This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 47,782 times.

Many customers prefer to pay with credit cards instead of using checks and cash. If you sell any type of service or product, you may find that accepting credit card payments can increase your business. Begin by deciding how you want to interact with your customers. There are several ways to accept credit cards. You can use a point of sale (POS) system, a mobile credit card processing system, or the internet to accept payments.

Steps

Opening a Merchant Account

-

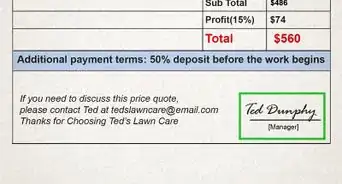

1Collect the necessary documentation. Generally, you must have a business bank account before your financial institution will allow you to open a merchant account. To open a business bank account, you will need your business license and your employer identification number (EIN).

Get your business license from the Secretary of State in the state where your business is located. Get your EIN from the Social Security Administration.[1] -

2Open a merchant account. A merchant account is a bank account through which you accept and process any kind of electronic payment. In addition to credit cards, it allows you accept debit cards, gift cards and ACH payments. You can open a merchant account with your bank or through a third-party payment processor like PayPal.[2] [3]

- Banks assume some risk when they allow businesses to accept credit card payments through a merchant account. Therefore, they require an underwriting process that evaluates the legitimacy and credit-worthiness of your business.

- You can usually use the same merchant account to accept POS and online credit card payments. When you set up your merchant account for your brick-and-mortar store, ask if it is transferable to your online storefront.[4]

Advertisement -

3Apply online or in person. Provide the required information. You will need the name of the authorized signer on the account, your bank account number and routing numbers. In addition, you will have to provide your EIN. Bring estimates of the volume of transactions you plan to process. Know your business start date, and provide your contact information.[5]

Using a Point of Sale (POS) System

-

1Choose a POS for brick-and-mortar locations. If your business has a physical location and does a high volume of transactions, a POS system might be for you. It directs customers to a specific location in your business where they can complete their purchases.

Employees can be trained to use the equipment and scheduled to man the register. Examples of businesses that use a POS system include spas, restaurants and retailers.[6] -

2Acquire the necessary equipment. You will need a checkout terminal. This includes a credit card swiper, a near field communication (NFC) reader (to process Apple Pay, Android Pay or Square payments) and a bar scanner.

You also need a cash register and printer. The credit card swiper reads the customer’s information and submits it directly to the credit card company.

You will receive confirmation that the payment has been accepted or declined. The payment is then sent to your merchant account and then to your bank account.[7] [8]

Choose between a traditional or a mobile POS system. A traditional system includes a credit card swiper, a terminal with a screen, a receipt printer and a cash register.

A mobile POS system is meant to be used with a smartphone or tablet. It comes with a stand for your mobile device, a credit card swiper and a dongle that attaches to a headphone jack. -

3Pay the fees. The cost of a POS system varies. The type of POS system you choose and the kinds of credit cards you accept affect the cost. Also, in some cases, the volume of sales may have an impact on the cost.[9]

- Credit card swipe fees range from .35 percent to 3.7 percent. In addition, you must also pay a set amount of 10 cents to 30 cents per transaction.

- Equipment can be purchased or leased, and the cost varies depending on what you purchase.

- Chargeback fees occur when you have to return funds to a customer, usually in the case of fraud. These can cost approximately $30 per month.

- Some vendors charge sign up, application and subscription fees.

- Prepare to pay an early termination fee of several hundred dollars if you want to end your service early.

- Payment Card Industry (PCI) Compliance fees are usually $99 per year.

Accepting Payments on a Mobile Device

-

1Choose this option to be able to accept payments anywhere. For example, a repair person, street vendor or food truck operator would benefit from a mobile payment processor.

Or, if you frequently work as a vendor in flea markets or craft fairs, a mobile payment system would free you from requiring cash-only transactions.

Also, this is a useful option if you have a brick and mortar store but want to be able to accept payments from anywhere in the store.[10] -

2Purchase the equipment. You need an app that allows you to accept credit card payments with your mobile device. For example, you can use Flint, Square, Cartwheel Register or PayPal Here. These apps require a credit card reader that attaches to your mobile device. The reader reads the credit card’s magnetic strip and processes the payment.[11] [12]

- Make sure your card reader is compatible with your smartphone or tablet. You can choose one that works with Android or iOS systems.

