This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

There are 22 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 45,098 times.

Tax credits reduce the amount of tax that an individual owes to the government. This differentiates them from deductions and exemptions, which reduce the filer's amount of taxable income. Tax credits are offered to individuals in various situations and are usually designed to either help a subset of the population afford their taxes or to encourage certain behaviors.[1] In general, individual tax credits fall into one of the following categories: family, health care, income/savings, education, homeownership, or green energy.[2] Check to see which tax credits you qualify for and use them to reduce your tax burden.

Steps

Understanding Tax Credits

-

1Understand what tax credits are. Tax credits are an amount of money that you can take off of the amount of taxes that you owe in a given year. These reductions in tax burden are offered by the government to people who meet specific criteria, like low-income homeowners or those who make an effort to use green energy.[3]

- The actual amount of the tax credit can depend on your income, your qualifications for the tax credit, and the nature of the tax credit itself.

-

2Compare tax credits to deductions and exemptions. The main difference between credits and deductions or exemptions is that credits are taken off of the amount of tax owed, whereas the other two reduce taxable income.[4] For this reason, tax credits are more valuable than deductions of the same value.

- For example, at a marginal tax rate of 12%, a $500 deduction would result in a reduction in taxes owed of $60. A $500 credit would result in a $500 reduction in taxes owed. This distinction can be useful in cases where you may be able to claim either a deduction or a credit for something, but not both.

- Education expenses are one area where a taxpayer may only be able to claim a deduction or a credit.

Advertisement -

3Get a tax refund with refundable credits. Tax credits may also allow you to get a tax refund, even if you don't regularly qualify for one. Credits are separated into two categories: refundable and non-refundable. Refundable tax credits allow you to accrue more credit amount than tax owed, which may allow you to receive a refund. Non-refundable tax credits, however, only credit you money up to the amount of your tax owed.[5]

- For example, the Earned Income Tax Credit (EITC) is refundable; any excess credit amount of the tax amount owed can be returned as a tax refund.[6]

-

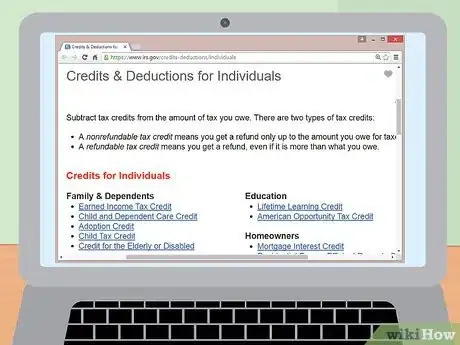

4Locate credits you may qualify for. The IRS offers a variety of credits that you may qualify for, depending on your living situation, income, or other factors. To see the full list of possible credits, see the IRS's website.[7] Investigate each one you think that you might qualify for and claim it on your taxes to receive the credit.

Finding Out Which Credits You Qualify For

-

1Claim tax credits for family and dependents. One of the primary areas in which taxpayers receive credits is family credits. Credits are available for those with children (including adopted children), those caring for the elderly or disabled, and those who pay for childcare. In order to claim most of these credits, you must earn under a certain amount each year and your relationship with the dependent (child or disable/elderly family member) must meet certain criteria. These criteria are specific to the tax credit being claimed. These tax credits include:

-

The Child Tax Credit: A tax credit of up to $2,000 for each qualifying child under 17. The amount of this credit depends on your income. Up to $1,400 per dependent is refundable.[8]

- Use IRS Publication 972 to calculate the amount you can gain from this tax credit.[9]

- The Credit for Other Dependents: This tax credit gives you up to $500 per qualifying dependent. Children over the age of 17 and other relatives you care for may be qualifying dependents.

- The Child and Dependent Care Credit: This credit allows you to receive a credit for money spent on care for a child or dependent up to $3,000 for one dependent or $6,000 for two or more. The amount of the credit is determined by your income and will be a percentage of your qualifying expenses.[10]

- Use IRS form 2441 to calculate and claim your Child and Dependent Care Credit.[11]

- The Adoption Credit: This credit provides a varied amount of money based on the expenses incurred in the adoption of a child.

- IRS Form 8839 provides a schedule for calculating the amount of this credit.[12] .

-

The Child Tax Credit: A tax credit of up to $2,000 for each qualifying child under 17. The amount of this credit depends on your income. Up to $1,400 per dependent is refundable.[8]

-

2Look into healthcare credits. Healthcare credits serve to reduce the cost of healthcare premiums for those who qualify. These credits are only available to certain individuals, like those who purchased health insurance through a government Health Insurance Marketplace or those who are eligible for certain types of government-assisted healthcare. These credits include:

- The Premium Tax Credit: Those who have purchased health insurance coverage from a state or federal Health Insurance Marketplace may be able to receive this credit to partially cover the cost of health insurance premiums. File form 8962 with your return to receive this credit.[13]

- The Health Coverage Tax Credit: This credit may cover up to 72.5% of health insurance premiums for qualifying individuals. Visit the IRS's website and search for this credit to find out if you qualify.[14]

-

3Get a tax credit for being a homeowner. The mortgage interest credit is designed to reduce the tax burden for low-income homeowners. To do so, you will need to contact the relevant government agency and obtain a Mortgage Credit Certificate (MCC) before buying the home. See IRS Form 8396 for more information on calculating this credit.

