you can carpool. Not only will this save you both money, it will also allow you to get a jump on traffic in the carpool lane!

- If selling a car is not an option for you, look into reducing your monthly gas costs. You can reduce gas costs by walking more or using a bike, leaving your car only for the most essential trips. This may require a lifestyle change, but even reducing your gas usage by 25% can have a large impact[16]

-

2Bring your own lunch to work. A sandwich from the deli and vending machine food can add up if you are buying them more than two or three times a week. In fact, home prepared meals are good for your wallet and for your health.[17]

- The price of groceries for a week are certainly less than eating out every day, especially if you look for deals at your grocery store. Get a club card at your local supermarket and take advantage of daily discounts. Use coupons to save money on your weekly food expenses.

- There are many great recipe blogs and books focused on cooking on a tight budget. Look at sites like Budget Bytes[18] and Simply Recipes[19] for recipes that won’t break the bank and still taste delicious.

- While you’re at it, go for the coffee machine at the office instead of a pricy latte at the coffee shop down the street. Try to curb your chai latte habit to once a week or twice a month and take advantage of the free coffee at work.

-

3Sell anything you don’t need. This may seem obvious, but often we hold on to items that we don’t use often enough to justify keeping. Look closely at the things you own and decide if there are things you could part with, like the waffle maker you haven’t touched in five years or the hockey sticks you haven’t used since you were 12.[20]

- Put the items up for sale online or hold a yard sale. Getting rid of items you don’t use in exchange for cash means more money in your bank account.

-

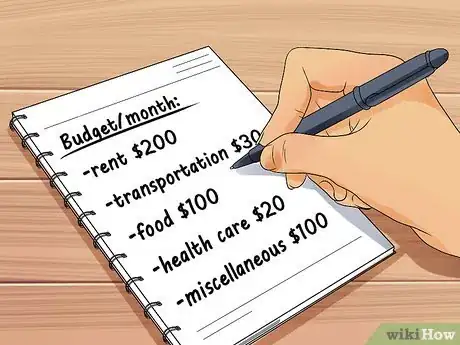

4Create a budget and stick to it. Determine what your basic expenses will add up to every month to make sure you don’t spend money you don’t have. These likely include:[21]

- Rent and utilities. Depending on your living situation, you may be splitting these expenses with a roommate or a partner. Your landlord may also pay for your heat, or you may pay for your electricity every month.

- Transportation. Are you walking to work every day? (Free) Biking? (Free after the initial payment for the bike and minor bike maintenance) Taking the bus? (Requires a bus pass) Carpooling? (Less than paying for gas and car maintenance on your own)

- Food. Factor the average amount per a week for meals for the month.

- Health care. With the passage of the Affordable Care Act, you are now required to carry health coverage. Use the Healthcare.gov website previously mentioned to help find the most affordable rates available to you.

- Miscellaneous expenses. If you have a pet, this could be where you determine how much pet food will be for the month. If you and your partner go for a date night once a month, factor this in as an expense. Account for every expense you can think of so you do not spend money without knowing exactly where it is going.

- If you have any debt payments, add these to your budget under necessary expenses.

- You should then compare your expenses to your monthly income. Though you may not make much on minimum wage, your expenses should never exceed your income. If this is the case, you may need to consider minimizing your expenses further. You may need to make more income through another part time job or make extra cash through mowing lawns or babysitting for a friend.

-

5Become aware of wants vs needs. Once your budget is made, be careful to look at which expenses are wants and which expenses are needs. A need is anything that is absolutely required for living, whereas a want is something that is simply nice to have. When looking at expenses to reduce, look to reduce wants first. This ensures as much money as possible is available for necessary expenses.

- For example, a cell phone may be a need. However, a 3GB data plan may be a want. In that case, 1GB plan may be sufficient, and by downgrading your plan, you can reduce costs.

- Carefully look through every expense and honestly ask yourself if it is a want or a need.

- It's okay to buy something that's really meaningful to you, but try to stay away from mindless impulse purchases.[22]

-

6Consider a career move that could lead to a higher wage. If you are frustrated by the limitations of a minimum wage job, consider working towards another career with better wages. [23]

- Research jobs that only require a two-year associate degree, such as a dental hygienist, a web developer, or a pharmacy assistant. These positions have starting salaries of $50,000 - $60,000 and are in high demand.

- Look into classes at your local community college and speak to representative at their financial aid office. There may be programs available in high demand careers that pay your tuition in exchange for a commitment to a new career.