-

3Pay the fees. The costs of using a mobile credit card payment processor vary depending on the vendor you use and the volume of sales. Expect to pay a monthly statement fee that ranges from free to $35 per month.

In addition, you will pay monthly minimum fees of up to $25 per month. Finally, transaction fees vary. They range from .38 percent to 3 percent plus a flat fee of 10 cents to 30 cents per transaction.[13]

Processing Online Payments

-

1Decide if this option is compatible with your business. If you run an online business, you need to give customers a way to make purchases with their credit cards. However, other types of businesses can also use an online credit card payment system.

Brick and mortar stores, for example, may choose this kind of system over a POS system. Similarly, a mobile business such as a repair company or vendor may choose to accept online payments with a laptop instead of with a mobile device.[14]

A brick and mortar store using this system would need a credit card swiper that can connect to a laptop. -

2Choose a payment gateway. This is the method for accepting online payments if you already have a merchant account. You simply need to sign up with a payment gateway, such as SecureNet or AuthorizeNet. The payment gateway acts like a credit card reader. It communicates with your merchant account to process the credit card payment.[15]

- Payment gateway companies are usually large and have helpful customer support.

- The usually offer lots of options for customization, so they are often compatible with large businesses that need personalized systems.

-

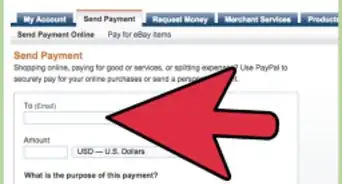

3Choose an all-in-one online payment solution. If you don’t have a merchant account, choose an all-in-one online payment solution, such as PayPal or 2Checkout. These services provide you with a merchant account and a payment gateway.

Set-up for these kinds of systems is quicker and easier than using a separate merchant account and payment gateway. You don’t have to worry about filling out two sets of applications and waiting for them to be processed separately.

However, your customers may be directed away from your website when making payment. For example, if you use PayPal, your customers may be directed to the PayPal site during their payment transactions. [16] -

4Pay the fees. The fees vary greatly depending on the provider you choose and the volume of sales. In general, the set-up fees for a third-party processor are lower than a POS or mobile system. This is because you usually don’t have to lease or purchase any equipment.

However, the transaction fees can be higher. Some third-party processors use a tier system. As the volume of transactions increases each month, the transactions fees decrease.[17]

References

- ↑ https://paysimple.com/blog/10-things-you-should-know-about-opening-a-merchant-account/

- ↑ http://www.businessnewsdaily.com/4394-accepting-credit-cards.html

- ↑ http://fitsmallbusiness.com/how-to-accept-credit-cards/

- ↑ https://paysimple.com/blog/10-things-you-should-know-about-opening-a-merchant-account-part-2-of-2/

- ↑ https://paysimple.com/blog/10-things-you-should-know-about-opening-a-merchant-account/

- ↑ http://www.businessnewsdaily.com/4394-accepting-credit-cards.html

- ↑ http://fitsmallbusiness.com/how-to-accept-credit-cards/

- ↑ http://www.businessnewsdaily.com/4394-accepting-credit-cards.html

- ↑ http://www.businessnewsdaily.com/4394-accepting-credit-cards.html

- ↑ http://www.businessnewsdaily.com/4394-accepting-credit-cards.html

- ↑ http://www.businessnewsdaily.com/4394-accepting-credit-cards.html

- ↑ http://fitsmallbusiness.com/how-to-accept-credit-cards/

- ↑ http://www.businessnewsdaily.com/4394-accepting-credit-cards.html

- ↑ http://www.businessnewsdaily.com/4394-accepting-credit-cards.html

- ↑ http://blog.bigcommerce.com/how-to-accept-credit-card-payments-online/

- ↑ http://blog.bigcommerce.com/how-to-accept-credit-card-payments-online/

- ↑ http://www.businessnewsdaily.com/4394-accepting-credit-cards.html

About This Article

To accept credit card payments, get a mobile credit card reader that plugs into your phone and download a mobile payment app, like Flint, Square, or PayPal Here. Or, you can pay for a POS system and set it up at your cash register so customers can easily swipe their credit card when they're checking out. If you have an online store, use an all-in-one payment system, like PayPal or 2Checkout, so people can use their credit card to buy things from you. For more tips from our Financial co-author, like how to set up a merchant account, keep reading!