This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

This article has been viewed 121,628 times.

The method for precisely determining the rate of amortization, which is the amount needed to pay off a particular mortgage loan, will vary depending on factors like the type of loan, its terms, and what options are exercised by the borrower. However, there is a standard formula used for calculating the loan payoff amount of a mortgage based on the principal, the interest rate, the number of payments made, and the number of payments remaining. This article provides detailed information that will assist you in calculating your mortgage payoff amount based on the terms of your loan. Contact your lender to confirm that your calculation is correct based on the particulars of your mortgage.

Steps

Knowing the Essentials

-

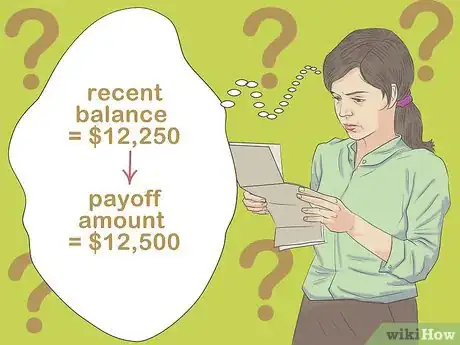

1Understand why your mortgage payoff amount does not equal your current balance. Your statement says your most recent balance is $12,250, and yet your payoff amount (the amount it would take to close out the mortgage) is listed as $12,500. How can that be?

- You may assume that some complicated financial formulas are at play (ones that cost you money, of course), but in fact the answer is quite simple: mortgages are paid in arrears. That is, you pay June’s interest with July’s payment.[1]

- This process starts at the beginning, at closing. If you close in June, for instance, your first payment won’t be due until August, with July’s interest included.

- Thus, to determine your payoff amount, the interest accrual since your last payment must be calculated and added to your balance. This interest wouldn’t typically be added to your balance until your next statement date.

-

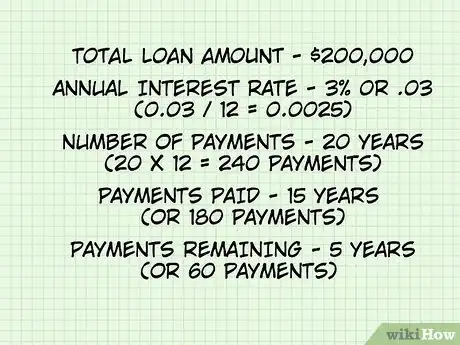

2Gather the information needed for your calculations. In order to determine the payoff amount, either using a calculation program or on your own, you need to know a handful of basic figures regarding your mortgage. All of these figures should be available on your statement or other loan documents. These include:

- The total amount borrowed when you took out the loan (for example, $200,000).

- The annual interest rate (for example, 3%, or 0.03). To do the calculations yourself, you will need to divide this number by twelve (0.03 / 12 = 0.0025), because mortgage interest compounds monthly.

- The total number of payments for the life of the loan, which for monthly payments is the number of years times twelve (for example, 20 years = 240 payments).

- The total number of years / payments remaining, and the number paid so far (for example, 15 years = 180 payments made; 5 years = 60 payments remaining).

Advertisement -

3Consider online calculators if you’d rather not exercise your math muscles. The calculations aren’t all that complicated, but punching a few numbers in and pressing “calculate” is certainly easier. A search for “mortgage payoff calculator” will provide several useful results. Try out a few to ensure accuracy.

- Please note, however, that you may find slight variations in your final results, probably only a few cents, but enough that you should always confirm your payoff amount with your lender before attempting to make a final payment.

- Using two such online calculators for a $200,000 loan at 3% annual interest over 20 years, with five years remaining, produces payoff results of $61,729.26 and $61,729.33, respectively.[2] [3]

-

4Contact your mortgage lender if you plan to make a final payment. Avoid making what you think is a mortgage payoff only to find out that you still owe a few dollars or cents that keeps your mortgage alive and accruing interest.

- Contact your lender by phone or online; lenders with online account management likely have a page that allows you to make the request. You will likely receive your payoff amount after a week.

- You will be asked to choose a specific date for which to determine the payoff.

