This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 87,986 times.

Learn more...

When someone you love dies, it may be difficult to inform everyone you need to while you are in the middle of grieving. However, one thing that should happen as soon as possible is to notify the Social Security Administration about the death. Letting them know that the person has died allows the Social Security Administration to mark the person as deceased and to halt any future payments going to them. Reporting a death promptly will also allow you to begin the process of applying for any survivor’s benefits that you or others in your family qualify for.

Steps

Having a Funeral Home Notify Social Security

-

1Verify that the funeral director will inform Social Security. If someone in your family has died and a funeral home is dealing with the burial or cremation, then they typically also contact the Social Security Administration. Ask your funeral director if this is the case, just to ensure that the death actually gets reported.[1]

- Your funeral director may bring this up without you asking while they are going over the things they are going to do for you.

Say Something Like...

"Is it part of your job to notify Social Security about the death?"

"I want to make sure that the Social Security Administration gets notified. Will you do that, or do I need to?"

-

2Give the funeral director the information they need to report the death. The funeral director will need basic information about the deceased, such as their full name, social security number, and date of birth. They will also need the name, address, and phone number of the widow or widower, if there is one.[2]

- Your funeral director will likely gather most of the information they need when doing their general intake for your deceased family member.

Advertisement -

3Sign paperwork that authorizes the funeral director to do the notification. Your funeral director will likely require you to sign a form that authorizes them to work on your behalf. By signing their paperwork, you are authorizing them to do a variety of tasks and you are ensuring that you will pay them for their services.

- You will not be required to sign the Statement of Death form that your funeral director submits to the Social Security Administration. That form only requires the signature of a licensed funeral director.

Notifying Social Security Yourself

-

1Call or visit the Social Security Administration. If you are not using a funeral director that can report the death, you will need to do it over the phone or in person. The phone number for the Social Security Administration is 1-800-772-1213.[3]

- If you want to visit a Social Security Administration office, search online on the Social Security Administration’s website for the office closest to you.

- However, in most cases it will be quicker and easier to report the death over the phone.

- If you are deaf and you need to call in to report a death, you can call the TTY number at 1-800-325-0778.

-

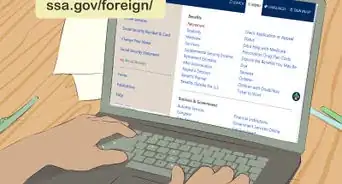

2Do not try to notify Social Security online. The Social Security Administration is unable to process death reports online. While you will be able to apply for survivor’s benefits online, actually reporting the death needs to be done in person or on the phone.[4]

- However, you can find information about the process, what documents you will need, and how to do a notification at www.socialsecurity.gov.

-

3Call the Social Security Administration during business hours. You can call the Social Security office between 7 AM and 7 PM Monday through Friday in whatever time zone you're in. At other times of day there will not be anyone available to answer your call but you may be able to leave a message to request a call back.[5]

Tip: If you can, try to call at a time other than lunch time or dinner time. These are times when lots of people call because they are off work. You are likely to have a shorter wait to talk to someone at other times of day.

-

4Use the death certificate to provide information for the Social Security Administration. When you call in to the Social Security Administration, you will need to have specific information ready for them. This information will be listed on the death certificate, so having it handy will speed up the process. If you visit a Social Security Administration instead of calling, bring a copy of the death certificate with you so it can be filed with them.[6]

- After calling in the death, a copy of the death certificate will need to be sent to the Social Security Administration.

- If it is taking a while to get a copy of the death certificate, you can still start the process of reporting a death. The process will just not be completed until the death certificate is filed.

