This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 71,380 times.

The American Express Credit card, also referred to as AMEX, is a particularly established and reputable corporation. Founded in 1850 as a shipping service, it slowly transitioned into the financial sector, issuing its first credit card in the 1950s. Today its cards are some of the more coveted because of their great reward programs. This can make them hard to obtain. To get one you will need to build your credit score. For the best rates and benefits, you'll want to build a solid credit history with your card.

Steps

Establishing a History with American Express

-

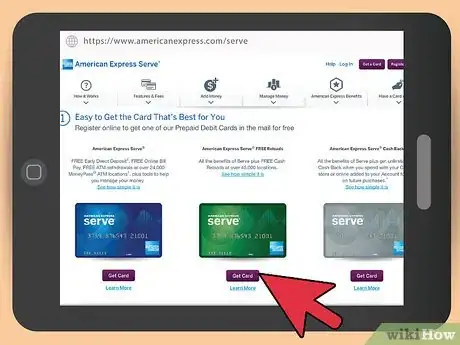

1Apply for an American Express Prepaid Card. A prepaid card functions almost exactly like a debit card; you receive no credit and can only charge what you have deposited in the account. American Express does not report your transactions with a prepaid card to the credit bureaus and so it will not influence your credit score. However, American Express does keep an internal record of your transactions with the prepaid card. If you use the card frequently and consistently deposit money on it, American Express might invite you to apply for a card with more stringent requirements.

- For many with low credit, this card might be the only way to get a foot in the door with American Express, but it will not build your credit score. You will need to build your credit score with other companies to make much progress toward obtaining American Card’s high-end products.

- Typically prepaid cards are a bad investment because they charge monthly fees and charge for every transaction you make with them. However, the only fee for an American Express prepaid card is a $2 ATM fee, making it perhaps the best product of its kind on the market.[1]

-

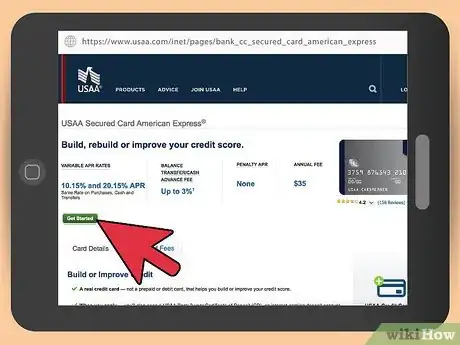

2Apply for a USAA Secured American Express Card. This card is only available to military veterans and their family members but can be a great resource for those eligible. As with other secured cards, you will need to submit a deposit as collateral and your credit limit will only be as high as your deposit. However, your deposit will accumulate interest (currently, 0.54%) and the card has a low APR of 9.9% to 19.90% with many benefits.[2]Advertisement

-

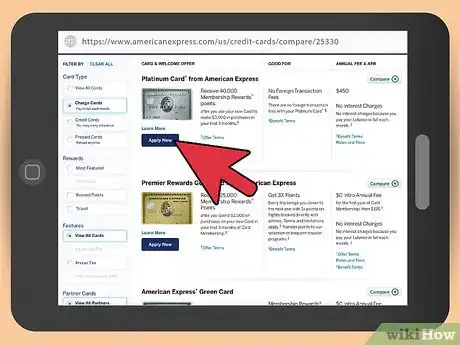

3Apply for an American Express charge card. American Express offers several charge cards, such as the Gold Card and Green Card. "Charge card" means that all of your debts are due at the end of the month. You cannot pay over time with a charge card.[5] This is less of a liability for the company and because of that, average or slightly above average credit will typically suffice when applying for a charge card. It will not improve your credit score as much as a regular credit card would, but it will establish a history with American Express and has some of the best reward programs available.

- For a charge card such as the Gold Card you will probably need a credit score near the high 600s.[6]

- Because you pay the full balance every month, you do not pay interest on your purchases.

- There is an annual fee for American Express charge cards, ranging from $95 per year for the Green Card to $450 a year for the Platinum Card.

- A charge card allows you to make purchases and pay them off. Paying your account promptly will build your credit history.[7]

- A charge card can affect your credit score when bureaus calculate the frequency of on-time payments and the length of credit history. However, it is not considered in your debt utilization ratio because there are no credit limits for a charge card.[8]

-

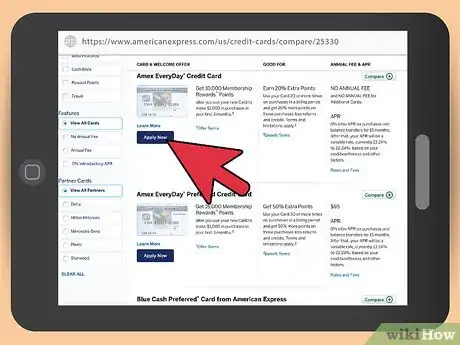

4Apply for an American Express credit card. A credit card, unlike a charge card, will allow you to carry a balance and pay over time. Because of this, you usually need a higher credit score to be approved for an American Express credit card than you do for a charge card. (American Express does not release information regarding credit scores necessary to be approved for a card.) American Express offers a range of credit cards, which include various benefits such as travel miles, cash back, or business accounts.[9]

- American Express has a "Choose a Card" feature that can help you choose which card is right for you.

