This article was co-authored by Vinny Lingam. Vinny Lingam is and investor and the CEO of Civic Technologies, a blockchain-powered identity protection and management startup. Vinny is known as the 'Bitcoin Oracle' amongst the cryptocurrency community. He was awarded the Top Young ICT Entrepreneur in Africa Award in 2006, was on the World Economic Forum for Young Global Leaders in 2009, and was voted one of the top 500 CEOs in the World in 2015. He is also an investor on Shark Tank South Africa. He has a BS in E-Commerce from the University of South Africa.

There are 13 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 14 testimonials and 82% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 574,187 times.

Bitcoin is an online alternative currency system, which acts as a form of digital money. Bitcoin is used both as an investment, and as a method of payment for goods and services, and is touted as a means to do so without needing to involve any third parties. Despite their growing popularity, most businesses still do not accept Bitcoin, and their usefulness as an investment is both highly questionable and potentially risky. Before proceeding to buy Bitcoin, it is important to understand what it is, and its advantages and disadvantages.[1]

Things You Should Know

- Before you purchase Bitcoin, you'll need a cryptocurrency wallet to store your coins.

- The easiest way to buy Bitcoin is through a reputable cryptocurrency exchange like Coinbase, Binance, or Gemini.

- You can buy Bitcoin in person through a Bitcoin ATM or through a service like LocalBitcoins.

Steps

Understanding Bitcoin

-

1Understand Bitcoin basics. Bitcoin is a completely virtual currency, that allows consumers a way to exchange money for free, without the use of a third party (like a bank, credit card company, or other financial institution). Bitcoin are not regulated or controlled by a central authority like the Federal Reserve and all Bitcoin transactions take place in an online marketplace, where users are anonymous and untraceable for the most part.[2]

- Bitcoin allows you to exchange money instantly with anybody in the world, without needing to create a merchant account, or use a bank or financial institution.

- Transferring money does not require names meaning there is little risk of identity theft.

-

2Learn about Bitcoin mining. To understand Bitcoin, it is important to understand Bitcoin mining, which is the process by which Bitcoin are created. While mining is complex, the basic idea is that each time a Bitcoin transaction is made between two people, the transaction is logged digitally by computers in a transaction log that describes all the details of the transaction (like the time, and who owns how many Bitcoins).[3]

- These transactions are then shared publicly into something known as a "block chain", which states every transaction, and who owns every bitcoin.

- Bitcoin miners are individuals who own computers that constantly verify the block chain to ensure it is correct and up to date. They are the individuals that confirm transactions, and in exchange for doing so, they are paid in bitcoin, which increases the supply.

- Since Bitcoin is not overseen by a central authority, mining ensures that the individual transferring the bitcoin has enough, that the agreed upon amount is transferred, and that the balance for each member of the transaction is correct afterwards.[4]

Advertisement -

3Gain familiarity with the legal issues surrounding Bitcoin. Recently, the federal agency responsible for combating money laundering announced new guidelines for virtual currencies. The updated guidelines will regulate Bitcoin exchanges, but will leave the rest of the Bitcoin economy alone, for now.

- The Bitcoin network is resistant to government regulation, and it has gained a loyal following among people who engage in illegal activities like drug dealing and gambling due to the fact money can be exchanged anonymously.[5] However, transactions are still traceable, and the FBI was able to seize numerous bitcoin wallets used by bad actors.

- Federal law enforcement may eventually conclude that Bitcoin is a money-laundering tool and may look for ways to shut it down. Shutting down Bitcoin completely would be a challenge, but intense federal regulation could push the system underground. This would then diminish the value of Bitcoins as legitimate currency.

Advantages and Disadvantages

-

1Become aware of Bitcoin's advantages. Bitcoins major advantages include low fees, protection from identity theft, protection from payment fraud, and immediate settlement.[6]

- Low fees: Unlike using traditional finance systems, whereby the system itself (like PayPal or a bank) is compensated with a fee, Bitcoin bypasses this entire system. The Bitcoin network is maintained by the "miners", who are compensated with new Bitcoin.

- Protection from identity theft: Bitcoin usage does not require a name, or any other personal information, simply an ID for your digital wallet (the means used to send and receive Bitcoin). Unlike a credit card, where the merchant has full access to your ID and credit line, Bitcoin users operate totally anonymously.

- Protection against payment fraud: Because Bitcoin are digital, they cannot be counterfeited, which protects against payment fraud. In addition, transactions cannot be reversed, like what occurs with a credit card chargeback.

