This article was co-authored by Derick Vogel and by wikiHow staff writer, Janice Tieperman. Derick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

There are 16 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 531,808 times.

A good credit score isn’t just a number on a piece of a paper—it’s your key to new opportunities in the future, like new housing, good insurance rates, and more.[1] You can’t boost your credit score overnight, but there are plenty of easy ways you can build good credit over time.

Steps

Managing Payments and Purchases

-

1Pay your credit card bills on time. Always pay household or credit card bills in full as soon as you receive them, which makes you look responsible and financially stable. Try to get caught up on any late payments as soon as you can.[2]

- See if you can set up automatic payments with your credit card company and/or bank. This way, you won't risk forgetting about your payments, which drops your credit score.

- Even 1 late payment can lower your credit score by 50-100 points.[3]

-

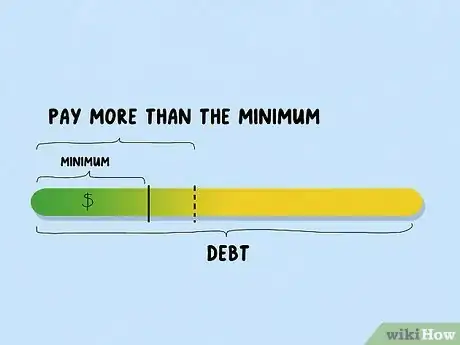

2Pay more than the minimum amount due on credit card bills. Stay on top of your credit card bills, and try to pay them off in full whenever you can. Don’t rely on “minimums,” or the smallest possible payment, to pay back your debt. If you only pay minimums, you’ll build up a lot of interest, which will make your debt even harder to pay off in the long run.[4]

- It’s okay if you pay with minimums once in a while—just don’t get in the habit of paying minimums every month!

Advertisement -

3Make purchases within your budget so you don’t overuse your credit. Don’t spend money on ridiculously large purchases, like a tropical vacation. Instead, make small, easy purchases that you can pay back in a short amount of time. Once you have good credit, you can start making bigger purchases, like a car or home.[5]

- If you live beyond your means, your credit score will reflect that.

-

4Spend less than 10% of your total credit limit. It may be tempting to splurge on a big purchase, but it won’t be as fun to pay back the enormous cost to your credit card company. You’ll look a lot more reliable and have a much better credit score if you limit yourself to using no more than 10% of your total credit limit at once.[6]

- Some people recommend spending less than 30% of your credit limit, but studies have shown that people with higher credit scores use on average about 7% of their total credit limit.

-

5Check your annual credit report for any changes or errors. Look over your credit report to see if your accounts, balances, and other financial information are accurate.[7] If you find any inaccuracies, send a letter to your credit reporting company to open an official dispute.[8]

- A credit report discusses your credit information, but not your credit score. You can check your credit score with a credit bureau, a non-profit counselor, or a third-party service.[9]

Boosting Credibility

-

1Open checking and savings accounts with your bank. The key to building good credit is looking reliable to your lenders. These accounts won’t show up directly in your FICO score or official credit reports, but some lenders like to check people’s bank information. With checking and saving accounts, you can prove that you’re financially stable and know how to manage your money.[10]

-

2Get a loan and pay it back within 1-2 years. Believe it or not, loans are a great way to prove that you’re financially responsible. Take out a small loan and work to pay it back quickly, which makes you look reliable. Double-check with your bank to make sure the loan will show up on your credit score—some loans aren’t factored into your credit report, which won’t help you build good credit.[11]

-

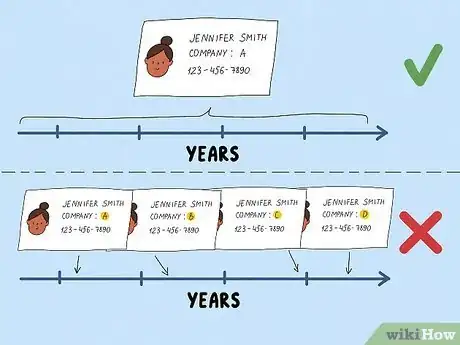

3Hold onto a job for a long period of time so you look financially stable. Stick with your job for several years, even if you aren’t thrilled with it. If you switch jobs too often, you won’t look too financially stable. Lenders want to know that you’ll be able to make your payments on time, and that you’ll pay back your loans reliably.[12]

- If you appear reliable, they may be willing to forgive a slightly less than ideal credit score.