- You may have better chances of being approved for an American Express credit card if you apply for a card through your bank, where you have an account in good standing. Bank of America, Citi, Wells Fargo, USAA, First National Bank, Barclays, and PenFed all issue American Express cards.

Building your Credit Score

-

1Research your credit score. Before you apply for a credit card, you should research your credit score. This is especially true if you do not have a credit history or believe that you might have a bad credit history. (If you have a bad credit history, see these wikiHow articles: Improve Your Credit Score or Get a Higher Credit Score Fast.)

- You can request a free credit report from each of the three credit bureaus once per year through annualcreditreport.com. However, your credit report does not contain your credit score. It does contain information that can help you manage your credit score, though.[10] For example, it's not uncommon to get information mixed up, so someone else's late payment or delinquent account could show up erroneously on your credit report. Getting these mistakes fixed will help boost your overall score.

- Your credit is calculated by three separate agencies: Equifax, Experian, and TransUnion. You should check all three. Some smaller lenders will only report to one of the three so that your credit score is liable to vary from one to the other.

- Credit scores range from 300 to 850. The average credit score is approximately 650-700, depending upon the credit bureau.[11]

-

2Apply within your means. If lenders see that you have made multiple applications for credit, this will affect your score and reduce your likelihood of receiving a card. This can reduce your score by as much as 10%.[12] You should be aware of what your credit score qualifies you for and apply exclusively for cards that you are likely to get. American Express does not release what credit scores will qualify you for which cards.

- A credit score of 700 or up will qualify you for a majority of cards, including some cards with very good benefits.

- If your credit score is anywhere from 600 to 700, you can likely get an average credit card, but might have some difficulty. It is improbable that you will get a card with great benefits. If available, research the average credit score of those receiving a card that you are considering applying for. Do not apply if the average is much above your own credit score.

- If your credit score is under 600 it is unlikely that you will receive a credit card. Instead, you should start out by becoming a cosigner on someone else’s card or by getting a secured card.[13] Note that you cannot become a cosigner on an American Express account.[14]

-

3Do some research online. While American Express does not release average credit score ranges necessary for card approval, you can sometimes find out the scores of other people who have been approved for a card. Sites such as NerdWallet and Credit Karma often post lists of credit cards for people with "fair" and "average" credit. Community members on this site will sometimes post when they have been approved, and what their credit scores were. This is not definitive information or a guarantee, but it could help you decide whether you have a likely shot at a card.

-

4Get a secured card. A secured card is a way to establish your credit if it is below 600, allowing you to eventually get an unsecured credit card. For a secured card, you will need to deposit cash in your account as collateral. Your spending limit will be approximately what you deposited, so that it functions almost like a prepaid card, except for the fact that the money you deposit as collateral will not count toward your payments.[15]

- American Express does not offer secured credit cards unless you are a military veteran or family of a veteran. If you have bad credit, you will likely need to begin building it with another company and before establishing a history of transactions with American Express.

-

5Sign up for a linked account. If you have a parent or a spouse who trusts you, you can ask to be added to her account. If they have good credit and handle the card appropriately, it can increase your credit score. Unlike many other cards, American Express does not accept co-signers. However, you can become an authorized user on someone else's American Express account.[16]

- An authorized user is someone who can use a credit card, but is not responsible for payments and can be removed from the account at any time. For people under 21 on their parents' card, the parent can even set a customized spending limit.[17] However, in recent years, some accounts have stopped reporting information on authorized users to the credit bureaus. Conveniently, American Express only reports positive information about authorized users, making it one of the better companies for increasing your score with an authorized account.

-

6Leverage your international history. Unfortunately, the credit bureaus do not consider any transactions conducted outside of the nation. If you are coming from another country, you will essentially start from scratch in building a credit score. You might, however, be able to use your prior credit history to establish a line of credit in the United States.

- If you do have records with a credit card in another country, you can try to bring print reports of these along with proof of income to a local bank. Some local institutions will be willing to offer credit cards based on this information.

