This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 234,773 times.

Businesses both large and small often sell their product to their customers on credit. Credit sales, unlike cash transactions, must be carefully managed in order to ensure prompt payment. Mismanaged accounts can lead to slow or late payments and default. One way to keep track of credit sales is to analyze the related financial ratios, such as the average collection period. Learning how to calculate the accounts receivable collection period will help your business keep track of how quickly payments can be expected.

Steps

Gathering Your Data

-

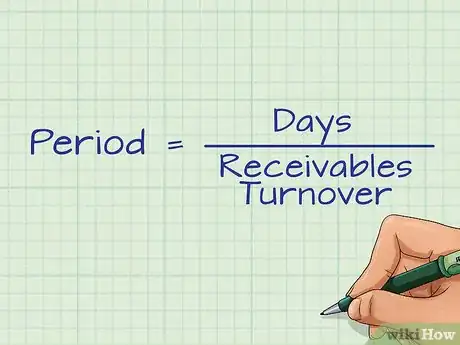

1Know what data you need. The average accounts receivable collection period can be calculated from the following equation: . In the equation, "days" refers to the number of days in the period being measures (usually a year or half of a year). However, the bottom of the equation, receivables turnover, must also be calculated from other data. This requires measurement of net credit sales during the period and average accounts receivable balance during the period.[1] Both can be calculated from sales and returns entries in the general ledger.

-

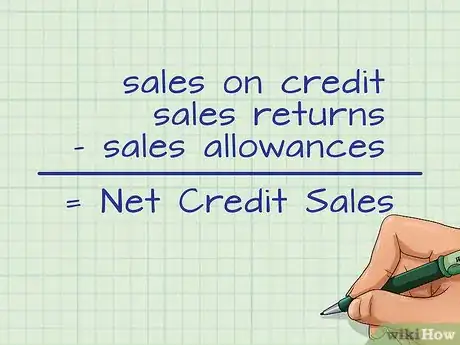

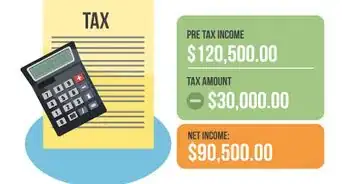

2Determine net credit sales. Net credit sales equals all of the sales on credit less all sales returns and sales allowances. Sales on credit are non-cash sales where the customer is allowed to pay at a later date. Sales returns are credits issued to a customer due to a problem with the purchase. Sales allowances are reductions in price granted to a customer due to problems with the sales transaction. If a company grants a large amount of credit, even to customers with a poor credit history, its net credit sales will be higher.[2]

- Use this equation: sales on credit – sales returns – sales allowances = net credit sales.[3]

Advertisement -

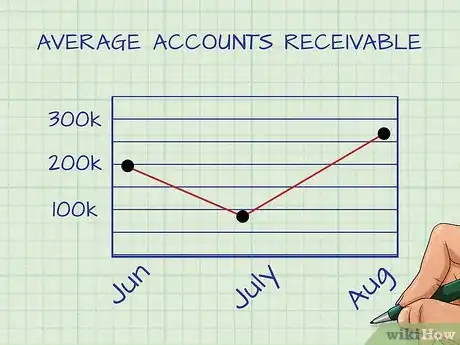

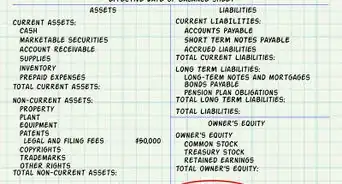

3Calculate the average accounts receivable balance. Use the month-end accounts receivable balance for each month in the measurement period. This information is always recorded on the company's balance sheet. For seasonal businesses, the best practice is to use 12 months of data to account for the effects of seasonality. Rapidly growing or declining businesses, on the other hand, should use a shorter measurement period, such as three months. Using 12 months of data would understate the average accounts receivable for a growing company and overstate it for a declining company.[4]

-

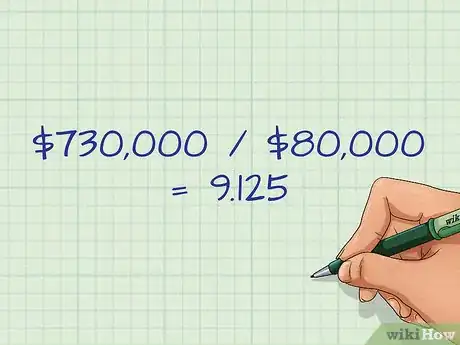

4Calculate the accounts receivable turnover ratio. This is a company's annual net credit sales divided by its average balance in accounts receivable for the same time period. This calculation tells how many times a company's accounts receivable turns over.[5]

- For example, suppose a company has $730,000 in net credit sales and an average balance in accounts receivable of $70,000. Use the equation $730,000 / $80,000 = 9.125 This means that the company's accounts receivable turns over about 9 times every year.

Calculating the Accounts Receivable Collection Period

-

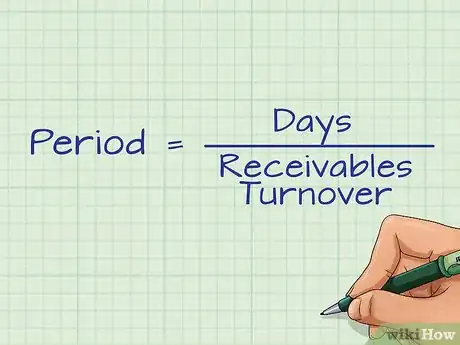

1Understand the equation for calculating the accounts receivable collection period. Again, the equation for this calculation is as follows: . The variables can be explained as follows:

- "Period" refers to the average accounts receivable collection period.

