This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 54,650 times.

If you donated non-cash goods to a charitable organization, the IRS has established several ways for you to calculate the fair market value for those items. Fair market value (FMV) is the price at which your goods would sell in an open marketplace. Generally, the amount of your charitable contribution (the amount that you will claim on your taxes) is the fair market value of the property that you donated at the time you made the donation. There are several ways to calculate the fair market value of property, including the selling price of the item; sale of comparable properties; the value of replacement cost; or by seeking an expert opinion. You want to choose a method that works best for the property that you are donating and offers you a supportable amount to deduct on your taxes.

Steps

Choosing a Valuation Method for Charitable Donations

-

1Consider the cost and selling price of the item. One of the most used valuation methods is to determine at what price your donated property would or did actually sell. When calculating FMV based on the selling price, the IRS states that the most accurate representation of the value of an item comes from its sale in an open market. This type of market could include The Salvation Army or Goodwill, which are both charitable organizations that are known for reselling used goods. When determining the FMV based on the sale of your item, consider the following:

- If your item was actually sold, was it sold relatively close to when you donated your goods? If so, the IRS finds that the value is a good reflection of FMV.

- Were you involved in the resale of the item? In calculating FMV, the IRS wants the resale of the donated property to be at “arms length,” meaning that the person making the contribution was not involved in the resale of the property.

- If an item that you donated can still be purchased for a the same amount that you paid, even if the item’s value is greater than that cost, you will only be able to claim the purchase price. For example, you purchased goods at wholesale for $5,000 but the resale value at the time of donation was $10,000. The IRS only allows you to claim $5,000 as the fair market value so long as the item was still being sold elsewhere at wholesale prices.

- In some instances you would be able to take the higher deduction with appropriate documentation. If there was an increase in the value of an item, you could claim the increased price as your FMV, so long as you have an expert explaining why this was a unique situation. For example, you purchased a painting for $10,000 and at the time of donation, one year later, it was worth $15,000. Since this was a unique item, unlike wholesale goods, you can claim $15,000 as your charitable donation. You are required to get an official appraisal establishing the new price.[1]

-

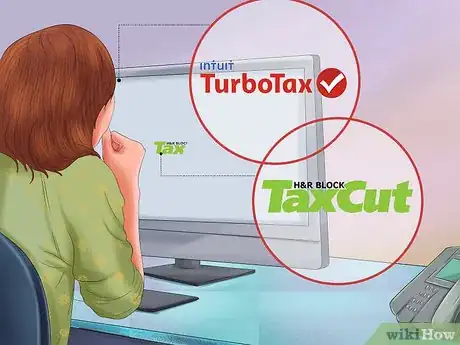

2Use tax programs to determine FMV. In order to assist you in locating the sales price of donated items, tax software programs such as H&R Block’s TaxCut and Intuit's TurboTax, provide donors with an estimated value of the items that they donate. When completing your taxes with one of these programs, you enter in a description of the item that you donated and the program will compare your item to the sale of other similar items online. You can then use the program’s valuation for FMV.[2]Advertisement

-

3Use the sales of comparable property as FMV. The second way that a person can calculate FMV for donated items is by looking at the price at which properties similar to the donated property sold. For example, if you donate the first edition of a rare book, you can then check whether any other first editions of that book sold recently sold and at what price. If your book is in a similar condition, you can use the sale price as your FMV.

- When using this method of valuation, you have to be careful to choose property that is similar not only in the type of property but also in a similar condition. For example, if you donated a rare book that was slightly damaged, you could not use the sale price of the same book in pristine condition as a comparable sale.[3]

- You can look online at places such as EBay or visit stores such as Goodwill and Salvation Army to determine the selling price for comparable clothing and household items.[4]

