wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 25 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 659,894 times.

Learn more...

Whether you have enormous savings or don't have a nickel to your name, you might need to use a credit card to get cash from an ATM at some point. A cash advance lets you access part of your credit line through an ATM, cash advance check, or bank teller. Like dipping into your savings account or overdraft protection, you should do this only as a last resort. That said, cash advances can be a life-saver that you shouldn't be afraid to use in a bind.

Steps

Preparing to Get a Cash Advance

-

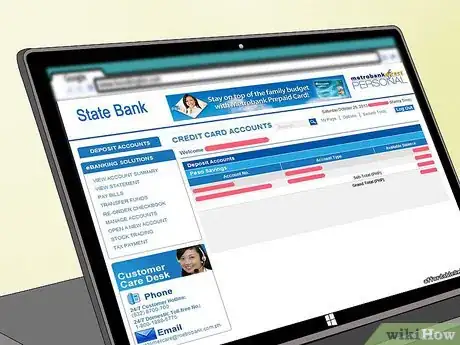

1Check your account status. Most credit cards have some sort of cash advance option, but you may not be able to get one if you're behind on your payments. Make sure your account is in good standing before attempting to get a cash advance.

- Check your statement online to make sure you haven't missed a payment or reached your borrowing limit. If either of these is a concern, you likely won't be able to get a cash advance.

-

2Make sure you have permission. Your bank or credit card company needs to authorize you to withdraw cash from an ATM using your credit card. Call your bank or credit card company's customer service department and ask how to start that process.

- Most cards automatically offer the option, but some either do not offer it or set restrictions.

- For example, some cards end the cash-advance option once your balance reaches a certain limit.

- You may be able to get this restriction removed by calling customer service and asking. Again, this is more likely if your account is in good standing and you don't have late payments on your record.

Advertisement -

3Find your Personal Identification Number (PIN). People sometimes try to use a PIN they’ve set up on their other cards, but you need to know the PIN for this particular credit card. Make sure you know the correct PIN before attempting to withdraw cash. Too many wrong attempts could freeze your account.

-

4Change your PIN if necessary. Many credit cards come with preset PINs that users never get around to resetting. If you've forgotten the original PIN, call the customer service department and ask about how to reset it.[1]

- This usually involves dialing an automated 800-number and changing your PIN over the phone.

- The automated system may ask you to enter your existing pin to make the change. If you don't know your existing PIN, ask a customer service representative to send a new PIN to you in the mail.

- Note that it may take 7-10 days before you receive it. If you know you'll need a cash advance soon, inquire about your PIN at least two weeks in advance.

Understanding the Terms and Conditions

-

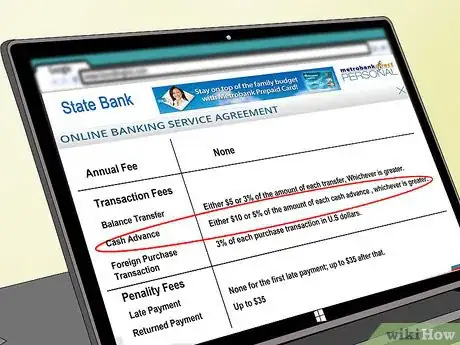

1Know the fees. Read through your account agreement before withdrawing any cash. You should understand the costs involved before taking action. You may be able to do this by logging into your account and searching on the website for your bank or credit card company.

- Standard terms for cash advances may include fees of 3-5% of the amount withdrawn.[2]

-

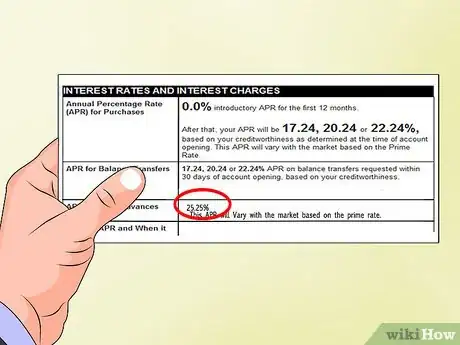

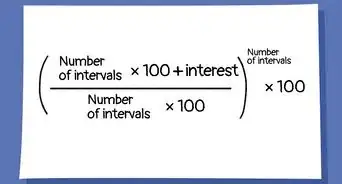

2Learn the interest rate. Find out what interest rate you'll have to pay on your cash advance, when it starts accruing, and how often it will accrue. Make sure you'll be able to pay the interest before you take out the advance.[3]

- Median annual interest rates for cash advance on most credit cards is currently around 24%. Generally, the cash advance rate is 5%-6% above the rate of purchases.

- Interest on cash advances often begins accruing immediately. Even if you pay off the advance as soon as possible, you may not be able to avoid paying at least some interest.[4]

-

3Understand the repayment system. Always ask if your next payments will go straight toward your higher-interest balances. If not, the cost of your cash advance may become punitive.[5]

- Pay off cash advance balances as soon as possible. The high interest rates on them mean the debt can quickly grow well beyond the amount you took out as an advance.

Withdrawing Cash

-

1Find an ATM to withdraw your cash from. Look for one associated with your bank. Otherwise, you might get charged a fee of $2-$5 by both your bank and the out-of-network ATM.

