This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 10 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 108,775 times.

Learn more...

If you’re a recent high school graduate just starting out or even a seasoned professional embarking on a career change, consider whether you want to become a claims adjuster for an insurance company. Claims adjusters (also known as “loss adjusters”) review claims for property damage or bodily injury made by an insurance company’s policy holders. As a claims adjuster, you'll likely have a fairly interesting job, but you have to get your education first.

Steps

Working on Your Education

-

1Decide if claims adjuster is a good fit for you. Most claims adjusters live active lives, as they spend their time out in the field investigating claims. The job can be high stress, but you won't be stuck behind a desk all the time.[1]

- Also, know that in many parts of this field, you'll be dealing with emergencies and catastrophes. That means that at some point you will be dealing with people who are facing the death of a loved one or coworker, and you'll likely be witness to some of the aftermath.[2]

-

2Get a high school diploma. A high school diploma or its equivalent is absolutely necessary to work in the insurance field as a claims adjuster. In fact, you can enter some insurance agency at the entry level with just this level of education. Nonetheless, moving on for more education will be helpful.[3]Advertisement

-

3Work on a bachelor's degree. A bachelor's degree or even an associate's degree can be helpful to you if you want to become a claims adjuster. The problem is, it's helpful to decide what part of the field you want to work in before deciding on a degree. The best option is to follow what you love. For instance, if you enjoy numbers and details, perhaps pursue a degree in accounting so you can work in the financial claims adjusting, a field where you assess losses due to problems in the company such as equipment loss or employees striking.[4]

- Another option is getting an engineering degree, which can be helpful in assessing damage in the industrial fields.[5]

- If the idea of extra school isn't your thing, consider getting a trade school degree in auto repair, as being able to assess the cost of a repair is something you could use in the claims adjuster insurance business.[6]

-

4Decide what major course you want to take. Mainly, claims adjusters are divided into two types, catastrophe and everyday claims. If you work as a catastrophe claim adjuster, you'll be the person on the ground after major weather events and emergencies, such as big tornadoes in Oklahoma or a hurricane hitting the coast. Because of the nature of these events, you may need to move around. Everyday claims adjusters focus on smaller events, such as car crashes, problems with homes, or claims made by companies.[7]

-

5Get the experience you need. If you can, try to get an internship while you are still in school. You can often find internships through your school or by looking at some of the major insurance companies in your area. Often, you can take just a summer internship or one where you work a few hours a week. One of the best things about internships is you'll get on-the-job training for the career you want.

- Ask your school if you can earn credit for your internship.

-

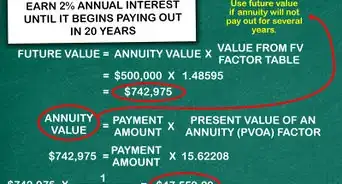

6Develop the appropriate skills. As a claims adjuster, you'll need a wide set of skills to help you in your day to day job. For instance, you'll need to be good in math, as you will be calculating the cost of damage. Focus on taking some math courses in high school and college so you'll be well prepared for that side of the job.[8]

- Develop analytical skills, as well. As an adjuster, you need to be able to look at all the pieces of data available before deciding on an amount or before deciding whether a claim is fraudulent.[9] Taking college courses, especially philosophy and English courses, can help you become more analytical. However, you can also develop these skills in your everyday life, by stepping back and analyzing the facts of a situation. For instance, when you are trying to make a decision about what car to buy, analyze all the details you have available to make your decision.

- Focus on communication and interpersonal skills. In this job, you must talk to a wide range of people and then present the facts compelling about why you made the decision you did, usually in writing.[10] Taking English classes and speech classes will help develop these skills, but so will working in retail and talking to people you meet out in the world to try to get to know them better.

Becoming Licensed

-

1Check your state's requirements. What is required for your license will vary by state. Therefore, check with your state's insurance board to find out what's required for a license in your state.[11]

-

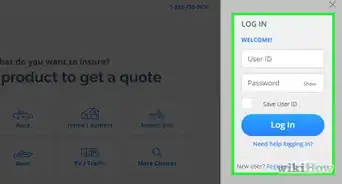

2Schedule your exam. Your state board will tell you who you need to schedule your exam with and what you will need to study for it. For instance, in Oklahoma, you take your exam with PSI Exams Online, at a cost of $20 to $40 in 2015, depending on what you take.[12]

-

3Study for your exam. Most states will have study material available to you so that you can study for your exam. You may also be able to find a class in your state that will help you prepare for the exam you are going to take. Which you chose depends on how disciplined you are in your studying.

-

4Meet any other requirements set out by your state. Passing the exam may be all your state requires for you to get licensed, which is how it is in Oklahoma. However, in other states, you may need to meet other requirements, such as having 2 years worth of experience in the field, as it is in California, before you can take the exam.[13]

-

5Take the exam. Once you feel you are ready, take the exam. Most of the time, you can take the exam online once you register to take it.[14] [Image:Study-a-Week-Before-an-Exam-Step-13.jpg|center]]

-

6Apply for your license. Once you pass the exam, you can apply for your license. What the application requires also varies by state. However, you should receive notification of whether you received a license within a month.