-

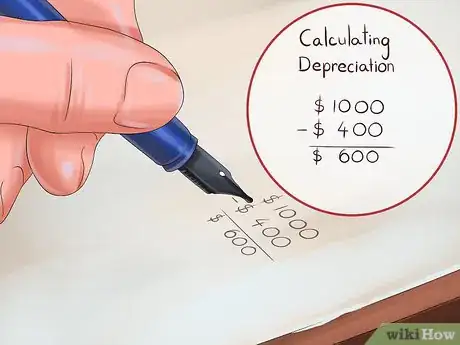

4Use the value of replacement cost as FMV. In some instances, the FMV will be best reflected in what it would cost to actually replace, build or manufacture the property that you plan to donate plus a deduction for depreciation. For example, if you planned to donate a used car, you can begin your FMV calculation by determining how much it would cost for you to purchase a similar new car. Once you find a new car, you would subtract the depreciation of your used/donated car from the cost of the new car. The amount left would be your FMV for your charitable donation.

-

5Get an expert opinion. For certain types of property, you will need to get an expert’s opinion to establish the fair market value of the item. This is especially true for works of art or for valuing rare coins. When using an expert to provide the FMV for an item, you must consider:

- Whether the expert is knowledgeable and competent; and

- Whether the expert’s opinion is thorough and supported by facts and experience.

- An expert must provide you with a written appraisal of the property.[5]

Valuing Clothes and Household Goods

-

1Donate used clothes that are in good condition or better. In order for you to take a donation for used clothing, the IRS requires that the clothing be in at least good condition. While the IRS does not define what it considers “good condition,” you can look at definitions from charitable organizations that accept used items.

- Salvation Army does not accept items that are torn, dirty, or broken.

- Goodwill states that if you would be willing to give the item to a friend or relative then it is in good enough condition to donate.

- If you donate a used item that is worth more than $500, then the IRS allows the item to be in less than good condition.[6]

-

2Know what household items can be donated. The IRS also places limitation on the household items for which you can claim a charitable deduction. Like clothing, used household items must be in good or better condition to take a charitable deduction. In addition, you can only take deductions on the following household items:

- Furniture and furnishings.

- Electronics.

- Appliances.

- Linens, and other similar items.

- Household items for purposes of charitable deductions do not include: food; paintings, antiques, and other objects of art; jewelry and gems, and collections.

-

3Choose a valuation method. When choosing a valuation method for used clothing and household goods, you should consider using either the cost and selling price of the item or comparable sales price. Since used clothing and household goods are generally significantly lower than the price of new items, you should not use the replacement item value method. An easy way to help determine the selling price of your goods is to use a valuation table from a charitable organization.

- Charitable organizations, such as Goodwill or the Salvation Army, provide price lists for items that they sell in their stores. These lists can be used to calculate FMV for your donated items.

- You can view the Salvation Army’s value guide at: http://salvationarmysouth.org/valueguide-htm/.

- You can view Goodwill’s value guide at: https://www.goodwill.org/wp-content/uploads/2010/12/Donation_Valuation_Guide.pdf.

Valuing Boats, Cars and Other Vehicles

-

1Calculate the FMV for a used car. When calculating the FMV of a used car, you need to determine the current value of your car. Several organizations collect this information in what is called a “blue book value.” These guides not only provide FMV estimates based on the make and model of your car but also help you make adjustments for mileage, unusual equipment or body damage.

- You can locate the average sale price of a car at http://www.kbb.com and http://www.edmunds.com/tmv.html.

- The FMV of your donated car may be less than the amount listed on one of the above websites if your car has engine trouble, high mileage, or body damage.

- If you donate a car that is worth more than $500 to a charitable organization, you can make a deduction based on either the gross proceeds of the sale of the car by the charitable organization or the vehicle’s FMV on the date that you made the contribution.

-

2Determine FMV for boats. Unless you are donating a small, inexpensive boat, the IRS expects that you will consult an expert when determining the FMV of the boat. Since the condition of the boat is critically to its FMV, you need to retain an appraisal from a marine surveyor or other expert in valuing boats.

- To get a general idea of what your boat’s FMV will be, you can use an online valuation website for boats. You can find this valuation website at: http://www.boats.com/nada-guides/.