-

4Maintain a consistent home address instead of moving around a lot. Credit agencies use your address to help keep tabs on you. If you change addresses constantly, lenders will have trouble verifying your identity and connecting your credit information to you. This can lead to discrepancies in your credit report, which is a big pain to sort out.[13]

- If you change your address, call up your bank or lending agency to let them know about the change.

-

5Use a rent-reporting service to help boost your credit score. Contact a group like RentTrack or Rental Kharma, who will transfer your bill payment history to your credit report. This may help boost your credit score, and make you look reliable to future lenders.[14]

- Not all credit scores will factor in these extra payments, but some might.

- Programs like Experian Boost make it easy to connect your monthly bills to your credit score. You can even boost your credit by paying for your Netflix account on time![15]

Using Credit Cards

-

1Ask to be an authorized user on someone else’s credit card. An authorized user is a fancy term for being a cardholder on someone’s account. Ask a partner, relative, or close friend with good credit if you can become an authorized user on their account. This way, lenders will associate you with the good credit on the account.[16]

- It’s best to become an authorized user on an account with good or excellent credit (somewhere between 670 and 850).

- You can also sign up for a joint account with someone who has more established credit.[17]

-

2Apply for a secured credit card if you’ve never used a credit card before. Give your credit company a certain amount of cash—this will act as your credit limit for your secured card. Practice responsible spending habits with your secured card, and pay back all of your loans on time. This helps you build your credit, and is a great stepping stone for getting an unsecured card, which typically comes with better perks.[18]

- Once you close your secured credit card account and upgrade to an unsecured card, you’ll get your original cash deposit back.

- It can be tough to get your foot in the door with big credit companies, like MasterCard or Visa. Instead, stop by your local department store or gas station and see if they have a credit card program.[19]

- Secured credit cards are also a good option if you have bad credit but need a new credit card to start rebuilding it.[20]

-

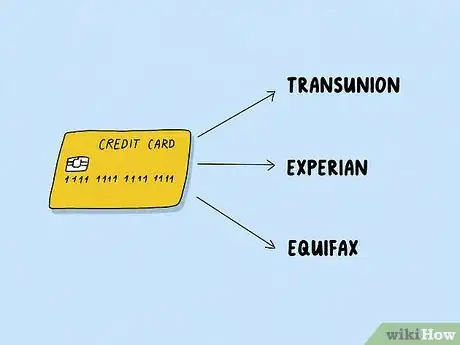

3Choose credit cards that report to major credit bureaus. You want your information reported to the major credit reporting companies, like TransUnion, Experian, and Equifax. These are the ones lenders are most likely to check, so it’s not great if your card only reports only to a small company.[21]

-

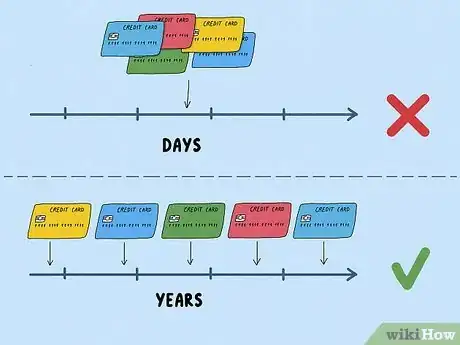

4Avoid applying for multiple credit cards at once. This can look risky to possible lenders, and may bring your credit score down. Instead, apply for credit cards one at a time, so you aren’t putting your score at risk.[22]

- Credit card applications tend to stack up on your credit report, even if your applications get approved.

- For instance, it’s safe to open 10 new credit cards over 5 years, as long as you aren’t applying for them all at once.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionIf I'm unemployed, how do I deal with credit card debt?

