This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

This article has been viewed 71,973 times.

The Self Employment Tax is a Social Security and Medicare tax on the net earnings of self-employed individuals in the United States. If you are self-employed, you are responsible for paying the entire tax, as you essentially serve as both employer and employee. The Internal Revenue Service has detailed instructions on how to calculate Self Employment Tax.

Steps

Determining If You Are Responsible for Filing Self-Employment Tax

-

1Understand who has to file self-employment tax. As an individual taxpayer, you are generally required to do so if you meet the following criteria:[1]

- You carry on a trade or business as a sole proprietor or independent contractor.

- You are part of a partnership that carries on a trade or business.

- You are otherwise in business for yourself.

-

2Calculate your net profit from your business. You need to do this by subtracting expenses from your revenue.[2]

- Calculate your net expenses by adding up all of your expenses from the past tax year relating to your business.

- Add up all revenues from your business from the past year.

- Subtract your business expenses from your revenues. This figure is your net profit.

- For example, if you made $1000 in revenues and had $200 in expenses, your net profit would be $800.

Advertisement -

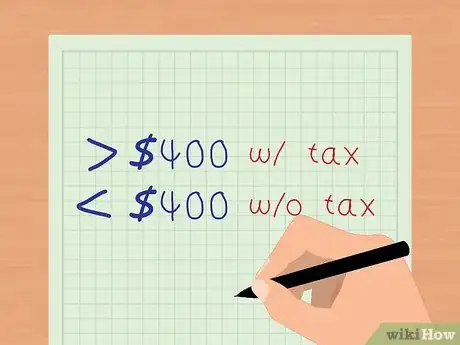

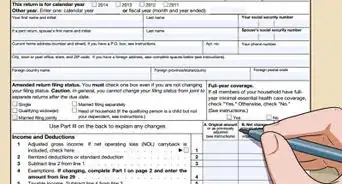

3Determine if you have to file self-employment tax based on your income. The IRS has income guidelines regarding self-employment tax. Self-employed individuals with a net profit of $400 or more must file self-employment tax. If your net profit was less than $400, you do not need to file self-employment tax.[3]

- If you do need to file self-employment tax, you will need to use Form 1040 Schedule SE to calculate your self-employment tax.

-

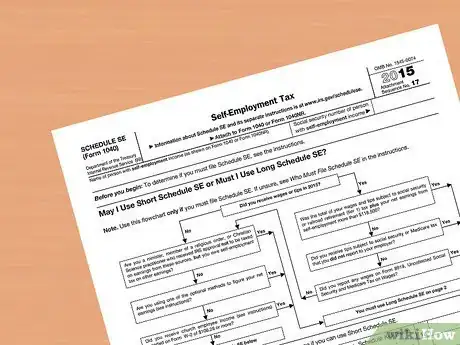

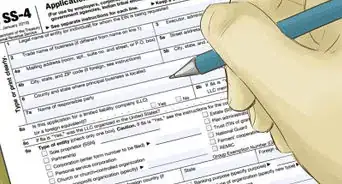

4Use Form 1040 Schedule SE to calculate self-employment tax. There is a short form and a long form on Schedule SE. Use the flow chart on the front to determine which one you will use. You’ll use this form to calculate how much Social Security and Medicare tax you owe based on your total wages and self-employment income.

- For example, if you made up to $128,400 in wages and self-employment income in 2018, that amount of income will be subject to a 6.2% Social Security tax, both for the employee side and the employer side (for a total of 12.4%). Any additional amount above $128,400 is not subject to the Social Security tax.

- All your wages and self-employment income are subject to a Medicare tax. This tax is 1.45% on the employee side and 1.45% on the employer side, for a total of 2.9%.

- Follow the instructions step by step on the form to calculate the tax.[4]

- Use a calculator to do your math. Trying to do this by hand can be time consuming and unnecessarily difficult.

- To fill out this form you will need a completely filled out Schedule C or Schedule C-EZ, receipts and documentation of your expenses and losses, and any other income information.