Dealing with Social Security Benefits After a Death

-

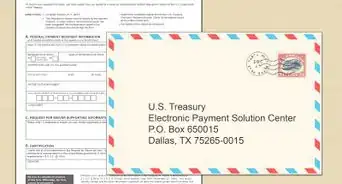

1Don't keep Social Security benefits that are received after the death. If the deceased person was receiving Social Security benefits, any benefits paid out after the death must be returned. If a check is received, it shouldn't be cashed and if there is a direct deposit made, you should ask the bank to return the funds.[7]

Tip: While it may be tempting to keep the money, especially in such a time of need, the Social Security Administration will require you to return the funds once they figure out that the funds were received after death.

-

2Ask about whether existing benefits will be transferred automatically. If the deceased person was receiving Social Security benefits, those benefits should automatically transfer over to their widow or widower. When you report the death, confirm that this is the case for you.

- If you are the widow or widower but you are also receiving benefits, you will not receive the deceased's benefits in addition to your own. In most cases the Social Security Administration will determine which benefits are higher, yours or your survivor benefits, and you will receive the higher amount.[8]

-

3Determine if anyone is eligible for survivor's benefits. After someone dies that has worked long enough to be part of the social security system, some of the deceased’s family members may be eligible for survivor’s benefits. If the deceased was not receiving benefits yet, those that may be eligible and will need to apply for benefits include:[9]

- A widow or widower that is 60 or older

- A widow or widower that is 50 or older and disabled

- A widow or widower any age caring for the deceased’s child who is under age 16 or disabled

- A surviving divorced spouse, under certain circumstances

- An unmarried child of the deceased that is under 18 years old

- An unmarried child of the deceased that is over 18 and disabled with a disability that began before the child was 22

- An unmarried child of the deceased that is under 19 and a full-time student

- Parents of the deceased, age 62 or older, who were dependent on the deceased for at least half of their support

-

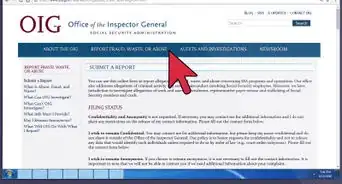

4Apply for survivor's benefits. If you or another family member of the deceased will likely qualify for survivor’s benefits, apply for them as soon as possible. Go online and apply for benefits through the Social Security Administration’s website, which is www.socialsecurity.gov. Once you apply you will need to provide the required documentation for your application, which includes: [10]

- Proof of death - either from the funeral home or a death certificate

- The deceased’s social security number

- The applicant’s social security number

- Social Security numbers of dependent children

- The applicant’s birth certificate

- Marriage certificate - if a widow, widower, or surviving divorced spouse

- Divorce papers - if applying as a surviving divorced spouse

- The deceased’s most recent W2 Forms or federal self-employment tax return

- Direct deposit information for the survivors - including bank account number and routing numbers

Community Q&A

-

QuestionI reported my husband's death to SSA. We were both receiving SS benefits. What else do I need to do?

Community AnswerNothing else. SSA is supposed to determine which benefit is greater and either continue your benefit or switch you to the spouse's greater benefit. SSA is also supposed to send you the small death (burial) payment automatically.

Community AnswerNothing else. SSA is supposed to determine which benefit is greater and either continue your benefit or switch you to the spouse's greater benefit. SSA is also supposed to send you the small death (burial) payment automatically.

References

- ↑ https://www.ssa.gov/pubs/EN-05-10008.pdf

- ↑ https://www.ssa.gov/forms/ssa-721.pdf

- ↑ https://www.aarp.org/retirement/social-security/questions-answers/report-death-to-social-security/

- ↑ https://www.aarp.org/retirement/social-security/questions-answers/report-death-to-social-security/

- ↑ https://www.ssa.gov/benefits/survivors/

- ↑ https://www.consumerreports.org/cro/magazine/2012/10/what-to-do-when-a-loved-one-dies/index.htm

- ↑ https://www.ssa.gov/pubs/EN-05-10008.pdf

- ↑ https://www.aarp.org/retirement/social-security/questions-answers/social-security-spouse-dies/

- ↑ https://www.ssa.gov/pubs/EN-05-10008.pdf