This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 14 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 92% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 201,598 times.

Starting a business is exciting and stressful. Setting up your base of operations, defining your products and services, and taking care of all the details. In the rush of getting to opening day, don't forget to tend to the legal requirements of establishing a business in Texas. Done correctly, having your legal ducks in a row will help your brand and make your business stronger.

Steps

Setting Up Your Business

-

1Decide on your business structure. Your DBA ("Doing Business As") filing must indicate what kind of business entity you are registering. Also, how you choose to organize your company will reflect on the form your business name must take. Consider consulting with a tax professional to determine the benefits and disadvantages of each entity. You have several choices, most of which can be set up without the assistance of an attorney.

- A sole proprietorship is a business with a single legal owner. As owner, you assume legal responsibility for the operation of your company.[1] As sole proprietor, you can style the DBA company name as you wish, but you cannot include "Corp.", "Inc.", "LLC" or any other suffix that would be misleading.

- In a general partnership, you and at least one other run the business jointly. Your partnership agreement will divide the work, the profits, and the legal liabilities.[2] Your business name can indicate the partnership, but like a sole proprietorship, your company name cannot mislead the public into believing you are something you're not.

- Limited liability companies can be set up through the Texas Secretary of State for minimal cost and without the assistance of an attorney. If you choose this business entity, your business name must include "LLC" or "Limited Liability Company."[3] [4]

- The final choice is to incorporate your business. A corporation has enhanced reporting and tax filing requirements. Strongly consider discussing this with a business attorney before attempting to incorporate. A corporation must include "Corp." or "Inc." in the DBA company name.[5] [6]

-

2Choose the partners or other business members. Before you file for your DBA company name, you should decide who will be your LLC members or business partners. Before you file, questions of how the business will be named and branded should be settled or you may incur additional fees and filings.Advertisement

-

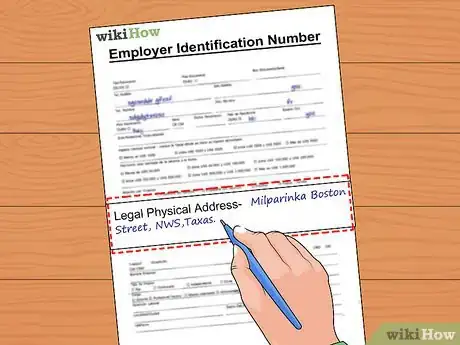

3Establish your Legal Physical Address. Even if your business is mobile, it must have a permanent home base. For the DBA filing, you can use a post office box as your address. You will also have to designate your business area where you will be using the business name. The filing form allows you to designate "all counties."[7]

-

4Name a registered agent. Every business in Texas must have a registered agent. This is the person that is authorized to accept legal papers on behalf of your company. The agent can be you, a partner, or an employee in your company. You can also name your lawyer or use a professional agent company.[8]

- The registered agent must have a physical office in the state of Texas. This address will be public record, so you should not use your residence.

-

5Obtain your Employer Identification Number (EIN). Even if you do not have employees, you should apply for an EIN from the Internal Revenue Service.[9] This filing number lets you shield your Social Security number from public records and if you business takes off, you'll be ready to make the proper tax filings when you hire people.

Filing for a DBA in Texas

-

1Understand the significance of a DBA. Business names in Texas are regulated under the Business Organizations Code (BOC). Under the BOC, a business cannot register a name that is "the same or deceptively similar" to another registered company. You cannot name your business in a way that customers might think they are dealing with another company.

-

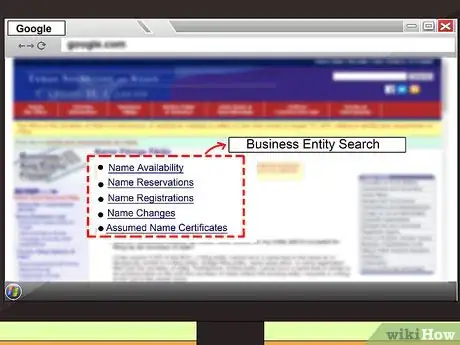

2Perform a DBA name search. All business entity searches in Texas are done through the Secretary of State SOSDirect website. You can set up an account for no charge and use the account for expedited and low-cost document filing during the operation of your business.[10]

- You can also register for temporary log-on privileges. You will not be able to file documents, but can perform the needed business entity search.[11]

- Perform your business name search with several variants on your proposed name. For example, if you search "Grandma's Fudge" and don't find it registered. Also search "Grandma's Candy" or "Grandma's Old-Tyme Fudge." You want a name that is not confusing with another business and that you can use to create a vibrant and unique brand for your company.

- Also perform a web search for unregistered companies that might be using a similar name. In your favorite search engine type "my proposed business name" and "Texas." While you won't be prevented from registering the name, you should consider if you want to copy another company's name.