- Once again, log into your account and browse the website. There should be a tool you can use to locate a nearby ATM.[6]

- If you’re abroad, search the website for foreign affiliations that offer fee withdrawals. You can find these relationships with many European and South American nations. They can save you a lot of money for both debit and cash advance withdrawals.

-

2Request your cash advance from the ATM. Insert your credit card and enter your PIN. The menu of choices should include a cash advance option. Enter the amount of money you want as your cash advance.

-

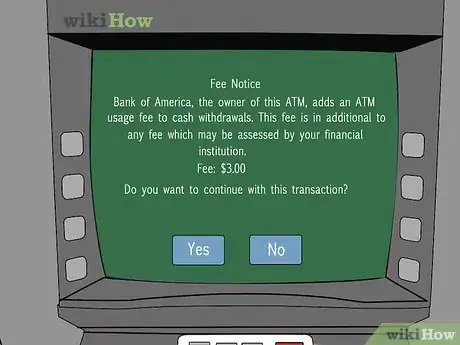

3Accept the fees. If there will be any extra fees for your transaction, the ATM will ask whether you accept them or not. To receive your cash, you will need to accept these routine fees.

-

4Take your cash. After you've accepted any fees, the ATM should give you the cash you asked for. Make sure to finish up the transaction and take back your credit card before leaving the ATM. Otherwise, the next person who visits the machine might be able to take out further advances on your card.

Community Q&A

Did you know you can get answers researched by wikiHow Staff?

Unlock staff-researched answers by supporting wikiHow

-

QuestionCan I get a cash advance on my debit card?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerThe ability to get a cash advance from a debit card does exist but it depends on your bank and the terms and conditions on your debit card. It is not usual to be able to get such an advance from an ATM because only the money available in your account can be removed from the ATM. Usually, you will have to go into the bank to obtain a cash advance from a debit card. Be aware that any cash advance will accrue not only the loan amount but also a fee for the advance and interest during the time it has not been paid back.

wikiHow Staff EditorStaff AnswerThe ability to get a cash advance from a debit card does exist but it depends on your bank and the terms and conditions on your debit card. It is not usual to be able to get such an advance from an ATM because only the money available in your account can be removed from the ATM. Usually, you will have to go into the bank to obtain a cash advance from a debit card. Be aware that any cash advance will accrue not only the loan amount but also a fee for the advance and interest during the time it has not been paid back. -

QuestionCan you withdraw money from a credit card at an ATM?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerWithdrawing money at an ATM is usually possible with most credit cards but first, check the terms and conditions on your card and second, check that the ability to make cash withdrawals has been activated for your credit card. If you’re unsure, drop into a branch of your bank and ask for them to check. However, it is generally a good idea to try to avoid doing this regularly, keeping it for emergencies or travel, because it usually entails both a fee and a higher interest repayment rate.

wikiHow Staff EditorStaff AnswerWithdrawing money at an ATM is usually possible with most credit cards but first, check the terms and conditions on your card and second, check that the ability to make cash withdrawals has been activated for your credit card. If you’re unsure, drop into a branch of your bank and ask for them to check. However, it is generally a good idea to try to avoid doing this regularly, keeping it for emergencies or travel, because it usually entails both a fee and a higher interest repayment rate. -

QuestionHow does a cash advance work?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerA cash advance is a small loan from the bank against either your bank account or a credit card account. It is an expensive way to get a loan, as it incurs both a fee for the transaction and a high interest rate until it is repaid. There may also be a limit on the amount you can remove and any former such advances usually need to be repaid before you can get another advance.

wikiHow Staff EditorStaff AnswerA cash advance is a small loan from the bank against either your bank account or a credit card account. It is an expensive way to get a loan, as it incurs both a fee for the transaction and a high interest rate until it is repaid. There may also be a limit on the amount you can remove and any former such advances usually need to be repaid before you can get another advance.

Warnings

- Unless you have no other options, do not take out a cash advance that you will not be able to pay back promptly. Because of its high interest rate, this method can be expensive if interest accrues for a long period of time.[8]⧼thumbs_response⧽

References

- ↑ http://www.mastercard.us/support/atm-locator.html

- ↑ http://www.creditcards.com/credit-card-news/cash_advance-guide-1267.php

- ↑ http://ptmoney.com/credit-card-cash-advance-bad-financial-move-or-good-emergency-plan/

- ↑ http://www.creditcards.com/credit-card-news/cash_advance-guide-1267.php

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-donts.asp

- ↑ http://www.mastercard.us/support/atm-locator.html

- ↑ http://ptmoney.com/credit-card-cash-advance-bad-financial-move-or-good-emergency-plan/

- ↑ http://www.creditcards.com/credit-card-news/cash_advance-guide-1267.php

About This Article

You can withdraw a cash advance from an ATM using your credit card, but you should only do so as a last resort because you will eventually have to pay the money back, including any fees or interest rates. To get a cash advance, insert your credit card into an ATM and enter your PIN number. If the ATM asks you to choose between “debit” or “credit” choose the credit option. Then, enter the amount of money you’d like to withdraw and accept any fees or charges for the transaction. The ATM should then give you the cash you requested. If you have any problems withdrawing a cash advance, call your bank’s helpline. For tips about how to find an ATM near you, keep reading!