This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 630,319 times.

If you are paid by the hour as an employee or contract worker, calculating your hourly income as an annual salary can be useful. You'll often need to provide your annual salary on applications. Or, you may want to compare salaries between new job opportunities. Either way, you can figure out your yearly salary using simple formulas and basic math.

Steps

If You Work the Same Number of Hours Each Week

-

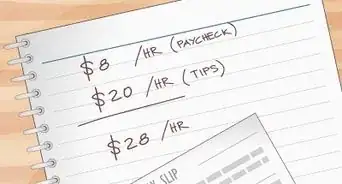

1Find out your hourly wage. You probably already know how much you make per hour. For example, you might make $15/hour. But if you don't, you'll need to find this information.

- Your hourly wage should be listed on your pay stub, if your employer provided one.

- If you aren't sure, you can also ask a manager, or someone in the personnel/human resources department.

-

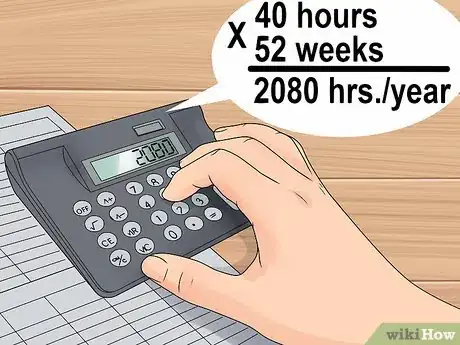

2Calculate the total hours you work each year. Multiply the number of hours you work each week by 52, the number of weeks in a year.[1]

- Remember, too that you should include any vacation hours earned or paid in a year. For instance, if you work 50 weeks out of the year, but you earn a two-week paid vacation, then your total weeks paid is 52. If you take unpaid vacations, then take this into account as well.

- For instance, if you work 40 hours a week, your math would look like this: 40 hours * 52 weeks = 2080 hours a year.

Advertisement -

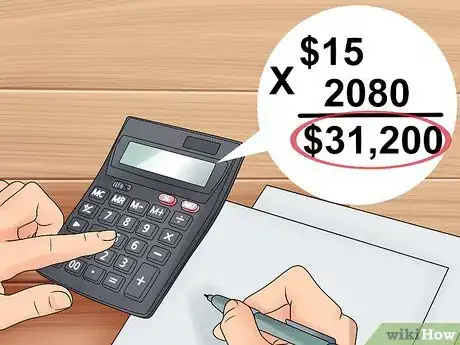

3Multiply your hourly wage by the number of hours you work each year. Now, all you have to do is multiply your hours by your wage.[2]

- Following the example above, $15 * 2080 = $31,200. This is your annual salary.

If You Work a Different Number of Hours Each Week

-

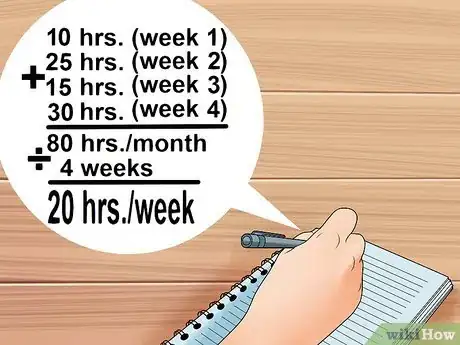

1Keep track of your hours. Write down the number of hours you work each day. At the end of the week, calculate how many hours total you worked.

- You can use a variety of electronic applications, online software, or even just write it in a notebook.[3]

- If your hours vary from week to week, you will want to keep track of your hours for a longer period of time. Then, you can average the numbers.

- For example, if you work 10 hours one week, 25 the next, 15 the following, and 30 the last week, you end up with 80 hours for the month. Divide this by 4 weeks and you get an average 20 hours a week.[4]

- If your hours vary a great deal between different times of the year, you may need to track an even longer period. For example, imagine you work 50 hours a week for a couple of weeks around the holidays, but only 20 hours a week during the summer. This is going to affect your calculations a lot. In the case of large variations, you might even have to track your hours over a whole year to get an accurate figure.

