This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

This article has been viewed 24,596 times.

Learn more...

Unlike insurance agents, who sell insurance on behalf of a company, insurance brokers can sell insurance on behalf of customers, finding the best policy for the consumer from many different insurers. Most insurance brokers are looking to go into business for themselves. Depending on licensure, they can sell life, accident, and health insurance, or property and casualty insurance. Missouri requires its insurance agents and brokers to have a license to provide insurance services to the public or companies. The requirements for obtaining a license to act as a broker are the same as requirements to be an agent--you will need to pass an exam and complete an application.

Steps

Preparing for the Exam

-

1Make sure you meet the requirements. Although the requirements to become an insurance broker in Missouri are not extensive, make sure you meet the requirements before you apply for the license. You must:[1]

- Be 18 years of age or older.

- Have a record free of certain criminal convictions. Most convictions will not bar you from obtaining a license to sell insurance, but that isn’t an absolute rule. For more information, contact the Missouri Department of Insurance, Financial Institutions, and Professional Licensing at 573-751-3518.[2]

- Pass the pre-licensing exam. This exam is called the Missouri Insurance Agent/Producer Exam.

-

2Choose your line. You’ll need to choose what type of insurance, or “line” of insurance, you wish to sell. The insurance licensing exam isn’t a comprehensive exam. There are different exams for different types of insurance. For example:[3]

- Property and casualty. This protects your property and your liability to someone else’s property. Think of it as insurance for things. Some examples of property and casualty insurance are homeowners, auto, and flood insurance.

- Life, accident, and health. As you might guess, this is insurance for people. It protects people from costs incurred as a result of sickness, injury, or death.

Advertisement -

3Buy your study materials. It costs money to register for the pre-licensing exam, so you might as well purchase study materials to make sure you score as highly as possible on the exam. There are several companies producing study materials for the exams, and several formats that you can use to study. These include:[4] [5]

- Taking an online class—either with an instructor or by following along with videos. Prices range from $131-$249.

- Taking a class in person. This is the priciest option, with rates for an eight hour course starting at $260 and increasing to $396.

- Self-directed study. This is where you simply purchase textbooks and study. Prices range from $75-$150, depending on materials and company.

-

4Set aside time to study. Learn about the format and content of the test in advance. It will save you time, worry, and money.

- The test is multiple choice format, divided into general knowledge and state specific sections. Depending on what line you are testing for, the exam will be anywhere from 110-170 questions held over two to three hours.[6]

- Many of the study packages will include practice tests. If your study package included a practice test, use one of those. You can also purchase one separately though PearsonVue, the company that administers the official exam. PearsonVue sells the practice tests for less than $20. [7]

- On any exam, a passing grade is 70. However, you only get a numeric score if you fail.

Completing the Licensing Process

-

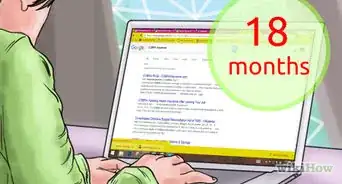

1Schedule an exam date. All exams are administered by PearsonVue. In order to register for the exam, you’ll need to go to http://www.pearsonvue.com/mo/insurance/, create an account, pay the fee and schedule a date.

- Creating an account is easy. All it requires is an address, name, phone number, and Social Security number.

- The fee to take the exam is $51.

- Download the Missouri Insurance Producer Candidate Handbook, as well as any subject outlines you desire, from http://www.pearsonvue.com/mo/insurance/.

-

2Come to the testing center prepared. Arrive at the testing center at least thirty minutes before the exam starts. Do not bring cell phones, wallets or handbags into the testing center. The testing center will provide you with any necessary materials, such as pencils and scratch paper, before the test begins.[8]

- You’re going to need two forms of current ID with signatures on the ID, like a driver's license or debit card.

-

3Apply for the license. After you’ve passed the exam, you’ll need to submit your application on the National Insurance Producer Registry (NIPR) website, at http://www.nipr.com.

- There is a $100 application fee. The NIPR will actually have a record of your exam result on file, so all you’ll have to do is enter your name, Social Security number, and pay the fee.

Community Q&A

-

QuestionCan missouri agents sell in other states

Community AnswerIt depends on the state, but an agent is different than broker anyway. An agent sells insurance for one insurer, while a broker can sell insurance from any insurance carrier. If you want to sell insurance in another state, you'll have to check with that state to see if they accept Missouri's licensing.

Community AnswerIt depends on the state, but an agent is different than broker anyway. An agent sells insurance for one insurer, while a broker can sell insurance from any insurance carrier. If you want to sell insurance in another state, you'll have to check with that state to see if they accept Missouri's licensing. -

QuestionPassing the exam is good for how long before you have to take it again?

Community AnswerYou have to apply for your license within one year of passing the exam in Missouri.

Community AnswerYou have to apply for your license within one year of passing the exam in Missouri.

References

- ↑ https://www.adbanker.com/staterequirements.aspx?state=MO&line=pl

- ↑ http://insurance.mo.gov/industry/faq/license.php#conviction

- ↑ https://www.adbanker.com/staterequirements.aspx?state=MO&line=pl

- ↑ https://www.kaplanfinancial.com/insurance/missouri/property-casualty/

- ↑ https://www.adbanker.com/pre-licensing.aspx#.MO.LH

- ↑ https://www.adbanker.com/staterequirements.aspx?state=MO&line=pl

- ↑ http://www.pearsonvue.com/mo/insurance/

- ↑ https://www.adbanker.com/staterequirements.aspx?state=MO&line=pl