-

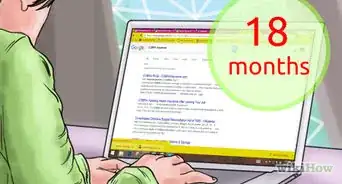

7Renew as needed. Most of the time, these licenses need to be renewed periodically. You may need to meet certain requirements before it is renewed, as well. For instance, in California, you must renew every 2 years, and in each set of 2 years, you must take 24 hours of continuing education, including an ethics course.[15]

- Continuing education credits can be fulfilled in a number of ways. For instance, you can go the normal route and take classes and workshops. However, you can also write for big publications in your field or give a workshop or lecture yourself.[16]

Becoming a Claims Adjuster

-

1Choose your path. When you enter the market, you'll need to decide whether you want to work as a staff member or an independent contractor. As a staff worker, you must show up for certain shifts every week, but the work will be steadier. As a contractor, you'll have more control over your time in some ways, but your work will likely be less steady. Also, you may be called at all hours of the day and night.[17]

-

2Find entry-level positions. You can find positions on major job websites, such as Monster, Yahoo!, or Indeed. However, you can also look on the websites for major insurance companies. Most companies have an area where they will list available jobs.

-

3Use everything you have. If you've gained experience as an intern, use that to get your foot in the door. In fact, it's best to try at the company you worked at before, especially if you left a good impression. If you don't want to return there, you can use that experience to help you stand out from other candidates who are fresh out of school and who don't have the skills you do.

-

4Match your skills to the job. As noted, certain skills transfer from job to job. For instance, if you've worked in retail, you likely have good interpersonal skills, so you can spin that in your interview. If you've worked as a cop or in security, you've likely done similar work to what you'll do as an adjuster; that is, you'll investigate a scene, looking for clues and talking to witnesses.[18]

-

5Understand how you will start out. You won't start out in the big leagues. In fact, you'll start off with small claims that won't cost the company so much if you make a mistake. In addition, you'll probably work under someone more experienced to learn the ropes.[19]

-

6Do your job well. The best way to continue moving up the ladder is to do your job well. If you feel you can't do it very well yet, ask senior claims adjusters for advice, and don't be afraid to study in your own time so you can become better at what you're doing.

Community Q&A

-

QuestionHow much money does a claims adjuster make?

Community Answer$35,000-$75,000 is a reasonable salary range for a career staff claims adjuster.

Community Answer$35,000-$75,000 is a reasonable salary range for a career staff claims adjuster.

References

- ↑ http://www.bankrate.com/finance/jobs-careers/confessions-of-insurance-claims-adjuster.aspx

- ↑ http://www.bankrate.com/finance/jobs-careers/confessions-of-insurance-claims-adjuster.aspx

- ↑ http://www.bls.gov/ooh/business-and-financial/claims-adjusters-appraisers-examiners-and-investigators.htm#tab-4

- ↑ http://www.bls.gov/ooh/business-and-financial/claims-adjusters-appraisers-examiners-and-investigators.htm#tab-4

- ↑ http://www.bls.gov/ooh/business-and-financial/claims-adjusters-appraisers-examiners-and-investigators.htm#tab-4

- ↑ http://www.bls.gov/ooh/business-and-financial/claims-adjusters-appraisers-examiners-and-investigators.htm#tab-4

- ↑ https://www.wetrainadjusters.com/becoming-a-florida-claims-adjuster

- ↑ http://www.bls.gov/ooh/business-and-financial/claims-adjusters-appraisers-examiners-and-investigators.htm#tab-4

- ↑ http://www.bls.gov/ooh/business-and-financial/claims-adjusters-appraisers-examiners-and-investigators.htm#tab-4

- ↑ http://www.bls.gov/ooh/business-and-financial/claims-adjusters-appraisers-examiners-and-investigators.htm#tab-4

- ↑ http://www.bestdegreeprograms.org/faq/whats-the-best-degree-path-for-becoming-an-insurance-claims-adjuster

- ↑ https://candidate.psiexams.com/catalog/fti_agency_license_details.jsp?fromwhere=findtest&testid=923

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/insurance-adjuster.cfm

- ↑ https://candidate.psiexams.com/catalog/fti_agency_license_details.jsp?fromwhere=findtest&testid=923

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/insurance-adjuster.cfm

- ↑ http://www.bls.gov/ooh/business-and-financial/claims-adjusters-appraisers-examiners-and-investigators.htm#tab-4

- ↑ http://www.adjusterpro.com/insurance-adjuster-career/how-to-become-an-insurance-adjuster.html

- ↑ http://www.bankrate.com/finance/jobs-careers/confessions-of-insurance-claims-adjuster.aspx

- ↑ http://www.bls.gov/ooh/business-and-financial/claims-adjusters-appraisers-examiners-and-investigators.htm#tab-4

About This Article

To become a claims adjuster, you'll need to be able to work well under stress and interact with people during emergencies since you'll be out in the field a lot. If you're still in school, focus on taking math and English classes, which will help you develop the skills you'll need for the job. You should also plan on getting your bachelor's degree if you don't already have one. If you want to get some first-hand experience, apply for an internship with an insurance company. To learn how to get licensed as a claims adjuster, scroll down!