- You will also have to reduce mortgage interest deductions by the amount of credit claimed here.[15]

-

4Claim education credits. Education credits seek to provide a reduction in tax burdens for students of eligible institutions of higher education. The two major credits, the American Opportunity Credit and the Lifetime Learning Credit, are mutually exclusive, meaning that they cannot be used for the same student.

- The American Opportunity Tax Credit provides a credit for tuition and fees associated with the first 4 years of a student's higher education. This credit may be claimed for up to $2,500 per eligible student. In addition, 40% of this credit is refundable. File Form 8863 to claim this credit.[16]

- The Lifetime Learning Credit is designed to help those already in the workforce pay for further education. It can provide up to $2,000 to a student each year to pay for tuition or education-related fees. Those who claim must have a modified adjusted gross income under $67,000 for single taxpayers or $134,000 for taxpayers that file as married filing jointly. File Form 8863 to claim this credit.[17]

-

5Get green energy tax credits. Green energy tax credits are available to those taxpayers who have homes or vehicles that meet specific green energy usage qualifications (like those with electric cars or have homes partially powered by solar power). These credits often cover part of the cost of installing or maintaining these green energy improvements or vehicles.

- There are two green energy home tax credits: The Nonbusiness Energy Property Credit and The Residential Energy Efficient Property Credit. Both cover expenditures, up to 10 or 30%, of buying or installing energy efficient fixtures or sources of alternative energy (wind, solar, geothermal, etc.). Both of these credits can be claimed by filing IRS Form 5695.[18] [19]

- There are also a variety of credits available to those who own qualified electric vehicles. Go to the IRS's website and search for electric vehicle credits to see which ones you qualify for.

-

6Claim income or savings credits. There are a variety of credits available to help low-income families reduce their tax burden. In addition, there is a credit available to those who receive income from a foreign nation to avoid being taxed twice (by the foreign nation and the US) on their income. These credits are:

- The Earned Income Tax Credit (EITC). The EITC is a common credit for working people earning low to medium levels of income. The EITC is refundable and may even result in a tax refund for those who do not owe any taxes. The actual amount of EITC payout depends on your taxable income, number of dependents, and filing status. The IRS offers an EITC assistant to help you through the process of claiming this credit.[20]

- The assistant is available on the IRS's website. Just search for the EITC assistant in the search bar.[21]

- The Saver's Credit. This credit is designed to help low and moderate income workers save for retirement. File form 8880 if you qualify for this credit.[22]

- Foreign Tax Credit: This credit helps reduce or eliminate double taxation on income earned in a foreign nation. File Form 1116 to claim this credit.[23]

- The Earned Income Tax Credit (EITC). The EITC is a common credit for working people earning low to medium levels of income. The EITC is refundable and may even result in a tax refund for those who do not owe any taxes. The actual amount of EITC payout depends on your taxable income, number of dependents, and filing status. The IRS offers an EITC assistant to help you through the process of claiming this credit.[20]

Calculating Tax Credits

-

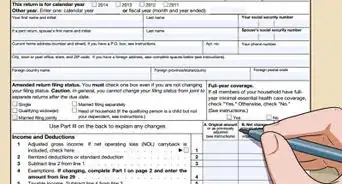

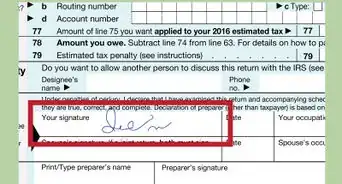

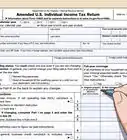

1Fill out your tax return form. In order to claim credits, you must first fill out your tax return form to determine your taxable income and amount of taxes owed. Beginning in 2018, all taxpayers must use Form 1040.

-

2Calculate your income. The calculation of tax credit amount of your eligibility for tax credits will often depend on your income. The exact number used is generally either your adjusted gross income (AGI) or your modified adjusted gross income (MAGI), which is your AGI with some deductions added back in. Both of these figures can be found by filling out your tax return form.

- AGI is calculated as your total income earned from all sources minus certain deductions, like student loan interest or penalties on early withdrawals of savings.

- MAGI is calculated by removing some of these deductions from AGI (this could also be understood as adding them back into AGI).

- Check the wording of the tax credit and the associated IRS Form to see which income figure you need.

