This article was co-authored by John Gillingham, CPA, MA. John Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

There are 20 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 72,899 times.

There are many reasons to choose self-employment. You may be attracted to the notion of being your own boss. You may have a brilliant idea, a solid sense of an industry, or a natural flair for self-promotion. You may just need money right now. Make a solid plan using the options available to you, and learn your new tax responsibilities for the money you earn.

Steps

Choosing a Business Model

-

1Form a company. You might want to start a company if you have an original business idea, if you have found a service gap in your area, or if you have a skill that is in high demand and would like control over your own schedule. Your company can be a sole proprietorship, a partnership, a corporation, an S corporation, or a Limited Liability Company (LLC).[1]

- To start your own company, you will need a business plan, a product or service, and startup funds.

-

2Open a franchise. If you would like to have your own business but would like the safety of a proven model, consider opening a franchise. Your franchiser will offer training, support, and a tried business model and policies.

- Do not invest in a franchise unless you can afford to potentially lose your entire investment while committed to a multi-year contract. Opening a franchise means sticking to your contract for the years specified, even if you are not turning a profit.[2]

Advertisement -

3Become an independent contractor. Independent contractors are freelancers, consultants, and other workers who are not employees. Independent contractors have more freedom to determine their own schedules than employees, but are liable for health insurance and paying self-employment taxes.[3]

- Highly skilled professionals such as accountants and engineers are often independent contractors. So are skilled laborers such as truckers, construction workers, and art models.[4]

-

4Use what you have. There are myriad ways to work for yourself using the skills and resources you already have. Become a dog-walker, a junk-hauler, a bicycle-delivery person, a freelance writer, a babysitter or a web developer. If you are looking to start your business quickly, take stock of your skillset and go from there.

- Work for an App. One quick way to get a job as an independent contractor is to sign up with a rapidly-expanding company with minimum requirements for hiring. Airbnb hosts and Uber drivers are independent contractors.[5]

Setting Up Your Business

-

1Write a business plan. If you are going into business with someone else, or if you are expecting to attract investors, you will need a formal business plan. This should include a summary of your business plan, a description of your company, an analysis of the market you are entering, a description of your company's structure, a description of your service or product, a statement on marketing strategy, financial projections, and, if you showing this to investors, a request for funds.[6]

- Your business plan will start with the summary, but you should write it last.

- If you are working only with yourself, it still pays to write up your business goals, your projected profits, and the steps you plan to take toward achieving them.[7]

-

2Choose a location. If you need an office space or a storefront, find it. If you are not ready to commit to a rental, or if you are planning on working from home, you can register your house as a home office. There may be exceptions for some forms of company in some states. Post office boxes are generally considered bad form for businesses, and may not fulfill legal requirements for some business models.[8]

- Independent contractors are not required to register a business address.

-

3Finance your business. Determine how much money you need to start your business. Make a budget that accounts for permit and license fees, rent, retirement plans, insurance, an initial purchase of goods, and anyone you will need to hire.[9] Search for business start up expense calculators. To make the money you will need, apply for loans and private and government-sponsored grants. Pursue venture capital by offering shares to investors.[10]

- Apply for a loan with your bank or with the Small Business Administration: [1]

- If you are starting a low-cost business such as lawn-mowing or babysitting, you may not need any financing at all.

-

4Register a name. If you are forming a company, you will need a name. Think of something distinctive that describes the services you are offering. Search for your company's name in the Department of State Business Registry under "Corporate Name Availability" to make sure nobody else has used it. Every state maintains its own list of business names and the departments that control these lists go by different names. The state Secretary is often in charge of managing this list. Once you know your name is original, register it with the appropriate department.[11]

- Register through the Department of State Website, or mail in your form to the address they give.

- Comply with legal requirements for your business structure. If you form an LLC, for example, you may be required to include the abbreviation "LLC" in your company's name. [12]

-

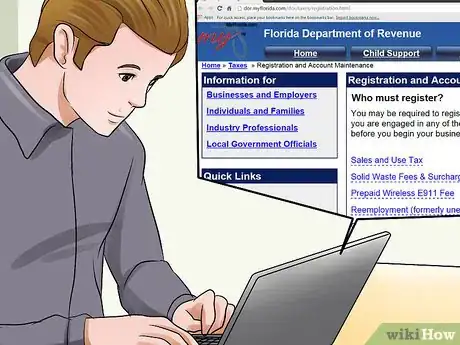

5Register with the Department of Revenue. If you want your company to have employees, or sell goods and collect sales tax, you’ll need to register with the Department of Revenue.[13] Go to your state's Department of Revenue and register there.

- If you are the only member of your new business, and will not collect sales tax, you will pay self-employment tax instead.[14]

Choosing a Business Structure

-

1Consider forming a sole proprietorship. If you open an unincorporated business alone, you are a sole proprietor. Sole proprietors are responsible for paying the entirety of their company's taxes, but reap the entirety of profits earned. Consider founding a sole proprietorship if you would like to answer only to yourself and can personally afford financial setbacks.[15]

- Sole proprietors are not the same as sole members. If you are the sole member of a domestic limited liability company (LLC), but choose to classify the LLC as a corporation, you are not a sole proprietor.

-

2Form a partnership if you want to work with someone else. If you would like to share gains, losses, responsibilities and labor with one or more people, consider a partnership. Like a sole proprietorship, owners of a partnership pay individual taxes. If you would like to be your own boss but be responsible to an equal, a partnership is an excellent model.[16]

- Employees do not count as partners, or vice versa.

