This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 26,596 times.

Generally, you earn Social Security credits when you work and pay Social Security taxes. Social Security credits determine, generally, when you are eligible for Social Security benefits, and how much you can get in benefits. The number of credits you need may differ depending on whether you're applying for retirement or disability benefits. The calculation also is different when calculating benefits for survivors after someone who has been working and paying Social Security taxes dies.[1]

Steps

Earning Retirement Credits

-

1Work in a job that counts towards Social Security. Most jobs qualify to earn Social Security credits, even earnings from self-employment. However, there are some jobs that aren't covered by Social Security and don't earn credits.[2]

- Federal employees hired before 1984, railroad employees with more than 10 years of service, and employees of some state and local governments aren't covered by Social Security.

- Social Security also has special rules for the way credits are earned if you do domestic or farm work, or if you work for a church or church-affiliated organization that doesn't pay Social Security taxes.

- If you're in the military, you generally earn credits the same way civilians do, although you may earn additional credits while you're on active duty.[3]

-

2Pay Social Security taxes. To be eligible for Social Security retirement benefits, you must actually pay Social Security taxes on the money you earn. If you are an employee, your employer automatically withholds this money from your paycheck in most instances.[4]

- Employers pay a portion of their employees' Social Security taxes. If you're self-employed or run your own business, you are responsible for paying all of your Social Security taxes yourself.

Advertisement -

3Calculate your yearly earnings. Earning credits is based on the length of time you work as well as the amount of money you earn. You can figure out the total amount you've earned by looking at your W-2s or 1099s.[5]

- You can also check the specific amount of your income that was subject to Social Security tax by looking at your Social Security statement. You can access your statement online at https://www.ssa.gov. From the home page, click the "Sign In/Up" link and follow the prompts to create an account.

- The Social Security Administration also mails you a statement every few years.

-

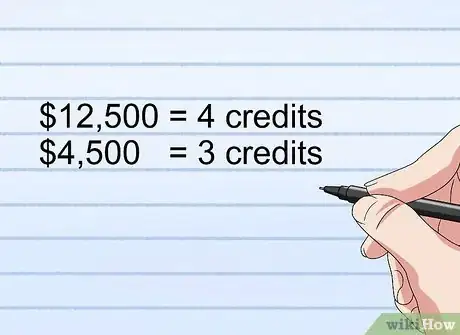

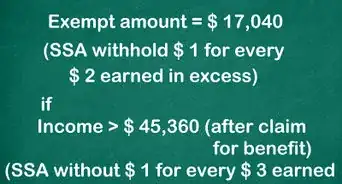

4Divide your earnings to find your credits earned. Social Security credits are, essentially, accounting units. A specific amount of money (which changes every year) equals one credit. You may earn up to 4 credits in any given year. For 2017, you receive one credit for every $1,300 you earn.[6]

- For example, if you earned $12,500 in 2017, all of which was covered by Social Security, you would earn 4 credits for the year. On the other hand, if you only earned $4,500 in 2017, you would only earn 3 credits. You need to earn at least $5,200 to earn the full 4 credits.

-

5Review your Social Security statement regularly. Your Social Security is an important part of your retirement, so you need to make sure your income is being reported and credited correctly. If you check your Social Security statement regularly, you can identify possible errors in your employer's records.[7]

- Make it a habit to compare your end-of-year pay stub with your Social Security statement and make sure the total income figures are the same. If they aren't the same, the issue may be either with your employer or with Social Security.

- If you're self-employed, compare your Social Security statement to your tax returns to make sure your income is reflected accurately.

-

6Make sure your employer's records are accurate. Income might not be credited properly to your Social Security account if your employer has a mistake in their records. Check your pay stub and W-9 with your employer to make sure they have your correct Social Security number if you notice any discrepancies.[8]

- Talk to your manager or someone in payroll or human resources if there is an error in your records that is affecting your Social Security.

- If your employer's records are accurate, Social Security's records may be inaccurate. Call 1-800-772-1213 to report the error using Social Security's automated system, or stop by the nearest Social Security office.

Calculating Disability Credits

-

1Determine the quarter when you became disabled. Generally, the number of credits you need to qualify for disability depends on when you became disabled, and the calendar quarter in when your birthday occurs.[9]

- If your birthday is between January 1 and March 31, it falls in the first quarter. If your birthday is between April 1 and June 30, it falls in the second quarter. If your birthday is between July 1 and September 30, it falls in the third quarter. If your birthday is between October 1 and December 31, it falls in the fourth quarter.

-

2Check the years when you worked. To qualify for disability, you must meet a recent work test. At least a portion of your credits must have been worked in the years immediately before you became disabled. You'll use calendar quarters to determine whether you pass this test.[10]

- For example, if you became disabled in the quarter you turned age 31 or later, you must have worked for at least 5 years out of the 10-year period ending in that quarter.

- The Social Security Administration has a table in its pamphlet on disability benefits, available at https://www.ssa.gov/pubs/EN-05-10029.pdf.

- If you're blind, you may not need to meet this test. Contact the Social Security Administration at 1-800-772-1213, or visit the nearest Social Security office.

