This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 66,533 times.

Escrow is frequently associated with real estate transactions. A lender will often require a mortgagee to place a certain sum of money into a special escrow account held by a third- party financial services company who will in turn see that property taxes and insurance payments are made in a timely manner. It is a method of ensuring that the collateral for a loan, which is usually property, will not be lost through catastrophic events (like fires, floods, etc.) or non-payment of taxes, in which case the local government could legally seize the property. People purchasing real estate must know the amount of money they will need to set up an escrow account at the time they close on their property.[1] The following steps will help you to calculate escrow payments and the amount due at closing.

Steps

Calculating Monthly Escrow Payments

-

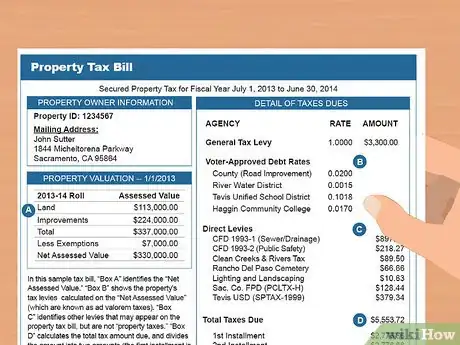

1Determine the amount of the previous year's property tax bill. First, you'll need to know the amount of property tax you can expect to pay this year. You can get this information from your agent or the current owner. If it is a new building, talk to the tax assessor's office to get an estimate of yearly taxes based on similar properties.

-

2Find out how much your insurance costs will be for the next year. Call several homeowners insurance companies and get quotes for yearly premiums. Consult with your lender to make sure you are getting the amount of insurance required.Advertisement

-

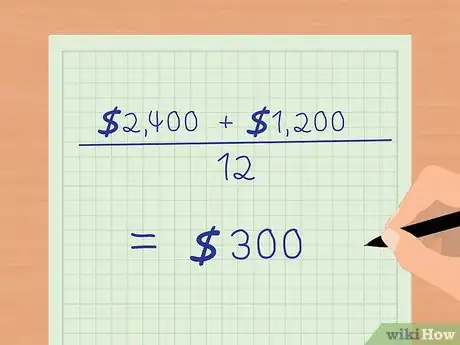

3Add the yearly taxes and insurance premium together and divide by 12. This is how much money will be added to the monthly mortgage payment and deposited into an escrow account. If the insurance company requires an initial deposit, include that figure in your estimate.

- For example, imagine that you determine that you owe a total of $2,400 per year in property taxes and $1,200 in insurance premiums. Add these together to get a total of $3,600. Then, divide this number by 12 to get your monthly escrow payment, which would be $3,600/12, or $300.

-

4Consider making a larger down payment instead. Some lenders will not require an escrow account if the borrower is placing a 20 percent down payment on the property. Speak with your loan officer and see if the bank is willing to consider this option.

Calculating the Amount Due at Closing

-

1Understand why you need an escrow deposit. Lenders traditionally require an escrow deposit in an amount that ensures the balance always covers at least two months' worth of insurance and property tax payments. This escrow amount is governed by HUD, the Department of Housing and Urban Development in the United States or by the FSA, the Financial Services Authority in the United Kingdom.[2]

- Essentially, the deposit ensures that the balance of the escrow account is never too lower to cover two months of payments in the event that you don't make your payments.

-

2Determine your monthly insurance and tax payments. This means that you've have to determine your individual monthly contributions to your escrow account that cover the cost of your annual insurance and tax payments. Do this by dividing your yearly insurance amount and annual property tax amount by 12. While these payments will be made together in reality, you'll need to separate them to find your amount due at closing.

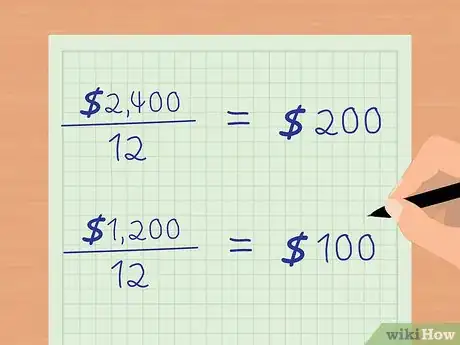

- For example, using the amount from Method 1, we have $2,400 each year in property taxes and $1,200 each year in insurance premiums. So, our monthly property tax payment would be recorded as $2,400/12, or $200, and the the monthly insurance payment would be recorded as $1,200/12, or $100.

-

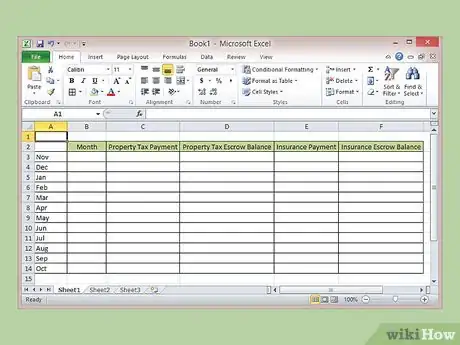

3Create an escrow schedule. To calculate the amount due at closing, you'll need to create a schedule that covers the payments into and out of your escrow account over the next year. To do this, create a table that is five columns wide and 12 rows deep. You can do this either by hand or on a spreadsheet program such as excel. The rows will be labeled by the month, starting with the first month the escrow payment is due and continuing until the month before that month in the next year (for example November through October). The five columns will be labeled as follows, from left to right:

