This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 111,982 times.

Most people think of Social Security solely as a retirement program. According to the U.S. Social Security Administration, however, close to 2 million children who have had a parent die receive 1.5 billion in survivor benefits each month.[1] Benefits are available for unmarried children under the age of 18, children who are 19 and are still attending secondary school full-time, and children of any age who were disabled before the age of 22.[2] Social Security survivor benefits for children are intended to replace lost household income following a parent's death. They can be used to pay for expenses associated with housing, feeding, clothing, educating, and providing other necessities of life.[3]

Steps

Preparing to Apply

-

1Understand eligibility. In order to be eligible for benefits, the deceased must have earned a certain number of “credits,” based on age at the time of death. A worker can earn up to four credits a year. In 2015, a worker earned one credit for every $1,220 of wages or self-employed income.[4]

- The amount of credits needed will depend on the worker’s age when he or she died. The younger the deceased was, the fewer credits required for survivor’s benefits. No age group requires more than 40 credits to trigger benefits.[5]

- Furthermore, benefits will not be denied if the deceased earned six credits within the last three years of his or her life.[6]

-

2Get certified birth certificates. To apply for survivor’s benefits for children, you will need your birth certificate and the child’s. If you do not have a birth certificate, you will need to order one.

- You can get copies of birth certificates through VitalChek. Visit www.vitalchek.com and select “Birth Certificate” and then “Start Your Order.”

- If your child is adopted, then you will need a copy of the adoption certificate.

- After entering the name of the person whose birth certificate you are purchasing, you will then select your state.[7] Then you will be prompted to select the city in which the person was born.

Advertisement -

3Obtain a death certificate. You need a death certificate for the deceased.[8] For information on how to obtain a death certificate, read wikiHow’s How to Acquire a Death Certificate.

-

4

-

5Find the deceased’s tax forms. You will also need a photocopy of the deceased’s most recent W-2 form or self-employment form.[11]

- If you were divorced from the deceased and do not have access to his or her tax records, you should contact the executor of the deceased’s estate. In order to get tax information from the IRS, you need the authorization of the executor, who has the power to get that information.[12]

- If your children are earning money, then you will also need tax forms showing how much income they have made.

-

6Get Social Security Numbers. You will also need Social Security Numbers for you, for the deceased, and for any children.[13]

- If your child does not yet have a Social Security Number, you need to apply for one. You can do this at the Social Security office.[14]

- You will have to complete a form, SS-5, at the office.[15] You will need your child’s birth certificate (which you will need anyway to apply for survivor’s benefits). You will also need something to establish your child’s identity: for example, a state-issued identification card, school identification card, or daycare record.[16]

-

7Contact the Social Security Administration. As soon as possible after the date of death, contact the office to apply for Social Security survivor benefits for a child. You cannot apply online.[17]

- Call the Social Security Administration toll-free at 1-800-772-1213 from 7 a.m. to 7 p.m. Monday through Friday. Those who are deaf or hard of hearing should call the TTY line at 1-800-325-0778.

- Visit or call your local Social Security office. To find contact information for the Social Security office closest to you, go the Social Security Administration's website, click "Find a Social Security Office," enter your zip code in the field provided, and click "Locate."

-

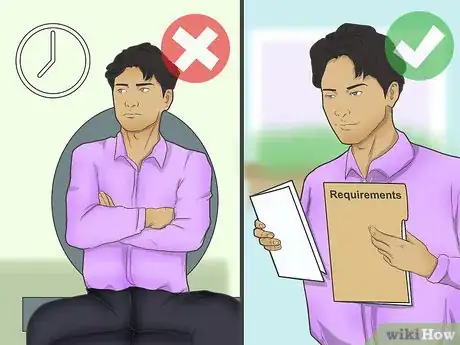

8Don’t wait. It is imperative that you start the application process as soon as possible. Benefits will be due retroactive to the date of death in most cases, but in some instances, benefits will only be retroactive to the date of application.[18]

- Also note that there is a $255 one-time payment available to a spouse or children of the deceased if the deceased worked long enough for his or her age group. However, the beneficiary must apply for this benefit within two years of the death.[19]

Applying for Benefits

-

1Visit the Social Security office. Arrive at the Social Security office as soon as it opens on the day you are instructed to apply for benefits. Social Security does not make fixed appointments. You will be told what day to arrive to apply for Social Security survivor benefits for a child, but service on any given day is first-come, first-served.

