This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 7 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 536,931 times.

Because charitable donations are tax-deductible for the donor and reportable by the nonprofit organization, a donation receipt must include specific information about the value of the donation and what the donor received in return. The IRS provides guidelines for what should be included on these receipts, though not specific forms; if you have questions about the tax law, you should consult the IRS website or a tax attorney. Nonetheless, charities can create a simple donation receipt on the computer or by hand to issue to donors.

Steps

Creating a Receipt

-

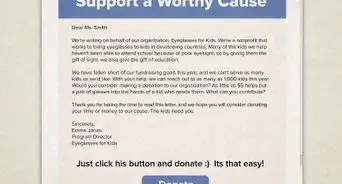

1Pick a form. The receipt doesn't not need to be any particular style. That is, it can be a letter, a postcard, an email, or a form you fill in and hand to the donor, for instance. As long is it includes the appropriate information, it will fulfill the purpose of a donation receipt.[1]

-

2Include your name and your status. One of the most important items to include in your donation is the name of your charity. In addition, you need to acknowledge that you are a non-profit, meaning you have 501c3 status under the federal government.[2]Advertisement

-

3Include the donor's name. You must include the donor's name on the receipt for it to be valid. Ask for the name when the donation is given, if it's not provided on a check or other statement.[3]

-

4Add information about the donation. You'll need to include the date the donation was made, as well as the amount of the donation. If the donation was not in cash, you need to add a description of the donation, such as "five men's dress shirts" or "black leather love seat." You should not specify a value if the contribution was not money; that task is up to the donor.[4]

- For instance, if your donor gave your charity new computers, your description could say "The donor John Doe gave four desktop computers. The computers are brand new this year." You should also include the brand and type of computers.

- If the donation is a vehicle, you must include the VIN number.[5]

-

5Declare whether the donor received goods in return for the donation. The IRS makes a distinction between donations made without retribution and donations made that receive goods or services in return. This distinction is made because only the amount that exceeds the goods or services is considered tax deductible.[6]

- For instance, if someone donated money and in return, she attended a charity dinner, that is considered goods or services. In that case, you need to provide a description of what she received and approximately how much those goods or services are worth.[7]

- However, if someone just gave computers and didn't get anything in return, that means he did it purely for donation sake. In that case, you need to state that the donor did not receive goods or services in return for the donation.[8]

- Some goods are considered insubstantial and do not qualify as good or services. The IRS has specific laws about such items, but in general, items such as cheap pens or mugs with your charity's logo on them do not count as goods or services that must be declared.[9]

- If the only benefits received are intangible and of a religious nature, you need to make a statement relaying that information.[10]

-

6Include extra information for vehicles over $500. Donations of vehicles require a few more statements from you, especially if you turn around and sell the vehicle. If the vehicle is between $250 and $500, you can use the standard donation receipt.[11]

- If the vehicle is sold, you'll need the date the vehicle was sold, as well as the gross profits you made from the sale. You'll also need to declare that you sold the vehicle under an arm's length transaction that was made between two unrelated parties. Finally, you need to tell the donor that the deduction she takes on her taxes cannot be more than the gross profits you made from the sale.[12]

- If you keep the vehicle, you'll need to state that you intend to keep the vehicle to use for an extended period of time, as well as how you plan to use it. The IRS calls this "significant intervening use," and it means that you plan to use the vehicle extensively when it is donated. You'll also need to say how long you will use it and certify that you will not sell the vehicle before the date you state.[13]

-

7Add a disclosure statement if required. Different states have different laws regulating nonprofits in the state. Some states require that you include a disclosure statement when writing acknowledgement letters or receipts. What is included in that disclosure varies by state, but many legal websites list the requirements.[14]

- For instance, Virginia nonprofits are required to state that the donor can receive a financial statement about the nonprofit from the State Office of Consumer Affairs in the Department of Agriculture and Consumer Services, P.O. Box 1163, Richmond, VA 23218.[15]

