This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 57,574 times.

Knowing how to track old insurance policies can mean a windfall of funds for you or your family if you know how to access the information and are the rightful beneficiary. Whether you had a parent or other family member pass away or you have simply misplaced your own insurance policies, you need to be aware of what is required of you to track down the policy information to claim the benefits that are rightfully yours.

Steps

Looking Through Personal Information

-

1Look through financial records. Providing it is your insurance, or you are the beneficiary of the insurance and have the right to be the personals legal representative, you can begin by looking through financial records. These include old bank books, online bank records, as well as tax records and old statements. If they have a key location where they keep old statements, make sure to look through these.[1]

- You are looking for records of cancelled checks for premium payments, old records of premium payments, or any old tax records that could indicate the name of insurer.

- Be sure to check the mail as well for any incoming information from the insurance company.

- If there was an insurance policy, there will likely be a financial record of it somewhere.

-

2Contact relevant individuals. If you were unsuccessful, you should begin by contacting various professionals to see if they know anything about an insurance policy. These professionals include any financial advisers/planners that had a relationship with the policy owner, accountants, insurance agents, or any other professional who had any relationship with the policy holder.[2]

- In addition, contact their previous place of work, as well as former places of work. If they worked in a larger business, you would want to contact the company benefits office. They would know about any workplace coverage, as well as any additional coverage or benefits that were purchased.

Advertisement -

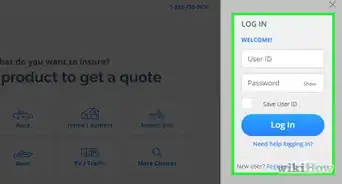

3Contact any known insurance companies that the policy holder had a relationship with. For example, you are most likely looking for a life insurance policy. It is possible that the policyholder had their life insurance policy at the same company that sold other forms of insurance coverage they have. During your search of financial records and conversations with professionals, keep your eye out for the mention of auto insurers, home insurers, disability insurers, or any other type of insurers.

- Contact them to see if the policy holder had any other type of policies with that same company. In addition, ask them if they were aware of any other insurers that the policy holder had.

- If you live in a smaller city, you can also try calling all the major insurance companies one-by-one to check. This may be impractical in a larger city with hundreds of providers.It may be worthwhile to call the most prominent providers, however.

- If you live in a large city, call the insurance companies closest to where the policy holder lived, as well as the largest names.

- Identify yourself and your relationship to the decedent.

- Be prepared to show a death certificate for the decedent.

Using Services and Organizations for Help

-

1Contact the state(s) lived in by the policy holder. Every state has an insurance department, and these departments set standards and regulate insurance activities in the state.[3] Fortunately, several states currently have programs -- or are developing programs -- specifically intended to track down old life insurance policies for potential beneficiaries.[4]

- These are typically known as policy locator services, and if you are an executor or legal representative of a deceased person with a policy, you can submit your legal information and a death certificate, and the service will contact all the life insurance providers in the state.

- Use the National Association of insurance commissioners website to find out the contact information for your state insurance department. You can then call them to ask about any specific policy locator services.

- If they do not have a policy locator service, ask them for how they can help. At the very least, they can provide a list of insurance providers close to the address of the policy holder.

- They can also let you know about any insurance company mergers.

-

2Contact your state's unclaimed property office. If a policy holder has died, and the insurance company is unable to contact them to provide the money owed, they will sometimes resort to giving the money to your states unclaimed property office. The National Association of Unclaimed Property Administrators is the authority for unclaimed property offices, and if you visit their website at www.unclaimed.org, and click "Reporting Resources" you will be able to access the office contact information for each state.[5]

- MissingMoney.com provides a database of unclaimed property for states, that allows policy holders and beneficiaries to perform an in-depth search of property that is rightfully owned to them, and legally required by law to be turned over to state governments. [6]

-

3Use the Medical Information Bureau's Policy Locator Tool. You can find this resource at www.policylocator.com. The Medical Information Bureau has 430 member organizations, and these organizations share medical and application information. This means that the organization may have evidence of life insurance applications performed after 1996.

- This is a fee-service, and the fee is $75. Within 10 days, they will produce a report that will provide information of any applications completed by the person of interest, the insurance company, the date of application, and the contact information for the insurer.

- The MIB cannot tell you if a policy was issued. To learn this, you must contact the insurance company yourself using the contact information provided.

-

4Use VitalChek.com to prove you are the beneficiary. If you are successful in locating a policy, you will need to prove it is yours. If you have the required information such as a death certificate. If you do not have this information, VitalChek.com is authorized by the government to provide the death certificate that you need.

-

5Check with past employers and groups. Most employers will have an employee benefits administrator who is in charge of every employee's benefit package. Call or email them and ask if there are any group life insurance policies still in effect. You can also ask if the deceased purchased any additional coverage at work.

- In addition to employers, a lot of fraternal organizations, unions, and professional associations offer life insurance policies to their members.[7] Check with these organizations and see if they have any records about the deceased's policies.

-

6Hire tracers to track down missing policies. Tracers are professional individuals and groups that you can hire to locate missing policies. Several companies out there offer these services for a fee. If you hire them, they will contact insurance companies and other places to try and locate lost policies.[8] However, be aware that some individuals and groups out there may be trying to scam you. Do your research and make sure you are hiring someone reputable.

-

7Beware of scammers. Before you use a specific service to help you, do some research and make sure it is not a scam. If any organization asks for a fee up-front, as opposed to taking a percentage of the policy they find, you should be wary. If you think an organization might be trying to scam you, look up the organization online and find reviews. If there is no information about the organization, think about using another service with a better reputation.

- If you get a solicitation from an insurer, do not contact them with the number or address provided on the mailing. Instead, look up the insurer online and use the number or address you find on the internet.[9]

References

- ↑ http://www.kiplinger.com/article/insurance/T034-C001-S001-how-to-track-down-a-lost-life-insurance-policy.html

- ↑ http://www.kiplinger.com/article/insurance/T034-C001-S001-how-to-track-down-insurance-policies.html

- ↑ http://www.naic.org/index_about.htm

- ↑ http://www.kiplinger.com/article/insurance/T034-C001-S001-how-to-track-down-a-lost-life-insurance-policy.html

- ↑ http://www.kiplinger.com/article/insurance/T034-C001-S001-how-to-track-down-a-lost-life-insurance-policy.html

- ↑ https://www.missingmoney.com/Main/Index.cfm

- ↑ http://www.insure.com/life-insurance/lost-policies.html

- ↑ http://www.iii.org/article/how-can-i-locate-lost-life-insurance-policy

- ↑ http://www.consumerreports.org/cro/magazine/2013/02/how-to-find-lost-life-insurance-policies/index.htm