Calculating Self-Employment Tax Using Short Schedule SE

-

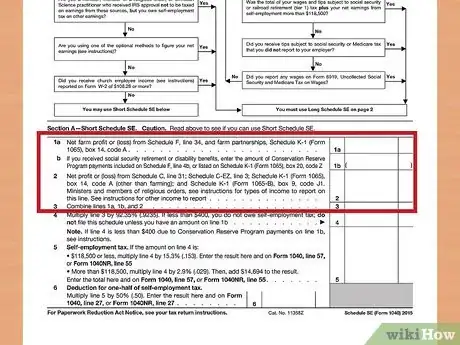

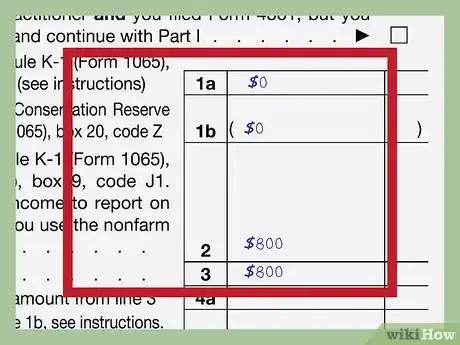

1Complete the first portion to determine net profit. Follow these steps: [5]

- On line 1a, enter net farm profit or loss from Schedule F, line 34. Income from farm partnerships can be found on Schedule K-1, box 14 Code a. If you did not have farm profit, enter 0.

- For line 1b, enter any social security retirement or disability benefits from the Conservation Reserve payments section on Schedule F, line 4b or Schedule K-1, box Z.

- For line 2, enter net profit or loss from Schedule C (line 31), Schedule C-EZ (line 3), or Form 1065 Schedule K-1 (box 14, code A and box 9, code J-1).

- Combine lines 1a, 1b, and 2 and enter this value in line 3 of the form. For example, if you had zero farm income (line 1a), zero social security retirement or disability benefits (line 1b), and $800 profit (line 2), you would enter $800.00 for line 3.

-

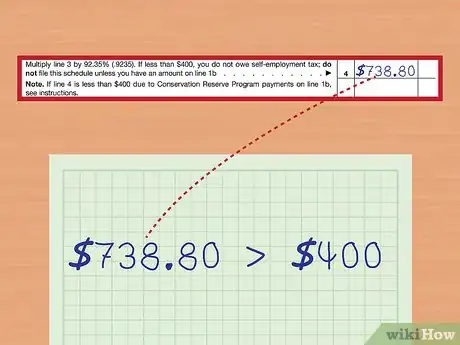

2Multiply the figure in line 3 by 92.35%. To do this, simply multiply the amount from line 3 by .9235.[6]

- Enter this figure on line 4.

- For example, if you had $800.00 profit from self-employment, you would multiply 800 by .9235. 800 x .9235 = 738.80. You would enter 738.80 on line 4 of the Short Schedule SE form.

- If this amount is less than $400, you do not need to pay self-employment tax.

- If this amount is $400 or more, proceed to line 5 of Short Schedule SE.

- In our example, $738.80 is greater than $400. You would need to proceed to line 5.

-

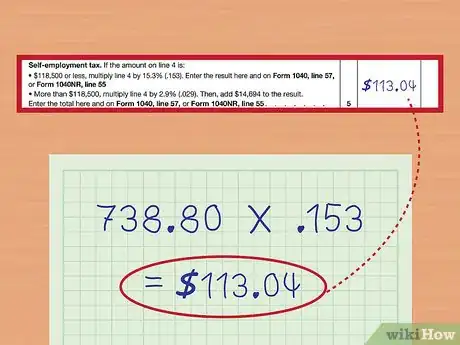

3Fill out line 5 of the Short Schedule SE form. To do this calculation, look closely at the figure you entered on line 4.[7]

- For 2018 returns, if this amount is $128,400 or less, multiply line 4 by .153 and enter this figure in line 5.

- If the amount you entered is more than $128,400 for 2018, you would need to multiply line 4 by .029 then add $15,921.60 to the result. You would then record this figure on line 5.

- For example, if you had $738.80 on line 4, you would multiply it by .153. 738.80 x .153 = 113.04. You would enter $113.04 on line 5 of the form.

-

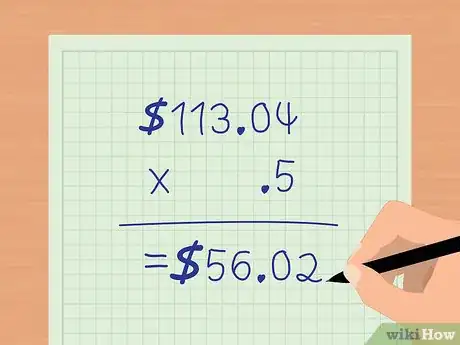

4Complete line 6 of the Short Schedule SE form. You will need the information you entered on line 5 to complete this.[8]

- Multiply line 5 by .50.