- Immediate transfer and settlement. Traditionally when money is transferred, it involves significant delays, holds, or other hassles. The lack of a third party means that money can be transferred directly between people with ease, and it without complexities, delays, and fees associated with making purchases between parties that are using different currencies and providers.

-

2Become aware of the downsides of using Bitcoin. With traditional banking, if someone makes a fraudulent transaction on your credit card or your bank goes belly-up, there are laws in place to limit consumer losses. Unlike traditional banks, Bitcoin does not have a safety net in place if your Bitcoins are lost or stolen. There is no intermediary power to reimburse you for any lost or stolen Bitcoins.[7]

- Keep in mind the Bitcoin network is not immune to hackers, and the average Bitcoin account is not completely secured against hacking or security breaches.[8]

- One study found 18 of 40 businesses offering to exchange bitcoins into other currencies have gone out of business, with only six exchanges reimbursing their customers.

- Price volatility is also a major downside. This means that the price of Bitcoin in dollars fluctuates wildly. For example, in 2013, 1 Bitcoin was worth about US$13. It then quickly moved to over US$1200, and is now approximately US$18597.99(as of 16/12/2017). This means if you are converting to Bitcoin, it is important to stay in it, as moving back to USD could result in a significant loss of funds. [9]

-

3Understand the risks of Bitcoin as an investment. One of Bitcoins popular uses is as an investment, and this deserves a special word of caution before proceeding. The main risk of investing in Bitcoin is it's extreme volatility. With prices moving rapidly up and down, the risk of loss is substantial.

- In addition, because Bitcoin's value is determined by supply and demand, should Bitcoin end up being subject to government regulation in any form, it could reduce the amount of people who want to use Bitcoin, which could theoretically make the currency worthless.[10]

Bitcoin Storage

-

1Store your Bitcoins online. In order to buy Bitcoins, you first need to create a storage site for your Bitcoins, and this is the first step to purchasing Bitcoin. Currently, there are two ways you can store Bitcoins online:[11]

- Store the keys to your Bitcoins in an online wallet. The wallet is a computer file that will store your money, similar to a real wallet. You can create a wallet by installing the Bitcoin client[12] , which is software which powers the currency. However, if your computer is hacked by a virus or hackers or if you misplace the files, you may lose your Bitcoins. Always back up your wallet to an external hard drive to avoid losing your Bitcoins.

- Store your Bitcoins via a third party. You can also create a wallet by using an online wallet via a third party site like Coinbase or blockchain.info[13] , which will store your Bitcoins in the cloud. This is easier to set up, but you will be trusting a third party with your Bitcoins. These sites are two of the larger and more reliable third party sites, but there are no guarantees about the security of these sites.

-

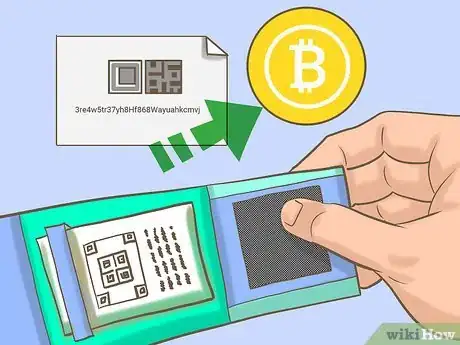

2Create a paper wallet for your Bitcoins. One of the most popular and cheapest options for keeping your Bitcoins safe is a paper wallet. The wallet is small, compact, and made of paper that has a code. One of the benefits of a paper wallet is the private keys to the wallet are not stored digitally. So it cannot be subject to cyber attacks or hardware failures.

- Several online sites offer paper Bitcoin wallet services. They can generate a Bitcoin address for you and create an image containing two QR codes. One is the public address you can use to receive Bitcoins and the other is a private key, which you can use to spend Bitcoins stored at that address.

- The image is printed on a long piece of paper that you can then fold in half and carry with you.

-

3Use a hard-wire wallet to store your Bitcoins. Hard-wire wallets are very limited in number and can be difficult to acquire. They are dedicated devices that can hold private keys electronically and facility payments. Hard-wire wallets are usually small and compact and some are shaped like USB sticks.[14]

- The Trezor hard-wire wallet is ideal for Bitcoin miners who want to acquire large numbers of Bitcoins, but do not want to rely on third party sites.