- "Days" refers to the number of days in the period being measured.

- "Receivables Turnover" refers to the receivables turnover ratio calculated earlier using net credit sales and average account receivable over the period.[6]

-

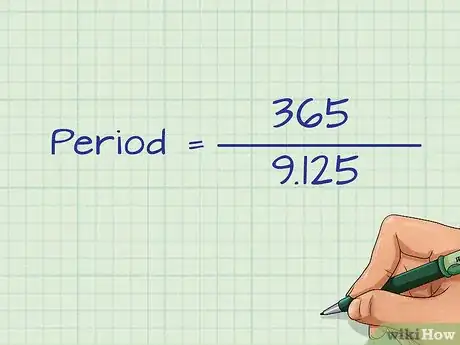

2Input the variables. Using the information from the earlier example, we have a company with $730,000 in net credit sales and an average accounts receivable of $80,000. This results in a receivable turnover ratio of 9.125. This data was measured over a year, so 365 will be used for the top of the equation. The completed equation now looks like this: .

- The top of the equation, the number of days, should be substituted for the number of days in the period being measured. 365 is usually used for a whole year, 180 for a half year.

-

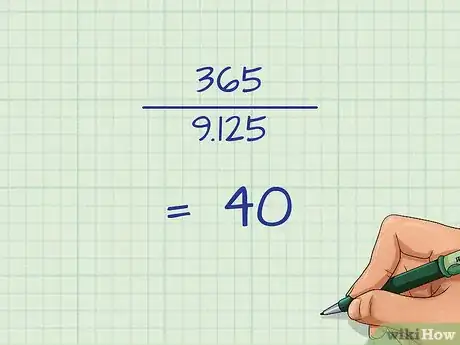

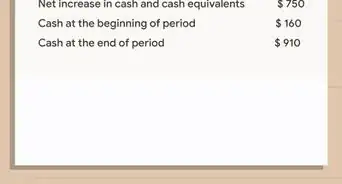

3Solve the equation. Once you have your variables in the equation, you can simply divide to solve the equation. In the example, the equation solves as 365/9.125= 40 days.

-

4Understand your result. The result of 40 indicates that the average accounts receivable collection period is 40 days. This means that the business owner can expect a credit sale to be paid by the customer within 40 days. This can help them plan for how much cash they need to have on hand for expenses and bills.

Using the Data

-

1Understand the significance of the accounts receivable collection period. Calculating the accounts receivable collection period tells companies how long customers are taking to pay the company for their credit sales. A lower figure is better. This means that customers are paying the company in a timely manner. If customers pay in a shorter amount of time, the company then has less funds tied up in accounts receivable and more funds available to use for other purposes. A low number also indicates that customers are less likely to default on credit payments.[7]

-

2Compare accounts receivable collection period to the standard number of days customers are allowed before a payment is due. For example, suppose a company has an accounts receivable collection period of 40 days. This means its accounts receivable is turning over approximately 9 times per year. On the face of it, this seems beneficial to the company. However, suppose the company's credit terms require customers to pay within 20 days. This difference between the credit terms and the accounts receivable collections period means the company does not have diligent collections procedures.[8]

-

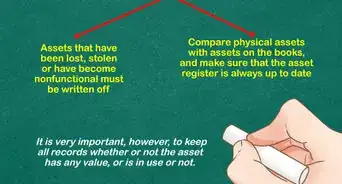

3Know how to keep the accounts receivable collection period short. Companies must grant credit prudently. Customers' credit should be screened before a credit sale is approved. Customers with poor credit histories should not be approved for credit sales. Also, companies should have vigorous collections activities. Accounts should not be allowed to linger unpaid beyond the company's credit terms.[9]

-

4Consider the correlation between the annual sales figure and the average accounts receivable. Companies with seasonal sales may have unusually high or low average accounts receivable figures, depending on where they are in their seasonal billings. Companies should either annualize the receivables data or use a shorter measuring period to account for seasonal differences in the average accounts receivable balance.[10]

- To annualize receivables, companies should average the accounts receivable balance for each month of an entire 12-month year.

- Companies can calculate the accounts receivable collection period using a rolling average accounts receivable balance that changes every three months. The calculated accounts receivable collection period will fluctuate each quarter based on seasonal sales activity.

References

- ↑ http://www.financeformulas.net/Average-Collection-Period.html

- ↑ http://www.accountingtools.com/questions-and-answers/what-are-net-credit-sales.html

- ↑ http://www.accountingtools.com/questions-and-answers/what-are-net-credit-sales.html

- ↑ http://www.accountingtools.com/questions-and-answers/how-do-i-calculate-average-accounts-receivable.html

- ↑ http://www.exinfm.com/board/accounts_receivable_ratios.htm

- ↑ http://www.investopedia.com/terms/a/average_collection_period.asp

- ↑ http://www.accountingtools.com/receivables-collection-period

- ↑ http://www.accountingtools.com/receivables-collection-period

- ↑ http://www.accountingtools.com/receivables-collection-period