This article was co-authored by Alex Kwan. Alex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 81,943 times.

If you work for an hourly wage, you may want to calculate your wages by hand to verify that the paycheck you receive each week is correct. In general, you only need to know your hourly pay rate and the number of hours that you work. Some other factors, like state and federal taxes, may apply as well. If you earn tips as part of your pay, you will need a slightly different calculation.

Steps

Calculating Regular Wages Based on Hourly Pay

-

1Know your hourly pay rate. When you were hired, you should have been notified of your pay rate. If you do not know your hourly rate, you should ask your supervisor or the company human resources director.[1]

- Since July 24, 2009, the federal minimum hourly wage in the United States is $7.25.

- As of January 1, 2017:

- thirty states or territories had minimum hourly wage rates greater than the federal rate.

- twenty-one states or territories apply minimum hourly wage rates equal to the federal rate.

- You can look up your individual state at https://www.dol.gov/whd/minwage/america.htm.

-

2Record your hours worked. Every company or employer will have a different system for you to record the hours you work. In some places, you may punch a time clock when you enter and leave. Others may have you record tasks on time slips and enter them into a computer system. Whichever system your employer uses, make sure you know how to record your time. You may want to keep a private record in addition, to compare with your paycheck.[2]

- If you receive different pay rates for different working times, you should keep separate records. For example, if you earn one rate for weekdays and a higher rate for weekends, you should count your weekday hours and your weekend hours separately.

Advertisement -

3Keep track of overtime. If your contract allows you to earn a higher overtime rate after a certain number of hours, you should keep track of the hours that qualify for overtime. For example, if you get overtime after 40 hours each week, and you worked 50 hours, then you would have 40 hours at your regular rate and 10 hours at your overtime rate.[3]

- Alternatively, some people might earn overtime after 8 hours on one day. If, during one week, you worked 10 hours, 10 hours, 8 hours, 4 hours, and 6 hours, you would have 34 hours at regular time and 4 hours at overtime.

-

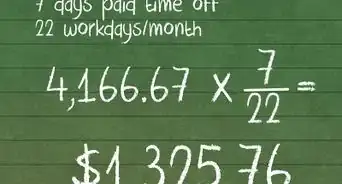

4Multiply your hours worked by the pay rate. Take your total number of hours at your base pay rate and multiply it by the rate. If you have additional hours at a second rate (overtime or weekend, for example), multiply those hours times that rate separately. Then add the two numbers together.[4]

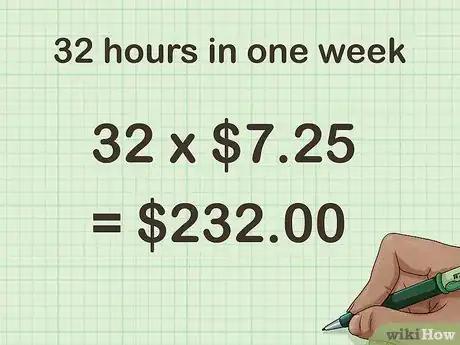

- For a simple example, suppose you worked 32 hours in one week at the federal minimum wage rate of $7.25 per hour. Calculate your wages for this week as .

- For a slightly more complicated example, suppose you worked 40 hours at a rate of $9.00 per hour, and you worked overtime for 12 hours at a rate of $13.50 per hour. This calculation will be:

- .

-

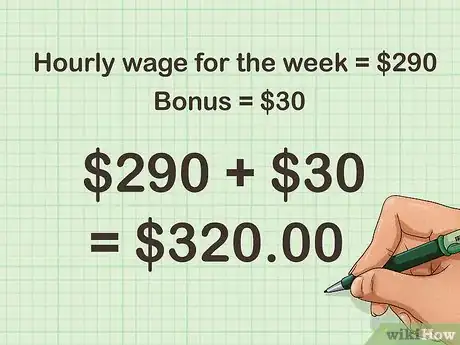

5Add on any bonuses. Some employees are eligible for bonus pay for a variety of reasons. If this applies to you, then add any bonuses to your wages after completing the prior calculation.

- For example, if your hourly wages add up to $290 for the week and you earned a $30 bonus, your total would be $320.