-

3Choose a Limited Liability Company (LLC) structure over a corporation. An LLC combines many of the advantages of sole proprietorships/partnerships and corporations for its owners. If you own an LLC, you are considered a "member." Most states allow single-member LLCs, as well as partnerships. If you form an LLC, you will be protected from personal liability for business debts as if you were corporation.[17]

- Additionally, you will not be required to pay corporate taxes. LLC owners pay personal taxes, much like owners of partnerships and sole proprietorships.[18]

-

4Consider forming a corporation. An LLC (limited liability corporation) is cheaper to run, but there are also reasons to incorporate. For example, you may choose to form a corporation if you want to be able to offer stock options.[19] This can help you attract investors and highly skilled employees. Corporations are taxed at a lower rate than individuals, so you can save money on a highly profitable business by keeping profits inside the business.[20] However, profits in a corporation are taxed at a corporate level, then the profits are taxed again at a personal level when they are distributed to owners in the form of dividends. Therefore, the actual taxes might be greater than they would be if paid on a pass through basis.

- If you are an independent contractor and your clients want you to be incorporated so that you do not show up in their tax records as an employee, you might choose to incorporate.[21]

-

5See if you might count as an S corporation. If you form an S corporation, you pass financial gains, losses, deductions and credits to your shareholders. You and your shareholders will be taxed as individuals, and your corporation will not be taxed.

- To qualify as an S corporation, the company you form must be domestic, have no more than 100 shareholders, and have only one class of stock. Other restrictions may apply.[22]

Paying Self-Employment Taxes

-

1Get an EIN. Request an EIN if your company has more than one owner or member, if you plan to hire any employees, or if you choose to be taxed as a corporation rather than an independent contractor or sole proprietorship. Get your EIN through the IRS website. Your EIN is free.[23]

-

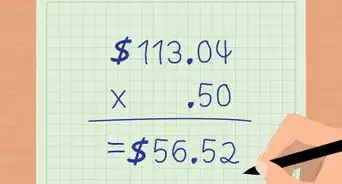

2Pay quarterly estimated taxes. Self-employed people must pay quarterly estimated taxes throughout the year.[24] Failure to pay your estimated taxes so may result in a penalty. To pay quarterly estimated taxes, fill out form 1040 ES: [2]

- Due dates for estimated taxes are April 15th, June 15th, September 15th, and January 15th.[25]

- If you are an independent contractor, the companies you work for will send you a 1099-MISC instead of a W2. You must still pay quarterly estimated taxes.

-

3Track your expenses. Keep a separate bank account for your work, and track any expenses related to it (cell phone, gas money, website maintenance).[26] If you work from home, you may qualify for a home office deduction.[27]

- You can get a deduction for anything you spend money on for business that is "ordinary and necessary." This includes salaries and taxes you pay as well as insurance costs.[28]

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhat should I keep in mind when paying taxes as a self-employed person?

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

Certified Public Accountant & Founder of Accounting Play As a self-employed person, you have the combination of having more tax burden, more administrative burden, and no hand holding. Try to practice extreme organization and be ahead of schedule to avoid getting yourself in any trouble. Taxes for the self-employed person should be a year round ordeal. Engage in meaningful tax planning so that you can be ahead of schedule, get things in at the right time, and know where you stand when it comes time to pay taxes.

As a self-employed person, you have the combination of having more tax burden, more administrative burden, and no hand holding. Try to practice extreme organization and be ahead of schedule to avoid getting yourself in any trouble. Taxes for the self-employed person should be a year round ordeal. Engage in meaningful tax planning so that you can be ahead of schedule, get things in at the right time, and know where you stand when it comes time to pay taxes.

References

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center

- ↑ http://www.consumer.ftc.gov/articles/0401-thinking-about-buying-franchise

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ https://www.sba.gov/content/self-employed-independent-contractors

- ↑ https://ttlc.intuit.com/questions/2561815-uber-driver-questions

- ↑ https://www.sba.gov/category/navigation-structure/starting-managing-business/starting-business/how-write-business-plan

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ http://www.dos.pa.gov/BusinessCharities/Business/RegistrationForms/Documents/RegForms/15-8913%20Cert%20of%20Org-Dom%20LLC.pdf

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ https://www.sba.gov/content/venture-capital

- ↑ http://www.dos.ny.gov/corps/bus_entity_search.html

- ↑ http://www.nolo.com/legal-encyclopedia/pennsylvania-form-llc-32189.html

- ↑ http://dor.myflorida.com/dor/taxes/registration.html

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/sole-proprietorships

- ↑ https://www.irs.gov/businesses/partnerships

- ↑ http://www.nolo.com/legal-encyclopedia/llc-basics-30163.html

- ↑ http://www.nolo.com/legal-encyclopedia/llc-basics-30163.html

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/forming-a-corporation

- ↑ http://www.nolo.com/legal-encyclopedia/corporations-faq-29122-4.html

- ↑ http://www.nolo.com/legal-encyclopedia/corporations-faq-29122-4.html

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/s-corporations

- ↑ http://www.nolo.com/legal-encyclopedia/pennsylvania-form-llc-32189.html

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ https://www.irs.gov/publications/p505/ch02.html#en_US_2015_publink1000194638

- ↑ https://ttlc.intuit.com/questions/2926899-how-does-my-work-in-the-sharing-economy-uber-airbnb-etc-affect-my-taxes

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center

- ↑ https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Deducting-Business-Expenses

About This Article

To be self-employed, form a company if you have an original business idea or a skill that's high in demand. If starting your own business sounds too risky, consider opening a franchise, which offers a proven business model with training and support. Alternatively, become an independent contractor by working as a freelancer, such as an engineer or accountant. You can also sign up to work for an app, such as Uber, which employs you as an independent contractor. For tips on how to pay self-employment taxes, read on!

-Step-9.webp)

-Step-9.webp)