- This figure is what you should enter on line 6. This is the deduction for self-employment tax.

- For example, if you had line $113.04 on line 5 of the form, you would multiply this figure by .50. 113.04 x .50 = 56.52. You would enter $56.52 on line 6.

Calculating Self-Employment Tax Using Long Schedule SE

-

1Complete lines 1a, 1b, and 2 on Long Schedule SE. These are the same as in Short Schedule SE (See Part II, Step 1).[9]

- Enter the sum of 1a, 1b, and 2 on line 3 of Long Schedule SE.

- For example, say your farm income was $0 (line 1a), you had no earnings from social security retirement or disability (line 1a), and your business had a profit of $800 (line 2).

- $0 + $0 + $800 = $800.

- You would enter $800 on line 3 in this example.

-

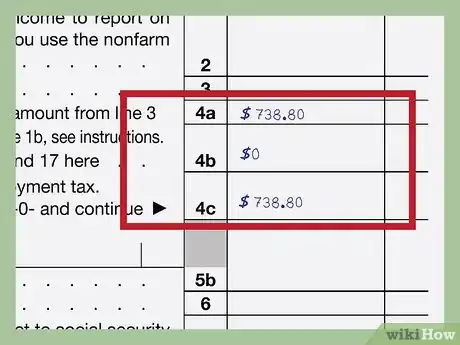

2Complete line 4, parts a, b, and c. You will need the information from 3 to do this. The total from line 4c will tell you if you have to pay self-employment tax or not.[10]

- For 4a, if the figure you entered in line 3 was more than $0, multiply this figure by .9235.

- For example, if you entered $800 in line 3, you would multiply this by .9235 for line 4a. $800 x .9235 = 738.80. You would enter $738.80 for line 4a.

- Fill out 4b using the optional methods on the bottom of the page only if you had farm income. Otherwise, enter $0.

- For 4c, add lines 4a and 4b.

- For example, if you had entered $738.80 in line 4a and $0 in line 4b, your total for line 4c would be $738.80.

- If line 4c is $400 or less, you don't need to file self-employment tax. If line 4c is greater than $400, you will need to proceed with the rest of Long Schedule SE.

-

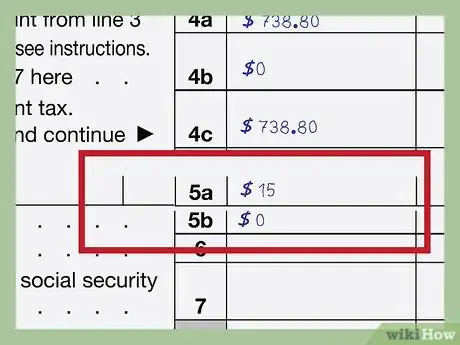

3Complete section 5 for church related income. If you do not have church related income, enter 0 for both lines 5a and 5b.[11]

- Enter church related income on line 5a.

- Multiply line 5a by .9235.

- Enter this amount in line 5b. If the amount is less than $100, enter $0.

-

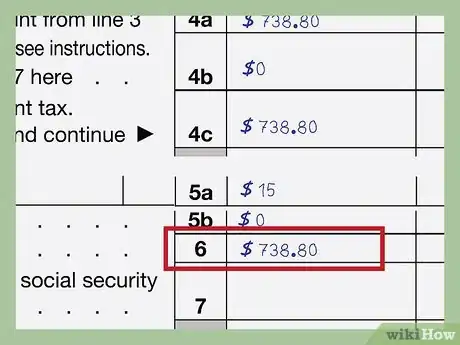

4Complete line 6. This combines earnings from self-employed income and church related income.

- To complete this step, add together the values from 4c and 5b.

- For example, if you entered $738.80 on line for 4c and $0 on line 5b, you would enter $738.80 on line 6.

- Make sure you have done your calculations correctly before moving on.

-

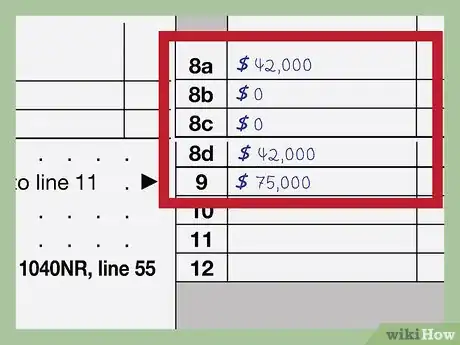

5Fill out lines 8 and 9 of the Long Schedule SE form. You will need any information from your W-2 forms for these lines, as well as information on tips not reported to social security and any other wages subject to social security tax.[12]

- For line 8a, enter social security wages and tips (boxes 3 and 7 on your W-2 forms).

