This article was co-authored by American Automobile Association. The American Automobile Association (also known as "AAA" or "Triple A") is a federation of motor clubs throughout North America and a non-profit organization focused on the safety of the driving public and the future of mobility. Best known for providing its members with roadside assistance, AAA has also been providing auto repair services and insurance for auto, home, life, and business for over a century. Founded in 1902, AAA is headquartered in Heathrow, Florida.

There are 15 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 32,574 times.

If you are in an accident or experience any other sort of automotive mishap, it is extremely important to know the proper way to file a car insurance claim. Failure to do so may cost you hundreds or even thousands of dollars and put your future at risk. Though insurance policies can often be wordy and complicated, filing a claim need not be. Contact your insurance company as soon as possible after being involved in an accident. Protect yourself by taking the other driver's information before parting ways at an accident.

Steps

Preparing to File a Claim

-

1Recognize when you should file a claim.[1] There are a number of situations in which you should file an auto insurance claim. The most common type of situation in which you’d need to file an insurance claim is when your car is involved in an auto accident. However, you should also file a claim if your car is vandalized or stolen.

-

2Inspect your insurance policy. The explanation and fine print of car insurance policies appear to be long-winded and often seem extremely complicated. The best thing to do before proceeding too deeply into the insurance claims process is to read and re-read your policy. You’ll then understand the intricacies of what your own personal responsibility is in the event of an accident or other automotive mishap, and what your insurance company's responsibility is in such an incident.

- You might need to pay a deductible -- a fee to help cover the costs of the accident -- if you’re found to be at fault. If you’re not at fault, your insurance company might be able to help you recover the deductible from the driver who is at fault.[2]

Advertisement -

3Contact your insurance company.[3] Your insurance company’s number should be on the front of your insurance card. You might also be able to find it among your insurance policy documents or on the insurance company’s website. Contact the insurance company as soon as possible so you can find out what their specific claims process entails.[4]

- Many insurance companies have online portals where you can file a claim, upload relevant documents, and check the status of your claim. Ask your insurance company about such an option.[5]

Proceeding With the Claims Process

-

1Provide your insurance company with the necessary information.[6] You will need to provide information about both your policy and the nature of the claim. Depending on the nature of your claim, you will need to provide different kinds of information. Your company will inform you of exactly what information they expect when you contact them by phone.[7]

- The basic information you will need to provide includes your name, policy number, nature of the damage to your vehicle, and the start and end dates of your policy.

- Supplemental information could include weather conditions, time and date, and names and addresses of all passengers or drivers involved in the accident or event.

- If you were in a collision with another driver, provide any details you can about them, such as their name, insurance company and policy number, license plate, and car model and color. You should also identify who was at fault, if possible.

- If police were involved, provide a copy of the ticket issued and the police report.

- Some companies require a sworn statement about the details of your claim.

- Include photos of the damage to your car.

- Keep copies of all the paperwork and documentation you provide your insurance company in a folder along with your insurance policy. You might need to refer to these documents later.[8]

-

2Consult your company representative.[9] After providing the insurance company with relevant information, your claim will proceed to the next stage, and you will be assigned an insurance claim representative. This individual will examine evidence of injury claims and help guide you through the claim process. Provide all the information you can to this representative and direct any questions you may have about your policy and claim to them.

-

3Ask questions of your representative. Even if you think you know the answers, it’s best to be clear on the policy and claims process. If you have questions during your initial consultation, ask them. However, you should definitely take time after your initial consultation with your company representative and going over your policy to think of questions that could clarify the process. You might want to ask:[10]

- How long does the claims process usually take?

- Is there a time limit for filing a claim?

- What is my policy limit and deductible?

-

4Visit a certified repair shop for an estimate.[11] Your insurance company, or the insurance company of the person who caused the accident, needs to know the repair costs of your vehicle. Even if the accident was your fault, you need to inform the insurance company about the cost of repair. Do not, however, move forward with your repair until your insurance claim has been settled. Otherwise, you might end up paying more for your repair than you’ll get from your insurance claim.

- If you think a certain repair shop is inflating the cost of repair, don't be afraid to take your vehicle to a different shop.

- Sometimes, though, your insurance company will insist upon a certain repair shop in your area, so make sure you discuss this with your claim representative.[12]

- Choose a repair shop that provides guaranteed prices and specific timelines for repairing your automobile.

-

5Arrange for the claims adjuster to look at your car.[13] The claims adjuster is an agent of the insurance company who uses police reports, vehicle repair estimates from the repair shop you visited, and the other documentation you provided to determine fault and issue a cost estimate.[14] When you contact your insurance company, ask when and how to reach the claims adjuster.

- In certain cases, the company may send a claims adjuster to the scene of the accident, or to inspect your car after the fact.

- An adjuster may also ask you to bring your car to him or her to inspect and appraise it.

Filing Other Types of Claims

-

1File a bodily injury claim. If you have personal injury protection (PIP) as part of your car insurance policy, you can receive coverage on any medical bills incurred as a result of a car accident.[15] If you broke your arm or experienced whiplash as a result of your accident, you can take advantage of your PIP by filing a bodily injury claim. Include injury reports and hospital bills among the other information you send to your insurance company. Photos of any injury you or your passengers may have sustained are also useful.

-

2File a property damage claim. If you had valuable property in your car that was damaged at the time of your accident, or even stolen out of your car, you might be able to file a property damage claim with your insurance company. For example, if you were transporting a brand new computer home in your trunk and someone smashed their car into your from behind, crushing your new PC, you could file a property damage claim. Check with your insurance company to see if your policy covers property damage claims.