-

8Sign the form. It's important for someone from the organization to sign the form. That acknowledges that the charity has created the document and signed off on the donation.[16]

-

9Separate the thank you letter. If you're also including a thank you letter, it's a good idea to send it separately from the donation receipt. The donation receipt is created for tax purposes, while the thank you letter acknowledges the donor's contribution to the organization. You can send them in the same envelope, but they should at least be on separate sheets of paper. Your donor may want to display the thank you letter without disclosing how much she donated.[17]

-

10Keep a copy. If you happen to write the receipt by hand or create it in such a way that you don't have a saved copy on the computer, keep a copy of the receipt. You can make a photocopy or scan it into the computer, for instance. You'll need it for tax purposes later. Some organizations use receipt books that automatically make a carbon copy of the receipt.

Understanding the Law Around Donation Receipts

-

1Give a receipt if possible for a donation over $250. To make a claim on taxes over $250, the donor must have a written acknowledgement from you, the charity. Though you are not required by law to provide it, you build goodwill with your donors by providing it.[18]

- Donors can make claims on their taxes for donations under $250 with a bank statement to show they made the donation.[19]

-

2Give a receipt for a donation of $75 that buys goods or services. If you provide a good or service in return for a donation of $75 or more, you are required to provide a receipt to the donor. That means that if the donor pays $75 and receives a calendar or a dinner, for example, you must provide a receipt under law.[20]

-

3Provide receipts upon request. Donors cannot claim donations over $250 on their taxes without a written receipt from the charity. Also, some donors just feel better having the receipt for donations under $250, and in fact, some may not have bank statements to prove they made the donation. Therefore, when a donor requests a receipt, even if the donation is under $250, provide one.[21]

Sample Donation Receipts

References

- ↑ http://www.nonprofitexpert.com /charitable-receipts-required

- ↑ http://cullinanelaw.com/donation-acknowledgement-letters-what-information-do-we-need-to-include-for-tax-purposes/

- ↑ http://www.nonprofitexpert.com/charitable-receipts-required

- ↑ http://cullinanelaw.com/donation-acknowledgement-letters-what-information-do-we-need-to-include-for-tax-purposes/

- ↑ http://www.nonprofitexpert.com/charitable-receipts-required

- ↑ http://cullinanelaw.com/donation-acknowledgement-letters-what-information-do-we-need-to-include-for-tax-purposes/

- ↑ http://cullinanelaw.com/donation-acknowledgement-letters-what-information-do-we-need-to-include-for-tax-purposes/

- ↑ http://cullinanelaw.com/donation-acknowledgement-letters-what-information-do-we-need-to-include-for-tax-purposes/

- ↑ http://www.nonprofitexpert.com/charitable-receipts-required

- ↑ http://cullinanelaw.com/donation-acknowledgement-letters-what-information-do-we-need-to-include-for-tax-purposes/

- ↑ http://www.irs.gov/pub/irs-pdf/p4302.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/p4302.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/p4302.pdf

- ↑ http://www.perlmanandperlman.com/practice_areas/registration_compliance/charitable_organizations.shtml

- ↑ http://www.perlmanandperlman.com/practice_areas/registration_compliance/charitable_organizations.shtml

- ↑ http://www.nonprofitexpert.com/charitable-receipts-required

- ↑ http://www.adrp.net/assets/adrp%20best%20practices%20-%20gift%20acknowledgment.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/p1771.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/p1771.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/p1771.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/p1771.pdf

About This Article

To create a donation receipt, include the name of your charity, and acknowledge that you have 501c3 status under the federal government. You also need to add the donor's name for the receipt to be valid, as well as the date of the donation and the amount of money given. If the donation wasn't financial, include a description like "5 men's shirts." Additionally, note whether the donor received any goods in return for their donation, because this will affect how much of the donation is tax deductible. For tips on how to include a disclosure statement and what to do if you receive vehicles as a donation, read on!