This article was co-authored by Jonathan DeYoe, CPWA®, AIF®. Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 63,458 times.

With careful planning, it is possible to live off the interest from your investments. The more money that you can invest upfront, the more interest you will be able to collect as income. If you can't live entirely off of your interest earnings, you may be able to collect enough from small scale investments to cover some living expenses.

Steps

Making an Investment Strategy

-

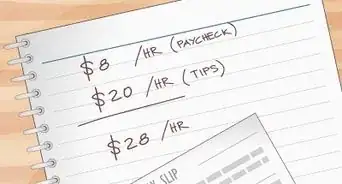

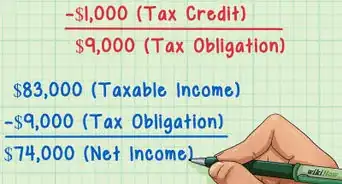

1Earn enough money to live off of interest. First, calculate your current expenses and you desired expenses. Factor in for the amount of money you see yourself needing yearly for the foreseeable future. Once you've calculated your average yearly expense from now until you're finished living off interest, calculate the percentage of your savings that you expect to make each year.

- Finally, divide your yearly expense by the percent that you'll earn. So if you expect to live off of 50k per year and make 8%, you need 625,000 to get started (50,000/.08=625,000).

-

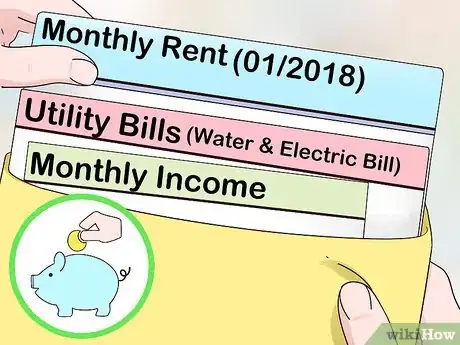

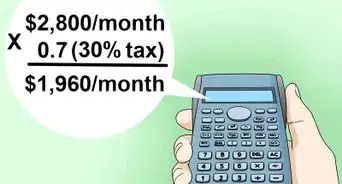

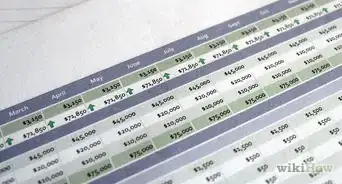

2Create an investment plan. Taking your salary and expenses into account, make a plan for earning and investing money. Look at your monthly income and necessary expenditures, such as rent and utility bills, to see how much money you can spare for investments. Decide how much money you will invest each month, and how much you will keep for travel, entertainment, and other indulgences.[1]

- Make sure to calculate how much money you can safely withdraw without affecting the amount of interest you'll earn.[2]

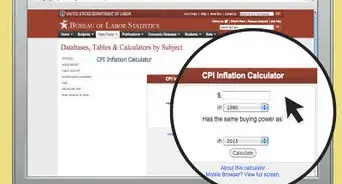

- Plan to re-invest some of your returns each year in order to keep up with the rising cost of living.[3]

- To live off interest, you'll likely need to save up 25-30x your current annual expenses.[4]

Advertisement -

3Consult with a financial advisor. Setting up your investments so that you can live off interest requires careful planning, which will be made easier with the help of an expert. Visit with a financial advisor who can provide advice about your savings and investment choices. You can find a financial advisor through your bank, insurance company, or an independent financial consulting company.[5]

-

4Make investments that will pay off at different times of the year. To ensure that you can live off interest year-round, build a portfolio with a mix of trusts, funds, and other income-paying investments. Choose investments that pay dividends at different points of the year so that your earnings will be spread out. This will not guarantee even payments throughout the year, but it will ensure that you have income to live off of.[6]

-

5Sell off bad investments. It is not prudent to hold onto investments that bring you big losses in the hope that they will improve. Sell bad investments to strengthen your overall portfolio. Avoid holding on to investments for reasons of loyalty or sentimentality (e.g. your company's stock, or stock you once thought had great promise.)[7]

Getting an Annuity

-

1Purchase an immediate annuity to get income right away. An annuity is essentially an insurance contract that guarantees that you will have money throughout your retirement. For a lump sum you can get an immediate annuity, which will generate payments right away. The payments received will depend on the lump sum you invest, current inflation rates, and your age.[8]

- Ask an agent form your insurance company to outline your annuity options to invest your savings wisely.

- These payments can be received monthly, quarterly, or annually.

- You can choose to get payments up until a certain age, or until death.