Derick VogelDerick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

Derick VogelDerick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

Credit Advisor & Owner, Credit Absolute First, you should call all your creditors and let them know you lost your job and are looking for help in deferring the payments. Ask them to send confirmation in email if possible. By deferring the payment, you'll be allowed to find a job without having to make the minimum payments and getting any penalties and 30 day late payments. However, if you can make the minimum payment, then at least do that.

First, you should call all your creditors and let them know you lost your job and are looking for help in deferring the payments. Ask them to send confirmation in email if possible. By deferring the payment, you'll be allowed to find a job without having to make the minimum payments and getting any penalties and 30 day late payments. However, if you can make the minimum payment, then at least do that. -

QuestionHow can I get a new credit card if I have bad credit?

Derick VogelDerick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

Derick VogelDerick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

Credit Advisor & Owner, Credit Absolute

-

QuestionHow much of my credit limit should I be using?

Derick VogelDerick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

Derick VogelDerick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

Credit Advisor & Owner, Credit Absolute Keep your credit card balances under 10% of the credit limit. For example, if your credit card has a $1000 credit limit, you would want to keep the balance under $100. Some people suggest keeping your balance under 30%, but studies show that people with a high credit score only use around 7% of their credit limit.

Keep your credit card balances under 10% of the credit limit. For example, if your credit card has a $1000 credit limit, you would want to keep the balance under $100. Some people suggest keeping your balance under 30%, but studies show that people with a high credit score only use around 7% of their credit limit.

Warnings

- Don’t close your credit cards unless you absolutely have to. Closing an account lowers the amount of credit you use, which will, in turn, lower your credit score.[25]⧼thumbs_response⧽

References

- ↑ https://www.cnbc.com/select/advantages-of-a-good-credit-score/

- ↑ https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-and-keep-a-good-credit-score-en-318/

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ https://www.cnbc.com/select/what-happens-if-you-only-pay-the-minimum-on-your-credit-card/

- ↑ https://www.forbes.com/sites/forbesfinancecouncil/2018/01/23/10-ways-young-people-can-build-a-strong-credit-record/#561008b94749

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ https://files.consumerfinance.gov/f/documents/201612_cfpb_credit_invisible_checklist.PDF

- ↑ https://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ https://www.consumerfinance.gov/ask-cfpb/where-can-i-get-my-credit-score-en-316/

- ↑ https://www.gsmr.org/financial-tips/how-to-build-good-credit

- ↑ https://www.gsmr.org/financial-tips/how-to-build-good-credit

- ↑ https://www.thestreet.com/personal-finance/debt-management/job-hopping-can-affect-your-credit-worthiness-13476108

- ↑ https://www.clearscore.com/credit-score/how-does-address-affect-credit-score

- ↑ https://www.forbes.com/advisor/personal-finance/how-to-get-rent-payments-added-to-your-credit-report/

- ↑ https://www.cnbc.com/select/experian-boost-allows-netflix-payments-for-credit-score-increase/

- ↑ https://files.consumerfinance.gov/f/documents/201612_cfpb_credit_invisible_checklist.PDF

- ↑ https://www.consumerfinance.gov/ask-cfpb/i-want-to-help-my-daughter-start-her-credit-history-what-should-i-do-en-1643/

- ↑ https://www.nerdwallet.com/article/finance/how-to-build-credit

- ↑ https://www.gsmr.org/financial-tips/how-to-build-good-credit

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ https://www.nerdwallet.com/article/finance/how-to-build-credit

- ↑ https://www.cnbc.com/select/how-to-build-credit-and-achieve-a-good-credit-score/

- ↑ https://www.nerdwallet.com/article/finance/how-to-build-credit

- ↑ https://www.cnbc.com/select/how-to-build-credit-and-achieve-a-good-credit-score/

- ↑ https://www.nerdwallet.com/article/finance/how-to-build-credit

About This Article

To build good credit, always pay your household and credit card bills on time since late payments will lower your credit score. If you have trouble remembering to pay your bills, try setting up automatic monthly payments so you don't have to worry about it. You can also improve your credit score by applying for a credit card and then consistently making payments on time. Just make sure you keep your total debt low so you don't get overwhelmed and miss payments. To learn how to use credit cards responsibly to build your credit, scroll down!