- Alternatively, if you had a credit card issued abroad and you were a good customer, the company might be willing to issue you an American card to begin building your credit score with. Try to work with an institution that you have had a history with.[18]

Using Your Credit Wisely

-

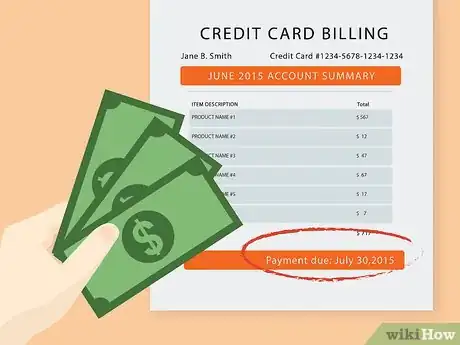

1Pay your bill on time. 35% percent of your credit score is calculated according to how consistently you pay on time. Paying early or paying above the minimum required payment does not have a direct effect on your credit score but might be noticed by some particularly sophisticated lenders. It is important though that you do not allow your debt to get so high that you are unable to make on-time payments. Paying more than the minimum is often necessary to do this.

- Credit card companies are prohibited from reporting late payments to the credit bureaus unless the payment is 21 days late and most companies will wait until 30 days after the due date.[19] However, your credit card is allowed to charge late fees for any payment that is even a day late and two months of consecutive late payments can be enough to increase your interest rate. This can affect your ability to make on-time payments in the future.

-

2Maintain a good ratio of debt to credit. 30% of your credit score is determined by how high your debt is compared to your maximum credit limit. Ideally, your debt should be less than 30% of the amount of credit that you are approved for.[20]

- This is where only paying your minimum balance is likely to adversely affect your credit. If you only pay the minimum balance, your debt is likely to increase progressively, lowering your credit score.

- This means that the higher your credit limit and the less that you use it, the better your credit score will be. Avoid department store credit, because these often have very low limits. Thus, if you use it at all, you will surpass the ideal 30% ratio and negatively impact your credit score.[21]

-

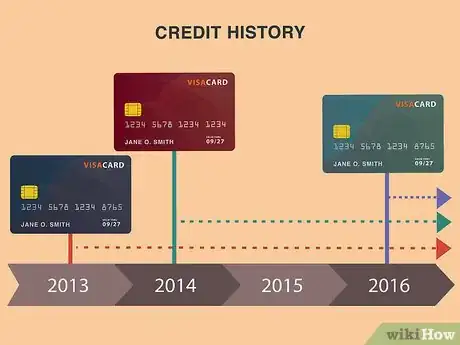

3Keep your card open. 15% of your credit score is calculated according to the length of your credit history. This is determined by how long your oldest account has been open, how long your newest account has been open, and the average age of all of your accounts.[22] This effectively means that you should limit changes in your accounts. Keep them open and refrain from taking out too many new cards.

-

4Contact American Express immediately if there is a problem. Examine your statement for fraudulent or inaccurate charges. If you find charges on the statement that you feel are in error, contact American Express and ask to have these charges reviewed and, if warranted, removed. If you cannot afford to make the minimum payment required, contact American Express immediately and set up a special payment arrangement.

References

- ↑ http://money.cnn.com/galleries/2012/pf/1204/gallery.best-cards-bad-credit/7.html

- ↑ https://www.usaa.com/inet/pages/bank_cc_secured_card_american_express

- ↑ https://www.creditcardinsider.com/credit-cards/usaa/secured-card-american-express/

- ↑ https://www.americanexpress.com/us/content/financial-education/guide-to-credit.html

- ↑ https://www.americanexpress.com/us/content/financial-education/types-of-cards.html

- ↑ http://creditcardforum.com/blog/credit-score-needed-for-american-express/

- ↑ https://www.americanexpress.com/us/content/financial-education/guide-to-credit.html

- ↑ http://www.nerdwallet.com/blog/american-express/charge-card-affect-credit-score/

- ↑ https://www.americanexpress.com/us/content/financial-education/types-of-cards.html

- ↑ http://www.consumer.ftc.gov/articles/0155-free-credit-reports

- ↑ https://www.americanexpress.com/us/content/financial-education/guide-to-credit.html

- ↑ http://www.nerdwallet.com/blog/credit-score/building-credit/

- ↑ http://www.moneyunder30.com/credit-score-needed-to-get-approved-for-credit-card

- ↑ https://www.americanexpress.com/us/content/financial-education/applying-for-a-card-as-a-young-adult.html

- ↑ http://www.nerdwallet.com/blog/credit-score/building-credit/

- ↑ https://www.americanexpress.com/us/content/financial-education/applying-for-a-card-as-a-young-adult.html

- ↑ https://www.americanexpress.com/us/content/financial-education/applying-for-a-card-as-a-young-adult.html

- ↑ https://www.americanexpress.com/us/content/financial-education/guide-to-credit.html

- ↑ https://www.americanexpress.com/us/content/financial-education/guide-to-credit.html

- ↑ http://www.nerdwallet.com/blog/credit-score/building-credit/

- ↑ https://www.americanexpress.com/us/content/financial-education/guide-to-credit.html

- ↑ http://www.nerdwallet.com/blog/credit-score/building-credit/