Paying off Debt and Saving Money

-

1Pay off your debt before you buy anything new. Your number one priority should be to pay off all debt so you can start to save. While diverting funds to debt repayment instead of other necessary purchases may be difficult, it can pay off in the long run. Keep some funds in the bank as an emergency fund and pay off your creditors.[24] [25]

- If you get a big tax return or a sudden rebate from the government, always pay your debts off before you buy anything for yourself. If you don’t have any debt and suddenly come into some extra money, bank at least half of it for emergencies or another time when you are not as flush.

- Debt repayment can represent a significant monthly cost. By reducing your debt, you can in-turn free up extra cash for saving or to go towards your monthly expenses.

- Consider balance transfer credit cards. These cards often have a 0% interest rate for a period for balances transferred from other credit cards. By transferring your balance, you can enjoy low or even interest free payments for a period, which allows you to reduce your debt quicker through 100% of your payment being applied to principle. Note that the low interest rate period often lasts for only 12-24 months, so make sure you use this period to eliminate as much debt as possible. Afterwards, a higher interest rate will apply.

-

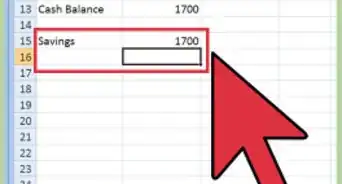

2Save your pennies. Literally. Put your small change in a jar. Once the coins start to pile up, roll up the coins and deposit them into your savings account. Even $10 or $20 in small change can mean more money towards food or extra expenses.[26]

- Try transferring a little bit of money to your savings on a consistent basis. As you get used to setting aside this money, start increasing the increment.[27]

-

3Avoid using credit cards. Every expense you charge on your credit card will need to be repaid, with interest. If you’re earning $8 an hour, repaying thousands of dollars may feel like a huge and impossible challenge. Piling up credit card debt will only make it more difficult to cover all your expenses, plus your debt payments.[28]

- Outstanding debt can also make it difficult to negotiate for a down payment for a house or car down the line.

- While it may be difficult, if you have a large credit card debt, consider stopping credit card use all together and cutting up your credit cards. Assume if you can't afford something without a credit card, that you should not be purchasing it at all. To assist in this, use your monthly budget as described above to make sure all your essential expenses are covered by the payments from your job. If your salary is insufficient to cover your basic expenses, you can attempt some of the above tips to reduce your monthly expenses to a level that can be covered by your income.

- Leave your credit card at home when you depart for the day to reduce impulse purchases.

References

- ↑ http://www.businessinsider.com/its-hard-to-live-on-minimum-wage-2014-10

- ↑ http://www.moneytalksnews.com/10-ways-save-money-when-youre-making-minimum-wage/?all=1

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ http://www.moneytalksnews.com/10-ways-save-money-when-youre-making-minimum-wage/?all=1

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ http://www.moneytalksnews.com/10-ways-save-money-when-youre-making-minimum-wage/?all=1

- ↑ http://www.foodpantries.org/

- ↑ http://www.feedingamerica.org/find-your-local-foodbank/

- ↑ http://www.fns.usda.gov/snap/eligibility

- ↑ http://money.usnews.com/money/careers/articles/2012/08/16/6-ways-to-maximize-a-minimum-wage-salary

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ http://money.usnews.com/money/careers/articles/2012/08/16/6-ways-to-maximize-a-minimum-wage-salary

- ↑ https://www.healthcare.gov/medicaid-chip/eligibility/

- ↑ http://www.bankrate.com/finance/credit-cards/want-a-lower-credit-card-rate-just-ask.aspx

- ↑ http://www.moneytalksnews.com/10-ways-save-money-when-youre-making-minimum-wage/?all=1

- ↑ http://money.usnews.com/money/careers/articles/2012/08/16/6-ways-to-maximize-a-minimum-wage-salary

- ↑ http://money.usnews.com/money/careers/articles/2012/08/16/6-ways-to-maximize-a-minimum-wage-salary?page=2

- ↑ http://www.budgetbytes.com/

- ↑ http://www.simplyrecipes.com/cooking_on_a_budget/

- ↑ http://www.moneytalksnews.com/10-ways-save-money-when-youre-making-minimum-wage/?all=1

- ↑ https://www.wikihow.com/Budget-Your-Money

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ http://www.moneytalksnews.com/10-ways-save-money-when-youre-making-minimum-wage/?all=1

- ↑ http://www.thesimpledollar.com/ten-steps-to-financial-success-for-a-minimum-wage-earner/

- ↑ http://www.moneytalksnews.com/10-ways-save-money-when-youre-making-minimum-wage/?all=1

- ↑ http://www.thesimpledollar.com/ten-steps-to-financial-success-for-a-minimum-wage-earner/

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ http://money.usnews.com/money/careers/articles/2012/08/16/6-ways-to-maximize-a-minimum-wage-salary?page=2