-

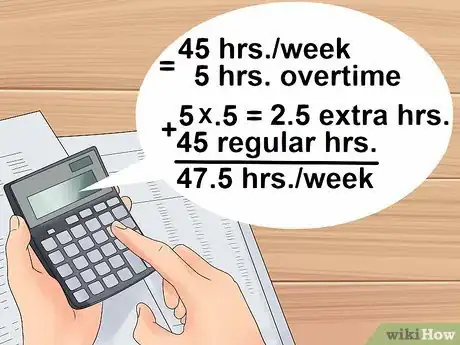

2Determine how many overtime hours you worked. If you work more than 40 hours in a 7-day period, your employer must pay you at one and a half times your regular wage. In other words, you should receive a half-hour credit for every hour you worked over 40 hours in a week.

- The formula for this calculation is: Total weekly payroll hours = Actual hrs worked + [.5 * (actual hrs worked - 40)]

- For example, say you work 45 hours one week. This is 5 hours of overtime. Multiply 5 by .5. This gives 2.5 extra hours.. Add this to the 45 regular hours. For this calculation, your hours for the week are then 47.5, rather than 45.

-

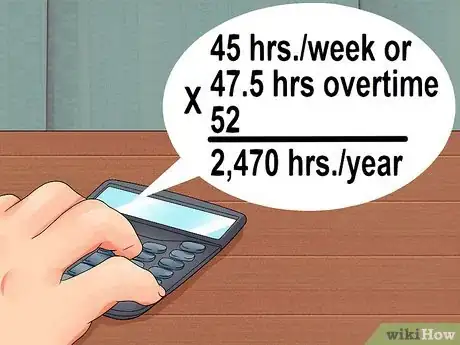

3Calculate how many hours you work in a year. To figure this out, multiply the average weekly payroll hours by 52.[5] For example, if you usually work about 45 hours a week, multiply 47.5 hours (adjusted for overtime) by 52. This equals 2,470 hours a year.

- If you track your hours for a whole year, you can simply add them up, rather than multiplying a weekly average by the number of weeks worked.

-

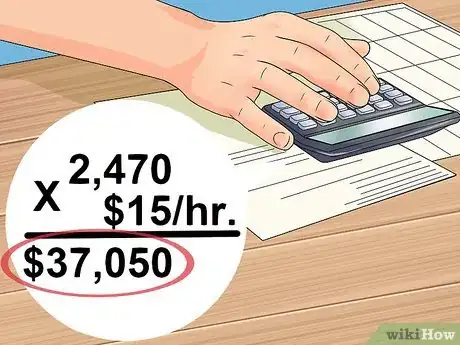

4Calculate your salary. Multiply the number of hours by your hourly wage.

- For example, if you make $15/hour multiply 2,470 by $15. This equals an annual salary of $37,050.

Additional Considerations

-

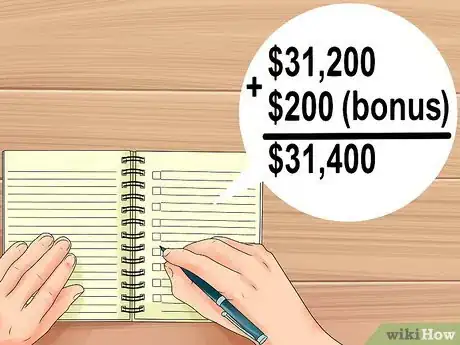

1Include bonuses. Add any bonuses, commissions or incentive payments you got to the annual salary figure. Many hourly positions have incentive arrangements that add to the hourly wage. For example, you might receive bonuses based on productivity, leadership, or tenure (length of time at the job).[6]

- Some employers provide a holiday bonus to all employees each year. Sticking with the example in Part 1, imagine you get $200 bonus every year. Your math would look like this: $31,200 + $200 = $31,400.

- If you receive a commission or other variable bonuses, you'll need to keep track of them over the course of a year to include them here. For example, imagine you get a $50 bonus every time you reach a certain level of sales. If you get this bonus 12 times over the course of a year, you multiply $50 time 12, getting $600. Sticking with the above example, you would then add $31,400 + $600 to get $32,000.