- If you want to make the final payment, you will need to complete some version of payment form (online or by mail) with the precise amount due and the time frame in which this amount is valid as a final payoff.

- Such requests can be made solely for informational purposes as well. Some lenders may even include a payoff amount on your monthly statement.

Making the Calculations

-

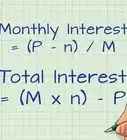

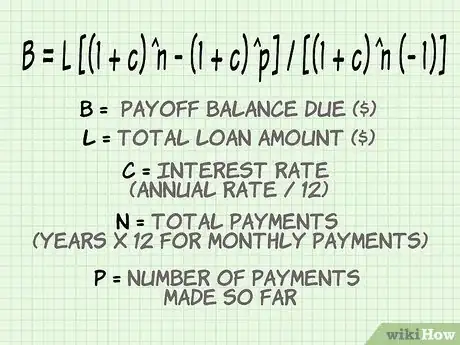

1Lay out the formula carefully. It looks rather unwieldy at first, but the math is relatively straightforward once you’ve inserted your figures. Just be sure to copy the formula exactly or your results may vary significantly. The formula is:[4]

- B = L [(1 + c)^n - (1 + c)^p] / [(1 + c)^n (- 1)] , in which:

- B = payoff balance due ($)

- L = total loan amount ($)

- c = interest rate (annual rate / 12)

- n = total payments (years x 12 for monthly payments)

- p = number of payments made so far

-

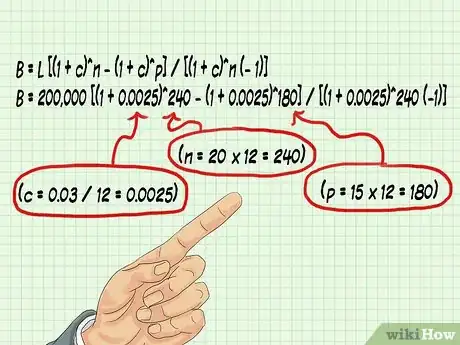

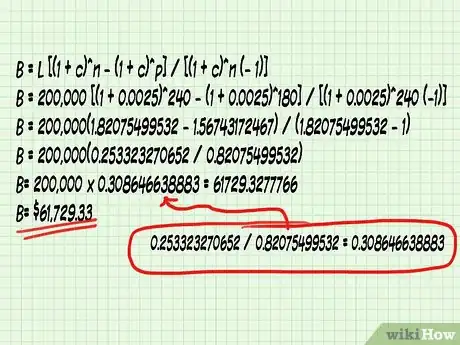

2Insert your figures. Using the same example as for the online calculators, a 20-year, $200,000 mortgage at 3% interest with five years to go, appears thusly:

- B = 200,000 [(1 + 0.0025)^240 - (1 + 0.0025)^180] / [(1 + 0.0025)^240 (-1)]

- Remember that the 3% annual interest rate (0.03) is divided by twelve because it compounds monthly (c = 0.03 / 12 = 0.0025).

- Twenty years of monthly payments is 240 (n = 20 x 12 = 240), and fifteen years of payments so far is 180 (p = 15 x 12 = 180).

-

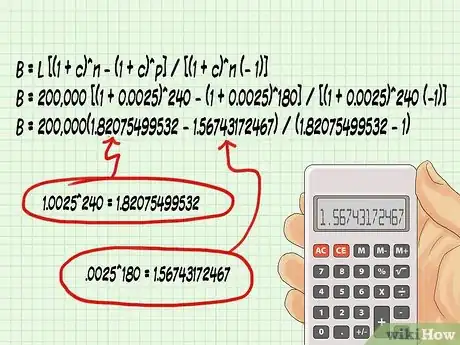

3Power up your numbers. After adding 1 to 0.0025 the three times it appears in the formula, you will need to raise the resulting 1.0025 to the 240th power (twice) and to the 180th power (once). A good calculator will come in handy here.

