This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 76,806 times.

Any time you complete paid work, there's always the chance that the other party won't pay up when they're supposed to. Whether you're a small business owner dealing with deadbeat customers or an employee waiting for wages that never show up, there are actions you can take to make your voice heard and demand payment. And, if the problem persists, you have the option to take legal action against them to make sure you receive your money.

Steps

Avoiding Payment Disputes With Customers

-

1Research your customer's credit before doing business with them. When you do a large job for someone, consider running a credit check first. It is not that hard to get set up to retrieve credit reports. You may find out that the customer has a habit of not paying their debts, so it's worth it to check before entering into a deal with them.

- You can also use the risk of not being paid as a justification for raising your fee. The higher the risk you will not be paid, the more you should charge.[1]

-

2Have a well-defined late payment policy. Institute a policy for dealing with late payments so that your actions are consistent in each case. It also helps customers when you are clear, in a contract or oral agreement, about when exactly you expect payment and what steps you will take if it is not received.

- For example, you could send a reminder invoice after the 30 day payment period is up, call the customer after 60 days have passed, and take the issue to court or a collections agency once 90 days are up.

Advertisement -

3Sign a written contract with your customer. Before performing any work, always sign a contract with your customer. A good contract will protect both of you from disputes later on. In some cases, you may able to be enforce an oral agreement, but this is always more difficult than enforcing a written contract. You need a written contract to legally enforce collection on the following types of debts:

- Contracts taking longer than a year to complete.

- Contracts lasting longer than one party's life.

- High-value contracts over a certain amount (the exact figure varies by state).[2]

-

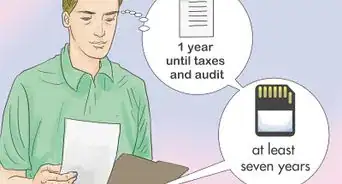

4Document your work well. Making a physical record of charges, work progress, expenses, and customer interaction will allow you to make a stronger case for debt collection later on. It's best to hold on to any documentation related to your contract. Make sure to:

- Keep signed work contracts.

- Take photographs of the work completed (before and after is best).

- Collect receipts for payments you made for materials.

- Ask the customer to sign off when the work is completed and for receipt of supplies or goods you procure on their behalf.

-

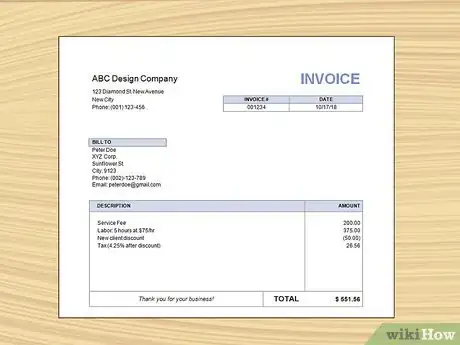

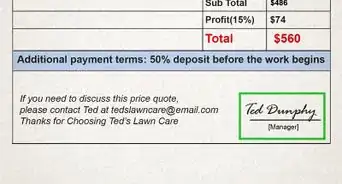

5Invoice your customer. Create a professional looking invoice form or use an invoice form that comes with your financial software. You can also download invoice templates for use in Microsoft Office. On your invoice, be sure to:

- Itemize your work. List parts and labor, or list separate jobs if you charge separately. Whatever you charge for, write a clear description.

- State the payment terms and a due date. Allow a reasonable amount of time for your customer to process the payment and paperwork on their end.

- Make it very clear where to send the payment and to whom to write checks. If you accept credit cards or other forms of payment, list them.

- List any late fees or interest you will charge on late payments, and note the deadline when payments become late.[3]

Reminding Them to Pay

-

1Determine when to take action. When you make a move to collect money from someone, you'll likely lose their future business or friendship.[4] If the person is your employer, you may even risk losing your job. However, collecting money owed to you is something that must be done. Follow your late payment policy, if you have one, and act accordingly. Make sure you stick to your late payment policy's schedule and complete each action as quickly as possible at each given date.

- If you are instead making a case for unpaid wages from an employer, considering setting up a schedule based upon reasonable time limits. For example, you could send them a payment reminder immediately and then wait two or three weeks for them to receive it and respond. If they don't do so, you can move on to sending another letter, calling them, or drafting a demand letter.

-

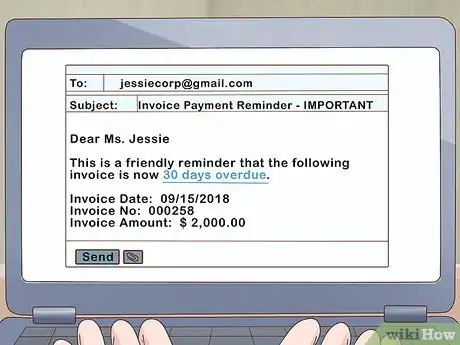

2Send a reminder letter. If your invoice does not result in a prompt payment, send a reminder. This lets the person know that you're aware payment hasn't been made and you are not going to forget about the debt.[5] Make it clear and firm, not confrontational. It's worth one more reminder, just in case the original invoice got lost in someone's paperwork.