-

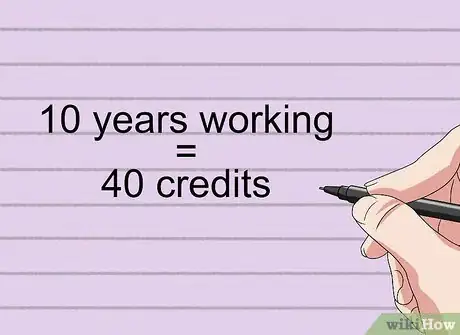

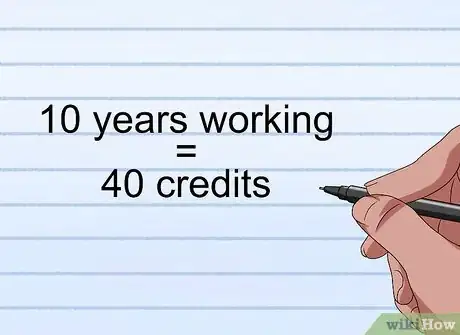

3Total the number of years you worked. You also must meet the "duration of work" test to qualify for disability. Generally, if you have 40 credits, then you qualify for full disability benefits. That would mean you had worked for 10 years.[11]

- If you are younger, you don't need as many years of work to qualify. For example, if you become disabled before you turn 28, you generally only need 1.5 years worth of work, or 6 credits, to qualify for Social Security disability.

-

4Consult a Social Security disability attorney. If you're applying for Social Security disability benefits, you have the right to be represented by an attorney. The process can be time-consuming and difficult, but having an attorney on your side will help.[12]

- Having an attorney also can save you the stress and hassle of having to appeal multiple denials.

- Most disability attorneys offer a free initial consultation, which you can use to get advice on your chances of approval, and how the process will likely go.

-

5Apply for benefits as soon as you become disabled. It can take months, if not years, to get approved for Social Security disability benefits. For this reason, it's generally best not to wait around to apply.[13]

- If you've talked to an attorney, they can help walk you through the process of completing and filing your initial application.

- There are also resources on the Social Security website that can help guide you through the application process.

Evaluating Survivorship Credits

-

1Find out who is eligible for survivors' benefits. When someone who has been paying into Social Security dies, certain members of their family, such as their spouse or children, may be eligible for survivors' benefits.[14]

- Generally, a surviving spouse is eligible for full benefits when they reach age 60. If disabled, they could be eligible for full benefits as early as age 50.

- Unmarried children and divorced spouses also may be eligible in particular circumstances. Contact the Social Security Administration at 1-800-772-1213 if you believe you may be eligible for survivors' benefits after the death of a loved one.

-

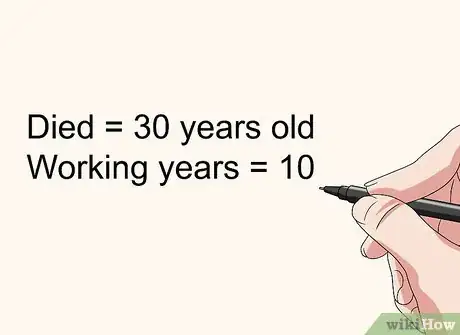

2Calculate how many years the deceased person worked. Generally, a deceased person needs to have worked 10 years before they died for their survivors to be eligible for Social Security benefits.[15]

- For younger workers, the Social Security Administration uses calculations similar to those used for disability benefits. For example, survivors could claim benefits from a young worker who died before the age of 28, provided they worked at least 1.5 years in the 3 years immediately preceding their death.

-

3Calculate the number of credits the deceased person had. Credits work much the same for survivors' benefits as they do for regular retirement benefits. Generally, if the person earned 40 credits, their survivors would be eligible for full survivors' benefits.[16]

- Workers earn credits for the money they earn that is covered by Social Security, up to 4 credits per year.

- Younger workers who die don't need to earn as many credits before their death for their survivors to be eligible for full benefits. The Social Security Administration uses the same calculations that would be used if the worker was disabled.

-

4Adjust credits needed based on the age of the deceased. If someone has died at a younger age, before they became eligible for Social Security benefits, their survivors still may be eligible for survivors' benefits. However, the amount they are paid, and the length of time they're paid, may be significantly reduced.[17]

- Generally speaking, however, a younger worker who dies does not need to have as many credits as an older worker for their eligible survivors to start receiving benefits.

-

5Contact Social Security for more information. If you believe that you or a member of your family may be eligible to receive survivors' benefits after the death of a loved one, you should call the Social Security Administration as soon as possible and explain your particular family situation.[18]

- Survivors' benefits are a little more complicated than retirement or disability benefits, and the qualifications are somewhat vague. Often, whether someone receives benefits is decided based on their particular circumstances.

- Social Security will look at how long the deceased person was working and paying into Social Security, and whether they were already receiving benefits.

References

- ↑ https://www.aarp.org/work/social-security/info-2015/social-security-credits.html

- ↑ https://www.ssa.gov/pubs/EN-05-10072.pdf

- ↑ https://www.ssa.gov/pubs/EN-05-10017.pdf

- ↑ https://www.ssa.gov/pubs/EN-05-10022.pdf

- ↑ https://www.ssa.gov/pubs/EN-05-10072.pdf

- ↑ https://www.ssa.gov/pubs/EN-05-10072.pdf

- ↑ https://www.fool.com/retirement/general/2015/05/10/social-security-credits-how-they-work-and-why-you.aspx

- ↑ https://www.ssa.gov/pubs/EN-05-10072.pdf

- ↑ https://www.ssa.gov/pubs/EN-05-10029.pdf

- ↑ https://www.ssa.gov/pubs/EN-05-10029.pdf

- ↑ https://www.ssa.gov/planners/credits.html

- ↑ https://www.ssa.gov/pubs/EN-05-10029.pdf

- ↑ https://www.ssa.gov/pubs/EN-05-10029.pdf

- ↑ https://www.ssa.gov/pubs/EN-05-10072.pdf

- ↑ https://www.ssa.gov/pubs/EN-05-10072.pdf

- ↑ https://www.ssa.gov/planners/credits.html

- ↑ https://www.ssa.gov/planners/credits.html

- ↑ https://www.ssa.gov/pubs/EN-05-10072.pdf

- ↑ https://www.aarp.org/work/social-security/info-2015/social-security-credits.html