-

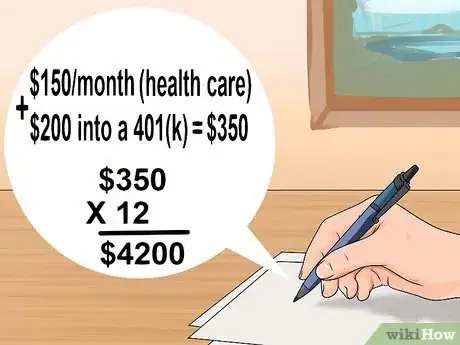

2Deduct benefits and payments. If you're paying into your health care or a 401(k), you may want to subtract these costs to get a measure of your "take-home pay."

- These amounts are still technically a part of your income. But, they represent money that does not increase your purchasing power.

- Look at your pay stub to find out how much is deducted for these expenses each month. To get an annual figure, multiply the monthly payment by 12. Subtract it from your annual income.[7]

- For example, if health care costs you $150 a month and you're putting $200 into a 401(k), that adds up to $350. $350 x 12 = $4200. Subtract this from your annual salary.

-

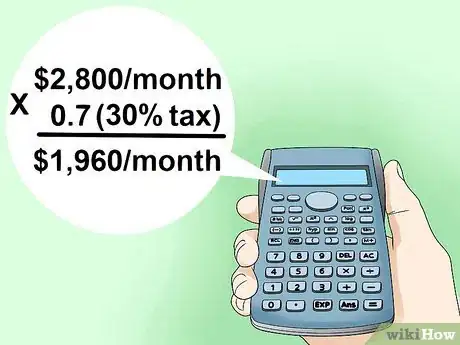

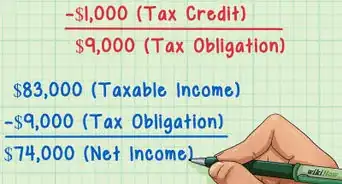

3Determine how much you pay in taxes. This will let you figure out your salary before or after taxes.

- You'll need to look up where you fall in the federal tax bracket to determine how much you'll pay in federal income tax. Your annual income will determine how much you are taxed. There are online tax bracket calculators that can help you figure this out if you don't know which bracket you are in.[8]

- Your state tax will depend on where you live. Some states have no income tax. For those that do, it will probably be about 5-6%. You can find your state's income tax rate online.[9]

- Subtract your income tax percentage from 100%. For example, if you're in the 20% bracket, you'd end up with 80%.

- Change this percentage to a decimal by moving the decimal point two places to the left. For example, if you keep 80% of your income, the decimal equivalent would be .80 (or just .8).

- Multiply your monthly income by the decimal to get your pay after taxes. You can calculate either your monthly or annual pay in this way.[10]

- If you make $2800 a month and fall in the 30% tax bracket, your decimal equivalent is .7. Multiply $2800 x 0.7 to get $1960 a month. This is the amount you receive after taxes are taken out.[11]

References

- ↑ http://www.hourlysalaries.com/

- ↑ http://www.hourlysalaries.com/

- ↑ http://www.entrepreneur.com/article/218171

- ↑ http://www.nidirect.gov.uk/calculating-your-working-time

- ↑ http://payroll.intuit.com/support/kb/1000600.html

- ↑ http://www.salary.com/types-of-bonuses/

- ↑ http://thefinancegeek.com/2010/12/how-to-figure-your-monthly-income-if-you-earn-a-yearly-salary/

- ↑ http://www.moneychimp.com/features/tax_brackets.htm

- ↑ http://www.tax-rates.org/taxtables/income-tax-by-state

About This Article

To figure out your yearly salary, start by multiplying the number of hours you work each week by 52 to determine how many hours you work a year. Next, multiply your hourly wage by the total number of hours worked. Then, make sure to account for any unpaid time off. For example, if you have a 2 week unpaid vacation, multiply the number of hours you worked by 50 instead of 52 to account for the 2 unpaid weeks. To learn how to determine your yearly salary if you work a different number of hours each week, keep reading!