- For line 8b, enter any tips not reported to social security from Form 4137.

- For line 8c, enter any wages subject to social security tax from Form 8919.

- For line 8d, add lines 8a, 8b, and 8c. Enter this value for line 8d.

- Subtract line 8d from line 7. The value for line 7 is $128,400 for 2018. Input this value on line 9.

-

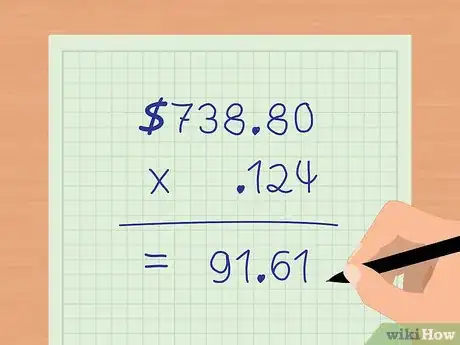

6Complete line 10 of the Long Schedule SE form. You will need to look at line 6 and line 9 of this form to do this.[13]

- Line 10 states to multiply the smaller of these 2 figures by .124: Line 6 or Line 9.

- Multiply line 6 or line 9 by .124.

- Let's assume that line 6 is the smaller of the 2. In this example, line 6 was $738.80.

- $738.80 x .124 = 91.61. You would enter $91.61 for line 10.

-

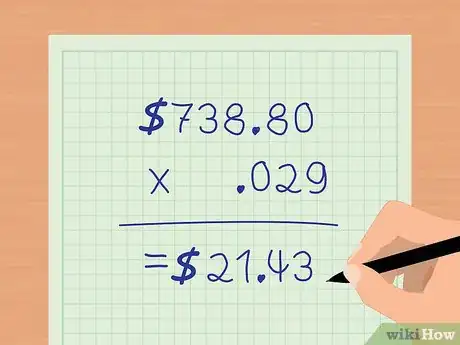

7Complete line 11 of the Long Schedule SE form. You will need the value of line 6 for this step.[14]

- You will need to multiply the value of line 6 by .029.

- For example, if line 6 were $738.80, you would multiply that value by .029. 738.80 x .029 = 21.43.

- Therefore, in this example, you would enter $21.43 as the value for line 11.

-

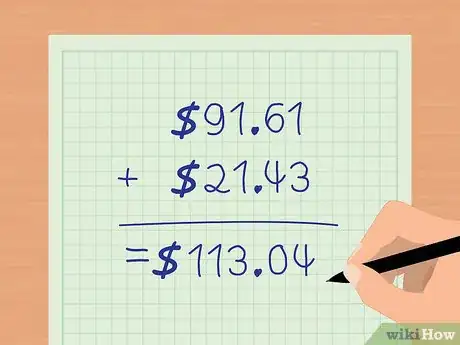

8Fill in line 12 on the form. To do this you would simply add lines 10 and 11 together.[15]

- For example, line 10 was $91.61.

- Line 11 in the example was $21.43.

- $91.61 + $21.43 = 113.04.

- Therefore, in this example, you would enter $113.04 for line 12.

-

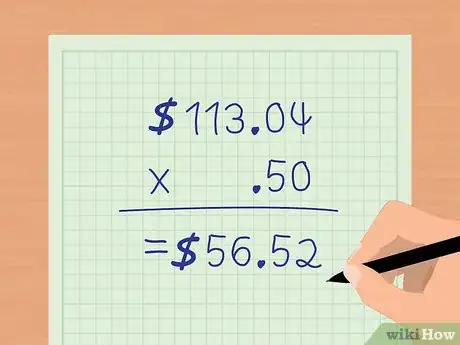

9Complete line 13 of the Long Schedule SE Form. This is the final step, and here you would calculate the self-income tax deduction.[16]

- Multiply line 12 by .50 to calculate this value.

- For example, the value for line 12 is $113.04. 113.04 x .50 = $56.52.

- You would then put in $56.52 for line 13.

- You have now calculated your self-income tax deduction.

References

- ↑ http://www.irs.gov/Individuals/Self-Employed

- ↑ http://www.irs.gov/Individuals/Self-Employed

- ↑ http://www.irs.gov/Individuals/Self-Employed

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040sse.pdf