- You can locate an accredited marine surveyor through the Society of Accredited Marine Surveyors at: http://www.marinesurvey.org.

-

3Calculate the FMV of an airplane. You can calculate the FMV of an airplane by retaining an expert or by using an aircraft bluebook. An aviation expert would be in the best position to consider all of the factors that impact an aircraft’s FMV, including: the condition of the aircraft; damage history; depreciation; and other technical factors. However, you can attempt the valuation yourself by using an aircraft bluebook. A bluebook should help you factor in the above considerations when calculating FMV.

- You can look at an aircraft bluebook online at: http://www.aircraftbluebook.com/UserGuide.do?product=ASR§ion=USER_GUIDE&page=INTRODUCTION.

Donating Items Worth More Than $5,000

-

1Group similar items of noncash property. When calculating the value of your noncash charitable deduction, the IRS requires that you group similar items together and calculate their value as a group rather than as individual donations. The IRS defines similar items as items of property that fall within the same general category, such as: coin collections, paintings, books, clothing, jewelry, non-publicly traded stock, land, or buildings.

- If after grouping your similar items for donation, the total value of the group exceeds $5,000 you must follow the IRS’s special rules for documenting the value of donations worth more than $5,000.[7]

-

2Have your item(s) appraised. When seeking a charitable deduction for a single item or group of items valuing more than $5,000 but less than $500,000, the IRS requires that you obtain a written appraisal by a qualified appraiser.

- A qualified appraiser is someone who has earned an appraisal designation from a recognized professional appraiser organization and has demonstrated competency in appraising the type of items for which you are seeking an appraisal or has met certain education and experience requirements.

- A qualified appraiser prepares and is paid for his or her appraisals.

- A qualified appraiser must demonstrate through a declaration in the appraisal that he or she is experienced in valuing the type of items for which you are seeking the appraisal.

- The appraiser cannot have been prohibited from practicing before the IRS for the three years prior to the date on the appraisal.

- The appraisal must include the method of valuation, such as the income approach or the market data approach, and the specific basis for the valuation, such as specific comparable sales transactions.

- You must obtain a separate appraisal for each item or group of items valued at more than $5,000.[8]

- You can locate a qualified appraiser at: http://www.appraisers.org/find-an-appraiser.

-

3Attach IRS Form 8283 to your tax return. Once you have your items appraised, you must complete section B of IRS Form 8283 and attach the form to your tax return. This form provides space for you to identify the items and value for charitable donations worth $500 or more. Section B is specifically for items worth more than $5,000. The form requests that you provide the following information:

- A description of the type of property that you donated and its physical condition.

- The appraised fair market value for each item worth more than $5,000 or group of similar items.

- The date and manner that the property was acquired by the donor.

- The donor’s cost in acquiring the item.

- The donor’s signature.

- The appraiser’s signature and declaration regarding his or her qualifications.

- An acknowledgement completed by the donee organization that states that the item was in fact donated.

- If the items in your group of similar items were donated to separate charities, you must complete a separate Form 8283 for each charitable organization.[9]

- You can download form 8283 at: https://www.irs.gov/pub/irs-pdf/f8283.pdf.[10]

Preparing and Organizing Charitable Donations

References

- ↑ https://www.irs.gov/pub/irs-pdf/p561.pdf

- ↑ http://www.nolo.com/legal-encyclopedia/how-value-noncash-charitable-contributions.html

- ↑ https://www.irs.gov/pub/irs-pdf/p561.pdf

- ↑ http://www.nolo.com/legal-encyclopedia/how-value-noncash-charitable-contributions.html

- ↑ https://www.irs.gov/pub/irs-pdf/p561.pdf

- ↑ http://www.nolo.com/legal-encyclopedia/how-value-noncash-charitable-contributions.html

- ↑ https://www.irs.gov/pub/irs-pdf/i8283.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i8283.pdf

- ↑ https://www.irs.gov/taxtopics/tc506.html