- The compact Ledger Bitcoin wallet acts as USB storage for your Bitcoins and uses smartcard security. It is one of the more affordable hardwire wallets on the market.

Buying on Exchanges

-

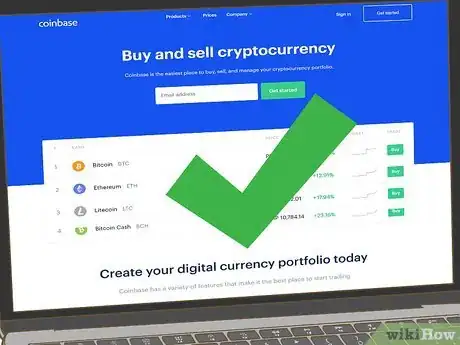

1Choose an exchange service. Obtaining Bitcoin through an exchange is the easiest way to obtain Bitcoin. An exchange works like any other currency exchange: You simply register and convert whatever your currency is into Bitcoin. There are hundreds of available exchanges, and the best exchange option depends on where you are located, but the more well known exchange services include:

- Cryptaw: This is a Singapore Based wallet service which allows user to trade Singapore Dollars for Bitcoins. The company currently has only web platform which is also mobile friendly.

- CoinBase: This popular wallet and exchange service will also trade US dollars and euros for Bitcoins. The company has web and mobile apps for more convenient Bitcoin buying and trading.

- Circle: This exchange service offers users the ability to store, send, receive, and exchange Bitcoins. Currently, only US citizens are able to link their bank accounts to deposit funds.

- Xapo: This wallet and Bitcoin debit card provider offers deposits in fiat currency that are then converted to Bitcoin in your account.

- Some exchange services allow you to also trade Bitcoins. Other exchange services act as wallet services with limited buying and selling capabilities. Most exchanges and wallets will store amounts of digital or fiat currency for you, much like a regular bank account. Exchanges and wallets are a good option if you want to engage in regular trading and don’t need total anonymity. [15]

-

2Provide proof of your identity and contact information to the service. When signing up for an exchange service, you will need to provide personal information to the service to create an account. Most countries legally require any individual or financial system using a Bitcoin exchange service to meet anti-money laundering requirements.[16]

- Though you are required to provide proof of your identity, exchanges and wallets do not provide the same protection that banks do. You are not protected against hackers, or given reimbursement if the exchange goes out of business.

-

3Buy Bitcoins with your exchange account. Once you set up your account via an exchange service, you will need to link it to an existing bank account and arrange to move funds between it and your new Bitcoin account. This will usually be done via a wire transfer and entails a fee.[17]

- Some exchanges allow you to make a deposit in person to their bank account. This will be done face to face, rather than through an ATM.

- If you are required to link to a bank account to use the exchange service, it will likely only admit banks from the country where the exchange service is based. Some exchanges allow you to transfer money to overseas accounts, but the fees will be much higher and there may be a delay changing the Bitcoins back into local currency.

Buying in Person

-

1

-

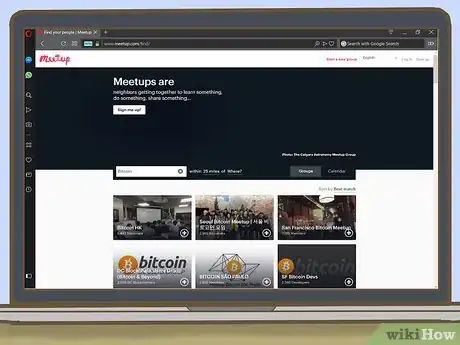

2Use Meetup.com to find sellers. If you are not comfortable with one on one trades, use Meetup.com to look for a Bitcoin meetup group. You can all then decide to buy bitcoins as a group and learn from other members who have used sellers to buy Bitcoins before.[20]

-

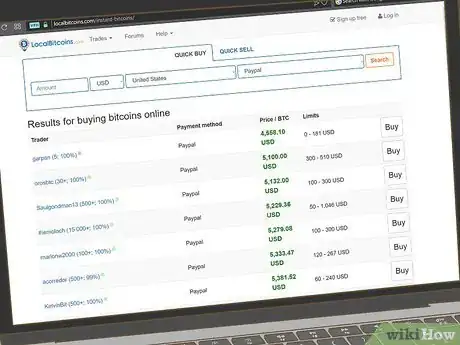

3Negotiate the price before the meet up. Depending on the seller, you may pay a premium of around 5-10% over the exchange price for a face-to-face trade. You can check the current Bitcoin exchange rates online via http://bitcoin.clarkmoody.com/ before agreeing to the seller’s rate.[21]

- You should also ask the seller if they prefer to be paid in cash or via an online payment service. Some seller may allow you to use a PayPal account to pay, though most seller prefer non-reversible cash as payment.