- This type of claim could also cover things like boats or specialty equipment you might have been towing behind your car at the time of your accident.

- Photograph damage to personal property that occurred as a result of the accident you’re filing a claim for.

-

3File a third-party claim. A third-party claim is one in which you file a claim with the other driver’s insurance company. This is the common route when the other driver is determined to be at fault.[16] A third-party claim proceeds nearly identically to that of a standard claim that you would file with your own car insurance company, but the might take longer than it would when dealing with your own company.

- If the company seems to be dragging its feet, contact the company representative from your insurance company for advice about how to proceed. They may be able to intervene and find out more information. You might need to engage in subrogation, the process through which your insurance company collects the costs associated with your accident, then pays them back to you.[17]

- If the other driver’s policy does not cover your total expenses, contact your insurance company about filing an underinsured coverage claim. This will allow you to get the difference on your costs from your insurance company.

Getting Back on the Road

-

1Get a rental car. Depending on your insurance policy, you might be able to get a rental car for no additional cost while your car is being repaired.[18] Ask your insurance representative if your policy includes rental reimbursement.

- If you cannot get the costs of a car covered by your insurance company, pay for one out of pocket, or have a friend or family member take you where you need to go.

-

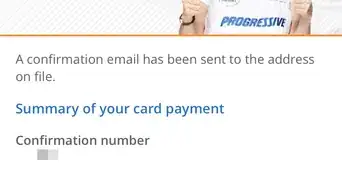

2Finalize the claim. Fill out any paperwork that the adjuster presents and accept the payment check. If disputes regarding fault ensue, or if you feel that you have not been given enough money for the damage to your car, you may demand that your insurance company takes a closer look at your case in order to get a fair payout.[19] If the accident was your fault and you feel you are paying too much for the other party's repair costs, it may be necessary to take legal action.

- If you and the other driver have two different stories about what happened, and your insurance companies cannot come to an agreement about who was responsible, you might need to pursue litigation. Consult a qualified lawyer if you intend to take legal action.[20]

-

3Have your car repaired. Your insurance policy could cover the costs of all or some of the damage. After getting your claim check, move forward with the process of having your car repaired. If your car is declared unrepairable (“totalled”), you will receive the blue book price (a standard price assigned to used cars) adjusted for certain specifics like the mileage and condition of your car.[21]

- With your check in hand, you don’t need to go to the auto repair shop that performed your original estimate. If the auto repair shop you went to was one the insurance company insisted upon, look around for different prices. Have your car repaired at the most reliable yet affordable shop.

- Repair your car with generic auto parts instead of manufacturer recommended or certified parts to save money.

Community Q&A

-

QuestionIs there a time limit on filing a personal injury claim?

Community AnswerThere is probably a time limit, yes. Depending on the insurance company, your time limit will vary. Talk to your insurance company representative about what your time limit is for filing a claim.

Community AnswerThere is probably a time limit, yes. Depending on the insurance company, your time limit will vary. Talk to your insurance company representative about what your time limit is for filing a claim.

References

- ↑ http://www.dmv.org/insurance/tips-for-filing-a-car-insurance-claim.php

- ↑ https://www.allstate.com/tools-and-resources/car-insurance/how-to-file-auto-insurance-claim.aspx

- ↑ http://www.dmv.org/insurance/tips-for-filing-a-car-insurance-claim.php

- ↑ https://magazine.northeast.aaa.com/daily/money/auto-insurance/file-an-insurance-claim-after-a-car-crash/

- ↑ https://www.allstate.com/tools-and-resources/car-insurance/how-to-file-auto-insurance-claim.aspx

- ↑ http://www.dmv.org/insurance/tips-for-filing-a-car-insurance-claim.php

- ↑ https://magazine.northeast.aaa.com/daily/money/auto-insurance/file-an-insurance-claim-after-a-car-crash/

- ↑ http://www.rmiia.org/auto/steering_through_your_auto_policy/Filing_an_Auto_Claim.asp

- ↑ http://www.dmv.org/insurance/tips-for-filing-a-car-insurance-claim.php

- ↑ https://magazine.northeast.aaa.com/daily/money/auto-insurance/file-an-insurance-claim-after-a-car-crash/

- ↑ https://www.allstate.com/tools-and-resources/car-insurance/how-to-file-auto-insurance-claim.aspx

- ↑ http://www.rmiia.org/auto/steering_through_your_auto_policy/Filing_an_Auto_Claim.asp

- ↑ https://www.allstate.com/tools-and-resources/car-insurance/how-to-file-auto-insurance-claim.aspx

- ↑ http://www.rmiia.org/auto/steering_through_your_auto_policy/Filing_an_Auto_Claim.asp

- ↑ https://www.esurance.com/info/claims/third-party-car-insurance-claims

- ↑ https://www.esurance.com/info/claims/third-party-car-insurance-claims

- ↑ https://www.esurance.com/info/claims/what-is-subrogation-and-why-it-important

- ↑ https://www.allstate.com/tools-and-resources/car-insurance/how-to-file-auto-insurance-claim.aspx

- ↑ http://www.rmiia.org/auto/steering_through_your_auto_policy/Filing_an_Auto_Claim.asp

- ↑ https://www.rocketlawyer.com/article/how-to-file-a-car-insurance-claim-after-a-car-accident-.rl

- ↑ http://www.rmiia.org/auto/steering_through_your_auto_policy/Filing_an_Auto_Claim.asp

- ↑ http://www.rmiia.org/auto/steering_through_your_auto_policy/Filing_an_Auto_Claim.asp

- ↑ http://www.rmiia.org/auto/steering_through_your_auto_policy/Filing_an_Auto_Claim.asp