- For many people, AGI and MAGI will be the same.[24]

-

3Complete the IRS form associated with each tax credit. To claim each credit, you will need to fill out the appropriate form completely and correctly and attach it to your tax return. For example, if you were filing the Child Tax Credit, you would use the Schedule 8812 to file the credit.[25]

- Additional information for each credit, including whether or not a taxpayer qualifies for the credit, can often be found on an additional IRS publication. The one specific to the Child Tax Credit is Publication 972.

-

4Determine the amount of the tax credit. In order to determine how much of each credit you are able to claim, you will need to fill out the associated worksheet or schedule correctly based on your income or other factors applicable to the individual credit. The schedule should clearly show calculations necessary for determining your credit amount. For example, the process for determining the Child Tax Credit is as follows:

- Multiply the number of qualifying dependents by $2,000 to get the maximum credit amount. For example, if you have 3 qualifying dependents, the maximum child tax credit is $6,000.

- If your Modified Adjusted Gross Income (MAGI) exceeds $400,000 for married filing jointly or $200,000 for other filers; you only qualify for a reduced child tax credit. Subtract the applicable limit amount from your AGI and multiply the difference by 5%. For example, if you are married and filing jointly with an AGI of $405,000, multiply the difference of $5,000 by 5% to get a reduction of $250.

- Subtract the reduction amount from the maximum credit amount to get your reduced child tax credit. Using the above examples, you would subtract $250 from $6,000 for a total child tax credit of $5,750.[26]

-

5Modify your amount of tax owed. Fill in the amount of the credit you are claiming on your tax return and use it, along with other claimed credits, to modify the total amount of taxes owed. If your credits are refundable or partially refundable, you may even be able to receive a tax refund.[27]

Expert Q&A

-

QuestionI usually do not owe tax. If I converted sufficient traditional IRA investments to Roth IRAs which resulted in $7,500 tax due, can I then use the $7,500 tax credit for electric vehicles?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant You are able to claim the $7,500 electric vehicle tax credit to the extent that you have a federal tax liability regardless of what type of income generated that tax liability. Converting a portion of your traditional IRA to a Roth IRA would be one way to generate a tax liability in order to use the electric vehicle tax credit. If you live in a state that imposes an income tax, be sure to consider whether the Roth IRA conversion will generate state tax due.

You are able to claim the $7,500 electric vehicle tax credit to the extent that you have a federal tax liability regardless of what type of income generated that tax liability. Converting a portion of your traditional IRA to a Roth IRA would be one way to generate a tax liability in order to use the electric vehicle tax credit. If you live in a state that imposes an income tax, be sure to consider whether the Roth IRA conversion will generate state tax due.

References

- ↑ http://www.investopedia.com/terms/t/taxcredit.asp

- ↑ https://www.irs.gov/credits-deductions/individuals

- ↑ http://www.investopedia.com/terms/t/taxcredit.asp

- ↑ http://www.investopedia.com/terms/t/taxcredit.asp

- ↑ https://www.irs.gov/credits-deductions/individuals

- ↑ http://www.taxpolicycenter.org/briefing-book/key-elements/family/eitc.cfm

- ↑ https://www.irs.gov/credits-deductions/individuals

- ↑ https://www.irs.gov/credits-deductions/individuals/child-tax-credit-glance

- ↑ https://www.irs.gov/publications/p972/ar02.html#en_US_publink100012088

- ↑ https://www.irs.gov/credits-deductions/individuals/child-and-dependent-care-credit

- ↑ https://www.irs.gov/pub/irs-pdf/f2441.pdf

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/adoption-credit-glance

- ↑ https://www.irs.gov/credits-deductions/individuals/premium-tax-credit-affordable-care-act

- ↑ https://www.irs.gov/credits-deductions/individuals/hctc

- ↑ https://www.irs.gov/credits-deductions/individuals/mortgage-interest-credit-at-a-glance

- ↑ https://www.irs.gov/credits-deductions/individuals/aotc

- ↑ https://www.irs.gov/credits-deductions/individuals/llc

- ↑ https://www.irs.gov/credits-deductions/individuals/nonbusiness-energy-property-credit-section-25c-at-a-glance

- ↑ https://www.irs.gov/credits-deductions/individuals/residential-energy-efficient-property-credit-section-25d-at-a-glance

- ↑ https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit

- ↑ https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/use-the-eitc-assistant

- ↑ https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-savings-contributions-savers-credit

- ↑ https://www.irs.gov/credits-deductions/individuals/foreign-tax-credit-at-a-glance

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/IRS-Tax-Return/What-Is-the-Difference-Between-AGI-and-MAGI-on-Your-Taxes-/INF22699.html

- ↑ https://www.irs.gov/uac/Ten-Facts-about-the-Child-Tax-Credit

- ↑ https://www.irs.gov/uac/Ten-Facts-about-the-Child-Tax-Credit

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/IRS-Tax-Forms/What-Is-an-IRS-1040-Form-/INF14479.html