- Avoid arriving at the Social Security office around lunch time or any later than 90 minutes before closing time.

-

2Answer all questions. You will meet with a Social Security intake representative who will ask you questions. Provide any required documentation and sign any paperwork presented to you by the Social Security intake representative during the application interview.

- The intake representative will provide you with a summary called a “Receipt for Your Claim for Social Security Child's Insurance Benefits” for each child for whom you are applying for benefits. Do not lose this. You will need it to check on the status of your claim later on. Make sure the intake representative also returns all original copies of important documentation to you before you leave the office.

- Make sure you get a business card with your intake representative's contact information before you leave the office. Your intake representative is your local, flesh-and-blood contact person should there be any delay in application processing or timely receipt of benefits at any future point.

-

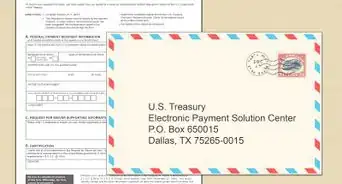

3Check your application online. Visit www.socialsecurity.gov/myaccount. You can then create an account. From your account, you can check for your benefit verification letter and calculate your benefit estimates.[20]

- You also can set up or change direct deposit online.

-

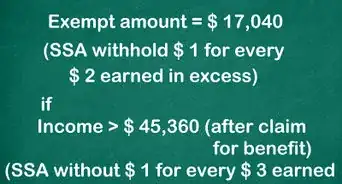

4Get benefits. Social Security uses the deceased’s base benefit amount and awards a percentage. A child receives 75% of the deceased’s benefit amount.[21]

- There are maximums that a family may get. The limit varies, but it is roughly between 150% and 180% of the deceased’s basic benefit rate.[22] Accordingly, if you have more than 2 children receiving benefits, their amount will be reduced so that the total does not exceed the family maximum.

Warnings

- This article is intended as legal information and does not provide legal advice. If you need legal advice, contact a licensed attorney.⧼thumbs_response⧽

Things You'll Need

- Your photo identification

- Social Security card for yourself, the deceased, and each child for whom you are applying for survivors benefits

- Certified copies of the death certificate; marriage certificate, if applicable; divorce certificate, if applicable; each child's birth certificate; and each child's adoption certificate, if applicable

- Proof of earnings for the previous and current year for the deceased and for each child for whom you are applying for benefits (if applicable)

References

- ↑ http://www.ssa.gov/OACT/FACTS/fs2011_06.pdf

- ↑ http://www.ssa.gov/pubs/EN-05-10084.pdf

- ↑ http://www.ssa.gov/pubs/EN-05-10085.pdf

- ↑ http://www.ssa.gov/planners/survivors/ifyou.html

- ↑ http://www.ssa.gov/planners/survivors/ifyou.html

- ↑ http://www.ssa.gov/planners/survivors/ifyou.html

- ↑ https://www.vitalchek.com/order_main.aspx?eventtype=birth

- ↑ http://www.ssa.gov/pubs/EN-05-10084.pdf

- ↑ http://www.ssa.gov/pubs/EN-05-10084.pdf

- ↑ https://www.vitalchek.com/divorce-records

- ↑ http://www.ssa.gov/pubs/EN-05-10084.pdf

- ↑ http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Deceased-Taxpayers-Getting-Information-from-the-IRS

- ↑ http://www.ssa.gov/pubs/EN-05-10084.pdf

- ↑ http://www.ssa.gov/pubs/EN-05-10023.pdf

- ↑ http://www.ssa.gov/pubs/EN-05-10023.pdf

- ↑ http://www.ssa.gov/pubs/EN-05-10023.pdf

- ↑ http://www.ssa.gov/planners/survivors/howtoapply.html

- ↑ http://www.ssa.gov/planners/survivors/howtoapply.html

- ↑ https://www.socialsecurity.gov/planners/survivors/ifyou7.html

- ↑ http://www.ssa.gov/pubs/EN-05-10084.pdf

- ↑ http://www.ssa.gov/pubs/EN-05-10084.pdf

- ↑ http://www.ssa.gov/planners/survivors/onyourown5.html