- In any communications with the person that owes you money, including the reminder letter, make sure to reiterate the amount owed, when the labor or service was completed, and what step you will take next should they ignore your demands. Additionally, you should let them know about acceptable forms of payment and state a firm deadline for receiving their response.

-

3Give the person a call. If they ignore your letter, give them a call before taking any further action. This should be a week or two after you think the person received your reminder letter. It's more difficult to ignore a phone call, so they may actually be coerced into paying you.[6]

-

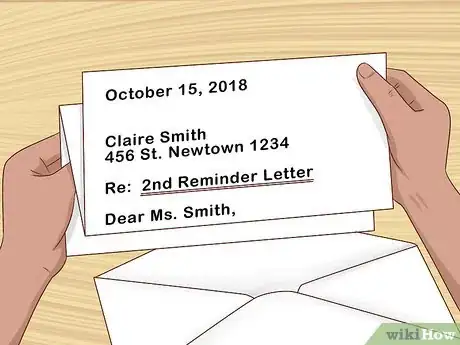

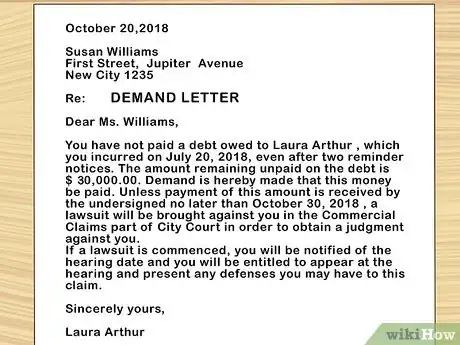

4Draft a demand letter. A formal demand letter more clearly announces the amount owed and the steps that will be taken if the debt continues to go unpaid. It also includes a deadline for both response to the letter and payment and a list of acceptable forms of payment. Remember, this letter is a professional document, and should be worded in a professional and consistent manner. Make sure you are absolutely clear and specific on every demand in the letter.[7]

- You may want to look into hiring a lawyer to draft this letter. This can add a sense of importance to your letter and make your customer more likely to respond. Call around to local attorneys for quotes for sending a demand letter. Just make sure the amount charged is less than half of the amount you expect to collect from the customer.[8]

-

5Send the demand letter. Make a copy of the letter first and keep it for your records. Then, send the letter through certified mail. Keep a copy of the receipt so that you can prove in court (if necessary) that the letter was sent.[9]

-

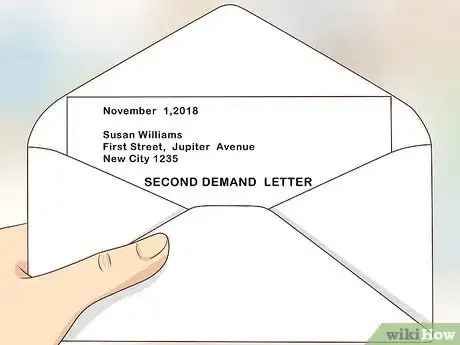

6Send another demand letter, if necessary. If you don't receive payment within the date specific in your letter, send another copy of the letter. This second demand letter should be adjusted for the current dates and also sent through certified mail.[10]

-

7Hire a collection agency. If you still haven't heard from the person that owes you money or received payment, you now have to hire outside help to get your money. This means either going to court or hiring a collection agency. A collection agency will be less of a hassle for you to use because you don't have to go to court, but keep in mind they may take a large fraction of the recovered money.[11]

Taking the Dispute to Court

-

1Make sure you are filing soon enough. If too much time has passed since the service was performed, you may be unable to file a legal complaint. The statute of limitations on debt collection varies from state to state, so consult with a lawyer or research your state's laws online to determine whether or not this time frame has passed.[12]

- The same goes for wage complaints. Make sure to check with your state's wage commission or board to check how long you have to file a complaint.

-

2Consult with a lawyer to make sure going to court will be worthwhile. A lawyer can advise you on what taking a complaint to small claims court would cost in court fees and attorney fees. You should compare this figure to the amount you are trying to collect and make sure it will be worth it to proceed to court. You don't want the costs of receiving the money to be more than the value of the money itself.

- If you are instead filing a complaint with your state's wage commission, it is unlikely you will need a lawyer's help.

- Keep in mind that, in some states, filing a wage complaint with the state may prevent you from taking the case to court later on.

