This article was co-authored by Ryan Baril. Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 71,001 times.

Prepaying your mortgage can shorten the life of the loan and save you a large amount of money in interest. There are two ways to do this: you could contribute extra money every month (or year); or you might be able to take advantage of falling interest rates by refinancing the loan. Whichever method you choose, the important thing is to make consistent payments. This article will show you how to save money by shortening your mortgage.

Steps

Making Extra Payments

-

1Ask if you can make extra payments. The key to paying off a mortgage early is to make extra payments against the principal balance. The lower your principal, the less interest you'll have to pay. Accordingly, check with your lender to see if they will accept extra payments.

- Some lenders will let you make extra payments but only at specified times.[1]

- Lenders may also charge prepayment penalties.

- Call your lender and ask what happens with extra payments. They won't do you any good unless they are applied to the principal. Some lenders apply additional payments toward interest, which benefits the lender more than it does you. [2]

-

2Write "Apply excess to principal" on the memo line of your check. Always include this phrase on extra payments to ensure that the money goes to paying off the principal of the mortgage and not the interest. Do this no matter what method of extra payment you choose.Advertisement

-

3Pay your mortgage every two weeks. In effect you can make an extra month's payment each year simply by paying half of your scheduled monthly mortgage payment every two weeks (rather than 12 times a year). If, for example, you have a 30-year mortgage for $220,000 at 4% interest, you'll be able to pay off your mortgage 11 years early by using the every-two-weeks schedule. [3]

- Let's say your monthly mortgage payment is $600. You would then pay $300 every two weeks—on the first and the fifteenth of every month, for example.

- To make things easier, automate your bill paying.[4]

- An alternative is to divide your monthly mortgage payment by 12, and add that amount to each month's payment. For example, if your monthly payment is $600, you could contribute an extra $50, and pay $650 each month. In this way, you'll effectively make an extra month's payment each year.

-

4Make an extra contribution once a year. You might not make enough money to pay extra every month. However, if you come into a lump sum of money during the year (perhaps a bonus or raise at work), you should consider directing it toward your mortgage payments in a lump sum. [5]

- You could also use any tax refund to pay down the principal on your mortgage.

- If you inherit money from a relative, you could apply part of that windfall to your mortgage balance. [6]

-

5Round up your payments. If your mortgage payment is $712, increase it to $750 or $800. Every little bit helps.[7] Choose an amount you can afford and budget for that amount. It may surprise you to learn how a small increase in monthly payments can have a large effect over time in whittling away at your mortgage.

-

6Start early. The sooner these efforts begin, the more money you will save in the long run. During the first five-to-seven years of a mortgage, the bulk of your payments go toward interest. Any extra payments go directly toward the principal amount of your loan. Accordingly, pay more in the early years when your monthly installments are primarily interest payments.

- However, it's never too late to start paying off your mortgage early by sending in extra money each month or year.

- To see how much you will save, use an online calculator. The AARP website has a calculator that is easy to use.[8]

Refinancing Your Mortgage

-

1Refinance when a lower interest rate becomes available. With a mortgage refinance (called a “refi”), you get a loan that pays off your current mortgage. A lower interest rate means your monthly payments will be smaller.

- Make sure that you are not refinancing for a longer term, as this will extend the length and increase the total cost of your mortgage.

- Most lenders are typically willing to refinance a mortgage. Inquire first with your current mortgage lender, and then check rates at any other bank where you do business. [9]

- You can also search online for favorable interest rates. Generally a refi should lower your interest rate by at least a full percentage point. Otherwise, it probably isn't worthwhile, considering the origination fees you'll have to pay on the new loan.

-

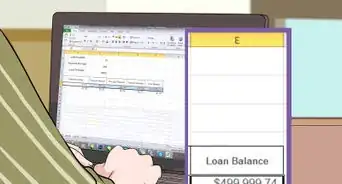

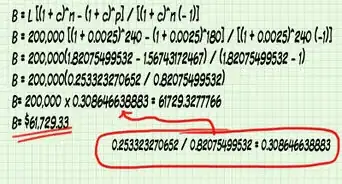

2Refinance into a shorter term. You'll pay off your mortgage faster if you refinance a 30-year mortgage with something shorter such as a 15- or 20-year mortgage. This type of refinance will reduce the total amount of interest that you pay. [10]

- With a refi, your monthly payments might increase. For example, refinancing a 30-year mortgage at 4.5% with a 15-year mortgage at 3.5% will save you money in the long term, but your monthly payment will be larger. Be sure you can afford the new payments before you sign the papers.