- 1.0025^240 = 1.82075499532

- 1.0025^180 = 1.56743172467

- B = 200,000(1.82075499532 - 1.56743172467) / (1.82075499532 - 1)

-

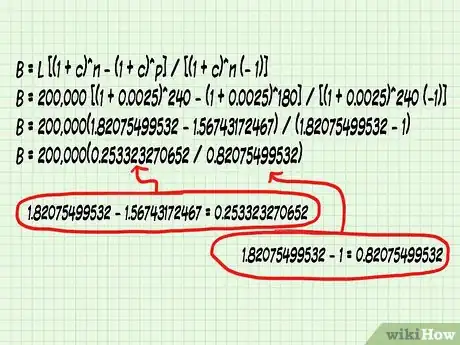

4Subtract from the inside. Once you accomplish this step, the formula will appear much more manageable and will be that much closer to completion.

- 1.82075499532 - 1.56743172467 = 0.253323270652

- 1.82075499532 - 1 = 0.82075499532

- B = 200,000(0.253323270652 / 0.82075499532)

-

5Divide, multiply, and conquer. Now you can finish things off and solve for B, your payoff amount.

- 0.253323270652 / 0.82075499532 = 0.308646638883

- 200,000 x 0.308646638883 = 61729.3277766

- Therefore, your payoff amount is $61,729.33.

Expert Q&A

-

QuestionHow do you calculate a mid-month mortgage payoff?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

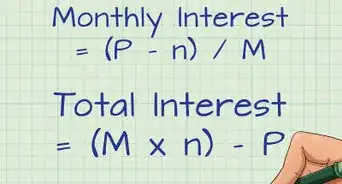

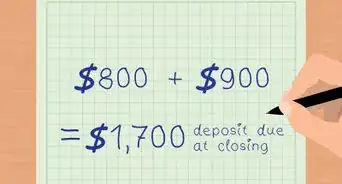

Real Estate Broker To calculate mid month, multiply the monthly payment for the insurance premiums, interest, taxes, homeowner insurance, and anything else that is lumped into the monthly mortgage payments by the number of days until the close divided by the number of days in the month.

To calculate mid month, multiply the monthly payment for the insurance premiums, interest, taxes, homeowner insurance, and anything else that is lumped into the monthly mortgage payments by the number of days until the close divided by the number of days in the month. -

QuestionI owe 31900.00 on mortgage initially. The rate is 6.5 and I have 11yrs & 10 months to pay off, what would my payoff be

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker There are many other factors that are needed to answer this question. You need what the total term of the loan is, the original loan amount, the total number of payments in the term and the total number of payments made so far.

There are many other factors that are needed to answer this question. You need what the total term of the loan is, the original loan amount, the total number of payments in the term and the total number of payments made so far. -

QuestionI have a mortgage with a private individual. I am going to pay off the mortgage. I need an ammortization schedule where I can plug in the amount of my monthly payments ($800) for the last 2 years at 7% interest.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker You can find free ammortization schedules on line. Just search for them. These will allow you to plug in your values.

You can find free ammortization schedules on line. Just search for them. These will allow you to plug in your values.

Warnings

- While you can make the calculations yourself, it always best to get the payoff number from the lender themselves. If your calculations are off even by a few cents, you may end up keeping the mortgage open, and you will continue to accrue interest.⧼thumbs_response⧽

References

- ↑ http://themortgageinsider.net/mortgages-refinancing/mortgage-payoff.html

- ↑ http://www.free-online-calculator-use.com/early-payoff-mortgage-calculator.html

- ↑ http://www.calculator.net/mortgage-payoff-calculator.html

- ↑ http://www.mtgprofessor.com/formulas.htm

- ↑ http://budgeting.thenest.com/pay-off-mortgage-balance-selling-home-28962.html

About This Article

Mortgage payoff is the remaining amount you need to pay on your mortgage, including interest. To calculate your mortgage payoff, you’ll need to know the total amount you borrowed, your annual interest rate, the total number of payments for the whole duration of the loan, and the total number of payments remaining. There are a number of online calculators that will work this out for you. All you need to do is enter your figures and take note of your mortgage payoff. For more tips from our Financial co-author, including the formula to manually calculate your mortgage payoff, read on!

-Step-18.webp)