- A reputable trader will always negotiate the price with you before you meet up. Many will not wait too long to meet up once the price is finalized, in case Bitcoin’s value takes a dramatic shift.

-

4Meet the seller in a busy public place. Avoid meeting in private homes. You should take all the precautions, especially if you are carrying cash on you to pay the seller for the coins.[22]

-

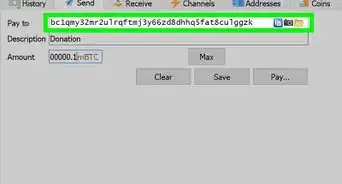

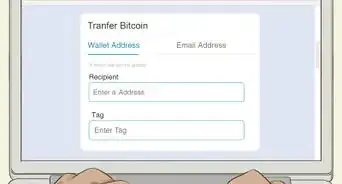

5Have access to your Bitcoin wallet. When you meet the seller face-to-face, you will need to access your Bitcoin wallet via your smartphone, tablet, or laptop. You will also need Internet access to confirm the transaction has gone through. Always check that the Bitcoin has been transferred into your account before you pay the seller.[23]

Using Bitcoin ATMs

-

1Locate a Bitcoin ATM near you. Bitcoin ATMs are a relatively new concept, but they are growing in number. You can use an online Bitcoin ATM map to find an ATM near you.[24]

- Many institutions around the world now offer Bitcoin ATMs, from universities to local banks.

-

2Take out cash from your bank account. Most Bitcoin ATMs only accept cash, as they are not set up to process debit or credit card transactions.[25]

-

3Insert your cash into the ATM. Then, scan your mobile wallet QR code or access the codes needed from your account via your smartphone to load bitcoins onto your wallet.[26]

- Exchange rates at Bitcoin ATMS can vary from 3% to 8% on top of the standard exchange price.

References

- ↑ http://www.forbes.com/sites/timothylee/2013/04/03/four-reason-you-shouldnt-buy-bitcoins/

- ↑ http://www.forbes.com/sites/perianneboring/2014/02/22/bitcoin-basics-for-the-76-percenters-who-dont-have-a-clue-what-it-is/

- ↑ http://www.moneycrashers.com/what-are-bitcoins/

- ↑ http://www.zdnet.com/article/how-to-buy-and-sell-bitcoins-part-1-theory/#!

- ↑ http://www.forbes.com/sites/timothylee/2013/04/03/four-reason-you-shouldnt-buy-bitcoins/

- ↑ http://www.moneycrashers.com/what-are-bitcoins/

- ↑ http://www.forbes.com/sites/timothylee/2013/04/03/four-reason-you-shouldnt-buy-bitcoins/

- ↑ http://www.forbes.com/sites/timothylee/2013/04/03/four-reason-you-shouldnt-buy-bitcoins/

- ↑ http://www.forbes.com/sites/perianneboring/2014/02/22/bitcoin-basics-for-the-76-percenters-who-dont-have-a-clue-what-it-is/

- ↑ http://www.investopedia.com/ask/answers/100314/what-are-risks-investing-bitcoin.asp

- ↑ http://www.telegraph.co.uk/technology/news/10559175/How-to-get-your-virtual-hands-on-some-bitcoins.html

- ↑ https://bitcoin.org/en/download

- ↑ https://blockchain.info/

- ↑ http://www.coindesk.com/information/how-to-store-your-bitcoins/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

- ↑ https://localbitcoins.com/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

- ↑ http://readwrite.com/2013/10/23/i-bought-bitcoin-in-person-and-heres-what-happened

- ↑ https://coinatmradar.com/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

- ↑ http://www.coindesk.com/information/how-can-i-buy-bitcoins/

About This Article

If you want to buy Bitcoins, you will need to set up an online storage site by either installing a wallet on your home computer or creating an account with a third party site. You can also store the key to your Bitcoins on a piece of paper printed with a code. Once you’ve set up your account, you can obtain Bitcoins by purchasing them through an exchange service, or you can purchase them from an individual Bitcoin seller. In some areas, you can even find Bitcoin ATMs where you can convert your Bitcoins into cash. To learn more about the risks and benefits of having Bitcoins, keep reading the article!