- Month

- Property Tax Payment

- Property Tax Escrow Balance

- Insurance Payment

- Insurance Escrow Balance[3]

-

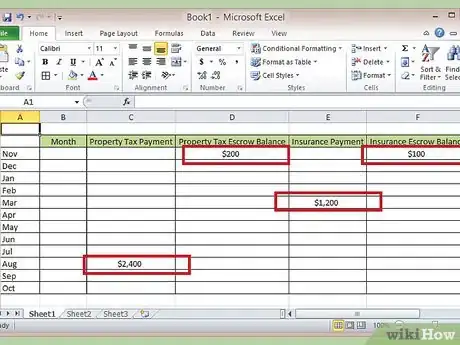

4Fill in your schedule. You'll need to include months that the insurance payment and property tax payments are due. Do this by placing the value of the payment next to the appropriate month in the two "payment" columns. In addition, you'll need to fill in the "balance" categories with the appropriate balance for that month. The first month's balance will be the amount of the monthly payment, in both cases.

- For example, imagine that for numbers mentioned above, your first escrow payment is due in November and that you have an insurance payment due in March and a property tax payment due in August. You would write $1,200 in the box under the insurance payment column across from the month of March and $2,400 in the box under the property tax column and across from the month of August.

- In addition, you would start at the top of the chart in the "balance" columns by writing in $200 in the property tax escrow balance column for November and $100 in the insurance escrow balance column for November. These represent the amount being paid in each month into each account.[4]

-

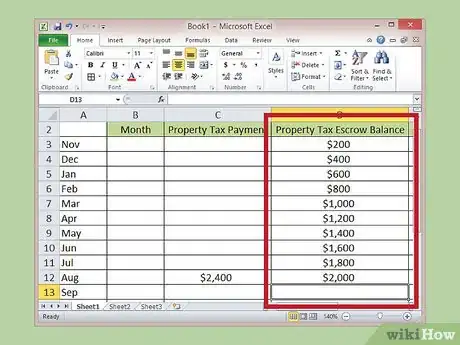

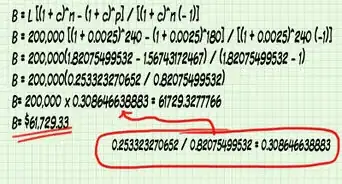

5Fill in the balances on your schedule. Continue filling in the "balance" columns by adding the appropriate monthly payment each month. This balance will increase until the month that the payment is made, during which time it will be decrease by the amount of the payment. Fill these out all the way to the bottom of your schedule. All balances should be "0" at the end of the schedule.

- For example, in your property tax escrow balance column, you would start by adding $200 each month, so November would be $200 and December $400 and so on. When you get to August, you will have input 10 months worth of payment, or $2,000. However, your payment is $2,400 for the year, so you will subtract $2,400 from your balance, giving you -$400 (negative four hundred dollars). This $400 is the "escrow deficiency" for your property tax payment.

- Do the same for your insurance escrow balance account and record the escrow deficiency. In our example, the deficiency would come out to $700.[5]

-

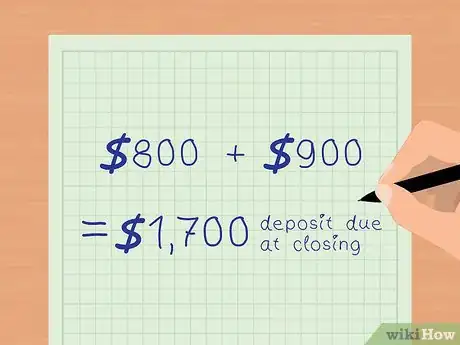

6Calculate your amount due at closing. This will combine your monthly payments into each account and your deficiencies after payments, so be sure to have those numbers ready. To get your amount due at closing, simply double your monthly payments for each account and add that number to your deficiency for that account. Then, combine the two accounts. This is your escrow deposit due at closing.[6]

- So, double your property tax escrow monthly payment of $200 to get $400 and add that to the deficiency of $400 to get a total of $800. Then, double your monthly insurance escrow account payment of $100 to get $200 and add your calculated deficiency of $700 to get a total of $900. Then, add the two totals to get $800 + $900, or $1,700. This is the deposit due at closing.

Expert Q&A

-

QuestionHow do I calculate escrow payments?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage Divide the amount that will be collected in escrow per year by 12, and that will be your monthly escrow payment.

Divide the amount that will be collected in escrow per year by 12, and that will be your monthly escrow payment.

Warnings

- Get official receipts from the insurance company and the tax assessor's office to ensure that the payments are being made on time.⧼thumbs_response⧽

- Inspect your property tax bill every year, specifically checking for critical errors in areas such as square footage, number of bedrooms and bathrooms, and improvements or other factors that can affect your property's value.⧼thumbs_response⧽

References

- ↑ http://www.mortgage101.com/article/what-is-escrow-payment

- ↑ http://www.mtgprofessor.com/A%20-%20Escrows/how_do_i_figure_escrows.htm

- ↑ http://www.mtgprofessor.com/A%20-%20Escrows/how_do_i_figure_escrows.htm

- ↑ http://www.mtgprofessor.com/A%20-%20Escrows/how_do_i_figure_escrows.htm

- ↑ http://www.mtgprofessor.com/A%20-%20Escrows/how_do_i_figure_escrows.htm

- ↑ http://www.mtgprofessor.com/A%20-%20Escrows/how_do_i_figure_escrows.htm

-Step-18.webp)