This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 100,475 times.

Most check writers don't intend to write bad checks, but everyone makes mistakes now and then. While it's nice to think that collecting on a bad check is as easy as calling the check writer, one phone call may not resolve every incident. Understanding how to collect money from a bad check and when to escalate collection efforts will help you confidently handle this unpleasant and somewhat embarrassing task.

Steps

Collecting on a Bad Check

-

1Contact the check writer directly as soon as a check is returned to you. While most large companies will run bad checks back through the bank a second time, you probably don't want to incur multiple bank charges for the same check if you are a small business owner or just an individual or organization who is the recipient of a bad check. Contact the person by phone and follow up with an email if you have their address.

-

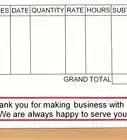

2Keep a record of the date and time you contact the check writer. When you contact the check writer, give him or her a deadline to resolve the problem, usually a week or two. Ask the person to contact you if the deadline isn't convenient and to make arrangements to resolve the issue. If the check writer does not respond within the deadline, send him a letter via certified mail that you will be contacting his local police department, since writing bad checks is considered theft.[1]

- If you don't hear from the check writer after the first or maybe second contact, ask your attorney to draft a more formal letter and have it delivered via certified mail.

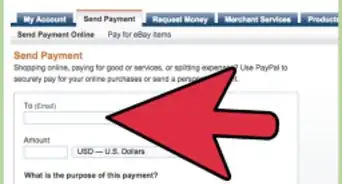

- Only accept cash from the bad check writer to cover the check and your returned check fee so you don't have to worry about more bank charges if a check bounces again or if you run a credit card.

Advertisement -

3Subscribe to a check recovery service. They will handle collections on bad checks for you. Their fees are a legitimate business expense and they take the hassle and embarrassment of dealing with bad check writers out of your hands. You can set up these services so bad checks go directly from your bank to the check recovery service. They will then begin electronic collection of the bad check and send you a report.

- You usually get 100 percent of the check value and can even get rebates to help you cover your bank charges, depending on your contract with the service.

- Check recovery service providers include Global Check Recovery, Fiserv, and Check Recovery Systems.

Taking Legal Action

-

1Know your state's laws governing the writing of bad checks. Every state is different, with some classifying writing bad checks as a civil offense while others consider it a criminal offense. If you've made every effort to contact the check writer personally and via a debt collector but have had no luck, you'll eventually need to turn to the courts to help you collect on the bad check.

-

2Sue in small claims court. If the amount owed is under a certain dollar amount as determined by your state, you can bring your case to a small claims court. You will not need to hire a lawyer for small claims court, but be sure to bring all documentation regarding the bad check and your written efforts to collect.[2]

- Small claims court limits range from $2,500 in Kentucky to $25,000 in Tennessee, with the usual amount around $5,000.[3]

- The results of your lawsuit against the check writer will ultimately depend on the court's decision on the intent of the check. The court will determine whether the check writer simply made a mistake (he thought he had the money in the bank and made an error in calculations) or was intending to defraud you, which should be provable by a history of bad check writing. Check by fraud is a much more serious charge and the check writer could end up in jail or prison, depending on the severity of the charges.

- In many states you will be able to recover not only the amount of the check but also triple damages of the check, court costs, interest, bank fees and attorney's fees if you used one. It would be useful to point out to the check writer that a $90 bounced check could result in owing over $1,000.[4]

-

3Hire an attorney. If the amount owed is over the limit for small claims court, you will need to hire an attorney and have your case brought to criminal court. Criminal cases can be costly if you go that route. Consider prosecution only if the offender is a persistent one in your business or if the amount of the bad check is substantial.

Avoiding Bad Checks

-

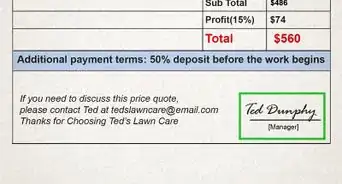

1Post your bad check policy. Your policy and the fee you charge for bad checks should be posted somewhere in your place of business where it's easily seen by your customers. This is usually near your cash register. Also include it in a section of a customer contract and on your website.

-

2Check your state law regarding fees. You may want to add a collection fee to help make up for your time and trouble of handling a bad check. Your state may have a law as to what fees (if any) collectors can add to the face value of the check. Many states limit collection fees up to a specific amount such as $100, or to a percentage of the face value of the check, and prohibit interest charges.[5]

- You will want to post this fee, if applicable, in your bad check policy.

-

3Always record the check writer's phone and driver's license number. Writing this information on the check will help should you need to contact the check writer if the check comes back to you for non-payment. It helps to keep a customer database of email addresses, as this may be a better, more convenient way of contacting the check writer initially.

- Collecting name and phone number and comparing the writer to a legitimate id with a picture should be a strict policy.

- Never take third-party checks.

Warnings

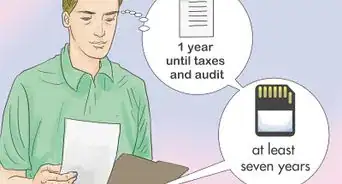

- If your case isn't resolved in two or three years, you may just have to write it off as a business loss. This is the statute of limitations for bad checks in most states.⧼thumbs_response⧽

References

- ↑ http://writersweekly.com/angela-desk/when-customers-write-bad-checks-my-successful-collection-technique-by-angela-hoy

- ↑ http://blogs.findlaw.com/law_and_life/2013/06/legal-how-to-dealing-with-bounced-checks.html

- ↑ http://www.nolo.com/legal-encyclopedia/small-claims-suits-how-much-30031.html

- ↑ http://patch.com/florida/templeterrace/you-deposited-a-check-and-it-bounced-now-what-9

- ↑ http://www.fair-debt-collection.com/searches/bad-checks.html

-Step-1.webp)