- For older people, the annual payout of an immediate annuity can be as high as 10%.[9]

-

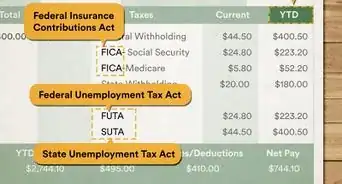

2Get a deferred annuity if you are still years away from retirement. if you do not need to earn an income from interest right away, opt for a deferred annuity. This will give you time to invest tax deferred money from each paycheck while you are working, which will grow tax free for you to collect, in regular payments, starting at a later date. See what deferred annuity options your insurance company offers to start building your financial security as early as possible.[10]

- Contributions to your deferred annuity do not have to happen at regular intervals or in equal amounts. There is no yearly contribution limit so you can invest large sums whenever you want to have them build interest, tax free.

-

3Choose a variable income annuity to diversify your investment. With a variable annuity, the money you invest will be split between different bonds, stocks, according to your risk level and preferences. There is a minimum income generated, which depends on variables like your age and the nature of the investments you've chosen. Ask your insurance provider about setting up a variable income annuity if you want your investment to be split into several subgroups with multiple opportunities for growth.[11]

Earning Interest to Cover Certain Expenses

-

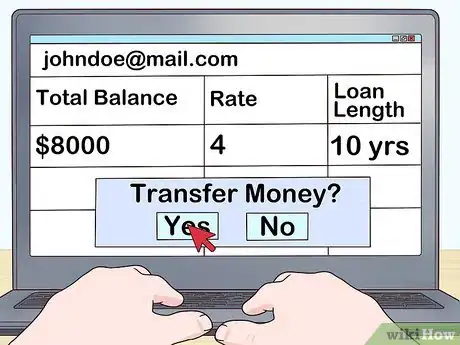

1Sign up for a high yield online savings account to earn 1% interest. Online savings accounts can offer interest rates of 1% or more since they don't have to maintain branch locations. Transfer money from your regular savings account into one of these high yield accounts, or save money gradually with each paycheck. Depending on how much you save, your interest money could cover certain living expenses like groceries or utilities.[12]

-

2Get a credit card that offers cash-back on your purchases. Cash-back credit cards can offer up to a 5% return on your total purchases in cash or gift cards of equivalent value. Using these cards to pay for everyday expenses is a good way to yield money without any extra effort or risk. Speak to a representative at your bank or credit card company to find a card that will yield you the biggest cash benefits.[13]

- Be sure to read the fine print on your credit card agreement before signing up for a new card.

- Some cards may have a limit for yearly cash-back earnings.

- Certain cards only offer cash-back for specific categories of purchases, such as restaurants or gas stations.

-

3Buy U.S. treasury bonds to earn interest bi-annually. Investing with the government treasury is entirely safe and the interest that you yield will be exempt from state and municipal taxes. Interest is paid every 6 months at a fixed rate. Purchase treasury bonds directly through the U.S. Treasury website at https://www.treasurydirect.gov/indiv/products/prod_tbonds_glance.htm.

- Treasury bonds have maturities of 30 years, but they can be sold before then.

- Interest earned on treasury bonds is still subject to federal taxation.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow can I retire solely off the returns from an investment?

Jonathan DeYoe, CPWA®, AIF®Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

Jonathan DeYoe, CPWA®, AIF®Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

Financial Advisor

References

- ↑ https://www.financialsamurai.com/how-to-build-passive-income-for-financial-independence/

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ https://www.cnbc.com/2019/06/27/how-to-figure-out-how-much-money-you-need-to-retire-early.html

- ↑ https://www.canada.ca/en/financial-consumer-agency/services/savings-investments/choose-financial-advisor.html

- ↑ http://www.telegraph.co.uk/investing/funds/make-investments-pay-monthly-salary/

- ↑ https://money.usnews.com/money/blogs/the-smarter-mutual-fund-investor/2012/06/05/avoiding-common-investing-mistakes-

- ↑ https://www.forbes.com/sites/feeonlyplanner/2015/07/15/annuities-the-good-the-bad-and-the-ugly/#6c2089c47990

- ↑ https://www.marketwatch.com/story/low-interest-rates-make-immediate-annuities-attractive-2015-11-04

- ↑ https://www.forbes.com/sites/feeonlyplanner/2015/07/15/annuities-the-good-the-bad-and-the-ugly/#6c2089c47990

- ↑ https://www.forbes.com/sites/feeonlyplanner/2015/07/15/annuities-the-good-the-bad-and-the-ugly/#6c2089c47990

- ↑ https://www.nerdwallet.com/blog/banking/best-high-yield-online-savings-accounts/

- ↑ https://www.investopedia.com/articles/personal-finance/040715/how-cashback-profitable-credit-card-companies.asp

About This Article

If you want to live off of interest, you will need to create an investment strategy in which you determine how much money you can afford to invest each month. Make an appointment with a financial adviser who can provide you with advice about your savings and investment choices. Choose investments that pay dividends at different points of the year so that your earnings will be spread out. If you need payments right away, you can use a lump sum to purchase an immediate annuity. If you want to learn more, like how to sell off bad investments, keep reading the article!