-

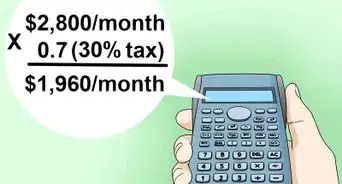

6Account for deductions. Your take-home pay, in most cases, is going to be less than the wages that you calculate. The difference will be made up of federal, state and local withholding taxes, Social Security withholding, and other things. In some states, your employer may have to withhold for unemployment insurance. You might also elect to have an amount withheld and deposited into a retirement fund.[5] [6]

- Withholding rates are different for everyone based on your tax bracket and local and state laws. If you want to understand your personal deductions completely, you should talk with your employer’s bookkeeper.

- Some online sources offer “wage calculators.” These are websites where you can enter your number of hours worked, your pay rate, and your number of dependents. The site will then calculate your weekly, monthly and annual wages. Bear in mind that any deductions are probably going to be estimates.[7]

-

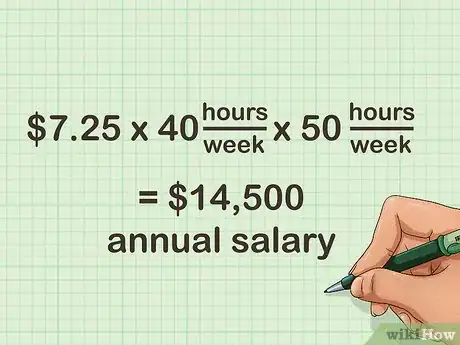

7Estimate your annual wages. If you work for an hourly rate, you can estimate your annual salary, especially if your hours are fairly regular. Assuming that you work a full-time, 40 hour per week schedule, simply multiply your hourly rate by 40, to calculate your weekly pay. Then multiply that result by 50 to estimate the number of working weeks per year. This will allow for some unpaid vacation or sick time during the year.

- For example, if you earn the minimum wage of $7.25 per hour, you would multiply annual salary.

- If you were hired for an annual salary, then that number, minus taxes and other withholdings, will be your annual pay.

Calculating Wages for Tipped Employees

-

1Find out your hourly rate. Tipped employees, including waiters and waitresses, earn a substantial part of their income through tips. These tips cannot be directly calculated or predicted. When you are hired, your employer may offer you any competitive rate or may choose to apply the minimum wage for your state.[8]

- As of January 1, 2017, the federal minimum wage for tipped employees is $2.13. This is calculated by starting at the regular minimum wage of $7.25 and subtracting a credit of $5.12 per hour. Essentially, the government is assuming that you will earn at least $5.12 each hour in tips.

- Eight states do not make any deduction to the minimum wage for tipped employees. Twenty-eight states or territories do apply a tip deduction, but still have minimum wages higher than the federal rate. Eighteen states use the federal tipped employee minimum of $2.13.

- You can find your state’s laws at https://www.dol.gov/whd/state/tipped.htm.

-

2Record your working hours. Use your employer’s record keeping system for recording the hours you work. You may also wish to keep your own separate record to compare with your paycheck.[9]

-

3Keep track of your tips. Different companies or employers may have a variety of policies for handling tips. Some places will pool the tips among all staff and then divide them evenly. Others will just allow you to collect your own tips from your work station. Follow your employer’s system. At the end of each day, you should count and record the amount of tips that you received.

- Because tips often come in cash, it is tempting just to grab the money and go at the end of the night. But if you are concerned with counting your wages, you should keep a record.

- Customers who pay with credit cards will often tip that way as well. You need to learn your employer’s system for crediting you with these tips. For example, the credit card tips may just be calculated in the computer and added to your paycheck each week.

-

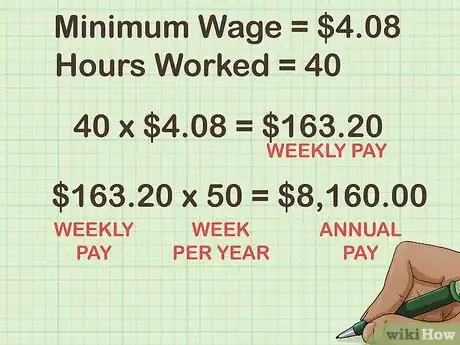

4Calculate your weekly or annual pay. To find your base pay, multiply your number of hours worked by your pay rate.

- For example, suppose you work in Ohio, where the tipped employee minimum wage is $4.08. You earn that wage, and work for 40 hours in a given week. Your base pay is therefore .

- If you want to estimate your annual pay, multiply this result by 50 weeks per year. This will account for about two weeks of unpaid vacation or sick time. Working with the above example, this results in .