-

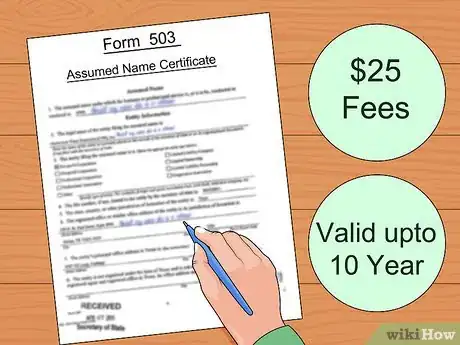

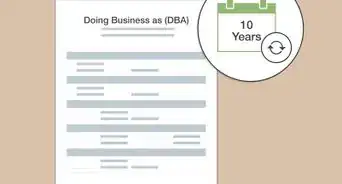

3File an Assumed Name Certificate with the state of Texas. To start the DBA process, you need to file a Form 503 - Assumed Name Certificate.[12] You can fill out the interactive Form 503 online and print out the completed document or you can print out a blank form and complete it by neatly printing the information in dark blue or black ink.

- By doing your work upfront of creating your business entity, determining a physical address, and performing a detailed name search, completing Form 503 will not take very long or require the assistance of an attorney.

- The initial Assumed Name Certificate is valid for ten years.

- The fee to file the certificate is $25.

- The Assumed Name Certificate can be filed electronically via SOSDirect, by mail to the address in the Form 503 instructions, or delivered in person to the James Earl Rudder Office Building in Austin, Texas.

-

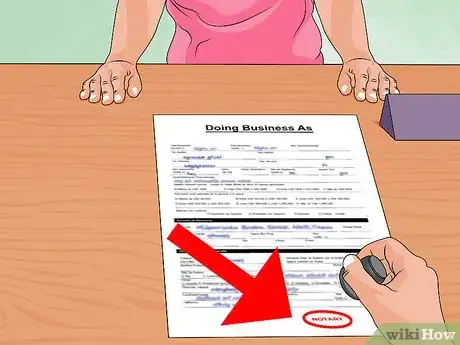

4Verify local DBA requirements. Many counties in Texas require a separate, notarized DBA filing before a business is authorized to open an office in the county. Contact the county clerk in your home base county for local filing procedures.

Exploring Other Options for Branding Your Company

-

1Consider filing for a trademark. If you will be doing business primarily within the state of Texas and your business includes unique goods or services, you can file for a state trademark. This gives you enhanced legal protection against those who might try to copy your ideas and solidifies your brand.[13]

- The fee to register a trademark is $50 per product or service class.

- Trademark forms are complicated. It can be filed without an attorney, but it is strongly recommended you consult with an attorney if you have any questions. You must have your products and services well defined to fit within one of the 45 classes.[14]

- The interactive trademark form can be completed online and printed. It must be notarized before submission.

-

2Incorporate your business name into logos. When you name your business, consider making it unique by having it incorporated into a logo. If you have graphic design skills, you can create it yourself. Otherwise, patronize another Texas business and have a logo professionally designed.[15]

-

3Use your business name on your website and social media. Registering your name and trademark gives your business an air of authority and professionalism. If you have sufficient programming skills, you can design your own website and social media pages. Otherwise, consider using a Texas marketing firm.[16]

- Add the phrase "[Business name] is registered to do business with the state of Texas and [county.] If you file for trademarks, add "[Name] is a trademark of [Business Name] of [Address, City, Texas]" to your home page and About page.

References

- ↑ https://www.sba.gov/content/sole-proprietorship-0

- ↑ https://www.sba.gov/content/partnership

- ↑ https://www.sba.gov/content/limited-liability-company-llc

- ↑ http://www.sos.state.tx.us/corp/businessstructure.shtml

- ↑ https://www.sba.gov/content/corporation

- ↑ http://www.sos.state.tx.us/corp/businessstructure.shtml

- ↑ http://www.sos.state.tx.us/corp/forms/503_boc.pdf

- ↑ http://www.sos.state.tx.us/corp/registeredagents.shtml

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

- ↑ http://www.sos.state.tx.us/corp/sosda/index.shtml

- ↑ https://direct.sos.state.tx.us/acct/acct-templogin.asp

- ↑ http://www.sos.state.tx.us/corp/forms/503_boc.pdf

- ↑ http://www.sos.state.tx.us/corp/tradepatents.shtml

- ↑ http://www.sos.state.tx.us/corp/forms/901.pdf

- ↑ https://www.thumbtack.com/tx/austin/logo-design/#

- ↑ https://www.thumbtack.com/tx/austin/branding-consultants/

About This Article

A DBA, which is short for ‘Doing business as,’ is a trade name that's slightly different than your legal business name. Before you file for your DBA, you’ll need to know your business address, employer identification number, and business structure, such as sole proprietor, limited liability company, or corporation. Don’t forget to search your company name on the Secretary of State Direct website to make sure your name is available. You’ll need to file a Form 503 Assumed Name Certificate. You can fill out the interactive form online or print out a blank form and fill it out by hand. File it through the SOS Direct website or mail the form to the address on the form. You’ll also need to pay the 25-dollar filing fee. Many counties also require a separate, notarized DBA so contact your county clerk to check if you need this too. For more tips from our Legal co-author, including how to choose a registered agent for your DBA, read on!