-

3Prepare for small claims court. If you are a business or contractor, the best way to collect money owed you is through small claims court in your state. However, if your customer owes more than the small claims limit (which varies from state to state), you will have to file your case in county or district court.[13] The filing fee is usually around $25.00 and the application very straightforward. Go to your county courthouse for the document you will need to file.

- Small claims court limits range from $3,000 to $10,000.[14]

- If you take a case to small claims court, be prepared for the client to bring a claim against you in return, claiming the work was substandard. Ask for this claim to be heard with yours. Have your documentation in order and be honest in presenting your case.

- Small claims court has a wait time for a court day that can be as long a nine months but once the court orders the client to pay you, you have the law on your side.

- You may be able to get your court costs back. Ask the court attendant if this is possible.[15]

-

4File a complaint with your state's labor board or commission. If your claim is for unpaid wages and is larger than the small claims limit, you will have to file a complaint with your state's labor commission instead. You can file this sort of complaint for any amount of unpaid wages, but keep in mind that a complaint filed with the state will likely take longer to be resolved than a small claims case.[16] To get started, gather information and records about pay you think is owed to you and fill out a claim form either at your local labor commission office or on your state labor commission's website.

- You have grounds to file a wage complaint for the following types of unpaid wages:

- Illegal deductions.

- Unpaid overtime.

- Minimum wage violations.

- Unpaid reimbursements.

- Oral promises to pay.

- Breaches of contract.

- Check your state labor commission's website to see how you have to file complaints. This may be as little as two years or as many as four.

- If your claim is accepted, you will receive communication regarding a settlement conference that includes you and your employer. This conference will help both parties reach a mutually agreed-upon settlement. If you don't reach a settlement, your case will be moved to a hearing.

- If there is a hearing, you will need to resubmit documentation of wages owed, so be prepared with these documents. Soon after your hearing, a decision will be mailed to you that states how much, if anything, your employer owes you. He or she will then be forced to pay it or take the case to the state supreme court.[17]

- You have grounds to file a wage complaint for the following types of unpaid wages:

-

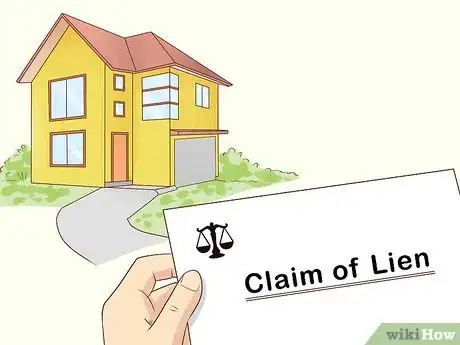

5Find out if you qualify to place a lien on the owner's house, called a mechanic's lien, if you are working with this type of contract. In many states money owed on construction projects gives contractors and suppliers the right to recover unpaid debts, usually construction or remodeling costs, in this way.[18]

- This is a little more complex and you should check with the agency in your state that oversees construction, such as Labor and Industries.

References

- ↑ http://quickbooks.intuit.com/r/money/how-to-get-paid-and-collect-money-youre-owed/

- ↑ http://blogs.findlaw.com/law_and_life/2011/10/are-oral-contracts-enforceable.html

- ↑ http://cashboardapp.com/blog/2013/11/04/what-is-an-invoice/

- ↑ http://www.earlytorise.com/6-secrets-to-getting-debtors-to-pay-up/

- ↑ http://www.earlytorise.com/6-secrets-to-getting-debtors-to-pay-up/

- ↑ https://www.americanexpress.com/us/small-business/openforum/articles/7-smart-tips-for-collecting-from-late-paying-customers/

- ↑ http://practice.findlaw.com/practice-guide/ten-tips-for-writing-an-effective-demand-letter.html

- ↑ http://wealthpilgrim.com/personal-debt-collection-collecting-money-owed-you/

- ↑ http://wealthpilgrim.com/personal-debt-collection-collecting-money-owed-you/

- ↑ http://wealthpilgrim.com/personal-debt-collection-collecting-money-owed-you/

- ↑ https://www.americanexpress.com/us/small-business/openforum/articles/7-smart-tips-for-collecting-from-late-paying-customers/

- ↑ http://blogs.findlaw.com/law_and_life/2013/12/legal-how-to-collecting-money-owed-to-you.html

- ↑ http://blogs.findlaw.com/law_and_life/2013/12/legal-how-to-collecting-money-owed-to-you.html

- ↑ http://blogs.findlaw.com/law_and_life/2013/12/legal-how-to-collecting-money-owed-to-you.html

- ↑ http://wealthpilgrim.com/personal-debt-collection-collecting-money-owed-you/

- ↑ https://las-elc.org/docs/self-help/Recovering_Unpaid_Wages.pdf

- ↑ http://www.wagetheftisacrime.com/File-Wage-Claim.html

- ↑ http://realestate.findlaw.com/owning-a-home/understanding-mechanic-s-liens.html