-

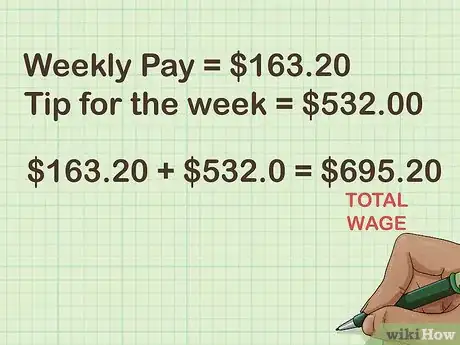

5Add on your tips. If you are trying to calculate your wages for one particular week, keep track of the tips that you earned that week. Add the total of your tips to your calculated base pay.

- Suppose the employee in the previous example, with base pay of $163.20, collected tips during the week that amounted to $532.00. This person’s total wages would then be .

- To extend this example to an annual estimate, multiply the weekly result by 50. This assumes that your tips will be steady throughout the year. For this example, the annual estimate will be .

-

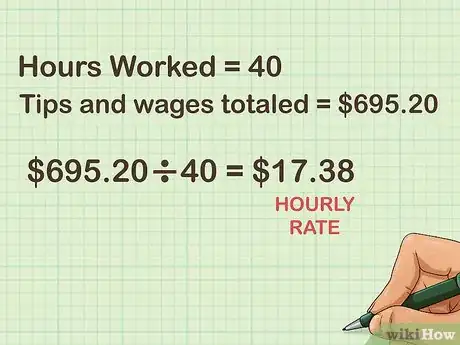

6Calculate your practical hourly rate. If you wish, you can figure out your hourly rate for the week, with base pay and tips combined. Simply divide your total calculated wages by the number of hours that you worked.

- For the ongoing example, if the tips and wages totaled $695.20, and you worked 40 hours, the hourly rate would be .

-

7Report your tips for tax purposes. The IRS requires tipped employees to keep an accurate, daily record of tips received through the month. By the 10th of the next month, you are then supposed to report this total to your employer. Your employer may require you to report tips more frequently. Your employer will use this figure to calculate your withholdings for taxes, Social Security and Medicare. Your employer will report all this information to the IRS.[10]

- You do not need to report tips if they total less than $20 per month.

Expert Q&A

-

QuestionWhat deductions are taken from a paycheck?

Alex KwanAlex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

Alex KwanAlex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

Certified Public Accountant It really depends on what kinds of benefit programs you pay into through your state and employer. However, you'll likely have federal income tax deductions, state tax, disabled insurance, unemployed insurance, employee benefits, and IRA and HSA deductions.

It really depends on what kinds of benefit programs you pay into through your state and employer. However, you'll likely have federal income tax deductions, state tax, disabled insurance, unemployed insurance, employee benefits, and IRA and HSA deductions. -

QuestionDo I need to add in my Social Security check into my wage total?

DonaganTop AnswererNo, Social Security benefits are not considered wages. You report those benefits on a separate line on your tax return.

DonaganTop AnswererNo, Social Security benefits are not considered wages. You report those benefits on a separate line on your tax return.

References

- ↑ https://www.dol.gov/whd/minwage/america.htm

- ↑ http://www.bizfilings.com/toolkit/sbg/office-hr/managing-the-workplace/calculating-employees-regular-pay-rates.aspx

- ↑ http://www.bizfilings.com/toolkit/sbg/office-hr/managing-the-workplace/calculating-employees-regular-pay-rates.aspx

- ↑ http://www.bizfilings.com/toolkit/sbg/office-hr/managing-the-workplace/calculating-employees-regular-pay-rates.aspx

- ↑ Alex Kwan. Certified Public Accountant. Expert Interview. 1 June 2021.

- ↑ https://www.irs.gov/individuals/employees/tax-withholding

- ↑ http://us.thesalarycalculator.co.uk/hourly.php

- ↑ https://www.dol.gov/whd/state/tipped.htm

- ↑ http://www.bizfilings.com/toolkit/sbg/office-hr/managing-the-workplace/calculating-employees-regular-pay-rates.aspx

About This Article

If you receive an hourly rate, you can work out your regular wages with a few simple calculations. Start by recording the hours you worked in a given period, such a week or month. Don’t forget to include any overtime you worked. Then, multiply the hours you worked by your hourly rate. If you were paid any bonuses during the pay period, add these too. Finally, subtract any deductions like federal, state, and local tax, social security, and any retirement funds you pay into. This will give you your take-home pay. If you don’t want to work this out manually, there are plenty of wage calculators online where you can input the information and they’ll do the math for you. For more tips, including how to keep track of tips, read on!