- Use an online calculator to determine how much you will save by refinancing. Zillow, for example, has an online calculator that is easy to use. [11]

-

3Gather required documents. You'll need to show the lender your financial information, so collect this ahead of time. Doing so will make the application process smoother: [12]

- Proof of income such as two recent pay stubs or a profit-and-loss statement if self-employed

- Latest tax returns

- Tax forms such as your W-2 or 1099s

- Proof of homeowner's insurance

- Property title insurance

- Information on your monthly debt load

- Documentation on assets such as stocks, bonds, real estate, savings accounts, and retirement accounts

-

4Don't borrow too much. Lenders may pressure you to take more money than you need. For example, let's say you owe $65,000 on a home worth $140,000. A lender might encourage you to borrow as much as 90% or 95% of your home's value in a conventional loan. In this example you could qualify to borrow $126,000, but that would be almost twice what you actually need. Don't succumb to salesmanship. Remember that your home is at risk whenever you borrow against it.

- Going deeper into debt doesn't benefit you. Yes, you might pay off your mortgage faster, but now you have a new debt, and your home is still the collateral.

-

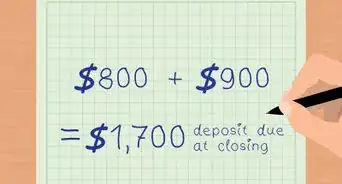

5Review the terms of the loan. Make sure there aren't hidden fees that will increase the cost of the refinance. For example, pay attention to the closing costs, which can substantially add to the amount you have to repay. [13]

- Some lenders might claim they won't charge you any closing costs. However, read the fine print: the costs may actually be rolled into the loan rather than appearing as separate items in the closing documents. Those fees are really the main incentive the lender has to refinance your loan.

-

6Apply to the principal the money you save by refinancing. A refinance will benefit you the most if you use the money saved to pay down the principal. For example, your monthly mortgage payment might have dropped from $1,000 a month to $650. Contribute that $350 saved to the principal on your loan.

-

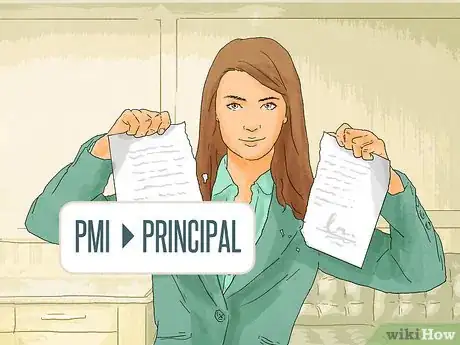

7Remove your private mortgage insurance (PMI). You are buying this insurance if your mortgage is "conventional" and you borrowed more than 80% of the home's value. PMI costs between 0.05% and 1% of the loan amount—a meaningful sum. Cancel this insurance as soon as possible (it benefits only the lender), and redirect the amount of the PMI premiums toward your principal. [14]

- You can ask to remove the PMI once your loan-to-value ratio reaches 80%. Your lender is required to remove it once you reach a 78% ratio.

References

- ↑ https://www.daveramsey.com/blog/3-easy-ways-to-pay-off-mortgage-early

- ↑ https://www.forbes.com/sites/trulia/2016/12/07/how-to-pay-off-your-mortgage-early/2/#6ffa72e53cdb

- ↑ https://www.daveramsey.com/blog/3-easy-ways-to-pay-off-mortgage-early

- ↑ http://www.clark.com/6-steps-pay-your-mortgage-early

- ↑ https://www.daveramsey.com/blog/3-easy-ways-to-pay-off-mortgage-early

- ↑ https://www.forbes.com/sites/trulia/2016/12/07/how-to-pay-off-your-mortgage-early/2/#6ffa72e53cdb

- ↑ https://www.daveramsey.com/blog/3-easy-ways-to-pay-off-mortgage-early

- ↑ http://www.aarp.org/money/credit-loans-debt/mortgage_payoff_calculator/

- ↑ https://www.realsimple.com/work-life/money/saving/pay-off-mortgage-early

- ↑ https://www.realsimple.com/work-life/money/saving/pay-off-mortgage-early

- ↑ https://www.zillow.com/mortgage-calculator/refinance-calculator/

- ↑ https://www.mortgageloan.com/7-types-documents-you-need-refinance-8699

- ↑ https://www.forbes.com/sites/trulia/2016/12/07/how-to-pay-off-your-mortgage-early/#2fb68eab5f39

- ↑ https://www.forbes.com/sites/trulia/2016/12/07/how-to-pay-off-your-mortgage-early/2/#6ffa72e53cdb

About This Article

To pay your mortgage faster, check with your lender to see if you can make extra payments toward your principal balance, which will also help you pay less interest in the long run. You can also pay your mortgage every 2 weeks as opposed to once a month, which will help you pay off an extra month every year. Or, whenever you get a bonus or tax refund, you could put it toward your mortgage to lower your principal balance. Also, consider rounding up your payments to pay your mortgage faster. For example, if you usually pay $750, start paying $800 instead. To learn how to refinance your mortgage, scroll down!

-Step-18.webp)